This article covers the following:

Review

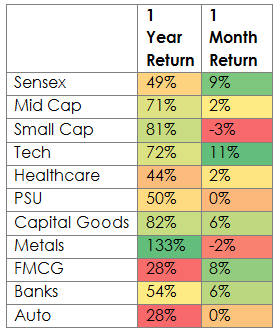

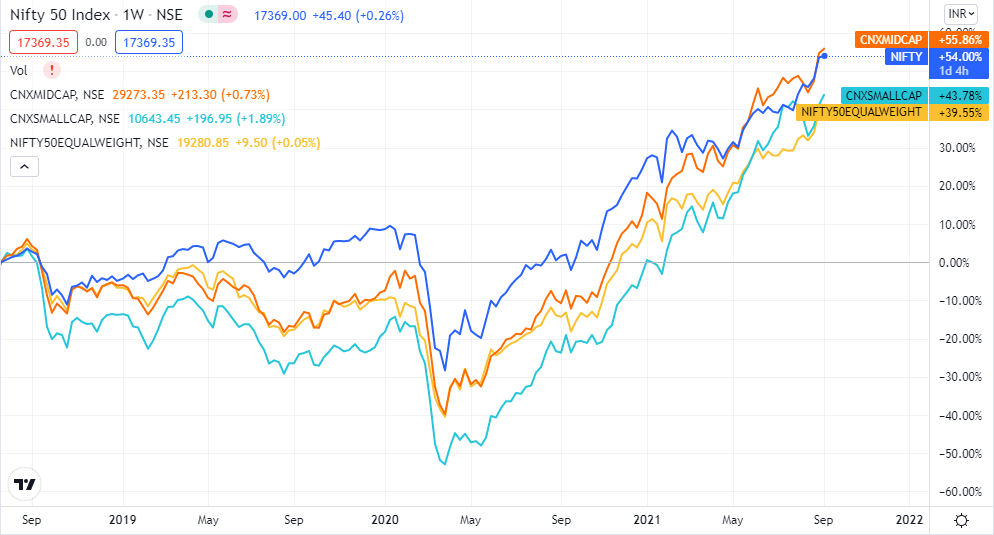

For the year ending Aug’21, Nifty closed at ~17,100, around 54% higher than last year. In the last 3 years, Nifty is up 59%; ~17% CAGR.

The last 1 year saw a massive shift in stock performance versus the prior 2 years where only Nifty stayed flat while the rest of the market saw correction. In the last 1 year, every segment of the market, small, mid, value, cyclical did better than Nifty. Low interest rates globally and high investor participation in the global market have led to good gains in stocks.

Performance of small/mid-cap, capital goods, and infrastructure was encouraging and playing a catch up until the last month. There was boarder participation and most portfolios made good returns in the last 18 months.

Here is the list of best-performing stocks, Year-to-date:

Sequential economic recovery & increase in the pace of vaccination is cheering the markets. However, third-time rising Covid cases across the world & India (impending third wave) may weigh on markets in September.

The overall sentiment was subdued throughout the month on the back of apprehensions that the US Fed may start tapering programs much earlier than previously expected. High inflation in the US may force FED to take rate increase call much before earlier anticipated end CY22.

Outlook

Nifty 50 index trades 30% above its fair value while there are pockets of extreme overvaluation and undervaluation. Nifty – led by a concentrated portfolio of Top 10 stocks – is around 30% higher than its fair price, while the same is not true for all stocks. (Nifty@MRP 13,129 Jun’21). The next update will be done after we incorporate the December Quarter results.

We are seeing a recovery in growth in the coming year so we may see an upward revision in our estimates. This can bring down overvaluation down by ~5-10%.

As of date, the average upside of our coverage universe is likely to be closer to 10% CAGR over the next 5 years basis based on a current estimate. Similar to Nifty, the average upside of our universe is low due to few stocks showing < 0% CAGR while the rest showing > 15% CAGR upside potential.

MoneyWorks4me performance was strong last year as we saw the market recognized undervaluation in pockets where we were invested. Even if we return before Covid correction, there are good versus Nifty’s performance as the market rally was broad-based.

We expect our margin of outperformance will increase in the future as Nifty’s concentration in few stocks may lag versus our portfolio which has better representation across sectors and relatively lower valuation.

Today, we are looking at opportunities in infrastructure, building materials, export-oriented capital goods, PSUs, and import substitute ideas. We continue to remain positive on existing companies that are delivering good growth. We are benefiting from early investments in building materials, industrials. Optimistic outlook on real estate and increase in order flows has led to a rally in infra and infra-related stocks. We have added stocks in the industrials segment as we expect balance sheet strength to improve and cash flow growth will be better than past.

Stocks in IT and Pharma have moved up ahead of their earnings growth, we are reducing our allocation in the same.

