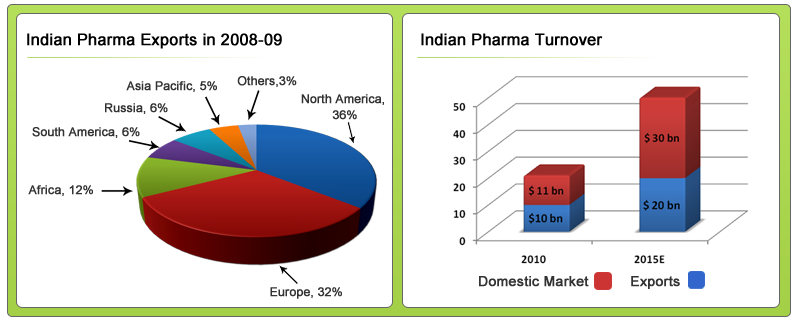

The Pharmaceutical sector in India is highly fragmented with more than 10,000 listed and unlisted companies. India is one of the fastest-growing pharmaceutical markets in the world, and its market size has nearly doubled since 2005. The total turnover of the Indian Pharma sector is estimated to be close to US$ 21 bn of which around US$ 9 bn comes from exports while the rest comes from domestic sales. US is the topmost destination for Indian Pharma exports followed by Russia, Germany and Austria. A region-wise segregation of Indian exports has been shown below.

The domestic pharma market is currently US $ 10 bn in size and is expected to reach ~US$ 20 billion by 2015 and establish its presence amongst the world’s leading 10 markets. Currently, India is the 4th largest market in the world in terms of volume and 12th in terms of value.

Based on the different therapeutic areas, the Pharmaceutical market can be broadly divided into 2 categories – Acute and Chronic.

- Acute Segment – It includes diseases that usually last for a short duration and includes therapies like anti-infectives, pain-killers or analgesics etc.

- Chronic segment – It includes diseases that are recurring in nature and include lifestyle diseases. This includes therapies like anti-diabetics, cardiovascular (CVS), cancer etc.

In most cases, ailments in the chronic segment ensure regular consumption of medicines for the lifetime of the patient. Thus, chronic segment is expected to grow much faster than the acute segment going forward. Currently, the Indian Pharmaceutical Market is more than 60% acute with the rest being chronic. The share of chronic is expected to increase going forward.

Anti-infectives is the largest contributor (17%) to the domestic sales followed by Cardiovascular and Gastrointestinal. The highest growth has been shown by Anti-diabetics followed by Neurology (CNS) and Cardiovascular.

So, how does the Pharma sector work? Here is the analysis

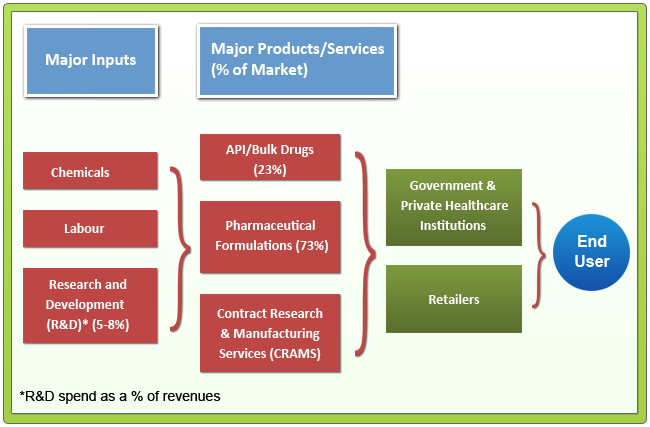

The working of the Pharma sector has been explained pictorially below:

Inputs:

The major inputs required for the Pharma sector are basic chemicals, labours and Research and Development (R&D). The sector is a research-driven industry with the focus being on discovering and launching new and innovative drugs. Companies spend millions of dollars/rupees on research and get the competitive advantage of patents if they are successful in launching drugs. In India, R&D costs as a % of revenues are around 5-8% on an average. This is very low compared to the companies in developed countries like US, UK etc. where the average R&D spend is close to 17-20% of the revenues.

