Parag Parikh Long Term Equity Fund (PPLTEF) performance has topped the charts in the last 1 and 3 years. For the period ending November 2020, it has delivered 14% CAGR in the last 3 years versus Nifty’s 6.6% CAGR. Investors now ask whether it was domestic stocks or international stocks that led to such stellar performance.

So what really led to superior performance for Parag Parikh Long Term Equity Fund: India or International?

Parag Parikh Long Term Equity Fund (PPLTEF) is one of the few funds that manage Indian and international stocks as one equity portfolio. As per the fund manager, different economies track the different market and economic cycles. Constructing a portfolio using this strategy would not only smoothen the returns but also open up more investment opportunities globally.

For investors, international exposure reduces volatility in returns.

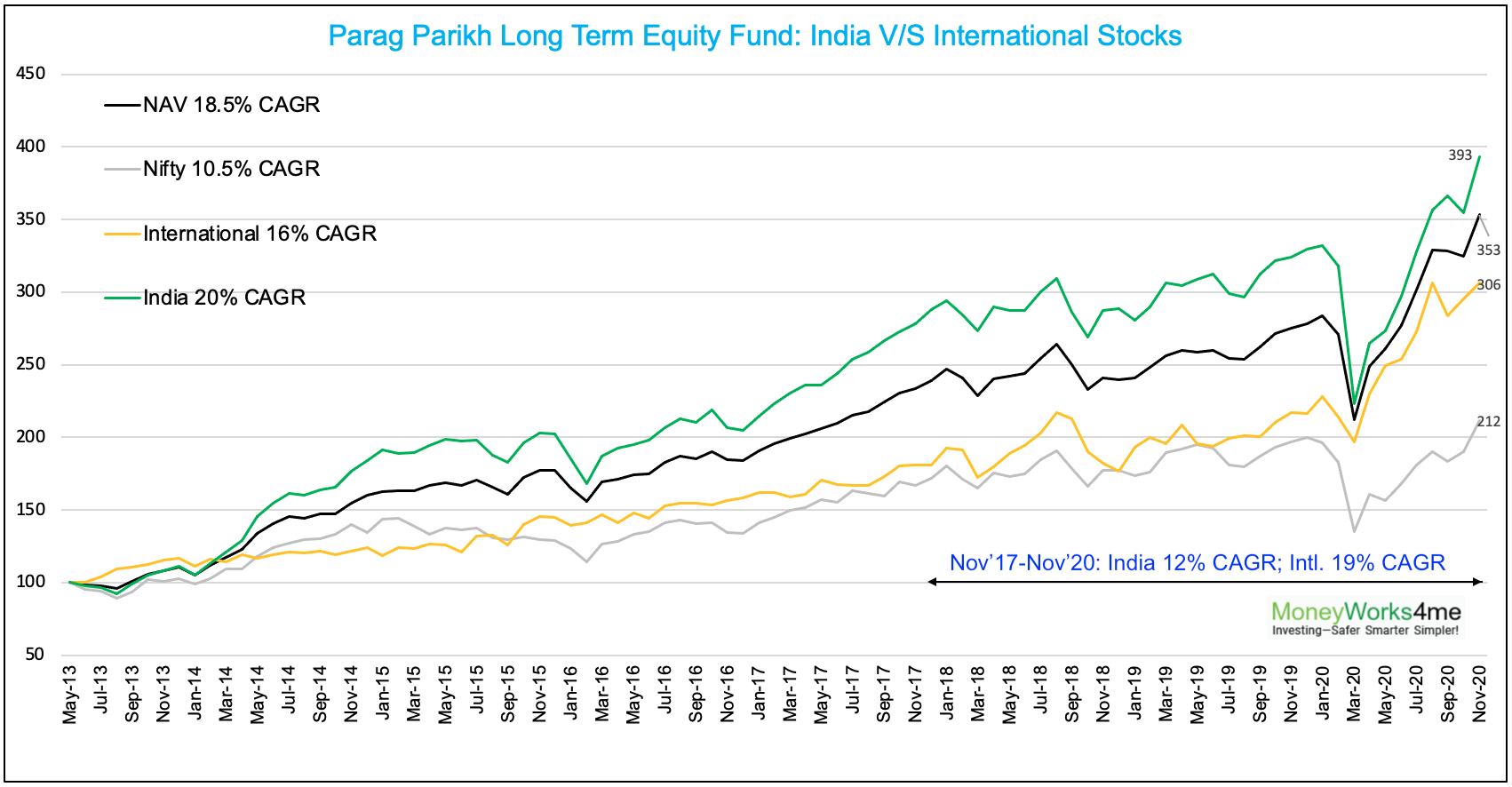

PPLTEF has completed 7.5 years. Since its inception, it has delivered a stellar 18.5% CAGR versus just a 10.5% CAGR from Nifty.

One wonders what led to superior performance for the fund. Is it India stocks or International?

We compiled the data from the monthly portfolio disclosures of Parag Parikh Long Term Equity Direct Plan (G).

We broke down the portfolio into India and International. We computed returns for each portion and then indexed it on a proportionate basis.

Assumptions:

(1) We have used month-end values for computing returns from international stocks; may vary based on the actual purchase price

(2) Indian stocks include cash and cash equivalent & all dividends

(3) Not adjusted for Expense Ratio.

