The power transmission equipment industry is a critical part of the Indian power sector. Power generation is the key growth-driver for the power transmission equipment industry.

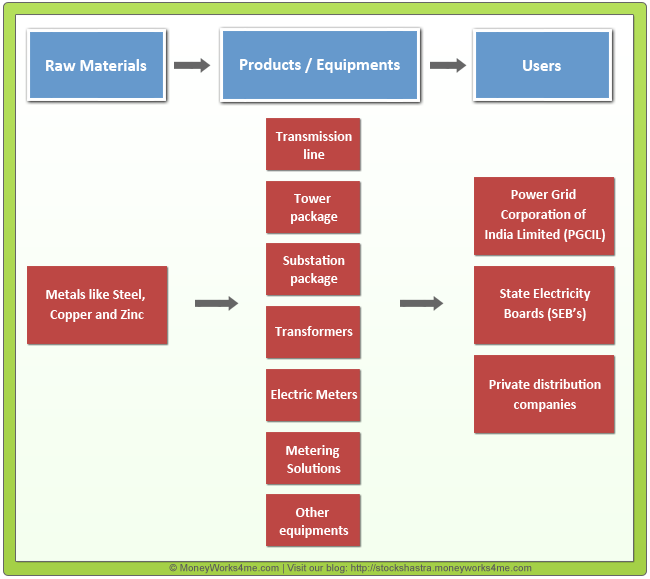

Power transmission equipment companies include those that manufacture transmission lines and towers, substations, equipments like transformers, reactors and electrical equipments like electrical meters and metering solutions.

The process of power generation and its eventual transmission and distribution (T&D) can be compared to the process by which food grains are supplied to cities from the places where they are produced and stored. Even if the warehouses are full with food grains, the transport infrastructure should be in good condition for the food grains to reach the end-users. If transport infrastructure is inefficient and inadequate, it not only results in supply shortage but also leads to wastage during transport. In case of power, generation capacity is the warehouse and T&D plays the role of transport. Considering the huge demand for power in India, massive generation capacity is planned in order to fill the electricity warehouse. At the same time, huge investment is required in building up the transportation facilities i.e. the T&D infrastructure so as to ensure efficient supply of power.

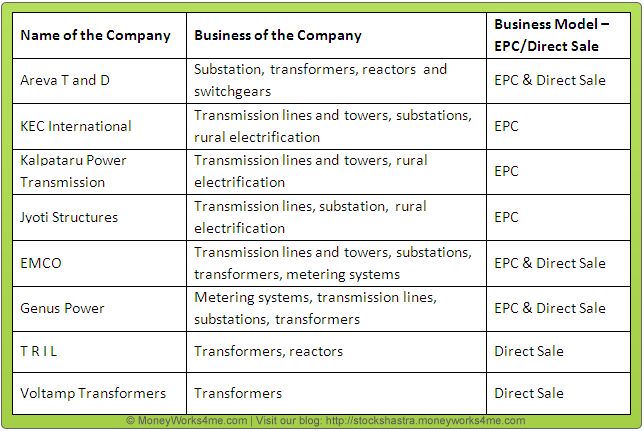

The companies in this sector work on 2 types of business models. What are they?

- EPC (engineering, procurement and construction): In an EPC contract, the EPC contractor (EPCC) agrees to deliver a completely commissioned plant to the owner for an agreed amount. Think of this as a builder who hands over the keys of a fully furnished flat to a purchaser. Transmission equipment companies that are in the business of setting up transmission lines and towers; and substations follow the EPC route wherein they take up turnkey projects.

- Direct sale of equipments: Companies that deal in manufacturing transformers and electric meters, directly sell them to Power Grid Corp (PGCIL), State Electricity Boards (SEB’s) and other private distribution companies.

Major Companies in the industry:

So, how does the industry work? Here is the analysis….

Who are the major users?

Power Grid Corp of India Ltd. (PGCIL) and State Electricity Boards (SEB’s) are the major users for power transmission equipment companies. PGCIL which is India’s central transmission utility (CTU) is responsible for the transmission of power from generation companies to distribution companies like the SEB’s. SEB’s distribute power to the end users which could be industrial, agricultural, commercial and domestic users.

