“Show me how MoneyWorks4me has performed in the past!” This is a very important question and the answer to it will help you decide, whether you should go ahead and subscribe or renew.

Once you have asked this question you have two challenges. One, can you trust the answer? Every Advisor/Fund Manager posed with this question runs the risk of trying to appear better than what they really are. And the methods they chose depend on their values dear to them. Second, how do you assess the answers you get? People tend to evaluate based on past returns, and that is wrong and inadequate for many reasons.

Measure and review Performance in comparison to what objectives you set out to meet.

You invest to meet your financial goals; earning high returns only helps you reach there faster. But, you need to remember that your financial goal is the ‘dog’ and high returns the ‘tail.’ And as the saying goes, ‘You must not let the tail wag the dog.’ Far too often, people forget this and chase higher returns as their goal usually with disastrous results, because they tend to ignore risks. Investing is all about the future, and the future is always uncertain. This means you are always exposed to risk, whether it materializes or not. If you invest for a reasonable time, you will encounter risk and how you react to that makes a big difference in meeting your goals!

Your financial goals are best met by staying invested for the long term rather than extra returns

We all are convinced that equity has given the best returns over the long term. The primary reason for this is compounding at an above-inflation rate that leads to supernormal wealth in real terms. However, if you don’t stay invested in the longer-term, you miss the very fundamental advantage of equity.

Our focus is to ensure you stay invested and don’t leave the party early!

Research indicates that investor returns are much lower than equity returns. Many expert Fund Managers and Research Advisories have stellar track record since inception but their investors haven’t earned equally good returns. Retail Investors often join the party late and leave it early. They usually buy high, after the recent good performance of equity and sell low, usually after a drop in the market. This unproductive behavior leads to poor returns, or worse, loss of capital.

The chief reason why investors leave early is that they react to a drop in their portfolio’s net worth. Now, we can all talk about why they should not, but that is not going to stop this reaction. Even savvy investors and Fund Managers react if the drop is ‘largish.’ Our method to ensure you stay invested is to ensure a very low Downside, better still if it can be avoided, no matter when you started investing using our services.

How have we performed against the objective of preventing a downside?

