In November 2020, Nifty touched an all-time high of 13,146 points after its intraday low of 7,511 points this year in March 2020. It appears as if market cycles generally of 10 years or more, were force-fit into 10 months or so. The year 2020 has seen all of it; Expansion, Recession, Recovery, Boom in such a short span.

This article covers the following:

What caused such a short market cycle?

The prime reason for the stock market crash was the economy going under lockdown fearing bankruptcies and inevitable recession. The faster recovery in markets is explained by liquidity pumped by the central banks through easy lending norms and lower interest rates.

Low-interest rates, easy liquidity left no choice for Foreign Institutional Investors (FII) but to opt for stocks in developed and emerging markets alike. It so happened that, stocks which otherwise track profit growth of companies, rallied ferociously without fundamentals recovering, leaving many investors astray. Post such gyrations in a single year, one starts wondering what’s next for stocks.

To everyone’s surprise, FIIs continue to invest in the market even in the month of November’20 and surprisingly, this is the highest ever monthly inflow. This has confused many investors and fund managers.

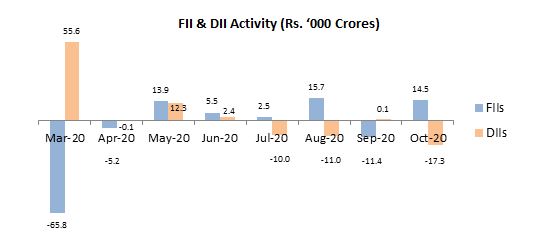

Let us first have a look at the stance of stock market participants like Foreign Institutional Investors (FIIs) & Domestic Institutional Investors (DII) in the last 6 months.

Since every buyer has a seller in the stock market, the largest players in the market DII and FII will be on the opposite side of the trade. While DIIs bought in March from FIIs, FIIs bought in July August October from DIIs.

What kind of inflows are these?

FII inflows are either long-term or medium-term in nature. Long term funds look for long term returns and usually buy when valuations are more favorable. At other times, FII funds might be invested in EM/other risky assets from a medium-term perspective. Currently, a lot of inflows appear to be coming from the western countries where bonds earn negative to low single-digit interest rates. This behavior is called “Yield Chasing”. These flows might be Index or sectorial ETF format. They might be buying and selling without paying much heed to valuation, but instead focusing on asset allocation basket-like Developed market stocks 40%, emerging market stocks 30%, and so on.

What does this inflow do to the market levels?

Price unconscious funds might take markets higher which may or may not correct sharply depending up how soon fundamentals catch up.

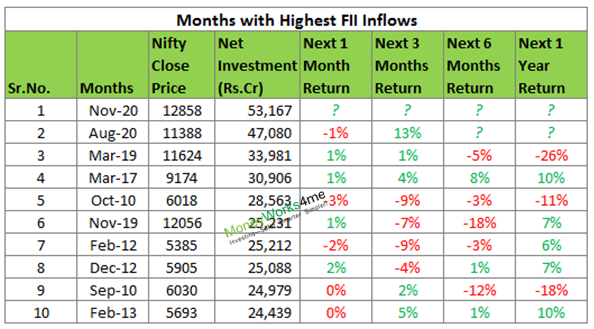

Often investors might conclude that markets will either go up or go down after large FII inflows.

Instead of keep such bias, let’s understand what data says. If we look at 10 months with the highest inflow since 2003, no conclusion can be drawn looking at Nifty returns over subsequent 1, 3, 6 & 12 months. Neither is high inflow means bullish nor bearish in short term.

