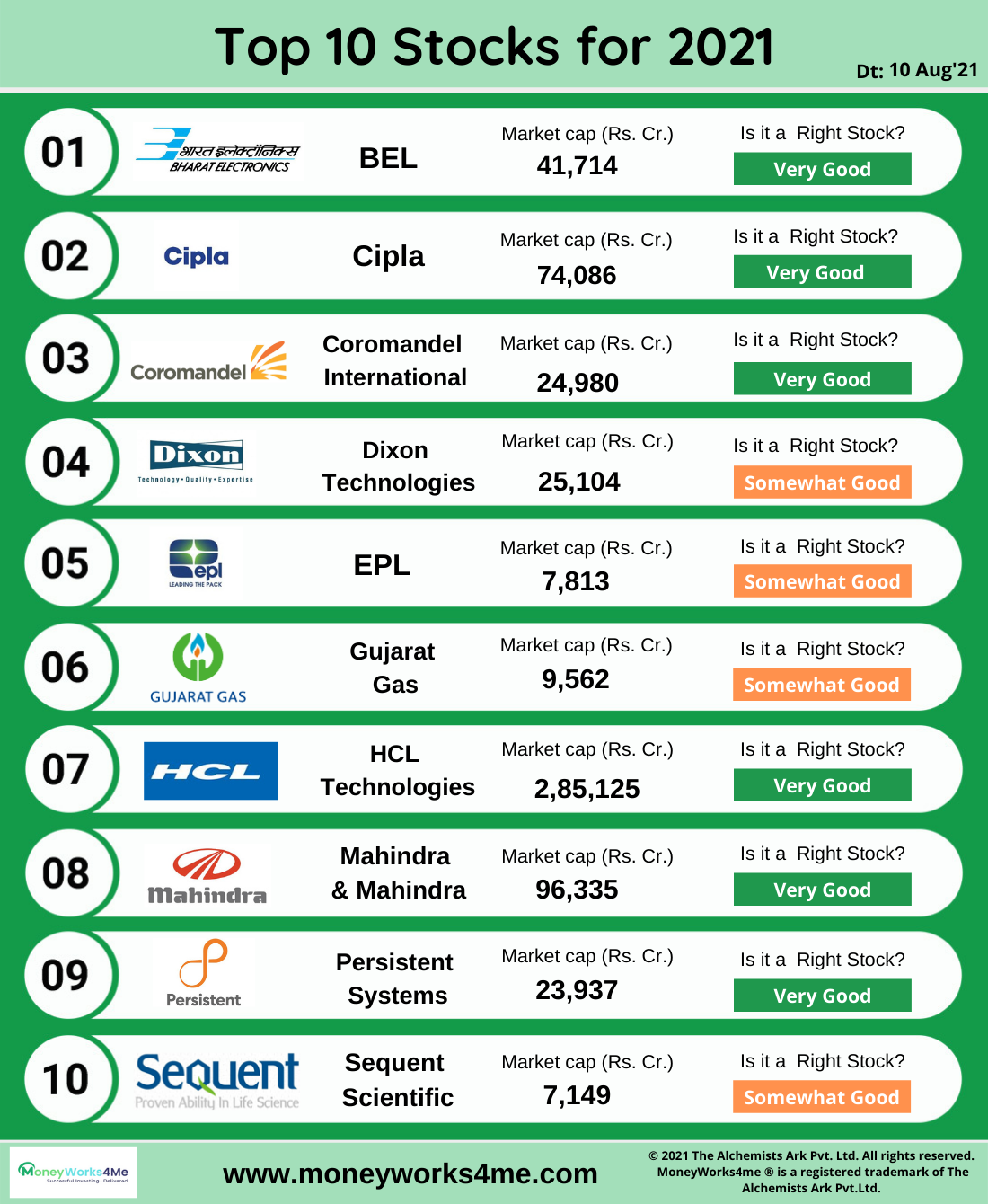

The top 10 stocks for 2021 are the stocks of companies that are scaling up a business or enjoying tailwinds in their respective sector will continue to grow and the stock prices will follow the same. Which are those best Indian stocks for 2021 you can own to make a return? Let us check out the story in each of the companies one by one.

