This article covers the following:

Review

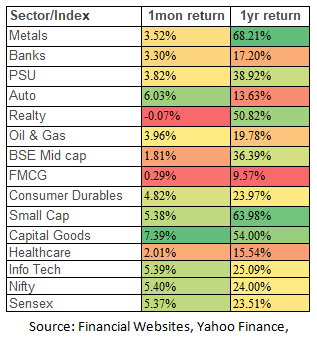

For the year ending Dec’21, Nifty closed at ~17,354, up 24% from last year. In the last 3 years, Nifty is up 59%; ~17% CAGR.

Economic recovery from pandemic-driven loss, surplus liquidity and key public welfare schemes announced by the government helped shrug off negative sentiments caused by the surge in Covid-19 cases and the ensuing lockdown restrictions

Markets climbed due to upbeat macroeconomic data, including strong domestic growth data, the rise in output of eight core sectors, 10-month high manufacturing data and a robust goods and services tax (GST) revenue collection

As seen above, metals, Realty, capital goods and PSU stocks contributed largely to the broad market rally on the grounds of economic activity uptick, low interest rates for housing and capex plans

Following is the list of the top 30 stocks that have generated maximum returns in the past 1 year.

Accelerated economic recovery across the sectors is exciting the market. Also, MF monthly inflows and SIP registrations have touched all-time highs in the previous month leading to stellar gains offlate.

Outlook

Nifty 50 index trades ~34% above its fair value while there are pockets of extreme overvaluation and reasonable valuations. Nifty – led by a concentrated portfolio of Top 10 stocks – is around 40% higher than its fair price, while the same is not true for all stocks. (Nifty@MRP 13,129 Jun’21). The next update will be done after we incorporate the December Quarter results.

We are seeing a recovery in growth in the coming year so we may see an upward revision in our estimates. This can bring down overvaluation down by ~5-10%.

As of date, the average upside of our coverage universe is likely to be closer to 10% CAGR over the next 5 years basis based on a current estimate. Similar to Nifty, the average upside of our universe is low due to few stocks showing < 0% CAGR while the rest showing > 15% CAGR upside potential.

Today, we are looking at opportunities in banking, infrastructure, building materials, export-oriented capital goods, PSUs, and import substitute ideas. We continue to remain positive on existing companies that are delivering good growth. We are benefiting from early investments in building materials, industrials. Optimistic outlook on real estate and increase in order flows has led to a rally in infra and infra-related stocks. We have added stocks in the industrials segment as we expect balance sheet strength to improve and cash flow growth will be better than past.

Stocks in IT and Pharma have moved up ahead of their earnings growth, we are reducing our allocation in the same. Same is true with few private companies in power sector.

We look at companies that have good earning triggers over the next 2 years.

We are investing in companies

- Coming out of sector consolidation/debt reduction, or

- Introducing new products, or

- Commissioning new capacities, or

- Executing orders in hand.

- Export-oriented companies as economic recovery is better in western countries.

This gives certainty of growth rather than plain anticipation.

We are incrementally adding to banks. Banks are key beneficiaries of credit cycle pick up. As industrial activity improves, the working capital loans will be drawn from banks which will to credit growth. Retail loan growth has already picked in form of housing loans and discretionary purchase during festive season.

We had cautious stance on banks as we expected slippages in unsecured and SME loans. But as economic recovery happened faster thanks to vaccination, we are seeing stability in retail and corporate balance sheets. Large banks (AUM > 1,00,000 Cr) have made sufficient provisions as well as raised money to maintain healthy capital adequacy ratio. With fear of NPA behind, they will start lending in areas that are growing well.

We see pick up in the mining, electricity production and manufacturing activity.

Caution

We recommend avoiding stocks/sectors that have run up much ahead of their earnings growth over the last 3-4 years. We observe many small and mid-cap stocks have run ahead of valuation as non-institutional participation has led to excesses in few pockets. We reduced allocation to few mid and small caps where prices have run up ahead of earnings growth.