Products/Services:

The Pharmaceutical products/services can be broadly divided into 3 segments

- Active Pharmaceutical Ingredients (APIs) – These are substances which are responsible for medicinal activity. For e.g. Paracetamol is an API which is present in drugs like Crocin, Anacin etc. and is responsible for relieving the pain. APIs (also called as bulk drugs) are the raw material for the final drug that we consume. Well known API manufacturers include Orchid Chemicals, Elder Pharma etc.

- Formulations – While APIs are responsible for the medicinal effect of a drug, we cannot directly consume an API due to different reasons like stability, taste, odour etc. Hence APIs are combined with certain substances called excipients to form the final drugs or formulations which are suitable for human consumption. Continuing the example given above, Crocin is a formulation. Companies like Sun Pharma, Cipla, Dr. Reddy’s etc. are examples of companies manufacturing formulations.

- Contract Research and Manufacturing Services (CRAMS) – Just like IT, major Pharma companies outsource their manufacturing work to low-cost centres like India to reduce cost while focusing on drug-discovery and marketing themselves. Further, they also outsource part of their research activities to some of the Indian pharma companies. Over the last few years CRAMS has emerged as a major focus area for many of the Indian Pharma companies. Examples include companies like Divi’s Labs, Jubilant Life Sciences etc.

As mentioned above, companies from developed countries spend a large amount on R&D and are responsible for discovering and launching a number of innovative drugs/formulations. Companies like Pfizer, Merck, Novartis, Roche etc are some of the biggest ‘innovator companies’ globally. Compared to this, Indian companies have established their presence in the generics segment.

So, what are generics? Generics are low-cost versions of branded drugs and have the same medicinal effect as the branded or original drug. Once the patent period for a drug expires, companies can come in with generic versions of a drug which provides affordable medicines for consumers. Indian companies have developed an expertise in reverse-engineering and developing generics.

Users:

Pharmaceutical products reach the end users through different mechanisms. There have emerged 2 different types of markets globally:

- Branded Markets: Countries like India, Brazil, Russia, Mexico, etc. are branded in nature. Consider the mechanism in India. In India, our doctor prescribes us the medicine for a particular disease. The prescription is usually a brand name of a drug for that disease. We also tend to purchase the exact brand prescribed by the doctor even if the chemist offers a different/generic version available at a low cost.

- Unbranded Markets: Developed countries like US, UK and some European countries are known as unbranded markets. Here, instead of prescribing the brand, the doctors prescribe the molecule or API (with the dosage) for a particular disease. In these countries, a large percentage of the population (~95%) has medical insurance. Hence, the insurance companies decide which generic drugs will be covered by the insurance; understandably these will be the ones which are sold at the lowest costs. When consumers approach the chemist, they are given the drug as per the prescription and their insurer.

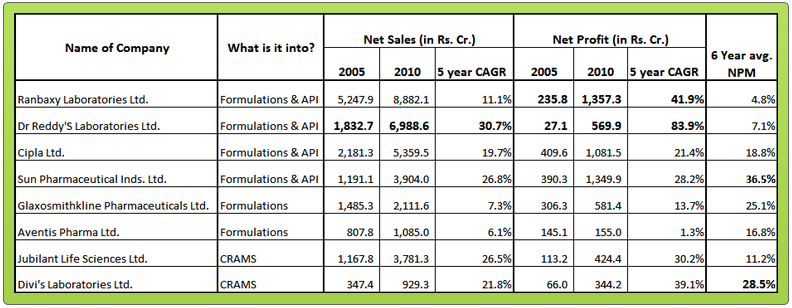

What does the Past say? Here’s the review of the Pharma Sector

As seen in the above table, Dr. Reddy’s Laboratories Ltd. has clocked the highest Net Sales CAGR of ~31% over the last 6 years. Its Net Profit has also grown strongly with a 5 year CAGR of close to 84%. However, its Net Profit margin is quite low at 7%. In terms of volume, Cipla is the market leader with a 5.3% market share in India.