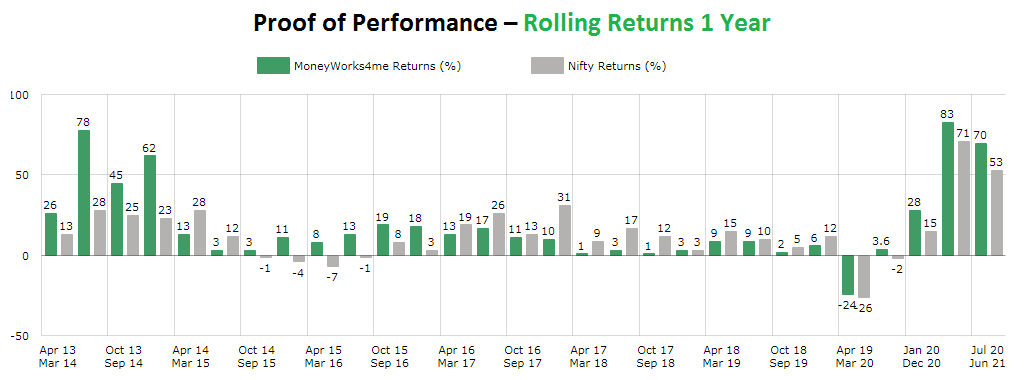

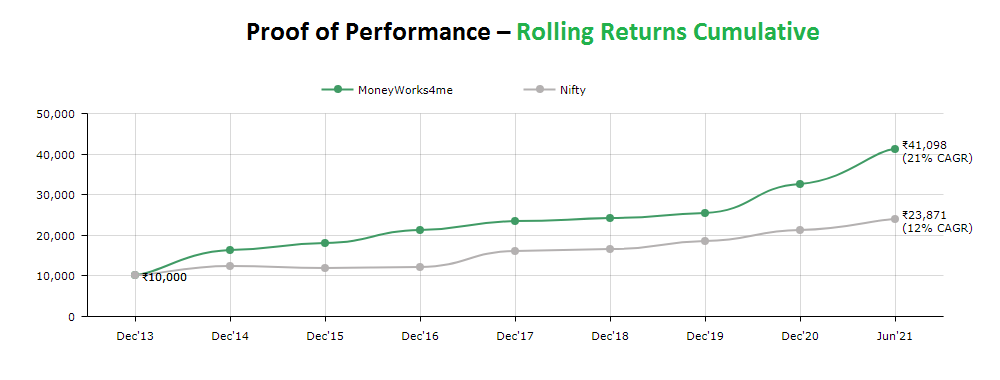

As you can see from the 1st bar chart for 1-year rolling, MoneyWorks4me has met its objective of preventing a Downside in your portfolio, immaterial of when you started. The comparison with Nifty 50 shows how the general market performed in the same period. There are periods when Nifty 50 has gone very low to negative, and in those periods MoneyWorks4me’s performance has been positive, and at times close to the long-term market growth. Usually, investment strategies that focus on delivering high returns, take higher risks. Therefore, when the Nifty 50 has fallen a little, they fall a lot, resulting in even larger numbers of investors exiting. While we can’t eliminate volatility completely, we tend to reduce by reducing allocation to equities when upside potential is unfavourable.

And, how has MoneyWorks4me performed at other times?

During a fast-rising market, we tend to lag behind the market, as we sell out stocks that have run well above their Fair Valuations. Holding onto such stocks increases the Downside Risk substantially. We also reduce exposure to equity, since we do not get opportunities at a reasonable price. This has happened in 2017 (post demonetization flow of money to equities has been unprecedented), and earlier in 2014 (the euphoria of BJP-Modi being voted with absolute majority). However, when seen over a longer time period of 3-years MoneyWorks4me has performed very close to the market in these times. And this improves when you compare the performance over a 5-year period.

During a falling market, we tend to do well, as we hold some Liquid Funds and buy bargains on the way down. Also, the market provides many good opportunities at attractive discounts. On a market bounce back, we do well as we would have bought stocks cheap in a correction. For the same reason, we also tend to well in a volatile market. The extremely high returns and beating the Nifty50 by a wide margin that happens in 2013 is not something we planned, it is the result of the process we follow. Can it happen again? Probably will, when the markets over-react and even strong company-stocks are available at reasonable to hefty discounts. But, we can’t predict this. We repeated the feat in 2020 when market was volatile, we managed to buy stocks at good prices. On longer term timeframe, our returns are higher versus Nifty50.

Why it is not useful to give ‘since-inception’ performance numbers?

Since-inception records are not worthwhile, because it assumes, ‘You would have invested since inception and stayed till today.’ Investors come at different points of time and expect Advisors/Fund Managers to grow their portfolio during that time-frame. So, investors must demand to see rolling returns with different start and end dates. This will ensure consistency of Advisory’s performance over time. As a side note, you should never believe stellar performance since inception, simply because the choice of when to start is most often when the market is down. No one starts a Fund when the market is high and asset prices are steep.

Second, generating very high returns comes at a very high risk. This could lead to several large falls in portfolio value. During this time, if you bail out of equities, the primary benefit of equities(compounding) is not achieved. Time in the market is more important than short-term high returns. Hence, we often focus on generating reasonable absolute returns, rather than peaks and valleys in performance.

Third, often Investors misunderstand that the Last 3/5/7 years Returns come in a linear fashion. The numbers do not show how the portfolio would have moved during that time-frame. The rolling performance gives a glimpse of how actual returns pan out in a volatile manner.

We hope, this answer to the question of MoneyWorks4me past performance has convinced you that we are focused, as you should be, on achieving your financial goals through long-term consistent compounding, and not obsess over yearly returns. Our process and results will ensure you stay invested and will prevent shocks of large downsides. Yes, we may under-perform in fast-rising markets, but that’s a sprint race, and coming second or third to Sprinters is no mean achievement for a Runner who has prepared for the marathon.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call 020 6725 8333 | WhatsApp 8055769463