Vijaya Diagnostic IPO Details:

IPO Date: September 1st 2021 to September 3rd 2021

Total Shares for subscription: ~1.85 Crore

IPO Size: Rs. 1,895.04 Cr

Lot Size: 28 shares

Price Band: Rs. 522-531/share

Market Cap: Rs. 5,400 Cr

Recommendation: Strong Avoid; Avoid for listing pop too

About the company Vijaya Diagnostic Centre

Vijaya Diagnostic Centre Limited (VDC) was incorporated on June 5, 2002. VDC is one of the leading integrated diagnostic chains in Telegana.

Vijaya Diagnostic offers pathology and radiology testing services to their customers through their network, which consists of 80 diagnostic centers and 11 reference laboratories across 13 cities and towns in the states of Telangana; Andhra Pradesh; the National Capital Region, and Kolkata.

Vijaya Diagnostic offers a range of approximately 740 routine and 870 specialized pathology tests and approximately 220 basic and 320 advanced radiology tests that cover several specialties and disciplines.

They currently offer RT-PCR testing and/or CT scan for COVID-19 diagnosis across 33 diagnostic centers in 11 cities and towns and COVID-19 vaccination services at their Kolkata and Gurugram diagnostic centers.

Vijaya Diagnostic has 2,325 full-time employees and regular consultants on a retainer basis, including 74 lab doctors, 19 Physicians, 105 radiologists, and 1,027 technical staff and phlebotomists.

Financials of Vijaya Diagnostic Centre

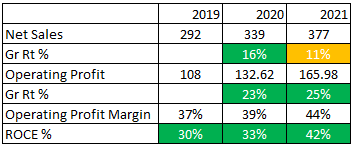

Vijaya Diagnostic earned ~Rs 300-350 Cr sales in the last 3 years with an annual growth rate of 15% CAGR. Its operating profit grew at a faster pace as the company incurs fixed costs and earns higher profit if sales grow faster than fixed costs.

Diagnostic business is an asset-light business with limited investment and costs leading to a very high return on investments. It is reflected in its return on capital employed ratio of 30%+ over the last 3 years.

Management of Vijaya Diagnostic Centre

Dr. S. Surendranath Reddy is the Promoter and Executive Chairman of the company. He has over 19 years of experience with the company.

Sunil Chandra Kondapally is the Executive Director of the company. He has been associated with the company since its incorporation. He has over 17 years of experience in the field of the pharmaceutical industry.

Sura Suprita Reddy is the CEO of the company. She has been associated with the company since its incorporation, she is heading the overall strategy, clinical excellence, operations, and expansion of the company.

MoneyWorks4me Opinion on Vijaya Diagnostic

How is the business of Vijaya Diagnostic Centre? Great, Good, Gruesome?

Great. Diagnostics business is high return accretive, low investment and growing business. As India’s disposable income increases and health awareness grows, the diagnostics business will see an uptick in volumes.

Vijaya Diagnostic being an organized player in the diagnostic industry, is likely to grow faster than overall diagnostic industry growth. Smaller players are consolidating or shutting down as they can’t generate enough volume of tests thereby unable to match low-cost testing of diagnostic chains.

Many of the leading players in the industry like Dr. Lal Pathlabs, Metropolis, etc. are clocking a growth rate of 15% annually. We expect a similar growth rate potential for Vijaya Diagnostic.

Given bright prospects, the company has come out with an IPO at Rs. 5,400 Cr valuation for just Rs. 350 Cr in sales. Within this, a lot of sales is attributable to Covid tests which will come down over subsequent quarters.

At Rs. 5,400 Cr in market cap, the company is demanding P/E of 60-75x on normalized earning per share. This is quite steep given that it has a limited presence in one state. Besides, the company’s size is too small to fight Pan-India players and may have to compete on price as most firms offer similar testing.

We recommend Strong Avoid on IPO. We DO NOT advice for listing gains.

IPOs are often priced on the expensive side as the outgoing shareholder or promoters do not wish to miss upside potential; however offlate the IPOs are taking advantage of the buoyant IPO market to price the issues quite steeply, beyond any blue sky scenario, thereby short-changing minority shareholders. This in turn is getting reflected in listing gains that have disappeared completely.

Note: We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on the business model and valuation.

| IPO Activity | Date |

| IPO Open Date | Sep 1, 2021 |

| IPO Close Date | Sep 3, 2021 |

| Basis of Allotment Date | Sep 8, 2021 |

| Refunds Initiation | Sep 9, 2021 |

| A credit of Shares to Demat Account | Sep 13, 2021 |

| IPO Listing Date | Sep 14, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 28 | ₹ 14,868 |

| Maximum | 13 | 364 | ₹ 193,284 |

| Date | QIB | NII | Retail | Employee | Total |

| Sep 01, 2021 | 0.23x | 0.01x | 0.46x | 0.24x | 0.30x |

| Sep 02, 2021 | 0.32x | 0.05x | 0.74x | 0.52x | 0.47x |

| Sep 03, 2021 | 13.07x | 1.32x | 1.09x | 0.98x | 4.54x |

When will the Vijaya Diagnostic Centre IPO open?

Vijaya Diagnostic Centre IPO will open for subscription on Wednesday, September 1, and will close on Friday, September 3.

What is the price band of Vijaya Diagnostic Centre IPO?

The price band for Vijaya Diagnostic Centre IPO is Rs. 522-531.

What is the lot size for Vijaya Diagnostic Centre IPO?

Retail investors can subscribe to the IPO minimum lot size is 28 shares, up to a maximum of 13 lots i.e. Rs. 1,93,284.

What is the issue size of Vijaya Diagnostic Centre IPO?

The total issue size is ~ Rs. 1800 Cr.

What is the quota reserved for retail investors in Vijaya Diagnostic Centre IPO?

The quota for retail investors in Vijaya Diagnostic Centre IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on September 8th and refunds will be initiated by September 9th. Shares allotment will be credited in Demat accounts by September 13th.

What is the listing date of Vijaya Diagnostic Centre IPO?

The tentative listing date of Vijaya Diagnostic Centre IPO is September 14th.

Where could we check the Vijaya Diagnostic Centre IPO allotment?

One can check the subscription status on Link Intime India Private Ltd.

Who are the leading book managers to the issue?

Edelweiss Financial Services Ltd, ICICI Securities Limited, Kotak Mahindra Capital Company Limited are lead managers for the IPO.

What does Vijaya Diagnostic Centre do?

Vijaya Diagnostic Centre offers pathology and radiology testing services to their customers through their network, which consists of 80 diagnostic centres and 11 reference laboratories across 13 cities and towns in the states of Telangana; Andhra Pradesh.

Who are the peers of Vijaya Diagnostic Centre?

Dr. Lal PathLabs, Metropolis, and SRL Diagnostics are peers of Vijaya Diagnostic Centre.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. You get all this for a price which can be as low as Rs. 4,999. The MoneyWorks4me PRO provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463