Sun Pharma enjoys the highest Net Profit margins with a 6 year average of 36.5%. This is because of the strong brand it has created and its strong presence especially in the CNS therapy area.

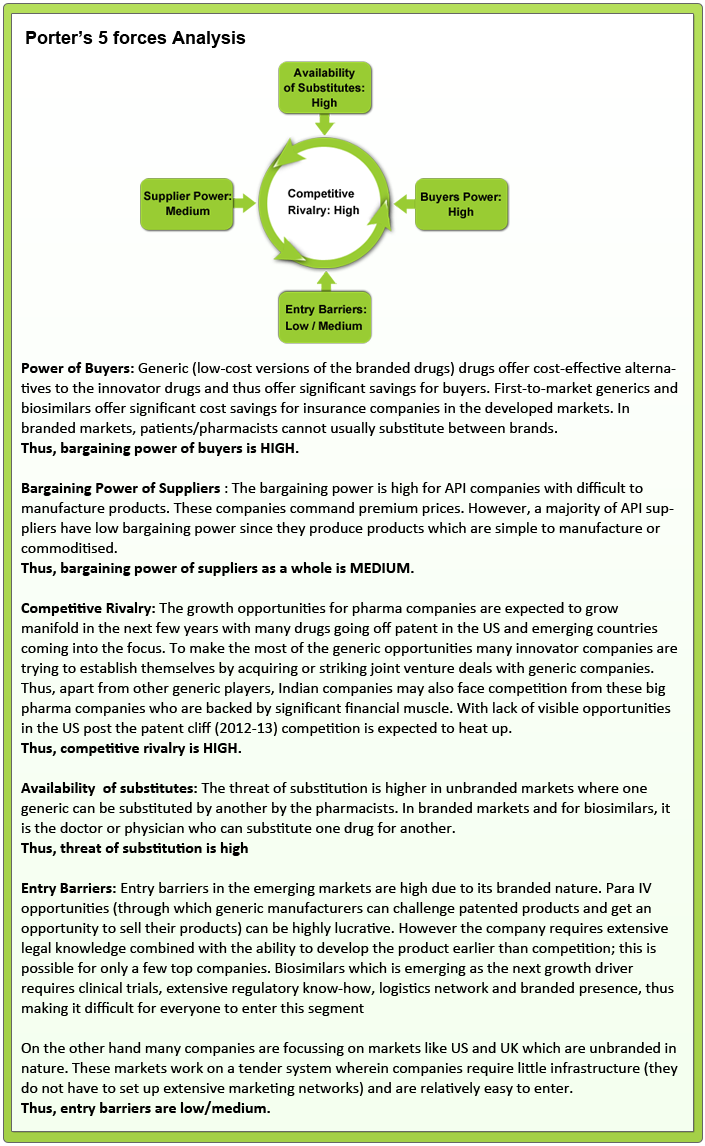

Porter’s 5 forces Analysis

What are the growth drivers of the Pharma sector? Here’s the analysis…

1) Increasing incomes & healthcare spends to spur domestic growth

With increasing affordability, shifting disease patterns and healthcare reforms, the total consumer spending on healthcare products and services in India has grown at a CAGR of more than 14% since 2000. According to a research report by the Mckinsey Global Institute, spending on healthcare in India will witness the highest growth rate among all spending categories over the next two decades. Healthcare spend is expected to grow to 13% of average household income by 2025 from 7% in 2005. This will be driven largely by increase in per capita disposable income which is expected to increase to US$765 in 2015 from US$463 in 2005.

The domestic pharma market will thus continue to grow rapidly (~15% sales CAGR over 2009-13) buoyed further by stronger penetration of semi-urban/rural areas and rising share of chronic therapies. McKinsey estimates the domestic pharmaceutical market will more than double to achieve sales worth US$ 20bn by 2015.

