What are the necessary and largely sufficient data points to look at to build conviction about a shortlisted opportunity? What structured report will make it easy to analyze and get useful insights of any stock and get better at it? What is required to feel confident about the future performance of the company? How do you do this without having to be an expert at financial data analysis?

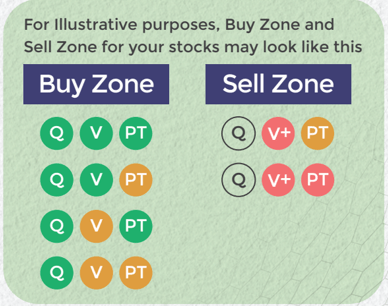

The Quality FastTag on a stock provided by Moneyworks4me or some other screening method that you use will give you a shortlist of stocks that are investment-worthy. But you need a way to confirm this for yourself so that you invest in it confidently. However, this should be something you can do with speed and accuracy.

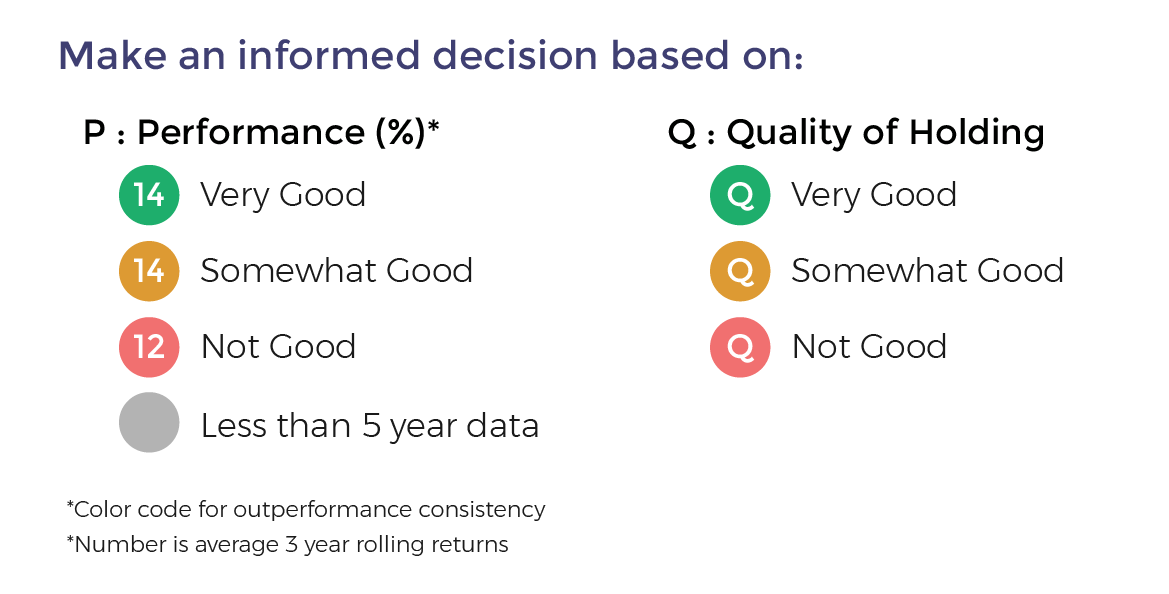

As a retail investor you don’t have the time, expertise and passion like Warren to sit around every day and study annual reports so thoroughly that you know more about the company that its overpaid CEO. Luckily, you don’t have to invest the amount of money that Warren does in any one stock. So, you need a very good fit-for-purpose, but accurate reading on the stock that enables you to make an informed decision.

You should be okay to miss out a few potential turnaround stocks, future winners but you want to avoid investing in a weak company. Remember, you will make your desired healthy returns on your portfolio even if you miss a few winners but buying more than a couple of loser stocks will adversely impact your returns.

Four Financial Parameters over 10 years in addition to the DeciZen Rating tells you one heck of lot about the company’s quality. They are:

-

Earnings per Share (EPS)

-

Net Sales

-

Book Value per Share (BVPS)

-

Debt-to-Operating Cash Flow.

Let’s see how!

What is Earning per Share, and why is it important?

What is the first thing that you will look for in a company before investing? Obviously, whether it is making a profit and consistently! Profit After Tax (PAT) is what shareholders get when all is said and done is Profits-After-Tax per Share (though what you actually get it in hand in the dividends the company pays out). This is known as Earnings per Share (EPS) which tells us what profits you earned on every share that you own of the company. Why is this important?

When you put money in a Fixed Deposit, you may get an interest @7%; i.e. you get Rs. 7 a year for a Rs. 100 invested in the FD. In addition to a promise from the bank of getting back your Rs. 100 at the end of the term of the FD. EPS/Price called Earning Yield rate, is the equivalent of the interest rate earned by the company, its owners. It tells you that a company earning an EPS of Rs. 7, if available at a price of Rs. 100, has the same Earning Yield rate as the interest on FD. Tthe more popular ratio is Price/EPS or P/E ratio or just PE which is the inverse of the Earning Yield rate.

But why would you pay more than Rs.100? The main fundamental reason could be that you expect the company to earn more than Rs. 7 the next year, and so on. For this, you need to see how well the company has grown its EPS year after year. This is so important that we have provided color codes to the yearly EPS growth rate on the Company 10-Year X-Ray.

When it is green it means it has clocked a healthy 12%+ growth in that year, if less than 8% it is coloured red and between 8 and 12% its Orange. Seen over 10 years, you can easily conclude on its profit track record.

Comment Your Thoughts: