Pharmaceuticals sector is one of the key sectors where Indian companies have created a global brand for themselves besides software. Indian companies have taken advantage of the opportunities in the regulated generics market in the western countries and made deep inroads especially in providing low cost equivalents of expensive drugs.Pharma outsourcing into India and low cost Healthcare services are expected to be the key areas of growth in the near future. In addition, the inherent potential of biotechnology has also attracted many new companies and this is also a key growth area for Indian companies. NSE Indices has developed Nifty Pharma Index to capture the performance of the companies in this sector.

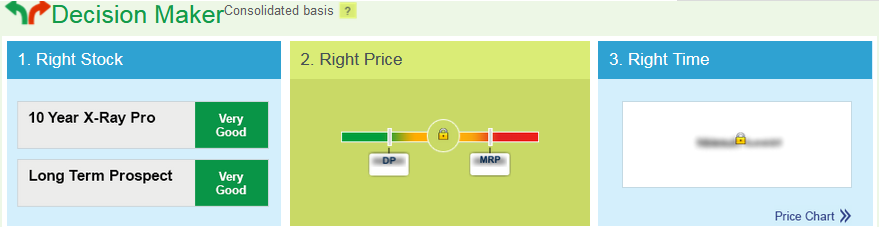

See MoneyWorks4me's rating on Quality, Valuation, Price Trend and Overall Rating to take informed stock investing decisions. Decizen:- Q: Quality, V: Valuation,PT: Price Trend

|

|

Company Name (M.Cap)

|

CMP

|

Price

Change |

Market

Cap (Cr) |

52Week

High |

52Week

Low |

ROE

|

P/E

|

P/BV

|

EV/

EBITDA |

5Y Sales

Gr.(%) |

5Y Profit

Gr.(%) |

More Info

|

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 |

Q

V+

PT

|

4,792 | 5.33% | 1,27,217 | 4,810 26 Jul, 24 |

3,300 06 Nov, 23 |

12.01 | 79.51 | 9.37 | 48.42 | 9.66 | 3.51 |

|

|

| 2 |

(L)

|

Q

V+

PT

|

1,578 | 5.22% | 1,27,452 | 1,599 26 Jul, 24 |

1,106 27 Jul, 23 |

11.92 | 29.62 | 4.77 | 17.41 | 8.47 | 14.67 |

|

| 3 |

(S)

|

Q

V

PT

|

448.8 | 3.78% | 24,197 | 484.9 08 Jul, 24 |

328.1 27 Jul, 23 |

3.55 | 163.26 | 5.90 | 32.91 | 17.07 | 6.90 |

|

| 4 |

Q

V+

PT

|

3,191 | 3.35% | 1,08,006 | 3,256 26 Jul, 24 |

1,771 01 Sep, 23 |

24.28 | 62.25 | 14.77 | 31.48 | 6.93 | 19.16 |

|

|

| 5 |

Q

V+

PT

|

1,714 | 2.91% | 4,11,150 | 1,723 26 Jul, 24 |

1,069 31 Oct, 23 |

16.82 | 42.93 | 6.46 | 28.06 | 10.78 | 22.72 |

|

|

| 6 |

Q

V+

PT

|

565.2 | 2.61% | 13,656 | 566.5 26 Jul, 24 |

287.6 17 Aug, 23 |

15.11 | 31.33 | 4.41 | 17.94 | 12.34 | 24.68 |

|

|

| 7 |

(M)

|

Q

V+

PT

|

28,702 | 2.50% | 60,854 | 29,628 16 Feb, 24 |

21,907 26 Oct, 23 |

34.87 | 50.66 | 16.63 | 34.51 | 9.72 | 21.88 |

|

| 8 |

Q

V+

PT

|

5,298 | 2.31% | 63,319 | 5,581 21 May, 24 |

3,440 05 Oct, 23 |

12.30 | 36.24 | 6.00 | 27.83 | 11.39 | 9.07 |

|

|

| 9 |

Q

V+

PT

|

1,286 | 2.23% | 32,588 | 1,374 18 Apr, 24 |

795.0 27 Jul, 23 |

9.67 | 61.44 | 5.13 | 25.37 | 11.18 | 4.98 |

|

|

| 10 |

(M)

|

Q

V

PT

|

1,840 | 2.13% | 83,886 | 1,850 26 Jul, 24 |

944.1 27 Jul, 23 |

14.31 | 43.82 | 5.92 | 21.71 | 6.41 | 36.90 |

|

| 11 |

(M)

|

Q

V

PT

|

368.6 | 1.91% | 44,254 | 376.8 26 Jul, 24 |

217.5 31 Oct, 23 |

8.64 | 370.95 | 4.09 | 100.31 | -3.80 | 31.80 |

|

| 12 |

Q

V

PT

|

1,386 | 1.77% | 81,229 | 1,409 15 Jul, 24 |

792.1 27 Jul, 23 |

6.75 | 42.75 | 4.12 | 29.56 | 4.49 | -7.93 |

|

|

| 13 |

Q

V+

PT

|

1,888 | 1.58% | 29,269 | 1,935 07 Feb, 24 |

1,185 28 Jul, 23 |

17.33 | 53.87 | 10.14 | 32.32 | 18.11 | 31.92 |

|

|

| 14 |

Q

V

PT

|

1,438 | 0.99% | 40,501 | 1,454 26 Jul, 24 |

702.0 12 Nov, 23 |

1.26 | 0.00 | 5.16 | 19.57 | 7.44 | -31.19 |

|

|

| 15 |

(M)

|

Q

V

PT

|

2,020 | 0.81% | 33,282 | 2,196 07 Feb, 24 |

1,172 27 Jul, 23 |

10.26 | 31.90 | 3.70 | 20.11 | 17.42 | 19.02 |

|

| 16 |

(S)

|

Q

V

PT

|

1,332 | 0.63% | 23,865 | 1,349 26 Jul, 24 |

725.0 02 Nov, 23 |

15.14 | 17.19 | 4.08 | 12.38 | 4.38 | 0.36 |

|

| 17 |

Q

V

PT

|

6,892 | 0.55% | 1,14,982 | 6,960 26 Jul, 24 |

5,212 30 Oct, 23 |

21.33 | 20.61 | 4.09 | 13.06 | 12.64 | 24.49 |

|

|

| 18 |

Q

V+

PT

|

1,210 | 0.34% | 1,21,377 | 1,215 26 Jul, 24 |

567.9 26 Oct, 23 |

20.25 | 31.45 | 6.12 | 21.35 | 8.23 | 15.65 |

|

|

| 19 |

(S)

|

Q

V+

PT

|

6,691 | -0.29% | 15,409 | 10,526 10 Jun, 24 |

5,851 13 Jun, 24 |

51.69 | 31.15 | 14.22 | 19.79 | 0.57 | 9.48 |

|

| 20 |

Q

V

PT

|

2,065 | -3.68% | 82,327 | 2,489 23 Apr, 24 |

1,681 01 Sep, 23 |

20.88 | 45.15 | 8.57 | 31.47 | 19.33 | 29.77 |

|

| Company Name | CMP | Price Change(%) |

|---|---|---|

| 4,792.15 | 5.33% | |

| 1,578.25 | 5.22% | |

| 448.80 | 3.78% | |

| 3,191.25 | 3.35% | |

| 1,713.60 | 2.91% |

| Company Name | CMP | Price Change(%) |

|---|---|---|

| 2,065.10 | -3.68% | |

| 6,690.85 | -0.29% |

News about Nifty Pharma

News about Nifty Pharma Intro:

Pharmaceuticals sector is one of the key sectors where Indian companies have created a global brand for themselves besides software. Indian companies have taken advantage of the opportunities in the regulated generics market in the western countries and made deep inroads especially in providing low cost equivalents of expensive drugs. In addition, the inherent potential of biotechnology has also attracted many new companies and this is also a key growth area for Indian companies. NSE Indices has developed Nifty Pharma Index to capture the performance of the companies in this sector.

Statistics:

The Nifty Pharma has delivered a CAGR of ~10% over the last decade. Pharma outsourcing into India and low cost Healthcare services are expected to be the key areas of growth in the near future. India is the largest provider of generic drugs globally. Indian pharmaceutical sector supplies ~50% of the global demand for various vaccines, 40% of generic demand in the US and 25% of all medicines in the UK. Indian pharmaceutical sector is expected to grow to US$ 100 billion, while medical device market is expected to grow US$ 25 billion by 2025.

