For a newbie investor, there are so many options, so many pros and cons. The jumble and jargon doesn’t make it any easier. It makes you wonder where to even begin.

For a newbie investor, there are so many options, so many pros and cons. The jumble and jargon doesn’t make it any easier. It makes you wonder where to even begin.

Starting out in the same predicament, I armed myself with a file of choices and trivia and attacked every investor with a host of questions. But, the mixed reviews just added to my confusion.

A number of people gave rave reports on the stock market, yet it seems a majority of Indians stay clear of it due to the many uncertainties. It makes you wonder though – how have people always managed to make more money in the stock market?

An Explanation: The story of the 3 Portfolios

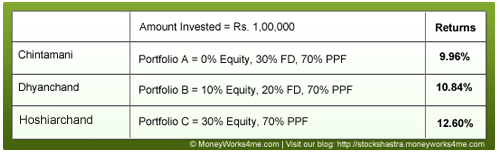

Three brothers decided it was time to invest some money. Rather than blow up their wealth on their personal whims and fancies, they were going to put a bit aside and let it multiply.

Each invested the same amount of money at the same time with 70% put straight into the Public Provident Fund.

As for the rest of their money, they had a few options to choose from.

Chintamani, the worrier was leaving nothing to chance. He put his 30% straight into Fixed Deposits. The risk – free, fixed return option with its regular income would make him sleep easy at night.

Dhyanchand was the cautious one. He put 20% of his money in Fixed Deposits and the remaining 10 % into the Stock Market. He understood that investing in stocks could make him money, but in this volatile economy, who knew if he’d even make a profit. Wasn’t it better to be safe than sorry?

Hoshiarchand, the smart and calculated risk taker, had shocked the others by investing his entire 30 % in the share market. Leaving out a safety net seemed a reckless thing to do. Wasn’t Hoshiarchand bound to regret his investment decision?

Here’s what Happened:

The PPF generates an after tax return of close to 12%, FD’s give about 6% returns, while equity generates 15% considering long term investing principles.

Thus, while Chintamani made close to 10% returns by investing 30% portfolio in FD’s, Dhyanchand made about 11% returns by investing some of his portfolio in equity, while Hoshiarchand made close to 12.5% by investing his 30% portfolio in equity. That means Hoshiarchand made 2.5% more than Chintamani. While you may think that 2.5% is not much, given a time period of 30 years Hoshiarchand would actually make double the returns as compared to Chintamani!!

Facts of Fixed Deposits

This clear cut investment option allows you to deposit your money for a specified amount of time, generating a pre-determined interest. Popular for its low risk status and regular income, it’s a strong contender for the small stakes crowd.

The Flip Side

1. Lower earnings

An FD generally gives you between 5 – 6 % return, which is far lower than the other options. It’d take a long time to see your money grow.

2. The Effect of inflation

It may seem risk free, but in times of inflation, you can lose money. If you get a 6% interest on your FD’s and inflation rose to 8%, you’d be down by 2%.

3. Tax on earnings

Although there are some tax benefits, the profit made on Fixed Deposits is taxable.

4. Time Restraint

Withdrawing from a FD before the due date ends up costing you. In case of an emergency, if you break open the deposit, you will get less than your owed percent.

How Stocks Make the Money

In this fickle economy, playing with stocks might seem a game of chance. A seasoned investor knows though that there are rules and strategies with which to get ahead, along with a bunch of benefits:

1. Instant Access

With stocks, you can pull out your money at any time. It all depends on whether you want it sooner or later.

2. Tax Friendly

The profit you make on dividends is tax-free.

3. Outwitting inflation

The stock market gives you a chance to buy in the slumps and sell in the boom. History has shown that it has always recovered from inflation.

4. Highest Earnings

At the end of the day, putting your money in the equity market gives you the greatest returns.

The Reckoning

At the end day there are two paths to choose from. The question to ask is whether it’s less risk or more profit you want to make.

FD’s come with an accolade for the low risk category, but they also mean a low earning outcome.

The stock market however may seem a random game of chance, completely dependent on the luck of the draw. An informed investor knows though that yes, there are some odds at stake, but also a far bigger fortune to be made!

Also Read: Trading or Investing – What’s right for you?

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

If you have funds which you dont require for next 5 years, it is prudent to invest a major chunk of it in well researched equities as historical data shows that over long run, equities beat all other asset classes.

HAHA fhut le bacche….

STOCK MARKET AB BAND HONE WALA HAIN…

FD AUR GOLD..

REAL ESTATE TOH JAB POLITICIANS NETA AUR CORPORATE WALIN PAKDE JAYENGE..ACHI IMANDAR SARKAR AANE KE BAAD TOH..

AUTOMATICALLY GHAR KA KEEMAT KAM HO JAYEGA