PowerGrid InvIT IPO Details:

IPO Date: April 29th to May 3rd, 2021

Total Shares for subscription: ~77.35 Crore

IPO Size: ~Rs. 7,734 Cr

Lot Size: 1,100 shares

Price Band: Rs. 99-100/share

Recommendation: Avoid for regular income; Prefer debt funds

About the POWERGRID Infrastructure Investment Trust

POWERGRID Infrastructure Investment Trust (“PGInvIT”) is an InvIT set-up to own, construct, operate, maintain and invest as an infrastructure investment trust as permissible in terms of the InvIT Regulations, including in power transmission assets in India.

It is registered with SEBI as an InvIT on January 7, 2021. Its Sponsor, Power Grid Corporation of India Ltd., also acting in the capacity of their Project Manager, is a CPSE under the Ministry of Power, GoI, and is listed on BSE and NSE.

As of November 1, 2020, its Sponsor is the largest power transmission company in India in terms of length of transmission lines measured in-circuit kilometers. As of August 31, 2020, the Sponsor’s share in India’s cumulative inter-regional power transfer capacity was more than 85%. According to the World Bank, its Sponsor was internationally the 3rd largest transmission utility as of October 25, 2019.

The Sponsor, Power Grid Corp, is engaged in project planning, designing, financing, constructing, operating, and maintaining power transmission projects across India and undertakes operations in the Indian telecom infrastructure sector. As of December 31, 2020, the Sponsor also provides transmission and distribution consultancy services in India and other jurisdictions, with footprints in 21 countries (including India).

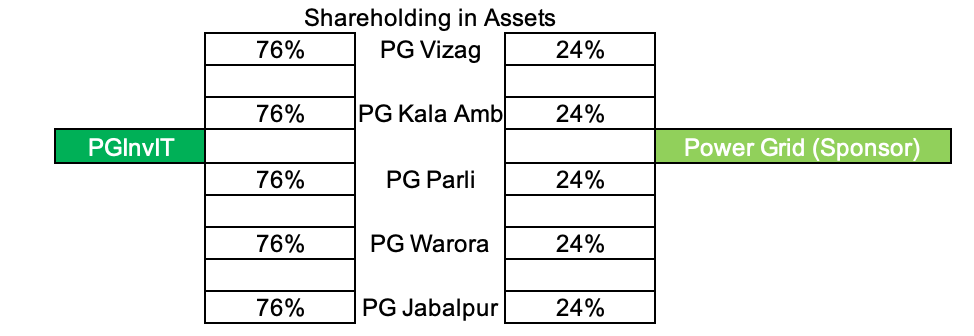

Of the Sponsor TBCB Projects, PGInvIT proposes to acquire 5 projects initially with a total network of 11 power transmission lines of approximately 3,698.59 km and 3 substations having 6,630MVA of aggregate transformation capacity, as of December 31, 2020, across 5 states in India (the “Initial Portfolio Assets”).

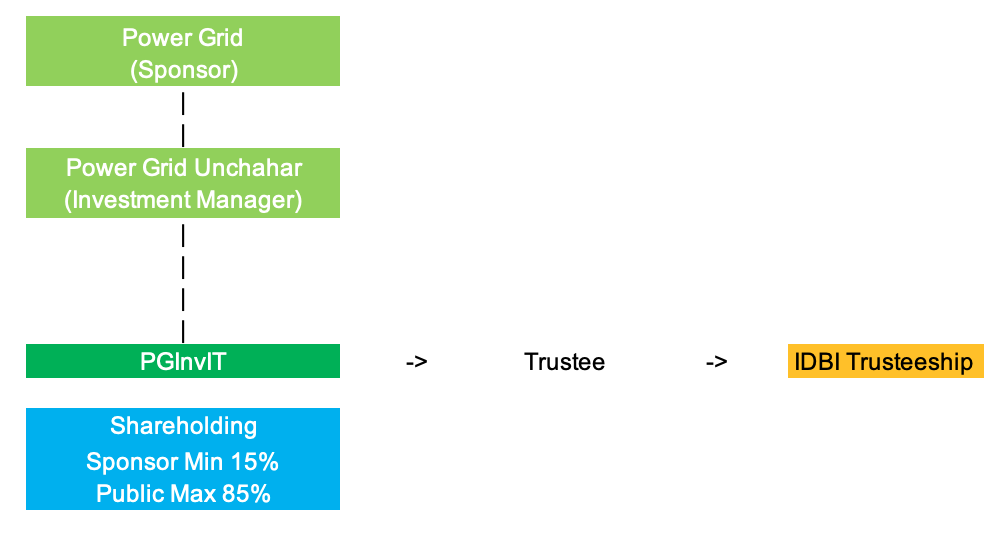

Their Investment Manager, POWERGRID Unchahar Transmission Ltd., a wholly-owned subsidiary of its Sponsor, is responsible for managing them and the Initial Portfolio Assets as well as undertaking investment decisions relating to their assets. Their Investment Manager has been engaged in the power transmission business since Fiscal 2014 and has relevant infrastructure sub-sector experience owing to its involvement in the construction and operation of a transmission system.