What does the past say?

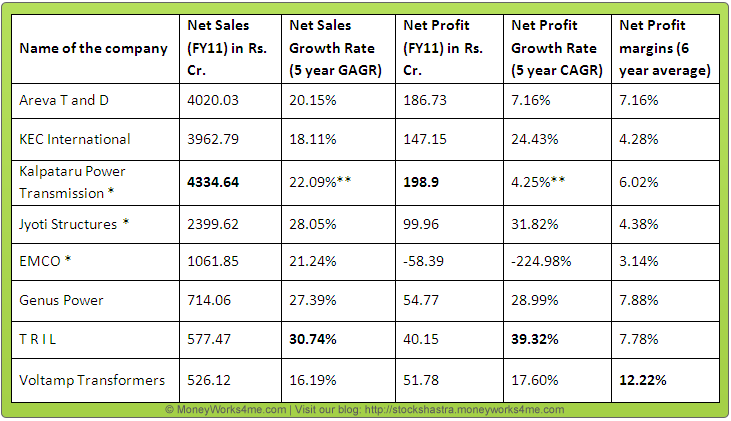

The major companies in this industry along with their growth rates in critical parameters are given below:

Among the EPC players, Jyoti Structures has shown highest growth in Net Sales and Net Profits. Among the other companies, Transformers and Rectifiers India Limited (TRIL) has shown very good performance with sales growing at a CAGR of 30.74% and profit at a CAGR of 39.32%. FY11 was bad for most of the companies because of low tendering activity by PGCIL and SEB’s.

It is observed that companies like KEC International, Kalpataru Power and Jyoti Structures which are mainly in to the EPC business operate at net profit margins in the 4-6% range . whereas the average margins of other companies is 7-9%.

Porters 5 Forces Analysis:

What are the Growth Drivers of the industry? Here’s the analysis:

Long-term demand for Power in India

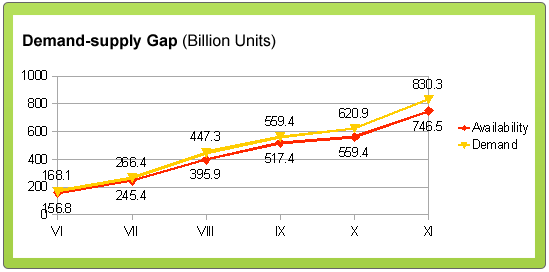

India has always been a power-deficient country. Over the years, the demand for power has always been greater than its supply. This power deficit is expected to continue in future because India is an emerging economy characterised by rapid urbanization and industrialization. The Government has set a target of 1,00,000 MW of installed capacity for the 12th Five Year Plan (2012 – 2017). These capacity additions must be supplemented by adequate T&D infrastructure. Hence, opportunities available are good for transmission equipment companies.

Co-relation with the Power Generation Industry

The power transmission equipment industry is an important support industry for the power sector of India and hence, the growth drivers for the power sector also act as growth drivers for the power transmission equipment industry. Globally, every dollar invested in generation has an equal amount invested in T&D. However, in India traditionally every dollar invested in generation has a corresponding half dollar invested in T&D. Due to this, transmission capacity in India lags behind the generation capacity. In order to make the rise in generation capacity meaningful, huge investments are required in T&D infrastructure.

Government

Government plays a crucial role in the power sector considering the critical nature of this sector for the Indian economy. Government’s role in the transmission and distribution sector can be understood from the following points.

-

- Investment plans by Government: The Government has increased the share of expenditure of T&D as a percentage of total expenditure on power from 44.2% in 10th plan to 51% and 56.4% in 11th and 12th plans.

- Restructured Accelerated Power Development and Reforms Programme (R-APDRP): The R-APDRP programme is being implemented by the Government in order to bring down the AT&C losses (Aggregate Technical and Commercial losses). The demand for electrical equipments like metering systems and metering solutions for power sector is expected to get a boost due to reforms under R-APDRP which requires metering at all levels of distribution of electricity. The programme also aims at revamping the transmission lines in order to reduce T&D losses which will require replacement of existing lines with new ones. On the whole, these reforms are expected to work in favour of equipment companies.