Top 10 Stocks for 2021

Here are the top 10 stocks that can keep performing in 2021 and are worth exploring

1. Bharat Electronics Ltd. (BEL)

BEL is India’s largest defense electronics equipment manufacturer, with ~60% share in defense electronics. The company is a key beneficiary of the Indian government’s increasing thrust on the replacement and modernization of military hardware in the country. The government’s push to source defense equipment from the home country provides a tailwind for further growth.

Bharat Electronics has an order book to the size of ~52,000 Cr which is ~4x TTM sales. The management has guided for 10-12% CAGR growth and a stable margin bodes well for the company’s future prospects.

2. Cipla Ltd.

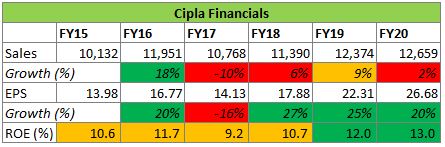

Cipla is the leader in generic respiratory drugs and inhalers. Covid has increased the target market for Cipla as many people may face respiratory problems even after fighting Covid-19. Together with new launches in the US and volume growth in India Cipla can have very good growth over the next 2 years.

Cipla’s domestic and international business has robust profitability in approx. 20%+ and ROE is higher than 25%. For the last 3 years earning growth was 15% CAGR and expected to remain in the same range over the next 3 years.

3. Coromandel International Ltd.

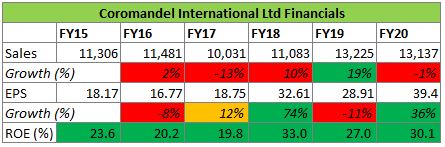

Coromandel, part of the Murugappa group, is the second-largest player in the phosphatic-fertilizer industry in India with a market share of around 17%. It is the market leader in Andhra Pradesh and Telangana – India’s largest complex-fertilizer market. Recently the company is increasing the sale of non-subsidy-based products, including crop protection, specialty nutrients (secondary and micro-nutrients).

With the increase in government spend and good monsoon, rural harvest and demand is likely to be robust. Coromandel has good products and superior distribution to benefit from growth in volumes. In the last 3 years, Coromandel International has grown its sales at 9% CAGR while profits grew at 31% CAGR with an increase in the share of high margin products. The next few years are expected to be a high growth period for Coromandel International.

4. Dixon Technologies (India) Ltd.

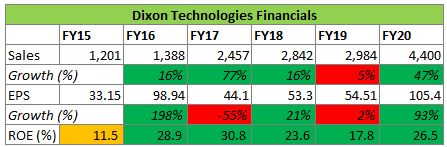

Dixon Technologies is a key player in the Indian EMS industry. It is expected to grow exponentially led by a focus on “Atmanirbhar Bharat”, government initiatives, and China+1. The company has a presence in several segments such as LED TVs, Washing Machines, Lighting Products, Mobile Phones, and Security Systems, Laptops, Medical Electronics, and STBs are in the pipeline.

The management has given a growth guidance of 20% for the next 5 years given the industry tailwind and the advantage from PLI scheme. Overall it’s a play on the growing EMS (Electronics Manufacturing Services) which is backed by several industry tailwinds and is at a nascent stage.

5. EPL Ltd.

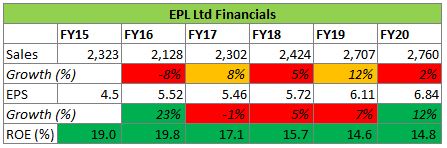

EPL (erstwhile Essel Propack) is owned by the Blackstone group. It is one of the leaders of packing for oral and personal care. EPL provides experience and manufacturing facilities to provide packaging material to India and abroad.

With new promoters and connections, it can source more supply contracts and gain market share in the packaging business. Ever since new management took over, its earnings growth is > 14% CAGR. We expect a similar run rate for the next few years.

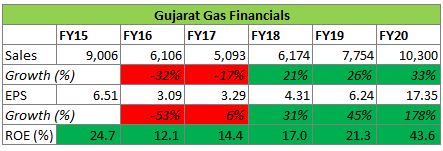

6. Gujarat Gas Company Ltd.

Gujarat Gas is into the distribution of CNG and LNG. Gujarat Government’s focus to increase usage of Gas as the primary fuel for vehicles and industries has improved prospects of Gujarat Gas.