We look at companies that have good earning triggers over the next 2 years. We are investing in companies i) coming out of sector consolidation/debt reduction, or ii) introducing new products, or iii) commissioning new capacities, or iv) executing orders in hand. v) Export-oriented companies as economic recovery is better in western countries. This gives certainty of growth rather than plain anticipation.

We recommend avoiding stocks/sectors that have run up much ahead of their earnings growth over the last 3-4 years. We observe many small and mid-cap stocks have run ahead of valuation as non-institutional participation has led to excesses in few pockets. We reduced allocation to few mid and small caps where prices have run up ahead of earnings growth.

In turn, we have shifted focus to Core stocks that have strong future prospects which will provide better downside protection. However, one has to keep return expectations moderate as valuations are no longer cheap but in the fair value zone.

We recommend treading cautiously in small caps where sales figures are below 2019 levels but may optically look at high growth today on a low base of 2020. We recommend using FY19-20 sales as a base while evaluating growth or valuation. (Compute P/E ratio using EPS of 2019/20, Compute P/S ratio using Sales of 2019/20). We use 1-year forward Sales and EPS figures as we estimate the future growth of companies.

Risks

Indian Economy

The second lockdown has dampened the sentiment for industries and consumers alike. However, the expectation is that economy will recover faster than before as lockdown opens up. We are seeing signs of turnaround by looking at volume growth/capacity utilization/inventory-sales ratio. Vaccination rate is another metric to track as it means faster normalization of economic activities.

While Q1FY22 corporate earnings were a mixed bag there were a few upgrades, especially in the IT, Metals & cement sectors. Autos & Pharma were major disappointments. Real estate continued to witness strong up move. August saw the highest number of residential registrations in a decade. On the macroeconomic front, many high-frequency indicators are pointing towards month-on-month improvement. June quarter reported GDP number was better than estimates. Normalization of economic activities continued through the month of August & Inflation for July also softened.

This time opening up may not see a U-turn in discretionary spending, unlike last year which was linked to pent-up demand. We remain cautious in Consumer stocks including Auto, FMCG, and Durables. Also, fully priced valuations have kept us away from these sectors.

Banking and financial services are again at the forefront to face the brunt of slow economic recovery. Leading private sector banks and NBFC both have warned of delinquencies over the next few quarters. We remain cautious and recommend owning only selective ones where we can estimate the worst-case scenario and still earn reasonable returns over the medium term. As the dark clouds get clear, we will see good wealth creation in banking stocks.

Even if near-term risks galore on valuation and narrow recovery, we will not be perturbed by interim correction, if any. We are well past the recessionary period, any interim correction will be transitionary and see faster recovery.

India’s corporate debt profile is very good versus the world. Most sectors have few strong players and highly indebted companies are already written off. This reduces risks in the country and financial system.

The Indian corporate sector is in the best position to gain pricing power and balance sheet strength. The majority of the sectors have seen consolidation. We are seeing this across sectors: Power, Telecom, Cement, Banks, NBFCs, Real Estate, building materials, Paper, pharma, capital goods, consumer durables, etc. This will give strong profitability for incumbents due to the high barrier to entry for the next few years.

Primary markets are getting complacent about risks where businesses with a long gestation period to profitability are enjoying several multiples of bids.

Global Economy

Western countries are reporting better outlooks as vaccination is picking up pace. This can lead to economic recovery over the next 6 months. Large stimulus checks are handed over to citizens has led to cash flowing into bank accounts. As people get vaccinated, they will spend this on shopping and traveling. This will help in economic recovery. We are already seeing huge pent-up demand causing shortage and inflation. Tight logistics and raw material suppliers are causing a spike in commodity and widgets prices. It is still uncertain whether inflation is transitionary or structural. As of now, it does look transitionary but it is most difficult to make macro forecasts and more so to benefit from it.

There are signs of speculation in US primary and secondary markets and Cryptocurrencies. A lot of trading activity has led to an increase in leverage and higher trading volume. This is a risk to the market if not the economy. It may happen that the market comes off as the economy recovers as the benefit from fiscal stimulus will fade off. Also, a new draft on widening the definition of corporate tax and tightening regulations around FAANG stocks can cause volatility. We are seeing regulatory tweaking by Chinese authorities in Chinese tech companies that serve large populations and control consumer data. We may see the snowballing effect on the global level which can impact stocks markets as technology companies are a dominant part of Global Indices.

*There is always some risk but every risk doesn’t materialize. It is important to keep an eye on risks but it may not require an action every time.

Frequently Asked Questions

Aggressive Investor: “Few stocks are making big moves why are we investing cautiously or selectively?”