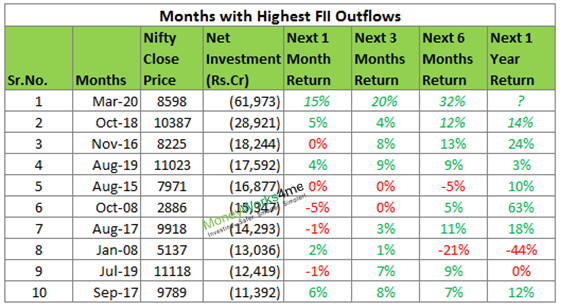

However, if we look at Nifty returns post highest FII outflows months, it is positive on most occasions. One possible reason for such observation is that high FII outflows itself caused Nifty to fall sharply, leading to a rebound in subsequent months. While this can be completely random, but it certainly refutes a conclusion that FII outflow may mean something terrible is going to happen in subsequent months.

If you are trying to seek a pattern from the past, it would turn out to be a futile exercise. There is no specific trend that emerges post FII inflows/ outflows. Hence going forward, finding meaning or timing your investment decisions based on inflow/ outflow of FII money (“smart or dumb money” if you call it so) might not work.

Log In | Register FREE | Schedule a DEMO | Solution Enquiry | Subscribe

So what is it that you can look for and rely on?

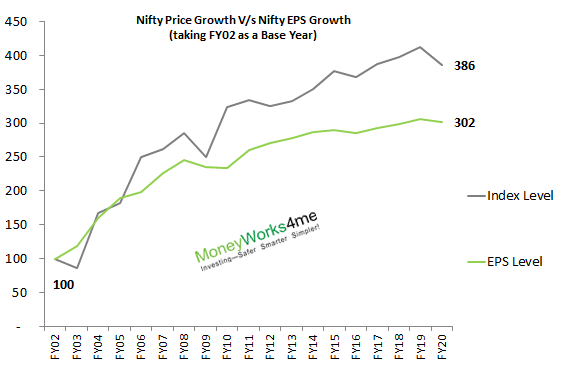

The value of the stock is decided on the basis of its current earnings and expected future earnings. The growth in earnings per share of a company ultimately decides the fate of the stock price. Over the long run, the correlation between index earnings and its price levels is quite high.

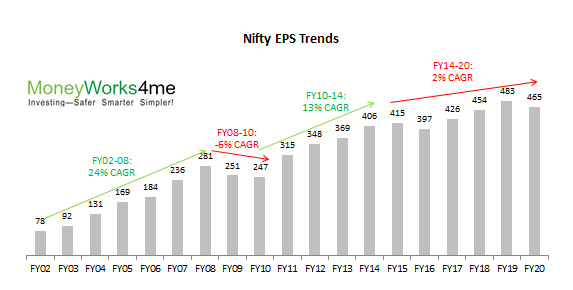

As evident in the graph, Nifty has moved in tandem with the earnings growth over the long term. In short term, liquidity into and out of the market does cause volatility but in the end, the market tracks its earnings growth.

In this chart, the earnings went up taking the markets higher. In hindsight, the chart looks steadily going up but the growth trajectory cannot be predicted in advance. As you can see above, the earnings might not grow every year but it is often concentrated in a 4-5-7 year period. Since we won’t know what the future holds, we have to remain invested. If you observe, the recent 5 year period has seen quite subdued earning growth. This is also reflected in low equity returns in recent times.

So what is the takeaway?

Timing the market based on the FII flows is a futile exercise as there is no clear pattern between high FII flows and market movements. The only correlation we found is between earnings and market prices. In the longer term, only earnings growth will lead to the sustainable growth of the market prices. Interim liquidity may cause arbitrary movements in prices but eventually, they will correct back to the growth trajectory of earnings.

Hence, it wise to focus on the bigger picture and stay invested without trying to time the market based on short-term factors like FII flows or any other. The opportunity cost is huge if you miss out on the big return generating months/days that come in between. You can read our blog here to find out the amount of returns you would have missed out on if you are not invested for the best performing months of Nifty.

We recommend building a portfolio of established companies with reasonable growth at the right prices. Building a portfolio of 20-25 such companies can help you earn good returns irrespective of short-term volatility and noises in the stock market.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call 020 6725 8333 | WhatsApp 8055769463