This article covers the following:

Review

For the year ending Mar’21, Nifty closed at 14,631, around 48.5% higher than last year. In the last 3 years, Nifty is up 36%; ~10.7% CAGR.

The last 1 year saw a massive shift in stock performance versus the prior 2 years where only Nifty stayed flat while the rest of the market saw correction. In the last 1 years, every segment of the market, small, mid, value, cyclical did better than Nifty.

Low interest rates globally and high investor participation in the global market have led to good gains in stocks. This was an unanticipated rise but appears robust enough to experience a very steep correction in the interim.

Incremental macro data was improving but has hit a pause to fresh lockdown across key states. Company activity has stopped and many manufacturing firms have taken maintenance shutdown.

Outlook

Nifty 50 index trades above its fair value while there are pockets of extreme overvaluation and undervaluation. Nifty – led by a concentrated portfolio of Top 10 stocks – is around 21% higher than its fair price, while the same is not true for all stocks. (Nifty@MRP 11,864)

If we see growth improving next year, we may see an upward revision in our estimates. We have made upward revisions in sectors where we are seeing a sustained recovery in earnings and cash flows.

As of date, the average upside of our coverage universe is likely to be closer to 10% CAGR over the next 5 years basis based on a current estimate. Similar to Nifty, the average upside of our universe is low due to few stocks showing < 0% CAGR while the rest showing > 15% CAGR upside potential.

MoneyWorks4me performance was strong last year as we got an opportunity to buy good companies at lower prices during the correction. Looking back, our process tends to deliver much higher than market returns coming out of the correction as we buy stocks aggressively at bargain prices than at elevated prices.

More importantly, 3-year performance is 15% CAGR versus 13.5% CAGR for Nifty. Also it worth noting that, MoneyWorks4me portfolio did not have an excessive concentration in few stocks/single sectors versus Nifty’s concentration in a stocks/sector (Top 5 stocks – 42%), (Top sector: Banks/Financials – 40%). Our portfolio valuation is lower than Nifty on P/E and P/B and MRP (DCF value) basis.

Today, we are looking at opportunities in infrastructure, building materials, export-oriented chemicals, PSUs, and import substitute ideas. We have incrementally added stocks in capital goods and Infrastructure as we started seeing sustained growth versus volatile growth earlier. We continue to remain positive on existing companies that are delivering good growth.

We look at companies that have good earning triggers over the next 2 years. We are investing in companies i) coming out of sector consolidation/debt reduction, or ii) introducing new products, or iii) commissioning new capacities, or iv) executing orders in hand. v) Export-oriented companies as economic recovery is better in western countries. This gives certainty of growth rather than plain anticipation.

Good companies earn higher returns on capital than their cost of capital over a cycle, they are less cyclical and present in a growing sector. We recommend buying such stocks only at a reasonable price or at the start of the cycle. This will ensure one earns good risk-adjusted returns over a holding period of 3-5 years.

We recommend avoiding stocks/sectors that have run up much ahead of their earnings growth over the last 3-4 years. It might be late to scale up into stocks. These stocks may continue to do well in short term due to price momentum but the risks of lower return or losses are higher over a 3-year holding period.

Register FREE | Schedule a DEMO | Solution Enquiry | Themes | Subscribe

Risks

Indian Economy

GDP data saw two-quarters of year-on-year decline, while the recent quarter was more reasonable 7.5% versus the previous quarter decline of 23%. In a previous note, we had written that, fortunately, the cases have subsided and fear of the second wave is receding.

However, the cases are rising again in key states which are in line with the second wave observed elsewhere like the US and Europe. However, with vaccination already rolling out, the ability to contain the spread is much better versus the first wave. We believe as vaccination reaches 20-25% population in key vulnerable states/cities, the spread will be contained.

The second lockdown has dampened the sentiment for industries and consumers alike. However, the expectation is that economy will recover faster than before as lockdown opens up.

Inflation from rising commodity and oil prices can spark fear in economic recovery. However, with lower utilization in various sectors, inflation might not be passed on completely to take advantage of higher volumes and favorable operating leverage.

