When you try a new dish and find it is not to your liking what are the chances of

- Eating it again – a small chance

- Making it part of your regular diet –remote possibility

- Making it your preferred dish- will take a miracle

Stocks is the asset class that gives the best returns, can create wealth, and help you meet your financial goals. You need it to be a positively good experience. Because if your first experience with stock investing turns out to be an unpleasant one, you like most people, will give it up. So you cannot afford to have an unpleasant experience.

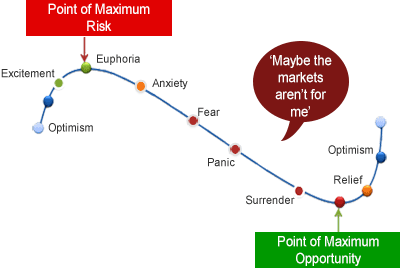

In a rising market, you may be thrilled that what you have bought has gone up. But for this to be a lasting first experience you need to come out a winner through one cycle of the market – going up and down.

Most people start investing in a rising market but unknowingly get exposed to average or poor quality stocks. In good times when everything is rising, it appears simple and sounds fun. But when the music stops and the market changes its trajectory, all the gains go away. Most retail investors then avoid the stock market as if it was a plague and forever lose the advantage of one of the best asset classes.

This pattern will be repeated forever, it is the way the markets work. Learning to navigate successfully through these cycles is the skill necessary for success in stock investing.

How do you build a stock portfolio with a strong foundation?

The first step is to select a set of stocks that can withstand and recover fast from economic and market downturns. At the same time, they ensure robust returns in times of economic growth.

Stocks of companies with strong brands (think Nestle), large size (TCS), high market share (Colgate), and steady business (HDFC Bank) tend to protect their profits in good times and bad. Companies with the above advantages earn high-profit margins and grow at an above-average rate year after year. Hence they tend to fall less and recover faster after market downturns.

The second step is to have a method of investing in these stocks. Prices can vary from attractive to very expensive. So how does one know when to buy? A sensible price anchor against which you can compare is necessary to take price-related decisions.

Using 52 weeks high or low, P/E or P/BV are examples of one type of anchor. These are all driven by market prices and may not have a correlation to the performance of the company.

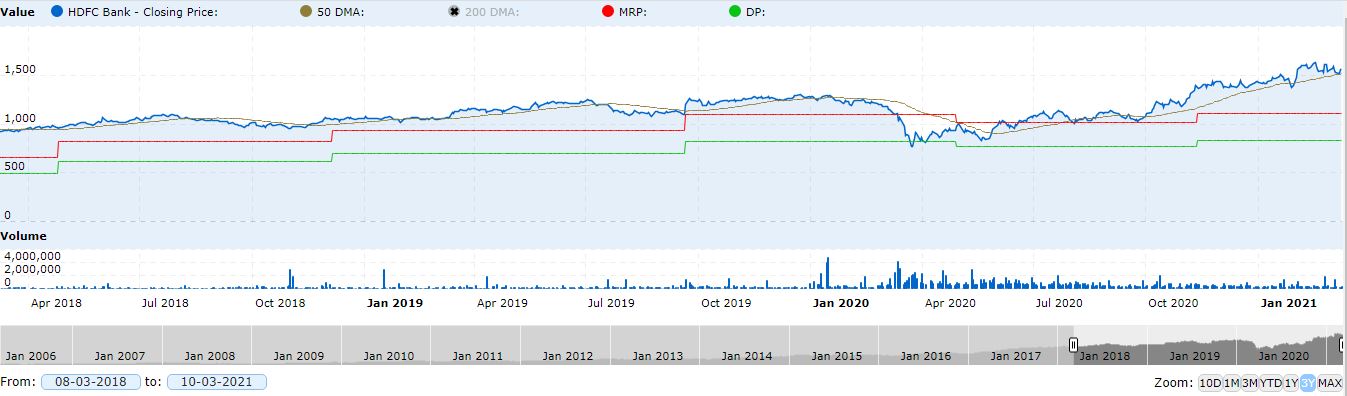

Just like while shopping you check for MRP, stocks also have their Fair price, i.e. MRP. MRP is calculated based on the company’s quality and future growth.

However, for investors to follow and trust an analyst they need to see transparently how these estimates have panned out over time. For example, Moneyworks4me clients can see the fair price estimate i.e. MRP over the last 10 years on the price chart of the stock. This gives them the confidence to act on our recommendations.

So how does one use MRP to build the portfolio?

We recommend using two powerful strategies:

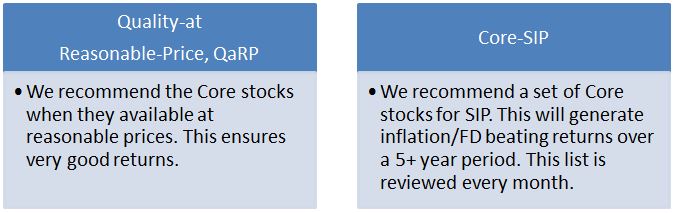

Quality at Reasonable Price (QaRP) is an investing process that takes advantage of investing in Core stocks whenever the market offers them at a reasonable price.

