This article covers the following:

Review

Nifty Total Return Index (Nifty including dividends) earned ~13.5% Year to date Nov’19 and ~15.5% CAGR in the last 3 years from demonetization lows.

Nifty continues to remain steady thanks to a handful of stocks making all-time highs while the rest of the market is at 52-week lows or even 3-year lows.

This has led to underperformance for most advisors and MFs. Just 37 out of Top 100 stocks actually made a double digit return for the year.

This narrow rally meant that an average investor’s portfolio hasn’t earned good returns from equity this year.

As we go deeper, small and mid-caps have done worse than large caps. Just 100 stocks out of 400 mid/small cap stocks in BSE 500 have earned double digit returns.

Around 150 stocks out of 400 have fallen more than 20%. This implies that small and mid-cap investing has not done well.

Our hypothesis at the start of the year turned out right where in we chose not to participate in small and mid-cap aggressively due to valuation concerns.

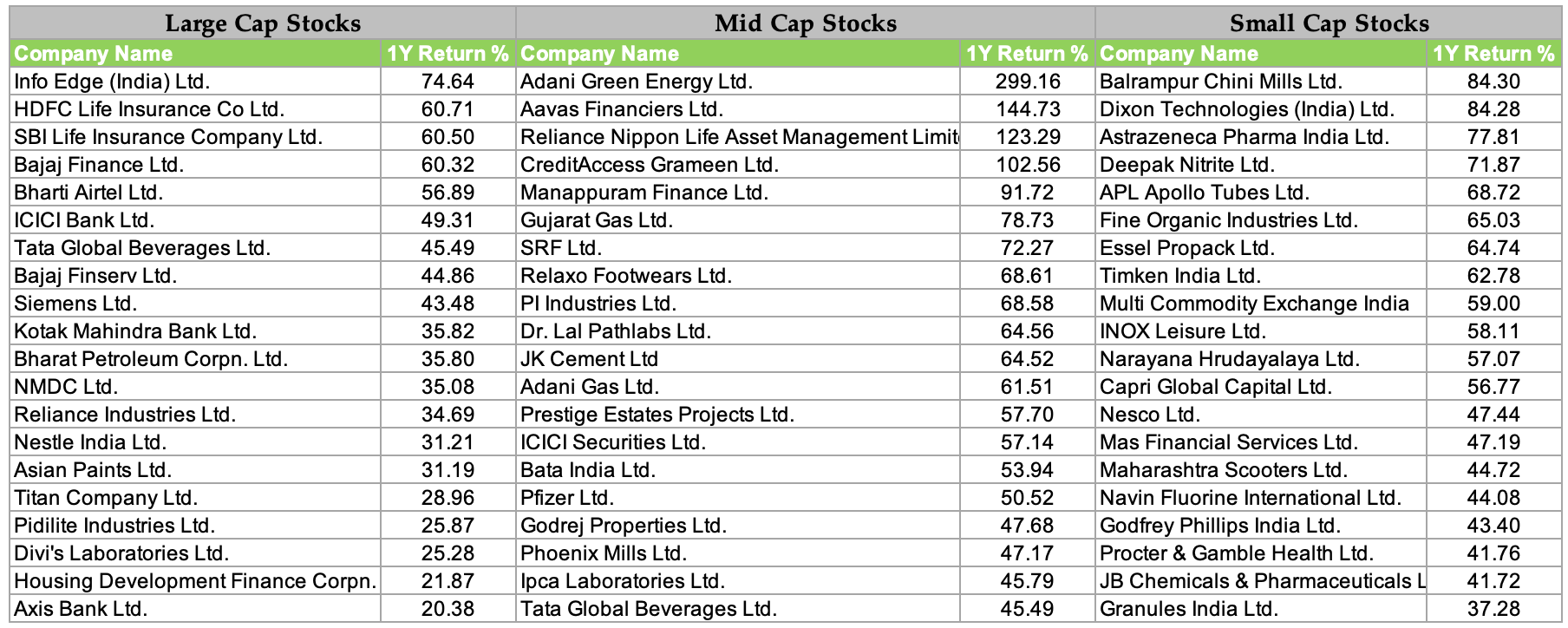

Following is the list of the best performers of 2019 in the respective categories:

The above stocks have managed to report superior sales and/or earnings growth in the year when the rest of the market was subdued.