PGInvIT’s Trustee, IDBI Trusteeship Services Ltd., is a trusteeship company registered with SEBI as a debenture trustee under the SEBI (Debenture Trustees) Regulations, 1993, since February 14, 2017. On behalf of their Unit-holders, the Trustee is responsible for (a) ensuring that their business activities and investment policies comply with the provisions of the InvIT Regulations, and (b) monitoring the activities of their Investment Manager (in terms of the Investment Management Agreement) and their Project Manager (in terms of the Project Implementation and Management Agreement).

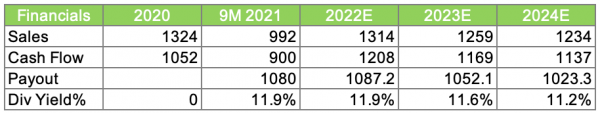

PGInvIT intends to distribute at least 90% of the net cash available for distribution to its Unit-holders once at least every quarter in every financial year. However, the first declaration of distribution by the Trust shall be made within 6 months from the listing and trading of units pursuant to the Offer, subject to compliance with the InvIT Regulations.

MoneyWorks4me Opinion

Investment Trust: InvIT or Investment Trust is a special purpose vehicle that holds assets and pays its unitholders income on regular basis. Any infrastructure company or other which has annuity type of assets i.e. throwing regular cash flow without the need of reinvestment, prefer to offload these assets to investors who are looking for regular income/dividends. Usually, institutions like insurance, pension funds, retirees, etc buy into such opportunities as they need regular income for day-to-day needs.

Power Grid Corporation of India is a transmission utility company that is involved in the erection of transmission lines and substations. Its primary expertise is Build and operate of utility assets. Once assets are built, it charges a transmission fee and earns profits in an annuity fashion this is called the own and maintain phase. In the own and maintain phase, it doesn’t need much expertise to operate and can lend maintenance service without owning those assets. So it can free up cash by offloading these assets to regular income investors who will happily own an annuity type of business.

Special Purpose Vehicle or InvIT is called PGInvIT. Power Grid is the sponsor while Power Grid Unchahar is an investment manager who will keep a record of investments of PGInvIT. IDBI Trusteeship is a trustee who will protect Unitholders’ rights.

Transmission assets will be held in this structure:

We believe that this investment, not equity-like and more debt-oriented. So we wouldn’t advise committing Equity money into this as of now.

The IPO is priced as per equity yield and the expectation is that some growth will happen from more volumes with additional capacity.

Recommendation: We recommend avoiding PGInvIT for now. Later we may recommend if dividend yield and upside potential get very attractive. We believe Power Grid stock is very attractively valued versus InvIT.

If you wish to earn a regular income, consider investing a portion of your fixed-income portfolio in G-sec bonds (ICICI Pru Gilt or HDFC Gilt fund) or Bharat Bond 2030/2031 with a minimum of the 7-year horizon and preferably a 10-year horizon.

| IPO Activity | Date |

| IPO Open Date | Apr 29, 2021 |

| IPO Close Date | May 03, 2021 |

| Basis of Allotment Date | May 10, 2021 |

| Initiation of Refunds | May 11, 2021 |

| A credit of Shares to Demat Account | May 11, 2021 |

| IPO Listing Date | May 17, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 1100 | ₹ 110,000 |

| Maximum | 1 | 1100 | ₹ 110,000 |

| Date | QIB | NII | Total |

| Apr 29, 2021, 05:00 | 0.03x | 0.17x | 0.10x |

| Apr 30, 2021, 05:00 | 0.38x | 0.83x | 0.61x |

| May 3, 2021, 05:00 | 4.63x | 4.92x | 4.83x |

When will the PowerGrid InvIT IPO open?

PowerGrid InvIT IPO will open for subscription on Thursday, April 29, and will close on Monday, May 3.

What is the price band of PowerGrid InvIT IPO?

The price band for PowerGrid InvIT IPO is Rs. 99-100.

What is the lot size for PowerGrid InvIT IPO?

Retail investors can subscribe to the IPO minimum lot size is 1100 shares, up to a maximum of 1 lot i.e. Rs. 1, 10,000.

What is the issue size of PowerGrid InvIT IPO?

The total issue size is ~ Rs. 7735 Cr.

What is the quota reserved for retail investors in PowerGrid InvIT IPO?

The quota for retail investors in PowerGrid InvIT IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on May 10 and refunds will be credited by May 11. Shares allotment will be credited in Demat accounts by May 11.

What is the listing date of PowerGrid InvIT IPO?

The tentative listing of PowerGrid InvIT IPO is May 17.

Where could we check the PowerGrid InvIT IPO allotment?

One can check the subscription status on Link Intime.

Who are the leading book managers to the issue?

Book running lead managers to the IPO are Axis Capital Ltd., Edelweiss Financial Services Ltd, HSBC Securities & Capital Markets Pvt Ltd, and ICICI Securities Limited.

What does PowerGrid InvIT do?

PowerGrid Invit is an SPE created out of PowerGrid. PowerGrid is a PSU company principally engaged in planning, implementation, operation, and maintenance of Inter-State Transmission System (ISTS), Telecom and consultancy services.

Who are the peers of PowerGrid InvIT?

There are no listed peers of the company. However, it can be compared with other power transmission companies.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me PRO solution which provides you with exhaustive research-backed recommendations on strong companies, mutual funds, and index funds. The MoneyWorks4me PRO is priced below Rs. 5000 but provides a guide to building a strong portfolio for beginners to become PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp: 8055769463