The Union Cabinet has given its nod for the amendment of existing Foreign Direct Investment (FDI) policy in the pharmaceutical sector in order to allow FDI up to 100 per cent under the automatic route for manufacturing of medical devices subject to certain conditions.

The drugs and pharmaceuticals sector attracted cumulative FDI inflow worth US$ 16.50 billion between April 2000 and March 2020 according to the data released by Department for Promotion of Industry and Internal Trade (DPIIT).

Pharmaceuticals export from India stood at US$ 20.70 billion in FY20. Pharmaceutical export include bulk drugs, intermediates, drug formulations, biologicals, Ayush and herbal products and surgical.

India's biotechnology industry comprising biopharmaceuticals, bio-services, bio-agriculture, bio-industry, and bioinformatics is expected grow at an average growth rate of around 30 per cent a y-o-y to reach US$ 100 billion by 2025.

India's domestic pharmaceutical market turnover reached Rs 1.4 lakh crore (US$ 20.03 billion) in 2019, up 9.8% from Rs 129,015 crore (US$ 18.12 billion) in 2018.

Medicine spending in India is projected to grow 9-12% over the next five years, leading India to become one of the top 10 countries in terms of medicine spending.

Going forward, better growth in domestic sales would also depend on the ability of companies to align their product portfolio towards chronic therapies for diseases such as cardiovascular, anti-diabetes, anti-depressants and anti-cancers, which are on the rise.

The steps taken by the government to reduce costs and bring down healthcare expenses drives the revenues of the pharma companies. Speedy introduction of generic drugs into the market has remained in focus and is expected to benefit the Indian pharmaceutical companies. In addition, the thrust on rural health programmes, lifesaving drugs and preventive vaccines also augurs well for the pharmaceutical companies. Low manufacturing cost is the key advantage of Indian players and this drives their growth and profitability.

Pharma sector includes active pharmaceutical ingredients (API) industry which is a part of chemical industry. The API which happens to be the raw material used by pharma companies is manufactured by companies with speciality in chemical segments. Hence they are crucial part of the pharma chain. The sector comprises of the multiple companies specialized in generic drugs and having low manufacturing as their key advantage. Also there are some large size companies which are specialized in over-the counter drugs/ medical accessories (like inhaler by Cipla). Some companies aim for the mass market while some aim for the niche drugs.

The large size companies such as Cipla, Lupin, Sun Pharma own notable brands, have a distribution across the country, capacity to heavily spend on R&D due to their balance sheet size. Pharma companies tend to trade at premium valuations due to their defensive nature of business. The other ancillary companies are packaging companies and other contract manufacturing companies.

1. Sun Pharma

Established in 1983 by Mr. Dilip Shanghvi, Sun Pharma (SUN) is the Indian MNC that manufactures and sells pharmaceutical formulations and APIs primarily in India and the United States. Over 72% of Sun Pharma sales are from markets outside India, primarily in the United States.

The company offers formulations in various therapeutic areas, such as cardiology, psychiatry, neurology, gastroenterology and diabetology. It also provides APIs such as warfarin, carbamazepine, etodolac, and clorazepate, as well as anti-cancers, steroids, peptides and controlled substances.

The 2014 acquisition of Ranbaxy made Sun the largest pharma company in India, the largest Indian pharma company in the US, and the 5th largest speciality generic company globally.

2. Cipla

Founded by Khwaja Abdul Hamied in 1935, Cipla Limited is an Indian MNC, headquartered in Mumbai, India. Cipla primarily develops medicines to treat respiratory, cardiovascular disease, arthritis, diabetes, weight control and depression; other medical conditions. Cipla is the key player in OTC medical accessories like inhaler pump.

3. Lupin

Incorporated in the year 1968 by Desh Bandhu Gupta, Lupin Limited is an Indian multinational pharmaceutical company based in Mumbai, India. It is one of the largest generic pharmaceutical companies by revenue globally. The company's key focus areas include paediatrics, cardiovascular, anti-infectives, diabetology, asthma and anti-tuberculosis. Lupin's research program covers the entire pharma product chain like generic research, Advanced Drug Delivery Systems, Intellectual Property Management, Novel Drug Discovery and Development and Biotechnology Research.

There is no specific index fund or ETF that can give you an exposure to all the Pharma companies. One idea is to buy stocks in the Nifty Pharma index in proportion to their weights in the index. Another idea is to gain exposure via investing in funds like DSP Healthcare, Mirae Asset Healthcare, etc.