Overall the sentiment remained negative due to no uptick from festive demand. The economy remains sluggish due to credit squeeze, lack of employment growth and no increase in demand.

Outlook

As on date, the average upside of our coverage universe is likely to be less than 10% CAGR over the next 3 years.

Just a handful of companies are delivering moderate earning growth due to slow economic growth.

These companies are enjoying high valuation as more and more investors are chasing them.

This trend will reverse as other sectors start showing signs of improvement.

Some pockets of the market like consumer staples, consumer discretionary and now insurance and AMCs are trading at stretched valuation.

We find that Nifty 50 also trades at 12-15% above its fair value as stocks with large weightage in the index are trading at elevated valuation.

We expect below-average returns from these baskets over the next 3 years even if earnings growth is good. Starting valuation plays an important role in long term returns.

Even if the indices valuation doesn’t look cheap, we don’t mind buying stocks with low valuation and good future prospects.

We are looking at companies that have good earning triggers over the next 2 years as we are not certain whether broad-based recovery will happen immediately.

We are investing in companies i) coming out of sector consolidation, or ii) introducing new products, or iii) commissioning new capacities or iv) executing the order in hand.

An investor can consider investing in value and high dividend yield stocks like Infra & Infra-related companies like capital goods, high-quality PSUs, corporate banks, pharmaceuticals, and select NBFCs.

We will be participating in some of these opportunities via thematic Mutual Funds.

We are still evaluating ‘Credit Risk funds’ as they might have become cheap, due to herd’s negativity, even after considering the risks they carry.

If we find any merit, we will share our recommendations and analysis with our subscribers.

We believe that small and mid-cap are not cheap yet to make risk-adjusted returns over an entire cycle.

Growth in small-cap stocks is poorer than large-cap stocks as they can’t wither the storm.

Even if they rise from here, long term returns won’t be commensurate for the risk one takes investing in small and mid-cap companies today.

A SIP product may work in such a small & mid cap but we recommend caution on lump-sum purchases till we don’t see broad-based earnings recovery in mid and small-cap companies.

Risks

GDP Slowdown

GDP growth averaged around 4.75% in the first half of FY20. This was the lowest in almost 8 years.

One will also notice that the slowdown is entrenched from large size purchases to small ticket items.

Private investment grew at only 1 percent. Nominal GDP growth fell to a new low of 6.1 percent.

As we know that equity returns have strong co-relation to the nominal GDP growth rate, the equity market has been underperforming.

Usually, slowdown stays for 2-4 quarters after which the low base effect kicks in thereby leading to above-average growth and sentiment improvement. So it is a wait and watches mode to see how it pans out.

We do not see merit in avoiding equity just because near GDP growth is lower. No one can time the pick up in the economy.

Markets may turn the corner before actual GDP growth picks up.

Opportunity for long term investors

Markets may remain subdued until the time earnings growth kick in. But this doesn’t mean stocks won’t rise.

In the previous month, we highlighted that stocks that are underpriced can rebound even of expectation that the worst scenario is behind us.

We already see some bounce back in the last of December’19. It is yet to be seen whether this recovery from the low sustains.

We expect the average to below-average return in Nifty over next 2 years so be light on Index Funds for the next few years.

But expect superior returns from stock picking as average stock today is trading cheaper than Nifty.

We are seeing a lot of NBFCs and banks recovering as the government’s push to resolve the liquidity crisis has brought some hope.

Near term uncertainty in structural growth, story spells an opportunity for long term investors. Stocks are beaten down from short term fears.

We do not find any merit in second-guessing what’s going to happen in the next 6months-1year. We leave this field open for speculators, fear mongers, and punters.

We are managing only long term money and predicting near term events is futile.

We continue to recommend Gold Fund/Gold (up to 5-10% of the portfolio) as a hedge from potential geopolitical risks and allocation to safe liquid funds/Fixed Deposits (10-20%) within in equity portfolio for capturing new opportunities.

Together these investments will hold the portfolio relatively intact even if the market reports minor declines.

Beyond this, tinkering asset allocation will only reduce long term returns thereby missing one’s target corpus.

Equity returns often give surprises, we wish to stay invested to enjoy such surprises.

MoneyWorks4me Outlook:

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463