We recommend treading cautiously in small caps where sales figures are below 2019 levels but may optically look at high growth today on a low base of 2020. We recommend using FY19-20 sales as a base while evaluating growth or valuation. (Compute P/E ratio using EPS of 2019/20, Compute P/S ratio using Sales of 2019/20). We use 1-year forward Sales and EPS figures as we estimate the future growth of companies.

We have shifted focus to Core stocks (Large Cap, market leaders) that have strong future prospects which will provide better downside protection. However, one has to keep return expectations moderate as valuations are no longer cheap but in the fair value zone.

Omicron, RBI Policy and IPO Frenzy continues

During the month, the Monetary Policy Committee retained the key lending rate, (repo at 4%) and maintained its stance as “accommodative”. The announcement was in the context of fresh threats from the Omicron variant. And so far, India has reported close to two dozen Omicron cases. However, as per the data, the fatality rate doesn’t seem to be the cause of worry.

As per the RBI governor, the emergence of Omicron has given rise to fears of further restrictions on travel and economic activity, which has led to “considerable uncertainty on growth dynamics” for the coming months. RBI expects headline inflation to peak in Q4FY22, after which it is likely to soften. The reduction in VAT of fuel will have direct impact on inflation, but price pressures may persist in the near term.

Risks

Indian Economy

Near-term risks can come from rising inflation. India still imports the bulk of its crude oil requirement and gas. Any rise in price will have to be passed on to the consumer. Other commodities like natural gas or coal have also spiked due to shortage issues across several countries. If this persists we may see risk to equity valuation. Corporates are highlighting the risks in cost structure as gross margins are getting squeezed. Companies are not taking price hikes in hurry as it may impact volume growth.

However, if we keep aside the current valuation, we are optimistic about the Indian economy over the next 5 years. Even if we purchase shares at slightly higher prices, there is a good chance of earning healthy returns over the next 5 years. The Indian corporate sector is in the best position to gain pricing power and balance sheet strength. The majority of the sectors have seen consolidation. We are seeing this across sectors: Power, Telecom, Cement, Banks, NBFCs, Real Estate, building materials, Paper, pharma, capital goods, consumer durables, etc. This will give strong profitability for incumbents due to the high barrier to entry for the next few years.

Government Divestment, PLI Scheme Incentives, Corporate tax cuts to boost economic activity. Also, immunity against the newer variants of the Virus is seen from published data which suggests that we might be heading towards the herd immunity stage

MSCI India index from march lows gave more than 100% Return. MSCI Emerging markets in which India forms around 8% gave around 45% returns and India became 12% of the index, in such a scenario FPI/FIIs are bound to book some profits. We see this as a regular rebalancing exercise and not a complete sellout.

Indias valuation in BRICS (Brazil, Russia, India, China, South Africa) was heightened around 20-25 times earnings, which led to a long china short India trade for some investors. We see that FPI Selling (long china short india) seems to have reduced

In comparison to FIIs, Domestic investors have formed a strong base which could be seen from the SIP numbers in mutual funds schemes crossing 1 Lakh Crore Mark. Insurance companies, retail investors, Mutual funds have been compensating fairly well for the corresponding FII selling.

Global Economy

There are signs of speculation in US primary and secondary markets and Cryptocurrencies. A lot of trading activity has led to an increase in leverage and higher trading volume. This is a risk to the market if not the economy. It may happen that the market comes off as the economy recovers as the benefit from fiscal stimulus will fade off.

US interest rates are rising as investors start factoring in economic recovery and rise in short-term interest rates by central banks. This can lead to correction or time-wise correction over the next few quarters. While such corrections with a backdrop of economic recovery are welcome as we get to buy stocks at lower prices. We despise corrections due to fear of recession but such interim correction with an improving economy is a good hunting ground for opportunities. That’s why they say, corrections are healthy.