Global Economy

Western countries are reporting better outlooks as vaccination is picking up pace. This can lead to economic recovery over the next 6 months. Large stimulus checks are handed over to citizens has led to cash flowing into bank accounts. As people get vaccinated, they will spend this on shopping and traveling. This will help in economic recovery.

Offlate there are signs of large speculation in US markets and Cryptocurrencies. A lot of trading activity has led to an increase in leverage and higher trading volume.

Frequently Asked Questions

Is it a good time to invest in Gold?

We recently wrote an article to our subscribers about whether it is the right time to add Gold and sell Equity.

Spike in commodity, asset prices, and rise in headline inflation has once again questioned the current monetary regime. While the low cost of funds helps economic recovery, it has side effects like inflation percolating in the real economy and asset prices.

We are seeing a persistent rise in prices of metals, basic commodity, raw materials, etc. Part of it is from supply chain issues as many producers couldn’t get their production back online, also there is ample cheap money to speculate on margin trading on commodity futures.

With fears of inflation and asset price rise, one question comes to mind naturally, is it the time to sell equity and buy gold?

Gold hedge against hyperinflation?

This is a 1-year rolling chart of inflation and gold % change. Whenever inflation shoots up, gold prices rallied. US inflation has more influence on Gold as it is trading in USD.

But even if India has higher inflation, gold will do well as INR will depreciate versus USD and gains would come from depreciation than gold alone. So even for Indian investors, Gold can be a good hedge for inflation.

How is gold valued?

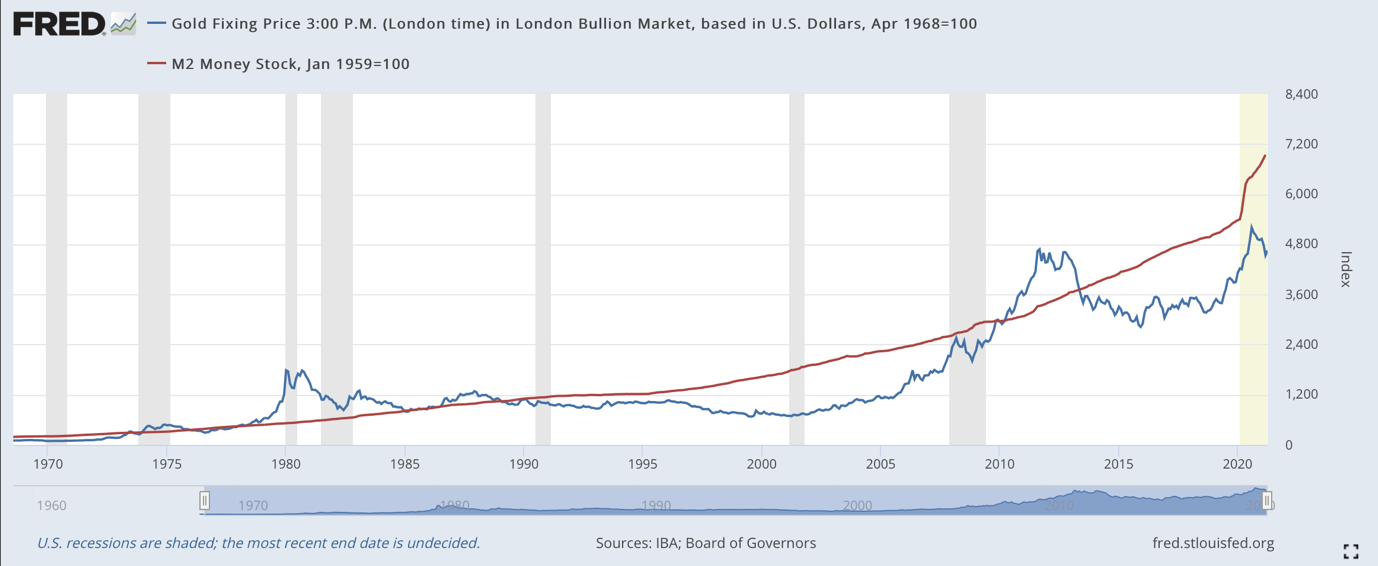

The value of gold is often compared to M2. It shows that Gold has not exceeded M2 so may not be very overvalued. M2 is a measure of the money supply that includes cash, checking deposits, and easily convertible near money. M2 is a broader measure of the money supply than M1, which just includes cash and checking deposits.