Today we are seeing run-up not-so-good quality stocks while quite a few Quality stocks are underperforming. Today’s fast-rising stocks are of inferior quality or very cyclical in nature. These are not great buys for the long term, at best trading plays. If you come across any stock tip or report, refer to our 10-Year X-Ray and you will notice that the color code of companies is either RED or mostly Red cells.

For long-term success we prefer caution over aggression, balanced versus bold, sustainable growth versus temporary.

Our process of fundamental analysis, and valuation-driven long-term investment management has served us well across market cycles. We do not move in and out sectors chasing price momentum nor do we believe that no price is too high for good merchandise. We have seen many cycles to believe that many of these tricks have good and bad years. We will also have our hits and misses but on aggregate, we try to deliver more consistent and higher returns versus other investment options.

“A principle is not a principle until it costs you something.” – William “Bill” Bernbach

On similar lines, “A process is not a process until it costs you something (or pinches you).”

Conservative Investor: “What if we are at the fag end of the bull market, time to sell?”

We have seen many recessions in past and saw stock market recoveries over a 2-3 year period. In the current scenario, we are past the recessionary period already, so any interim correction will be transitionary and may see a faster recovery versus the past.

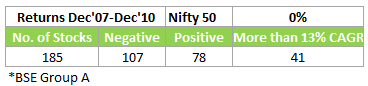

Let’s take the worst period with the benefit of hindsight when Nifty peaked in Dec’07 and 3 years after that.

If we observe individual stocks, we can see that markets made high in Dec’07, went through correction of 50%, and recovered in Dec’10. During this period Nifty was flat but more than 40% of stocks earned positive returns. Out of 185 large and mid-cap stocks (BSE Group A), 78 were positive, and more than half earned >13% CAGR. Together these 78 stocks earned >17% CAGR.

Now, this was the worst-case scenario where the market had a stellar bull run in 4 years preceding 2007. Companies had added a lot of debt for expansion and valuations were expensive.

Today, we are past recession i.e. back to back GDP de-growth and most companies are in much better shape than in Dec’07 at low utilization, low debt, and upward trajectory in volume growth.

The above table shows that, if we can pick stocks carefully by avoiding ones that have run ahead of their growth and inferior quality, we increase our odds of making very good returns in a 3/5 year period.

If we do get interim correction, we can earn more as we get to add to stocks at cheaper valuations. On your own, you can set up an additional SIP during interim correction to improve returns. Odds are highly in favor of staying invested rather than exiting or delaying fresh addition as we can’t predict the right time to invest expect in hindsight.

