Prince Pipes & Fittings Ltd IPO Details:

- Issue Open date: 18th December 2019

- Issue Close date: 20th December 2019

- Equity shares offered: 2.8 Cr

- Price Band: 177-178

- Issue Size: 500 Cr

- Minimum lot size: 84

Purpose of IPO

- A fresh issue of shares for repayment or prepayment of certain outstanding loans ~Rs 250 Cr;

- Offer by sale by promoters as they raise around ~Rs 250 Cr. They will be using this to pay off personal debt and reduce pledging on Prince Pipes & Fittings.

About Prince Pipes & Fittings Ltd

Prince Pipes and Fittings Ltd was incorporated in 1987. Mumbai based Prince Pipes and Fittings Limited is engaged in the manufacturing of polymer pipes and fittings.

It is operating in the polymer pipe segment under two brand names; which are Trubore and Prince Piping Systems.

The company has a corporate office in Mumbai and a strong presence across North, South and West India.

Prince Pipes has six manufacturing plants that are situated at Athal (Union Territory of Dadra and Nagar Haveli), Dadra (Union Territory of Dadra and Nagar Haveli), Haridwar (Uttarakhand), Chennai (Tamil Nadu), Kolhapur (Maharashtra) and Jobner (Rajasthan), with a total installed capacity of 241,211 tonnes per annum as on October 31, 2019.

Besides, two contract manufacturing units are located at Hajipur (Bihar) and Aurangabad (Maharashtra).

The company is also planning to open a manufacturing unit at Sangareddy (Telangana).

Segments

Polymer Pipes:

The Company produces four types of polymer pipes including CPVC, UPVC, HDPE, PPR.

The Company sells the products under Prince Piping Systems brand name to 843 distributors which further sell them to wholesalers, retailers, and plumbers.

At the end of October 2019, the company had a product range of 7,167 stock-keeping units.

These products are used for varied applications in plumbing, irrigation, and soil, waste, and rainwater (SWR) management and find their application in both, the rural and the urban setups.

Polymer Fittings:

The company sells three different polymer fitting types: – CPVC, PPR, and UPVC under brand Trubore.

The products under Trubore are directly sold to 212 wholesalers and retailers.

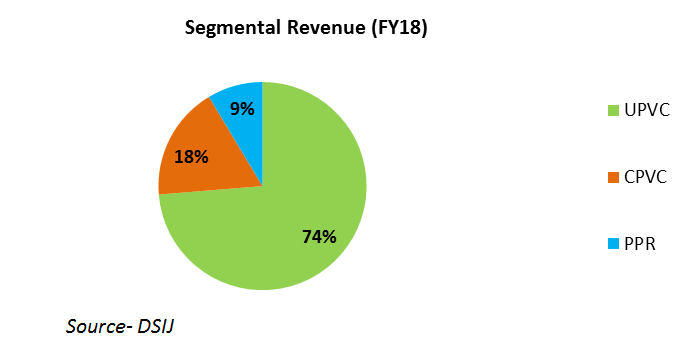

UPVC consists of a bulk of the business.

Plastic pipes and fittings industry is expected to grow CAGR of 16% to 49,000 Cr in FY23 from 27,000 Cr in FY18.

The industry has many players with granular market shares with 55% covered by unorganized players.

Among the organized players, Supreme Industries has the highest market share of 10% of the overall industry followed by Finolex industries with a market share of 9%.

Prince pipes and fittings enjoy a market share of 5%.

MoneyWorks4me Opinion

Prince Pipes and Fittings Ltd operate in a very competitive industry with a large unorganized player market.

Plastic pipes are very commoditized where brands do not play a major role and every player sells more or less similar products with no differentiation.

The key aspect of the business here is distribution ability.

We believe Prince Pipes and Fittings Ltd has a modest reach of distribution across the country.

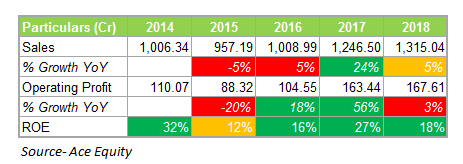

Bigger players like Supreme and Finolex give it a tough fight to Prince Pipes. We find that the growth rate is low for UPVC and high for CPVC pipes.

UPVC has a primary application in agriculture and irrigation and the margins are very low.

The company expansion plans into high margin products like fittings and CPVCs are yet to fructify as competition is increasing in the segment as well.

ROE for Prince Pipes is low even versus Finolex Industries (a dominant PVC player) and much lower than Supreme and Astral Poly (non-similar products break-up but same industry).

We find that Prince Pipes may continue to enjoy an existing market share in core regions West, North India, etc but scaling up pan-India is difficult with modest balance sheet size and late mover disadvantage.

There is a lot of competition from Ashirwad & Astral in newer, high margin segments like CPVC.

Finolex and Supreme are also finding it difficult to crack the market of CPVC as it doesn’t have an overlap of distributors.

Based on the average business model, we recommend to AVOID Prince Pipes & Fittings.

As an advisor, it is our duty to inform you what is right and refrain from risk-taking behavior in this market.

We will definitely recommend you select issues that are worth investing in. We are equally interested in making money as you are!

We continue tracking Finolex Industries, Supreme Industries, and Astral Poly as these companies have exhibited relatively stable growth and high ROE across several years.

IPO:

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463