In 2013, the investors who reacted to FED Tapper tantrum and did not invest in the correction, havelost opportunity to make significant returns. Learning from the same, the reaction to 2022 Fed Tapering, will be mellow in nature

*There is always some risk but every risk doesn’t materialize. It is important to keep an eye on risks but it may not require an action every time.

Frequently Asked Questions

Aggressive Investor: “Few stocks are making big moves why are we investing cautiously or selectively?”

Our process of fundamental analysis, and valuation-driven long-term investment management has served us well across market cycles. We do not move in and out sectors chasing price momentum nor do we believe that no price is too high for good merchandise. We have seen many cycles to believe that many of these tricks have good and bad years. We will also have our hits and misses but on aggregate, we try to deliver more consistent and higher returns versus other investment options.

For long-term success we prefer caution over aggression, balanced versus bold, sustainable growth versus temporary.

“A principle is not a principle until it costs you something.” – William “Bill” Bernbach

On similar lines, “A process is not a process until it costs you something (or pinches you).”

Conservative Investor: “What if we are at the fag end of the bull market, time to sell?”

We have seen many recessions in past and saw stock market recoveries over a 2-3 year period. In the current scenario, we are past the recessionary period already, so any interim correction will be transitionary and may see a faster recovery versus the past.

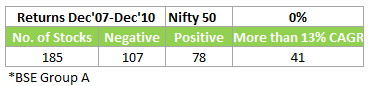

Let’s take the worst period with the benefit of hindsight when Nifty peaked in Dec’07 and 3 years after that.

If we observe individual stocks, we can see that markets made high in Dec’07, went through correction of 50%, and recovered in Dec’10. During this period Nifty was flat but more than 40% of stocks earned positive returns. Out of 185 large and mid-cap stocks (BSE Group A), 78 were positive, and more than half earned >13% CAGR. Together these 78 stocks earned >17% CAGR.

Now, this was the worst-case scenario where the market had a stellar bull run in 4 years preceding 2007. Companies had added a lot of debt for expansion and valuations were expensive.

Today, we are past recession i.e. back to back GDP de-growth and most companies are in much better shape than in Dec’07 at low utilization, low debt, and upward trajectory in volume growth.

The above table shows that, if we can pick stocks carefully by avoiding ones that have run ahead of their growth and inferior quality, we increase our odds of making very good returns in a 3/5 year period.

If we do get interim correction, we can earn more as we get to add to stocks at cheaper valuations. On your own, you can set up an additional SIP during interim correction to improve returns. Odds are highly in favor of staying invested rather than exiting or delaying fresh addition as we can’t predict the right time to invest expect in hindsight.