The rest of the article can be read here.

Is it a good time to invest in Momentum Strategy?

In investing, the best strategy is often assumed to be the one that is performing well today. Recency bias makes us forget that there are many strategies that work in the market over the long term.

We believe that momentum strategy has its advantages but it also has higher volatility and higher downside versus other fundamental-based strategies. For investors, it’s important to know the pros and cons of each process and prefer what suits them the most. Every strategy works for many years and then it stops working for few years.

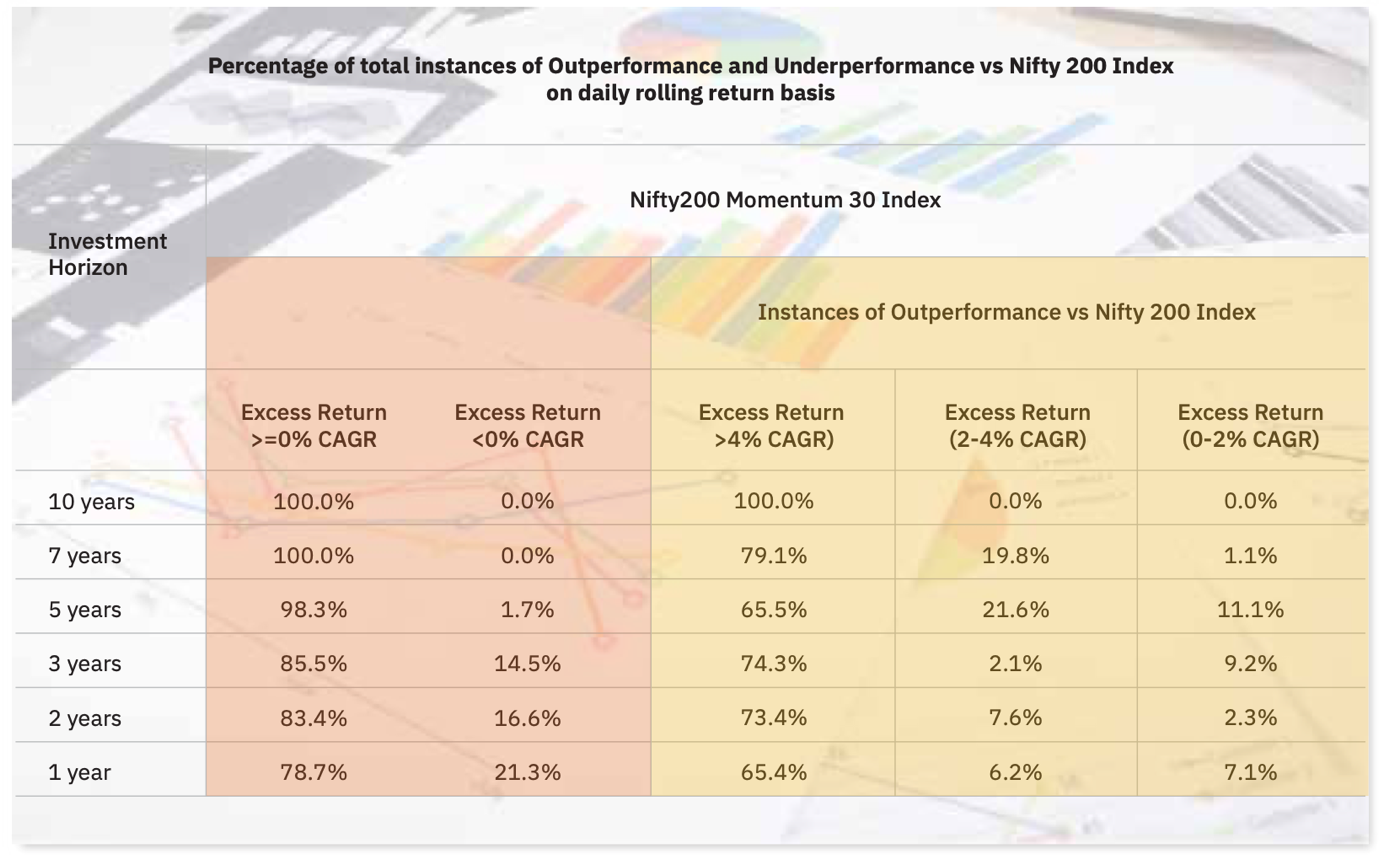

We see that NSE has introduced a Momentum index, Nifty 200 Momentum 30. Research paper on the same shows that the strategy underperforms the index just like any other strategy does from time to time.

Momentum 30 stocks will generate poor returns than Nifty 200 once every five years. Also, once in 7 years, there will be a three-year period when Momentum 30 will deliver lower than index return. This is true even for value, small-cap (size), and quality funds that lag the index temporarily.

In our Omega solution, we participate in each process as much as possible depending on valuation and outlook. It is difficult to anticipate every market cycle, so it’s prudent to be part of as many processes as possible.

We recommend investing only a portion of investable surplus in one strategy and giving it more than 5 years for improving chances of outperformance.

Shall we stay invested or sell equity?

Odds are highly in favor of staying invested rather than exiting or delaying fresh addition.

For fresh funds, we recommend 50-75% investment into stocks/funds that will do well over the next 5 years. If your time horizon is long term (5 years+), the current valuation will matter less. Here is one such exercise.

Nifty is indeed 20% expensive versus fair value. If Nifty is likely to earn 13% CAGR returns over the next 10 years, buying 20% above fair value reduces your returns by 2% CAGR i.e. it will earn 11% CAGR versus 13% CAGR. Now it doesn’t look so bad.

Now the risk is Nifty felt overvalued at 10,000 and 12,000 and again at 15,000. Those who jumped off earlier missed 50%+ returns from 10,000.

Should we book profits, are we up for deep correction?

Indian corporate sector is in the best position to gain pricing power and balance sheet strength. The majority of the sectors have seen consolidation. All inefficient and indebted firms are out of business while stronger ones now dominate the market.

We are seeing this across sectors: Power, Telecom, Cement, Banks, NBFCs, Real Estate, building materials, Paper, pharma, capital goods, consumer durables, etc. This will give strong profitability for incumbents due to the high barrier to entry for the next few years. This makes us confident that every small correction will be a buying opportunity rather than cause of worry.