You can use different criterias to arrive at the list of best stocks in the Nifty Pharma company index. You can use return ratios like ROCE or ROE, that will help you choose companies with profitable growth.

Based on ROE, the best stocks in the Nifty Pharma companies index are:

| Company Name | Is it a Right Stock ? | CMP | Market Cap(Cr.) | P/E | P/BV | EV/EBITDA | ROE |

|---|---|---|---|---|---|---|---|

| Sanofi India Ltd. (S) | Very Good | 6,691 | 15,409 | 31.15 | 14.22 | 19.79 | 51.69 |

| Abbott India Ltd. (M) | Very Good | 28,702 | 60,854 | 50.66 | 16.63 | 34.51 | 34.87 |

| Torrent Pharmaceuticals Ltd. (L) | Very Good | 3,191 | 1,08,006 | 62.25 | 14.77 | 31.48 | 24.28 |

| Dr. Reddys Laboratories Ltd. (L) | Very Good | 6,892 | 1,14,982 | 20.61 | 4.09 | 13.06 | 21.33 |

| Mankind Pharma Ltd. (M) | Very Good | 2,065 | 82,327 | 45.15 | 8.57 | 31.47 | 20.88 |

Based on the past year's gain, the best performing stocks are:

| Company Name | Is it a Right Stock ? | CMP | Market Cap(Cr.) | Yearly gain (%) |

|---|---|---|---|---|

| Lupin Ltd. (M) | Somewhat Good | 1,840 | 83,886 | 95.37 |

| Zydus Lifesciences Ltd. (L) | Very Good | 1,210 | 1,21,377 | 93.79 |

| Granules India Ltd. (S) | Somewhat Good | 565.2 | 13,656 | 82.94 |

| Glenmark Pharmaceuticals Ltd. (M) | Somewhat Good | 1,438 | 40,501 | 77.94 |

| Aurobindo Pharma Ltd. (M) | Very Good | 1,386 | 81,229 | 75.74 |

| View More |

Stocks with the highest revenue growth in the past 5 years is:

| Company Name | Is it a Right Stock ? | CMP | Market Cap(Cr.) | P/E | P/BV | EV/EBITDA | 5Y Sales Growth (%) |

|---|---|---|---|---|---|---|---|

| Mankind Pharma Ltd. (M) | Very Good | 2,065 | 82,327 | 45.15 | 8.57 | 31.47 | 19.33 |

| JB Chemicals & Pharmaceuticals Ltd. (S) | Very Good | 1,888 | 29,269 | 53.87 | 10.14 | 32.32 | 18.11 |

| Gland Pharma Ltd. (M) | Very Good | 2,020 | 33,282 | 31.90 | 3.70 | 20.11 | 17.42 |

| Laurus Labs Ltd. (S) | Very Good | 448.8 | 24,197 | 163.3 | 5.90 | 32.91 | 17.07 |

| Dr. Reddys Laboratories Ltd. (L) | Very Good | 6,892 | 1,14,982 | 20.61 | 4.09 | 13.06 | 12.64 |

Stocks with high profit growth often witness their stock prices gaining, irrespective of the market movements.

Stocks with the highest profit growth in the past 5 years is:

| Company Name | Is it a Right Stock ? | CMP | Market Cap(Cr.) | P/E | P/BV | EV/EBITDA | 5Y Profit Growth (%) |

|---|---|---|---|---|---|---|---|

| Lupin Ltd. (M) | Somewhat Good | 1,840 | 83,886 | 43.82 | 5.92 | 21.71 | 36.90 |

| JB Chemicals & Pharmaceuticals Ltd. (S) | Very Good | 1,888 | 29,269 | 53.87 | 10.14 | 32.32 | 31.92 |

| Biocon Ltd. (M) | Somewhat Good | 368.6 | 44,254 | 370.9 | 4.09 | 100.3 | 31.80 |

| Mankind Pharma Ltd. (M) | Very Good | 2,065 | 82,327 | 45.15 | 8.57 | 31.47 | 29.77 |

| Granules India Ltd. (S) | Somewhat Good | 565.2 | 13,656 | 31.33 | 4.41 | 17.94 | 24.68 |

MoneyWorks4me can help you identify the best performing Pharma sector stocks. The decision maker allows for simple and effective analysis.

Sign up now to start a successful investing journey!