Gujarat Gas has a large distribution and ties up for gas supply. It passes on an increase/decrease in gas prices to customers. For the last 3 years before Covid sales and earnings grew by more than 20% CAGR. Earnings are expected to grow at double-digit over the next 3 years as well.

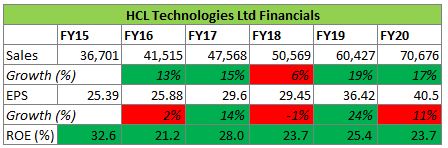

7. HCL Technologies Ltd.

HCL is a diversified IT/BPO services provider, primarily focused on ‘transformational outsourcing’. HCL Operates in various segments of IT services for large to mid-sized corporates in the US and Europe. Indian IT services continue to remain very cost-efficient for global outsourcing. HCL has been able to see sustained growth in Enterprise due to Success in large deal wins and acquisitions to increase scale or adding more clients to the portfolio.

For the last 3 years, its sales growth is 14% CAGR and earnings growth of 10% CAGR. Covid has accelerated the demand for IT infra for all companies alike. This will ensure sales growth momentum for HCL Technologies.

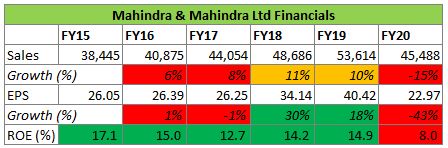

8. Mahindra & Mahindra Ltd.

Mahindra & Mahindra is involved in the manufacturing and marketing of tractors, utility vehicles, and light commercial vehicles including three-wheelers. Mahindra & Mahindra has three large segments -Tractors (35%), passenger vehicles (30%), and commercial vehicles including rickshaws (35%). The key brands include Scorpio, Bolero, Champion, and many more. Mahindra has a 40%+ market share in the tractor segment.

M&M also has a stake in Tech Mahindra and Mahindra & Mahindra Financial services which are long-term compounders. Rural growth and an increase in farm mechanization are key drivers for the growth of Mahindra & Mahindra. Management focus on improving RoE further improves the company’s long-term prospects.

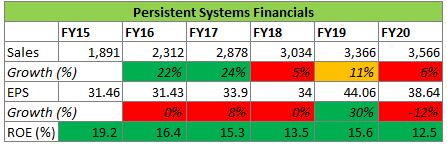

9. Persistent Systems Ltd.

Persistent Systems is a diversified IT services provider. Persistent Systems operates in various segments of IT services for large to mid-sized corporates in the US and Europe. Indian IT services continue to remain very cost-efficient for global outsourcing. Persistent Systems has been able to see sustained growth in Enterprise due to new annuity deals, fixed-price contracts, and alliances with large IT players eg. IBM & Salesforce.

For the last 5 years, its sales growth is 13.5% CAGR. The new CEO revamped the sales team and accelerated the demand for IT infra due to Covid will ensure sales growth momentum for Persistent Systems.

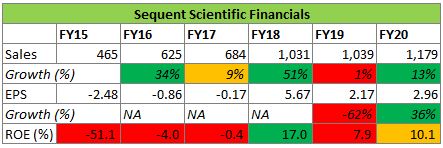

10. Sequent Scientific Ltd.

Sequent Scientific is a pure-play animal health business carved out after selling human API and specialty business. It is the largest animal health company in India and the 20th largest animal health company across the globe.

The animal pharma industry is expected to grow at 4.8% CAGR and the domestic is expected to grow at 12% CAGR as per experts. A lot of innovative drugs are going off-patent in the next 3 years which is quite favorable for generic players like SeQuent.

Disclosure- Above stocks are shared for further study and shouldn’t be construed as investment advice. Current prices might be high, reach out to advisors for the right price or wait for market volatility. Our clients may or may not be holding the stocks mentioned above.