Customers

Major customers for power transmission equipment companies are PGCIL, SEB’s and private distribution companies.

- Power Grid Corporation of India Limited (PGCIL): PGCIL is on course to achieve its targeted investment of Rs. 55,000 crore during the current XI Plan period ending 31st March, 2012. The outlay planned by PGCIL for the 12th plan is Rs. 1,00,000 cr. This outlay is for the huge network expansion by PGCIL during the 12th Plan in which about 52,000 circuit kilometres of transmission lines, 70 sub-stations and transmission capacity of 1,36,000 MVA are expected to be added. Hence, the remaining part of the 11th Plan and the 12th Plan is expected to be very good for transmission equipment companies.

- State Electricity Boards (SEB’s): Fuelled by power sector reforms in recent years, and focus on reducing T&D losses, state utilities have significantly stepped up spending in the transmission sector. In the 12th Plan, state transmission utilities are expected to invest approximately Rs. 1,00,000 cr. in order to expand the intra-state transmission network.

- Private Players: – Private sector participation in the transmission sector has been meagre so far. However, the Government is now encouraging participation of private players in this sector considering the inadequate transmission infrastructure of India. In future, transmission equipment manufacturers are expected to fetch good business from private transmission companies.

High capacity power transmission corridors (HCPTC)

The increasing share of private power companies in the power sector will necessitate the need for an inter-state transmission network, linking private generation companies (known as Independent Power Producers) to various parts of the country. PGCIL recently announced creation of nine high capacity power transmission corridors (HCPTC) linking independent power producers (IPP) plants in several states including Orissa, Chattisgarh, Jharkhand, Sikkim, Andhra Pradesh, Tamil Nadu and Madhya Pradesh to different regions of India at an estimated capital expenditure of Rs. 58,000 cr. The power transmission equipment industry is expected to benefit from this programme.

Fluctuation in prices of raw materials

Commodities like steel, copper and zinc constitute a high proportion of raw materials for companies in this industry. For EPC players, steel is the key raw material whereas for transformer companies copper and a lamination material known as CRGO Steel (Cold Rolled Grain Oriented Steel) are the main raw materials. The fluctuation in prices of these metals could have an adverse impact on margins of equipment companies. Margins of companies that have a larger share of contracts with a price variation clause are more protected than margins of companies having majority fixed price contracts.

Expected boom in Exports

Companies like Kalpataru Power, Jyoti Structures, Genus Power are already in to exporting of transmission equipments. These companies are expected to get further export boost due to certain international developments. More and more countries are planning and enforcing regulations to ensure replacement of all existing electromechanical meters with new static (electronic) meters for reasons such as tamper prevention, data reading, inclusion of communication features etc. As a result there lies a huge requirement of electronic electricity meters worldwide. Hence, good export opportunities are available for companies like EMCO and Genus Power. Export opportunities are also available for EPC players as they can take advantage of the new T and D projects being developed in Africa, Middle East and CIS countries.

So, is there anything to be concerned about?

Intense competition especially by Chinese players:

PGCIL’s plans to increase vendor base to ensure growth in transmission infrastructure has attracted many new and smaller equipment players. These players go for aggressive bidding; sometimes 15-20% lesser than the existing players’ bids. Such practices could lead to reduction in margins for the power transmission equipment industry.

Execution delays: Delays in execution could happen due to manpower shortages, delays in receipt of environment and land approvals, natural calamities, political unrests, terrorism, etc. With some HCPTC projects planned in politically sensitive states including Andhra Pradesh, Jharkhand, Chattisgarh and Orissa, these projects could face execution delays. All this might lead to lower than expected revenues for transmission companies.

Fluctuating metal prices: Metals like steel, copper and zinc constitute a high proportion of raw material costs. Significant fluctuating commodity prices could lead to lower margins for transmission equipment companies. Companies which have a higher share of fixed-price contracts are highly vulnerable to fluctuation in commodity prices.