2)Significant patent expiries in developed markets present good growth opportunities for Indian generic companies:

A slew of patents will expire in the US and EU over 2011-15, including top-selling brands Lipitor, Nexium, Zyprexa and Plavix. Over this period, products with estimated annual sales of ~US$ 80 bn in the US alone will lose patent exclusivity, and this will translate into an estimated incremental generic sales opportunity of US$ 18 billion (~60% of current US generic drug market); a similar incremental opportunity in developed European markets exists as well. A big share of this revenue will go to companies that secure high-margin first-to-file (FTF) sales which offer marketing exclusivity for 180 days. It is estimated that Indian companies can take about 20% of this S18 bn new market

3) Emerging markets to become the next destinations for pharma companies

“Pharmerging” markets, including the BRIC countries, South Africa, Mexico, Turkey, Poland, Indonesia and Romania, are growing faster than developed markets. According to IMS, a well-known industry research firm, “Pharmerging” markets will increase their share in global pharma from 16% in 2009 to around 25% in 2014-15. Indian generics are replicating their domestic success in markets like Russia, Brazil and Mexico which like India are branded in nature.

4) M&A a potential catalyst

With higher growth prospects in emerging markets, many multinational branded drug companies are trying to expand their presence in generic pharmaceuticals. This has increased their interest in generic companies with an established product portfolio and sales/distribution network in emerging countries including India. The acquisitions of Ranbaxy (by Daiichi Sankyo) and Piramal (by Abbott) are a case in point. This is expected to continue.

5) Biosimilars – potentially a big long-term driver

Biosimilars are reproductions of biotechnologically manufactured biopharmaceuticals that partially mimic proteins naturally present in the body. Biosimilars could potentially become an important long-term growth driver for the generic pharmaceuticals industry, with the global annual sales opportunity rising to as much as US$ 10bn by 2015 (once patents for several biologics expire). Indian generic companies still trail overseas rivals in biosimilars. Success will depend on building manufacturing capacity and the emergence of favourable regulatory reforms in the US and EU.

So, is there anything to be concerned about?

1) Product pipeline drying up

Innovative drugs by Big Pharma companies which is the lifeblood of generic drug makers, has been on the decline for the past several years. Some branded drug companies are also cutting R&D budgets. This trend may pressure growth in generics (over time) as competition for a dwindling number of new molecules intensifies. Besides, Big Pharma is focusing more on biologics and difficult-to-make niche products, which in turn is compelling generic drug makers to also focus in that direction.

2) Patent expiries could cannibalise other generic molecules in India

There is a risk that some of the growth from new generic drugs will come at the expense of lower sales from existing generic products. As some of the largest brands in the industry come off patent in coming years, their generic uptake will be at the expense of other generic molecules in similar therapeutic categories.

3) Big Pharma moving into generics

Recent deals in emerging markets and an increasing number of tie-ups with generic firms indicate that branded pharma companies are moving into the generic space. Companies like Pfizer, GSK, Sanofi, AstraZeneca and Abbott have already made moves in this direction and this could result in increased pricing pressure.

4) FDA delays, compliance issues

The US Food and Drug Administration (FDA) approval timelines have lengthened from an average of 16 months during 2006-07 to 26 months in 2009-10. This is negative for the whole industry and can have painful consequences for individual companies. In addition, ongoing FDA issues related to current good manufacturing practice (cGMP) compliance have been a concern for companies like Ranbaxy and Sun Pharma (via US subsidiary Caraco).

5) National Pharmaceuticals Policy 2006

Currently the Government controls prices of 74 bulk drugs which are mainly life savers under cost- based price control and effective monitoring of the National List of Essential Medicines (NLEM). But the new National Pharmaceuticals Policy 2006, which is still in draft stage, proposes to increase the price control to 354 drugs. This regressive policy threatens the growth of the industry. With 100% FDI and a proposed policy like NPP creates confusions about the future of the industry.

What is the future Outlook for the Pharma sector in India?

The Pharma sector in India is expected to show robust growth in the next few years driven by growth in all 3 segments viz.

- Domestic Formulations which are expected to grow at ~15%

- Exports which will see huge growth due to the patent cliff in 2012 and emerging markets like Brazil, Mexico, South Africa driving growth

- CRAMS which is expected to grow at a rate of around 13% globally.