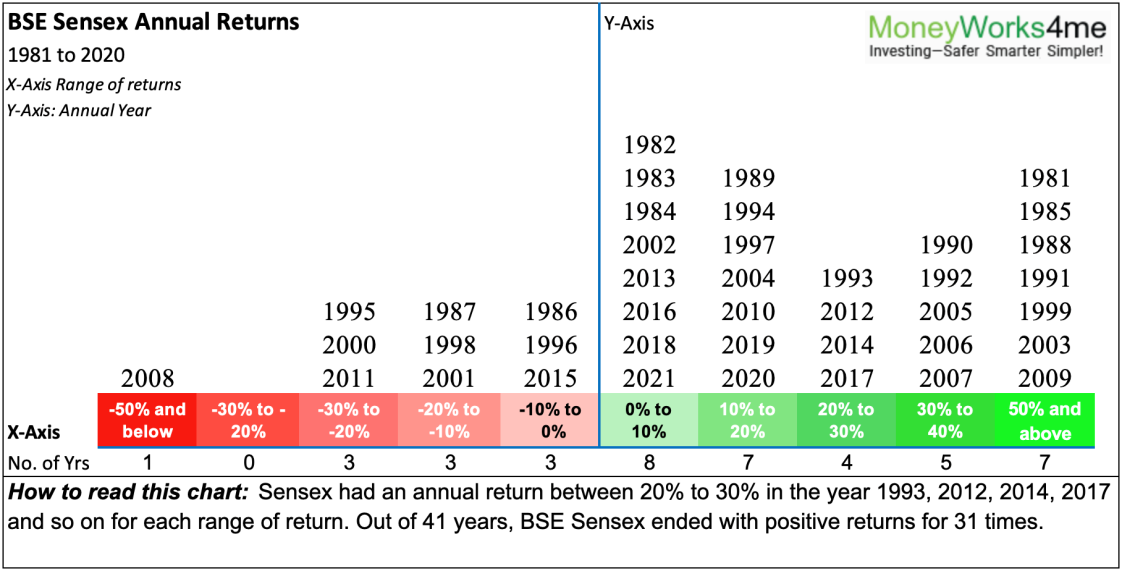

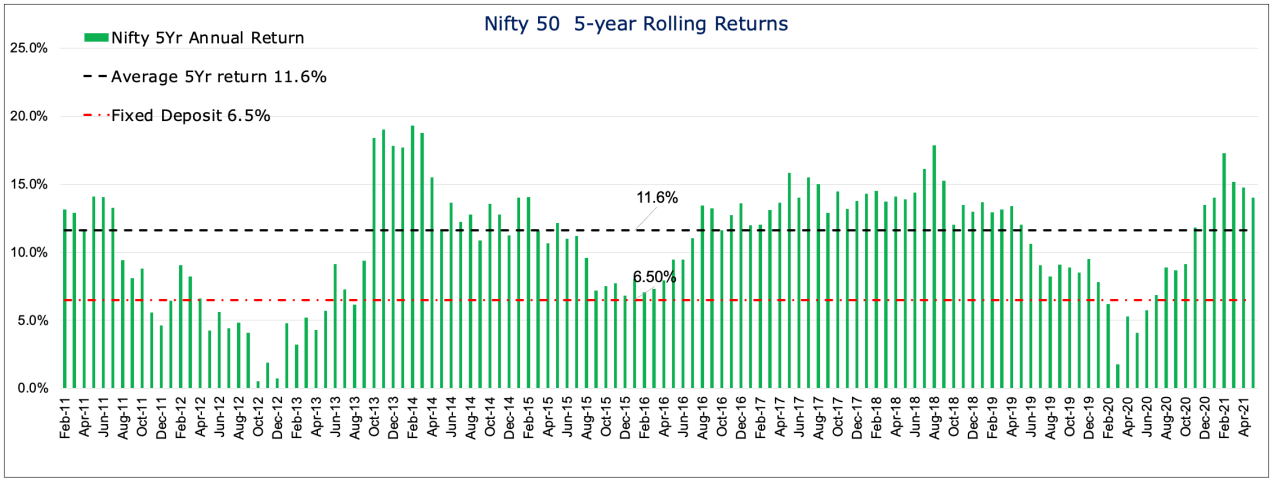

If we look at past data, there was an 85% chance of beating FD return on 5 year period. If your time horizon is long-term (5 years+), the current valuation will matter less and near-term events become irrelevant. We do not find any merit in second-guessing what’s going to happen in the next 6 months-1 year.

This is the reason we recommend not to disturb the equity portion in your asset allocation. Changing your asset allocation will reduce long-term returns or missing out on the target corpus.

If you have decided to stay with 60% Equity and 40% debt, you can rebalance but do not deviate much from 60% in Equity. Use our Financial Planning tool to find your target corpus and required asset allocation/monthly saving.

We have diversified our stocks portfolio, we have diversified assets and we have a long-term horizon. Together this takes care of all potential risks in investing.

MoneyWorks4me Outlook:

Make Informed Stock-Investing Decisions:

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463