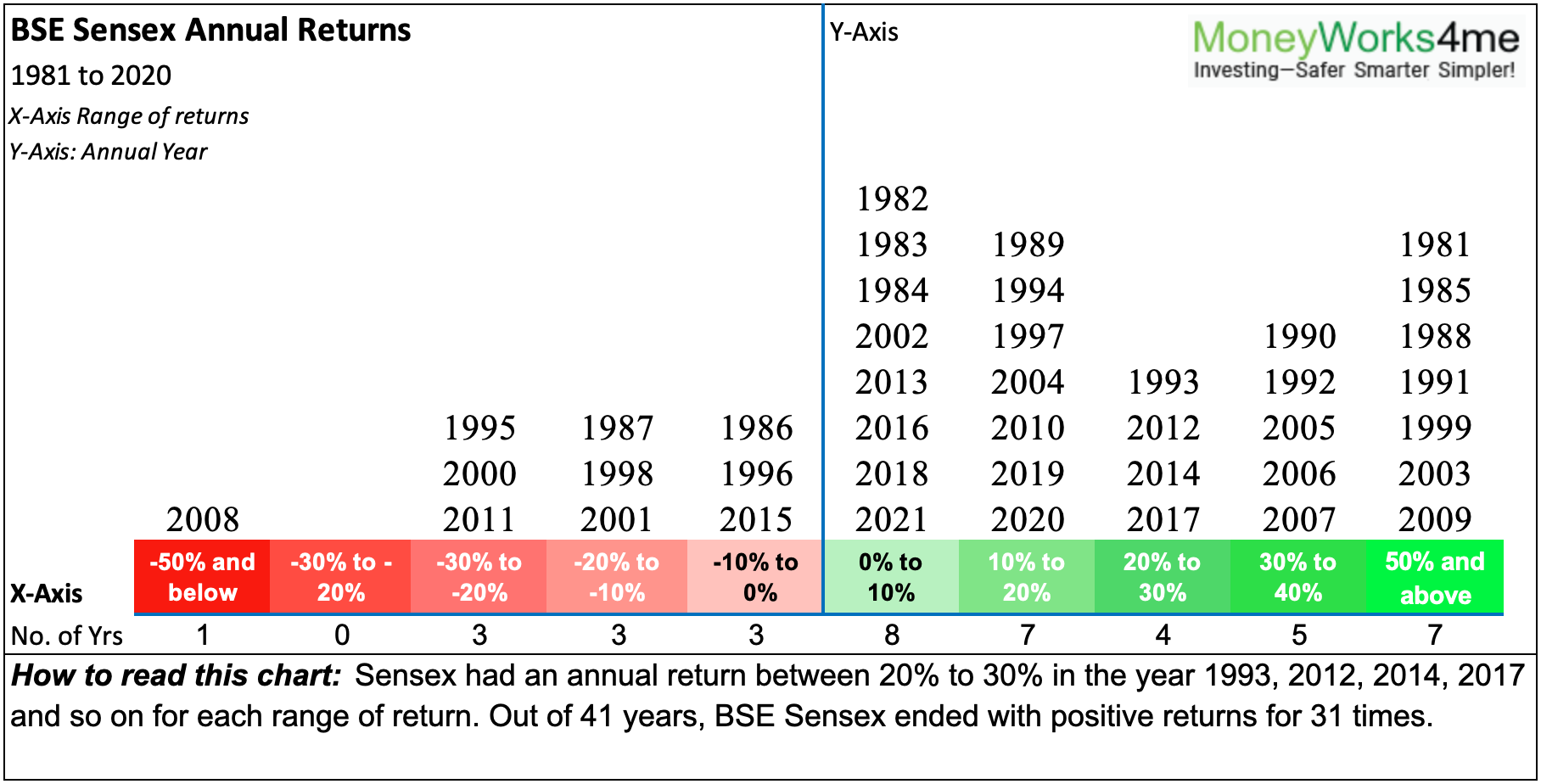

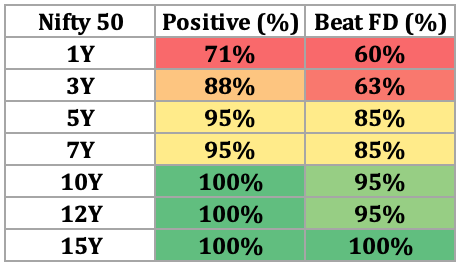

We do not find any merit in second-guessing what’s going to happen in the next 6 months-1 year. If we look at past data, there was an 85% chance of beating FD return and a 95% chance of positive returns in 5 year period. With such favorable odds, we believe investors should not worry about interim correction.

By booking profits (term used by speculators, not investors), you will park funds in Fixed Income. But chances are very high that Equity will beat Fixed income over 5 year period.

We recommend equity investing only for long-term savings so that near-term events become irrelevant. This doesn’t mean one throws caution to the wind. Shortlisted funds and stocks must be of good quality and diversified correctly, such that they will deliver returns over the long term. Picking the right stocks or funds is easier than predicting the market direction.

Avoid any type of regret while investing. Regret can come from either missing a winning stock or not adding enough to a winning stock. Rather focus on long-term process versus short-term outcome. All great investors have missed several stock ideas in their plain sight, but still, their track record is quite good because they stuck to their process.

Do not disturb equity allocation in your asset allocation. Changing you’re with asset allocation will only reduce long-term returns or increase the risks of missing one’s target corpus.

We have diversified our stocks portfolio, we have diversified assets and we have a long-term horizon. Together this takes care of all potential risks in investing.

MoneyWorks4me Outlook:

Investing successfully to reach your goals:

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp: 8055769463