Indian companies have the largest number of US FDA (Food and Drug Administration) approved facilities outside US. They have made regulatory filings for around 70% of the drugs that are going off patent in 2012. Besides many companies have sizable US exposure in their overall revenue. The big pharma companies also seem to have acknowledged capability of Indian companies with many tie-ups, acquisitions and product specific deals happening over the last 2 years.

The companies that will benefit the most are those which have a robust pipeline of products in the regulated markets, a favourable geographic mix (strong presence in India and US with some presence in emerging markets) and potential in biosimilars/niche products. These companies will be best positioned for sustainable growth.

Thus, considering all these factors, we can say that in the long term the Indian Pharma sector is poised for robust growth and is shifting from a defensive to a growth sector.

It is very important that while investing in a company, an investor selects an industry, where the long-term future prospects are bright. We have seen that in the long run the Indian Pharma sector is expected to have good growth.

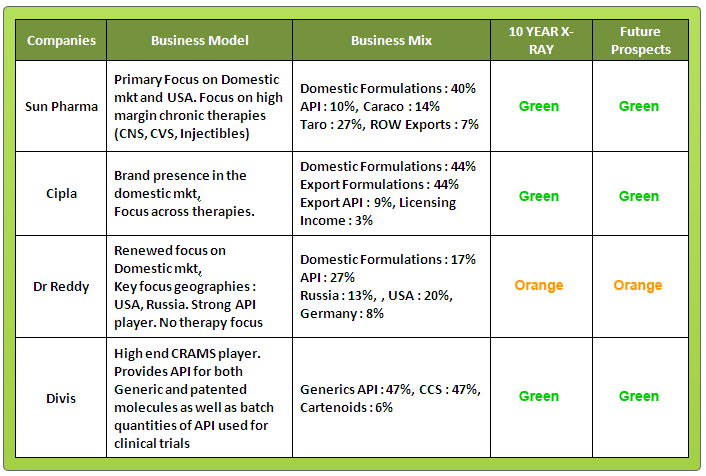

Also, it is equally important that the company has an excellent financial track record( i.e. Green 10 Year X-Ray) and its long-term future prospects are Green (Very Good).

*The 10 YEAR X-RAY facilitates analysis of the financial performance of the company considering the five most important parameters. A 10 Year period will normally encompass an entire business cycle. Analysing the performance over this time frame is essential to understand how a company has fared during the good as well as bad times. The five most important parameters that one needs to look at are Net Sales Growth Rate, EPS Growth Rate, Book Value Per Share (BVPS) Growth Rate, Return on Invested Capital (ROIC) and Debt to Net Profit Ratio.

Given below is the business model and the MoneyWorks4me assessment for a few Pharma companies: At MoneyWorks4me we have assigned colour codes to the 10 YEAR X-RAY and Future Prospects of the companies, as Green (Very Good), Orange (‘Somewhat Good’) and Red (Not Good).

While investing, one must always invest in the stocks of a company that operates in an industry with bright long-term prospects. Further, the company’s 10 YEAR X-RAY and future prospects should also be Green. The table given above gives you a list of few companies from the Pharma Industry that you could consider investing in. But, you need to invest in these stocks at the right price (i.e. when the market offers an attractive discount). To find out the right price to invest in these companies, become a member of MoneyWorks4me.com.

Disclaimer: This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

I am floored by the simple and yet a detailed approach adopted by you guys in putting across this report. Appreciate your efforts……….Cheers

Thanks a lot for the appreciation Vishal. We are striving continuously to maintain a similar level of simplicity and detail in all our reports.

Thanks a lot for the appreciation Vishal. We are striving continuously to maintain a similar level of simplicity and detail in all our reports.

Very lucid and yet very informative.. Great work..

really it’s very much informative …great work ….

Can you update this post to current times?

I couldn’t resist commenting. Exceptionally well written!

[…] rates have started increasing, you could increase your exposure to defensive sectors like FMCG and Pharma. However, always ensure that you invest in fundamentally sound companies at the Right […]