Top 30 performing stocks of 2020

The year 2020 has been a roller coaster year in every context and the stock market is no exception to that. It appeared as if market cycles that generally occur over 10 years or more, were force-fit into 10 months or so. The year 2020 has seen all of it; Expansion, Recession, Recovery, Boom in such a short span.

Let us have a look at the stocks that contributed to this party. Following is the list of the top 30 stocks that have generated maximum returns in the past 1 year.

During the bull market, all stocks, good and bad, may rise. However, if a company is not fundamentally sound or if it has not grown, the stock will give away all the returns it earned during the liquidity rally.

Which stocks are likely to do well over next year? We believe that stocks of companies that are scaling up a business or enjoying tailwinds in their respective sector will continue to grow and the stock prices will follow the same.

Stock Investing Faqs:

Which companies give the highest return?

We believe that stocks of companies that are scaling up a business or enjoying tailwinds in their respective sector will continue to grow and the stock prices will follow the same. Over the long term, it is observed that stock prices follow the earning trajectory of the company. Hence to generate high returns, it is important to track the earnings of the company and the stock price follows.

In stocks, what company had the best 2020?

Initially, IT and Pharma companies saw less/ no impact of the lockdown, and their sales remained intact. We have shortlisted 30 top-earning stocks since last year and most of them belong to these two sectors. Some of them are Aarti Drugs, Laurus Labs, Dixon Technologies, etc.

What are some Good stocks that can perform well in 2021?

Since 2020 saw a crash immediately followed by a flow of liquidity in the system, all the stocks rallied leading to a market rise by ~80% from its lows in March. The rally has been broad-based and all the stocks have participated whether they had or did not have sales growth. However, in 2021, the stocks without earnings growth might see some correction. We have shortlisted 10 stocks that can continue growing since they are backed by the earnings growth.

What is MoneyWorks4me way of stock investing?

At MoneyWorks4me we prefer to buy good quality companies at a reasonable price. We value each stock in our coverage and wait for their price to come close to a discount price or fair price.

Stocks with a strong long-term track record and good future prospects can trade at a discount to a fair price due to a temporary slowdown. At times, even great companies trading close to fair value. Buying stocks at such prices delivers consistent long-term returns.

MoneyWorks4me Superstars: Build a Portfolio of stocks that create wealth.

How does MoneyWorks4me help you identify the right stock?

It often happens that the market chases popular ideas rather than participating in tomorrow’s winners. MoneyWorks4me provides you with the right tools to identify good quality stocks at right time. With our help, you will get full access to around 20+ Sectors and 200+ companies to choose from. At MoneyWorks4me we value 200 stocks and track their progress. We help you identify when a stock is cheap and on the verge of pick up over the next 1-2 years.

Stock Screener: This tool enables you to screen stocks in a unique way.

MoneyWorks4me Stock Filter: Discover the best-performing stocks in NSE/BSE using our Stock Analysis Tool.

What does MoneyWorks4me provide to its non-subscribers?

MoneyWorks4me provides you the right tools to shortlist good stocks and analyze your favorite stocks.

1. Unique Stock Screener for India helps you filter out among 1000s of stocks and boil down to a handful for further analysis. Filter stocks based on profitability, growth, size, themes, and price.

2. Stock Analysis for Indian Stocks aka 10 year X-ray helps you scan stocks based on profitability, balance sheet strength, and growth. User-friendly format and color codes Green, Orange and Red saves time to turn over several stocks before you dig into details of specific ones.

3. Our Portfolio Manager helps you identify risks that you may have missed out on, for example, valuation risk, sector/stock concentration, downside potential, etc. The portfolio manager takes into consideration your entire assets and helps us ensure the right diversification.

4. Our Investment Shastra blogs provide insights into financial planning, investment planning, behavioral biases, and risk management. You also get a monthly outlook from our analysts who highlight interesting sectors to watch, fair value for the market, and market sentiment (bullish/bearish) to make better investment decisions.

How to Make Informed Stock Investing Decisions:

Best Stocks From:

Nifty 50 Nifty Next 50 Nifty 100 Nifty 200 Nifty 500 Healthcare Auto FMCG Nifty Financial Services Chemicals & Fertilizers Dividend Opportunities SmallCap 250 MidCap 100

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463