Sansera Engineering IPO Details:

IPO Date: September 14th 2021 to September 16th 2021

Total Shares for subscription: ~1.72 Crore

IPO Size: ~Rs. 1250 Cr

Lot Size: 20 shares

Price Band: Rs. 734-744/share

Market Cap: Rs. 3,800 Cr

Recommendation: Avoid

Purpose of the offer

Offer for Sale: Existing shareholders are selling their stake

About the company Sansera Engineering

Sansera Engineering Limited is an engineering-led integrated manufacturer of complex and critical precision engineered components across the automotive and non-automotive sectors, they manufacture and supply a wide range of precision forged and machined components and assemblies that are critical for engine, transmission, suspension, braking, chassis, and other systems for the two-wheeler, passenger vehicle, and commercial vehicle verticals. Within the non-automotive sector, they manufacture and supply a wide range of precision components for the aerospace, off-road, agriculture, and other segments, including engineering and capital goods. The company supplies most of its products directly to OEMs in finished condition.

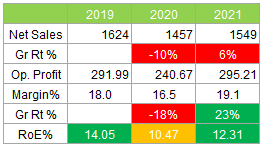

Financials of Sansera Engineering

Net sales have been flat due to slowdown in auto and impact of covid lockdown in the previous year. Sansera Engineering earns modest profitability as implied by its ROE.

Management

Subramonia Sekhar Vasan is the Chairman and Managing Director of our Company. He has been a Director of our Company since incorporation. He holds a bachelor’s degree in technology from the Indian Institute of Technology, Madras, and a post-graduate diploma in management from the Indian Institute of Management, Bangalore. He has over 39 years of professional experience.

Fatheraj Singhvi is the Joint Managing Director of our Company. He is currently the chairman of Pillar 3 of ACMA overseeing the activities of ACT, ASDC, HR, YBLF. He has over 39 years of professional experience. He is a chartered accountant and is a member of the Institute of Chartered Accountants of India. He was a partner at M/s. Singhvi, Dev & Unni from 1981 to 2006. He manages the Artificial Limb’s Centre and Dialysis Centre for Karnataka Marwari Youth Federation since 1982.

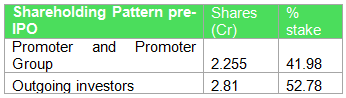

Shareholding pattern of Sansera Engineering

MoneyWorks4me Opinion on Sansera Engineering

How is the business model? Great, good, or gruesome?

The auto ancillary business is gruesome. It earns a marginal return on capital employed and exhibits no bargaining power over customers. In good times ancillary businesses earn from cyclical growth but in bad times, they may get squeezed by high working capital.

The auto and auto ancillary sector is currently going slow down due to series of lockdowns. OEMs are facing severe shortages in raw materials, particularly semiconductors. This will lead to poor growth in the medium term.

Besides, the automobile landscape is changing fast as the industry will shift to new technology which will bring growth of existing products down. We will be interested in stocks that will benefit from electric vehicles; however, we are yet to see meaningful contributions from EVs in any ancillary company.

We find Sansera Engineering’s prospects are difficult to assess and hence avoidable.

We recommend Avoid. Also, we recommend avoiding listing gains.

Note: We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on the business model and valuation.

| IPO Activity | Date |

| IPO Open Date | Sep 14, 2021 |

| IPO Close Date | Sep 16, 2021 |

| Basis of Allotment Date | Sep 21, 2021 |

| Refunds Initiation | Sep 22, 2021 |

| A credit of Shares to Demat Account | Sep 23, 2021 |

| IPO Listing Date | Sep 24, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 20 | ₹ 14,880 |

| Maximum | 13 | 260 | ₹ 193,440 |

| Date | QIB | NII | Retail | Employee | Total |

| Sep 14, 2021 | 0.29x | 0.07x | 0.87x | 0.36x | 0.53x |

| Sep 15, 2021 | 0.38x | 0.22x | 1.72x | 1.03x | 1.02x |

| Sep 16, 2021 | 26.47x | 11.37x | 3.15x | 1.37x | 11.47x |

When will the Sansera Engineering IPO open?

Sansera Engineering IPO will open for subscription on Wednesday, September 14, and will close on September 16.

What is the price band of Sansera Engineering IPO?

The price band for Sansera Engineering IPO is Rs. 734-744/share.

What is the lot size for Sansera Engineering IPO?

Retail investors can subscribe to the IPO minimum lot size is 20 shares, up to a maximum of 13 lots i.e. Rs. 1,93,440.

What is the issue size of Sansera Engineering IPO?

The total issue size is ~ Rs. 1250 Cr.

What is the quota reserved for retail investors in Sansera Engineering IPO?

The quota for retail investors in Sansera Engineering IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on September 21st and refunds will be initiated by September 22nd. Shares allotment will be credited in Demat accounts by September 23rd.

What is the listing date of Sansera Engineering IPO?

The tentative listing date of Sansera Engineering IPO is September 24th.

Where could we check the Sansera Engineering IPO allotment?

One can check the subscription status on Link Intime India Private Ltd.

Who are the leading book managers to the issue?

ICICI Securities, IIFL Securities, and Nomura Financial Advisory and Securities (India) are the book-running lead managers to the public issue.

What does Sansera Engineering do?

Sansera Engineering is an engineering-led integrated manufacturer of complex and critical precision engineered components across the automotive and non-automotive sector

Who are the peers of Sansera Engineering?

Motherson Sumi, Endurance Technologies are peers of Sansera Engineering.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. You get all this for a price which can be as low as Rs. 4,999. The MoneyWorks4me PRO provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463