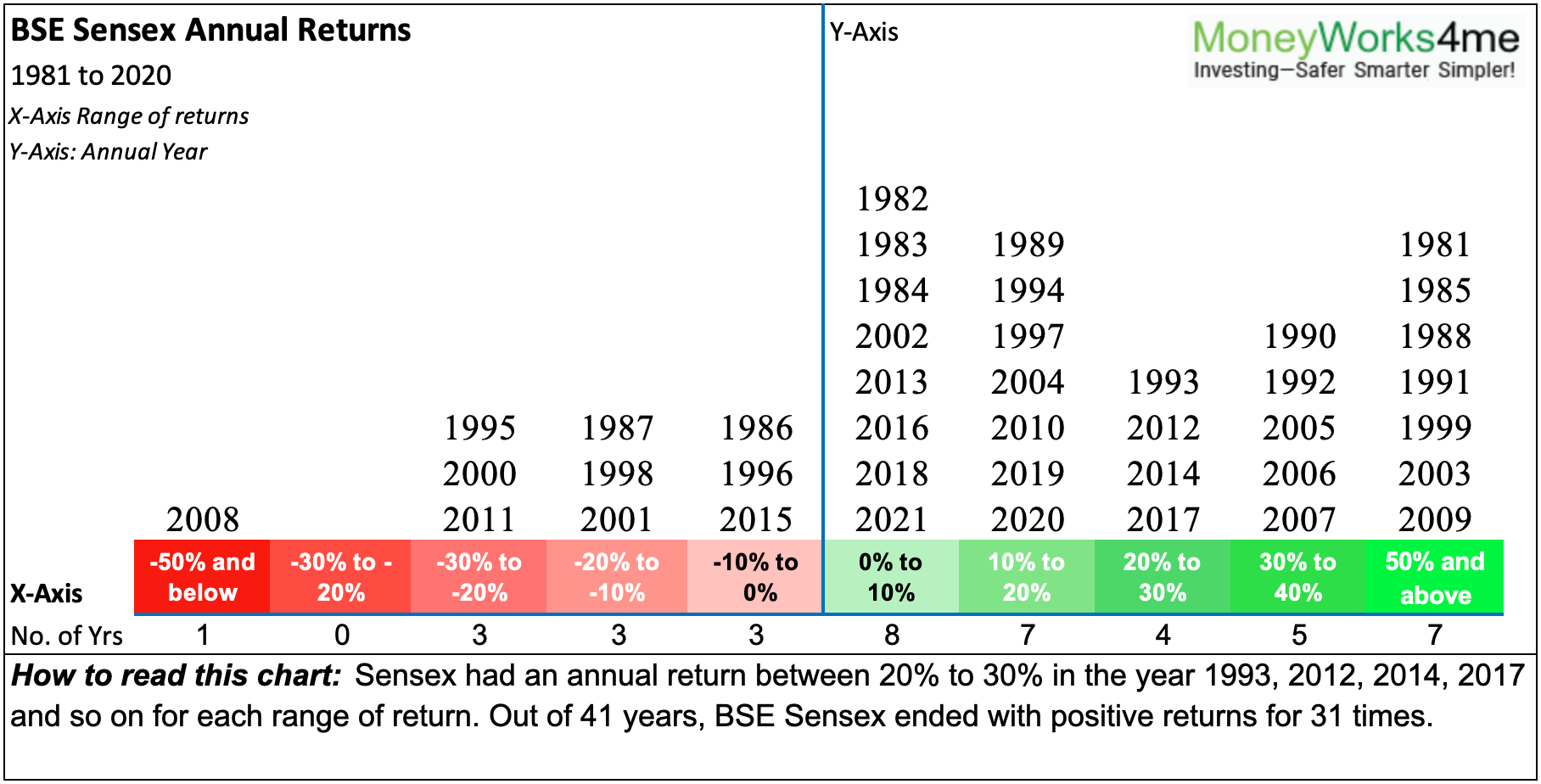

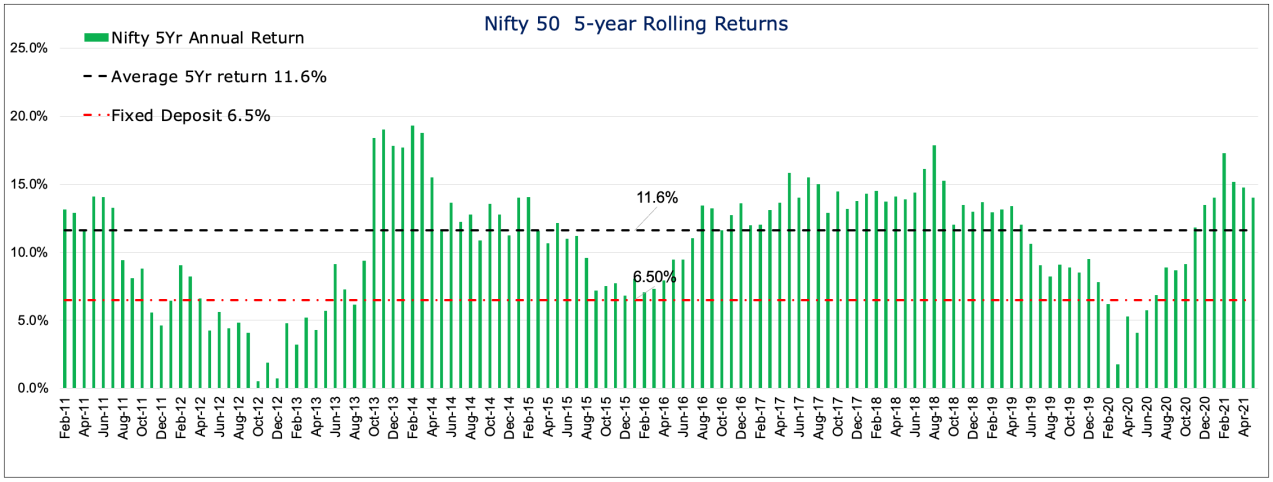

If we look at past data, there was an 85% chance of beating FD return on 5 year period. If your time horizon is long-term (5 years+), the current valuation will matter less and near-term events become irrelevant. We do not find any merit in second-guessing what’s going to happen in the next 6 months-1 year.

By booking profits (term used by speculators, not investors), you will park funds in Fixed Income till market correction (We do not know when and how much). But chances are very high that Equity will beat Fixed income over 5 year period.

This is the reason we recommend not to disturb the equity portion in your asset allocation. Changing your asset allocation will reduce long-term returns or missing out on the target corpus. If you have decided to stay with 60% Equity and 40% debt, you can rebalance but do not deviate much from 60% in Equity. Use our Financial Planning tool to find your target corpus and required asset allocation/monthly saving.

We have diversified our stocks portfolio, we have diversified assets and we have a long-term horizon. Together this takes care of all potential risks in investing.

MoneyWorks4me Outlook:

Investing successfully to reach your goals:

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463