SIP in Core Stocks: You can do a SIP in up to 10 core stocks close to fair prices but suitable for SIP.

If you like what you have just read you can build a portfolio with a strong foundation using Moneyworks4me Core 50 Superstars.

This plan covers 50 of the strongest companies in different sectors that you can confidently invest in using the two investing strategies mentioned above.

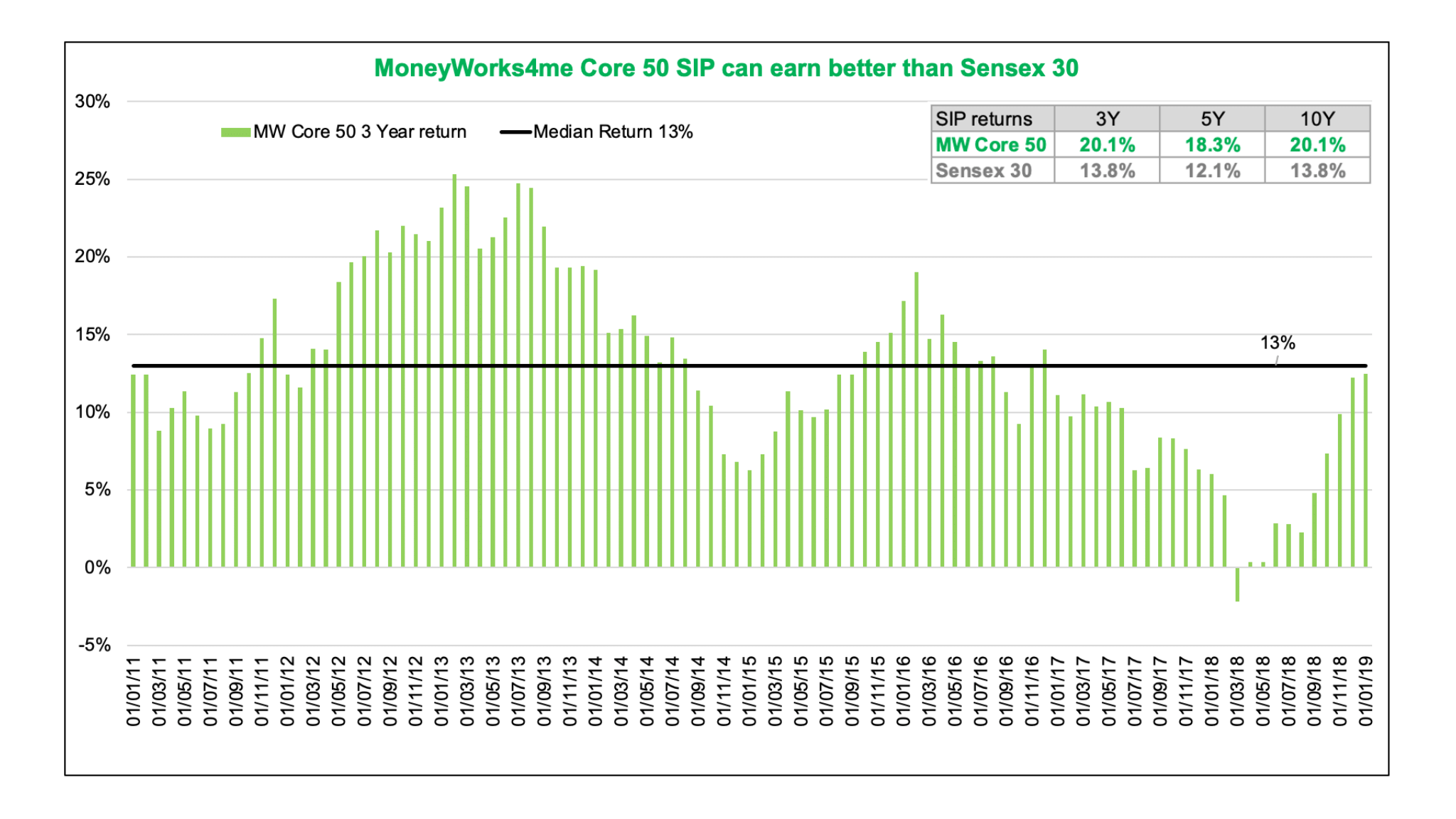

What will give you more confidence is that SIP in Core 50 Superstars delivered even better returns than SIP in Sensex 30 and much higher than FD.

Both these investment strategies complement each other to build your Core Portfolio under any market condition. Your core portfolio will deliver healthy-high returns while keeping the risk low.

It ensures you successfully navigate through your first market cycle and any volatility that the market throws up. You will be ready for a rewarding and exciting journey of stock investing.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp 8055769463