How do you build a portfolio that will deliver high compounding returns but keep risk at a manageable level? Do companies perform differently in different economic and market cycles? How can you use this to build your portfolio? How do you set your criteria to identify opportunities to do this effectively over time? What is required to build a large-size portfolio with confidence?

Quality-at-Reasonable-Price is the Investing Process that we recommend. It is the most suitable for retail investors and all DIY investors and you have seen the reasons why. You have also seen how to answer the 3 essential questions before you invest in a stock. Now, how do you build your portfolio using all that you have learnt, because the asset that is going to take you to your goal of financial freedom is your portfolio, more specifically your equity portfolio.

Choosing the First Gate in the Investment Opportunity Management System

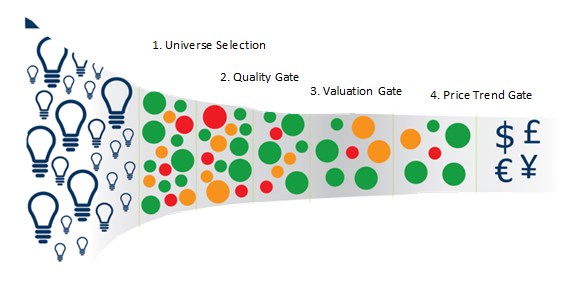

The first gate is about selecting the universe of stocks you are interested in. There are 5000+ listed stocks and all you need is 25 to 30 in your portfolio. The first gate serves a different purpose from the subsequent QVPT-Quality, Valuation and Price Trend gates and this is critical to building your stock portfolio.

This is apparent from the preferences investor show. Some are very conservative and invest only in safe large cap stocks: they maybe sacrificing potentially higher returns even when they need it to reach their goals. Others are aggressive and invest predominantly in small cap stocks to earn higher returns and suffer pangs of anxiety when the market corrects. It does not have to be an either-or choice and that is achieved by selecting the first Gate wisely.

Stocks exhibit a difference in how much returns they deliver and how volatile (price fluctuations) they are. After much

...........Read More

Comment Your Thoughts: