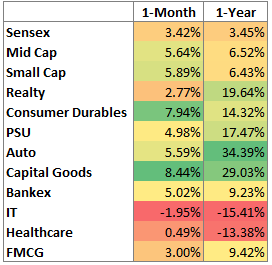

Sensex was up 3.5% in the month of August’22

The Sensex surged another ~3.5% in Aug’22 after experiencing a strong rebound of ~9% in the previous month. Mid and Small Caps outperformed Large Caps. Most major sectors, except IT, delivered positive returns with capital goods, consumer durables, auto, and banking is the best performing sectors.

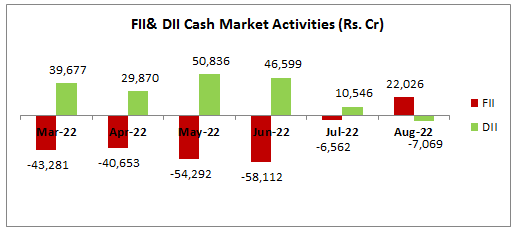

FPIs turning back to India

India witnessed one of the highest FPI outflows among peer markets – Indonesia, Philippines, S. Korea, and Taiwan. However, after being net sellers for the last 11 months, FIIs bought equities in the cash market worth approx. Rs. 22k cr. DIIs were net sellers for the first time in the last 17 months, selling equities worth approx. Rs. 7k cr.

Markets moving above Nifty @ MRP

At the time of writing this, Nifty 50 currently trades ~14% above its fair value, while there are pockets of extreme overvaluation and undervaluation. Nifty though is a highly concentrated portfolio dominated by the top 10 companies, hence it is not the case for all the stocks. Selected investment opportunities still persist in the market.

Fed turns hawkish, stirs global markets

Jerome Powell, in his speech at the Jackson Hole Symposium, delivered a strong message saying that the US Fed will likely impose large interest rate hikes in the coming months and is focusing on taming the highest inflation in four decades.

Stock markets which went by the early statements of the Fed which seemed dovish in nature factored that the rate cut could happen as early as 2023. After which the markets started rising approaching their previous highs. However, the latest statement from the speech suggests, that may not be the case, and tackling inflation would be the priority at the cost of easing credit.

India’s GDP growth back on track in Q1FY23

Real GDP grew at a healthy pace of 13.5% YoY, primarily due to the lower base of Q1FY22 due to the 2nd wave of Covid. An increase in private consumption was witnessed on the back of normalisation of demand. Manufacturing PMI remained flat whereas there was an increase in Services PMI. GST collections in Aug’22 were Rs. 1.44 lakh cr, up 28% YoY.

Retail inflation cools off but is still at higher levels

CPI decreased by 30 bps in July’22 due to lower food inflation. Higher LPG, kerosene, and coal prices led to an increase in fuel inflation. While CPI has been above 6% in 2022, the easing in international agriculture and industrial commodities along with softening in oil prices should result in softening of inflation in the months ahead.

Monsoon in India has been above average, with cumulative rainfall higher by 6% over its long-term average. However, the rainfall has been distributed unevenly. Rainfall was in excess in southern and central India, while much weaker in north-west, east, and north-east India. This can have an impact on food prices. However, for the past 3 years, India has seen a good monsoon in a majority of its parts. Also, the food stock is at sufficient levels. Hence, we do not see any major concern on that front.

Valuations are reasonable

Indian markets are trading at a premium to its emerging market peers. The current valuation is slightly elevated in comparison to the long-term multiples. However, we are confident about the economy over the next 5 years. Even if we purchase shares at slightly higher prices, there is a good chance of earning healthy returns over the next 5 years. The Indian corporate sector is in the best position to gain pricing power and balance sheet strength. The majority of the sectors have seen consolidation. We are seeing this across sectors: Power, Telecom, Cement, Banks, NBFCs, Real Estate, building materials, Paper, pharma, capital goods, consumer durables, etc. This will give strong profitability for incumbents due to the high barrier to entry for the next few years.

Wait & watch as of now, despite of correction in the US

The US S&P500 has roughly 15% from its peak. We have been warning our investors about the overvaluation in the US market and had advised them to reduce their positions. Despite of correction, we would still seek some clarity on the growth and controlled inflation before we consider adding a position in US markets.

The interest rates are expected to rise as Fed has hinted at tightening financial conditions to put an end to the 40-year high inflation in the US. Financial conditions have comparatively tightened off late yet very easily compared to the historical perspective.

Global investment firms are lowering their estimates for real GDP growth for China to 3.8% from 4.3% for 2022 and to 5.0% from 5.4% for 2023, due to longer-than-expected lockdowns and a worse-than-expected housing market correction.

Cooling down of the war between Russia & Ukraine is another factor to be monitored that can decide the further course of global markets.