Indian stocks have delivered close to 20% CAGR while International stocks delivered 16% CAGR, both exceeding Nifty’s 10.5% CAGR since inception.

The recent performance of International stocks is far superior versus Indian Stocks. International stocks delivered 19% CAGR from Nov’17 to Nov’20.

Register FREE | Schedule a DEMO | Solution Enquiry | Subscribe

International and India Breakup

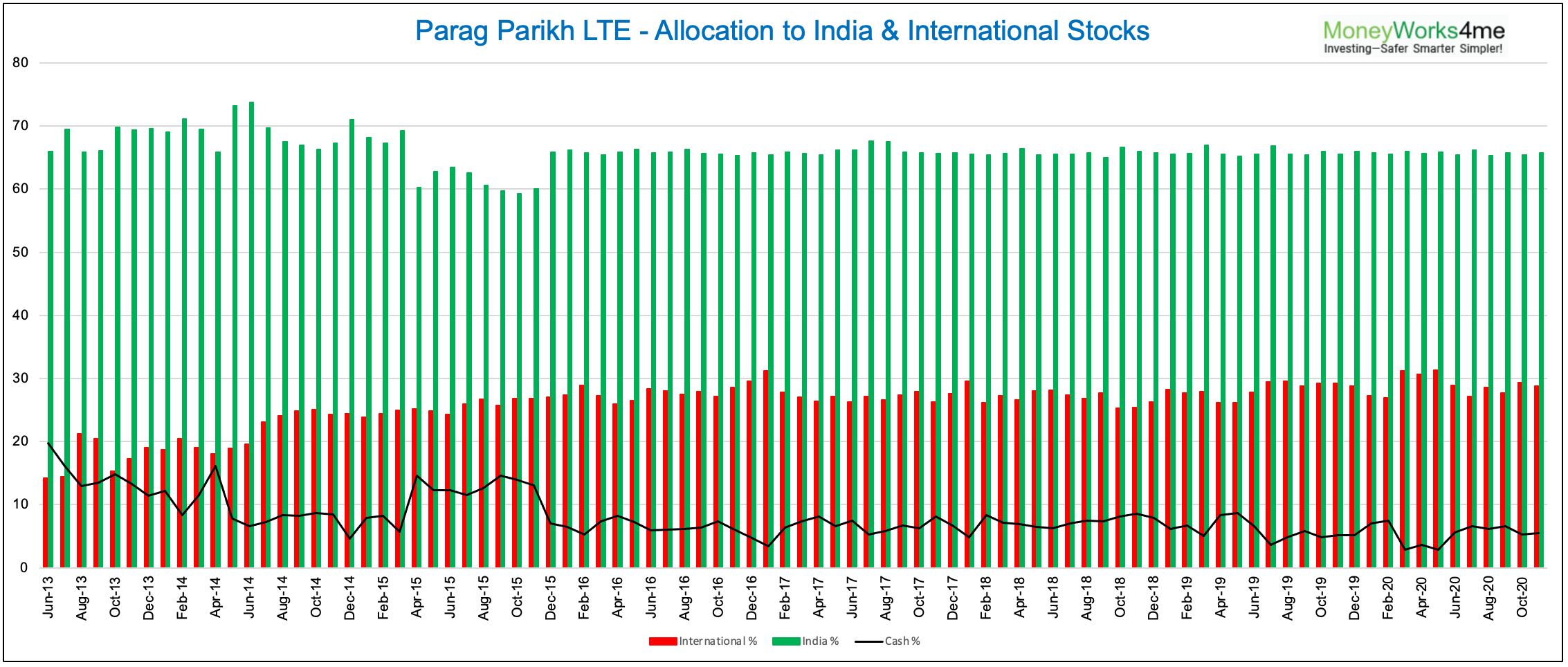

PPLTEF has maintained less than 30% of its portfolio in International stocks. Income Tax doesn’t allow Equity taxation for funds with less than 65% portfolio in Indian stocks.

Across time periods, the allocation to International stocks is less than 30%. Currency exposure to International stocks is fully hedged, so currency fluctuations don’t add or reduce returns.

Besides, a low churn portfolio and falling expense ratio add to returns. Read more about hidden costs in mutual funds.

Since we had studied the PMS performance of Parag Parikh Investment Advisory, we had recommended PPLTEF to our clients before it completed even 5 years as a mutual fund. Along with our clients, we are delighted to be an early investor in the fund.

Parag Parikh Long Term Equity Fund Faqs:

Is it good to invest in Parag Parikh long-term equity fund for 10 years?

Yes, it is good for a 10 year period. Given this fund is geographically diversified, conservative in valuation, and focused on quality companies, we believe it is a good fund to have for 10 year period.

Is it the right time to start a SIP in Parag Parikh long-term equity fund direct growth?

If you are a long-term investor (more than 5 years), yes this is a good time to start your SIP.

How good are Parag Parikh long-term equity mutual funds for investment?

PP LTE has completed 7.5 years. Since its inception, it has delivered a stellar 18.5% CAGR versus just a 10.5% CAGR from Nifty.

How do I invest in Parag Parikh Long Term Equity Fund?

You can invest via SIP or make a lump sum investment.

What is Parag Parikh mutual fund?

PP LTE or Parag Parikh mutual fund is a mutual fund with ~35% exposure to International Stocks along with exposure to Indian markets.

Check, Fund Review in Details!

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call 020 6725 8333 | WhatsApp 8055769463