Delay in power generation capacity addition: Power transmission equipment companies’ business largely depends on the power generation sector. Execution delays in power generation plants leads to fall in the quantum of orders for transmission equipment players. Historically, India has seen Power generation companies face delays due to problems such as shortage of coal supply, delays in acquisition of land, manpower shortage, shortage of equipment supply (Boiler, Turbine and Generator), etc.

Working capital intensive nature of business: Power transmission equipment business is working capital intensive in nature mainly because they deal with SEB’s which are known for delayed payments. For EPC players, the debtor days are very high in the range of 150-190 days. As money is locked with SEB’s, the equipment companies are required to borrow for short term to carry on operations, which impacts their profitability as interest payments are to be made.

What is the future outlook for the Power transmission equipment industry in India?

The power transmission equipment industry is a critical part of India’s power sector and is dependent upon on the power generation and power transmission and distribution sector of India. Given the fact that the demand for power is huge in India, the opportunities available for power transmission equipments are bright.

The T&D sector is suffering due to delays in generation and transmission plans, high Aggregate Technical and Commercial losses, insufficient metering, poor recovery of dues, and competition from Chinese and Korean players. However, with the sector receiving due attention and investment from the Government in the form of higher share of allocated expenditure in the XI and XII plans and programmes like R-APDRP and HPTCP, opportunities available for transmission equipment players appear to be good.

This industry performs well when PGCIL and SEB’s plans are on track and they place orders with equipment companies. FY11 was not good for the industry due to the subdued tendering activity by PGCIL and SEB’s. However, with the expected pick-up of ordering activity by PGCIL and SEB’s to meet their plan targets and with ordering for mega projects expected to commence, the sector is expected to do well in the coming years.

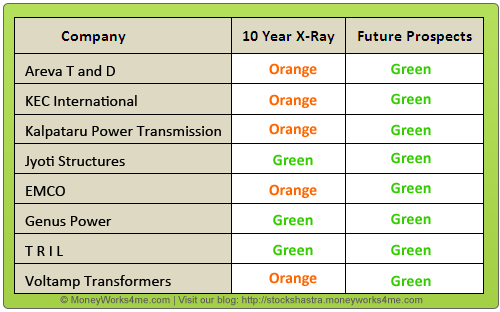

On the whole, the long term future prospects of this sector appear to be GREEN (Very Good).

Also, it is equally important that the company has an excellent financial track record( i.e. Green 10 Year X-RAY) and its long-term future prospects are Green (Very Good).

The 10 YEAR X-RAY facilitates analysis of the financial performance of the company considering the five most important parameters. A 10 Year period will normally encompass an entire business cycle. Analysing the performance over this time frame is essential to understand how a company has fared during the good as well as bad times. The five most important parameters that one needs to look at are Net Sales Growth Rate, EPS Growth Rate, Book Value Per Share (BVPS) Growth Rate, Return on Invested Capital (ROIC) and Debt to Net Profit Ratio.

Given below is the MoneyWorks4me assessment for a few Power companies: At MoneyWorks4me we have assigned colour codes to the 10 YEAR X-RAY and Future Prospects of the companies, as Green (Very Good), Orange (‘Somewhat Good’) and Red (Not Good).

While investing, one must always invest in the stocks of a company that operates in an industry with bright long-term prospects. Further, the company’s 10 YEAR X-RAY and future prospects should also be Green. Though the power sector is poised for good growth in the future, it remains to be seen whether companies in this sector can completely take the benefit of this growth and reflect it in their performance. Because of the very nature of the power sector (capital intensive + high debt) and lower placement of orders by transmission and distribution companies (PGCIL, SEB’s, etc.) most of these companies have had muted growth in one or more of their parameters. However, going forward, growth in this sector is inevitable considering the capacity additions planned by generation, transmission and distribution companies.

Hence, investors with moderate appetite for risk can consider investing in these companies, but only at the right price. (i.e. when the market offers an attractive discount). To find out the right price to invest in these companies, become a member of MoneyWorks4me.com.

Disclaimer:This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/ies. The person should use his/her own judgment while taking investment decisions.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

A very good usefull information for investor.

a very informative and comprehensive read.

Great wook. Thank you.