How are we looking at this?

Based on a current estimate, the average upside of our coverage universe is closer to 13-14% CAGR over the next 5 years basis.

Today, we are looking at opportunities in banking and financial, infrastructure, Utility PSUs, hospitals, autos, and logistics. We continue to remain positive on existing companies that are delivering good growth.

We have added stocks in the industrials and infra segment as their balance sheets are healthy and can participate in the Capex cycle. We expect cash flow growth to be better than past.

Despite of correction, we see Pharma and Chemicals trading at prices ahead of their earnings growth. As of now, we have limited our allocation in that space. The same is true with few private companies in the power sector.

IT has seen a sharp correction after a 2 year long Bull Run. We are being selective in that space. The company management is giving guidance for good growth for a year or two.

We look at companies that have good earning triggers over the next 2 years.

We are investing in companies:

- Coming out of sector consolidation/debt reduction, or

- Introducing new products, or

- Commissioning new capacities, or

- Executing orders in hand

This gives certainty of growth rather than plain anticipation.

What sectors we are looking at?

After the intent of the government to continue giving a boost to the CAPEX and investment in public infrastructure, we remain positive on the companies that would benefit from the Capex cycle. Infra, logistics, and industrial-related companies would be the key beneficiaries.

We are incrementally adding to banks. Banks are the key beneficiaries of credit cycle pick-up. As industrial activity improves, the working capital loans will be drawn from banks which will lead to credit growth. In a period of rising interest rates, the banks tend to benefit for a limited period of time. That is because their liabilities are locked in at a fixed rate (which is lower) and their assets (loans) are at a floating rate. This gives them the benefit of better margins in a short term.

We had a cautious stance on banks as we expected slippages in unsecured and SME loans. But as economic recovery happened faster, we are seeing stability in retail and corporate balance sheets. Large banks (AUM > 1,00,000 Cr) have made sufficient provisions as well as raised money to maintain a healthy capital adequacy ratio. However, almost all the banks from our coverage universe have reported good earnings. With the fear of NPA being behind, they will start lending in areas that are growing well. Recently, top management from big-sized banks have confirmed that the companies in Infra, PSU, and manufacturing are seeing good traction in asset growth backed by order book and demand both domestic and overseas. The rising inflation has led to increasing in demand for working capital loans.

We expect this to be the start of the structural credit cycle and not a one-off considering all the factors in place. The factors such as clean and capitalized balance sheets of banks (lenders), de-leveraged balance sheets of corporates (borrowers), lesser capacity addition in the economy post-2013 leading to the need for more capacity given rising demand, Capex program by government improving the sentiments of private players to participate.

In the last one month, we have seen the market recognizing the value of banks. Most of the private sector banks from our coverage and portfolio have seen a good run ahead of their MRPs. Given the structural benefit, we still remain positive on banks.

Beware of expensive stocks that have corrected from their highs

Not all the stocks that have corrected from their highs are worth buying. We recommend being cautious about the prices that you are paying for the stocks and avoid buying high P/E stocks that have fallen off from their highs. The current high-interest rate regime may lead to some of these stocks to not reach to those levels anytime soon. We believe that being selective in this kind of market towards quality stocks generating earnings and trading at reasonable valuations is a key to generating returns.

We recommend treading cautiously in small-cap companies where sales figures are below 2019 levels but may optically look at high growth today on a low base of 2020. We recommend using FY19-20 sales as a base while evaluating growth or valuation. (Compute P/E ratio using EPS of 2019/20, Compute P/S ratio using Sales of 2019/20). We use 1-year forward Sales and EPS figures as we estimate the future growth of companies.

What is MoneyWorks4me’s action plan for its subscribers?

We have given a couple of BUY calls in the past few months. The market has rallied since then. Given the strong dynamics of the economy, we are excited to BUY existing opportunities or new ones in near future. We are tracking more companies to add to our BUY zone, however, they are still ahead of our MRP. We might consider adding them as there is a slight correction here and there.

The deleveraged balance sheets of Indian corporates, sub-par capacity addition in the past decade, and increasing utilisation levels give us confidence in the credit cycle. This combined with the underperformance of the financial sector in the last couple of years gives us confidence in the prospects of lenders (BFSI sector).

We believe that the current economy recovery is led by the credit growth cycle which can be delayed but remains definitive. Also, the Indian corporate sector is in the best position to gain pricing power and balance sheet strength. The majority of the sectors have seen consolidation. We are looking at sectors that will be early beneficiaries of these two themes.

MoneyWorks4me Outlook:

MoneyWorks4me Superstars – The Complete Solution for DIY Stock Investors:

Best Stocks From:

Nifty 50 Nifty Next 50 Nifty 100 Nifty 200 Nifty 500 Nifty Financial Services SmallCap 250 MidCap 100

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 9860359463