The first week of every month is a time of great fun and frolic for all of us. The preceding month’s ‘hard work’ finally bears fruits and we get our salary in hand. Infact, even before we get our salary in hand we have our ‘Things to Buy’ list ready. We spend our money on food, clothes, transport, entertainment etc. Sometimes, we even borrow money to buy a TV, a car, to fund a much-awaited vacation or a house. We start the month as a king/queen literally splurging our money sometimes; but as the month passes we desperately try to make the money last and eagerly await the month end.

But, while we are busy figuring how to spend our hard-earned money, we fail to realize that our spending habits are not only important to us, but in totality they are important for the entire economy. Believe it or not, in a way, we consumers run the show!

What is consumer spending and why is it important?

Consumer spending is the total expenditure that we as consumers make throughout the year. In more technical terms it is known as Private Final Consumption Expenditure (PFCE). To give you an idea of how important consumer spending is, if we all decided to reduce our spending, we could actually bring down our economy!! Such is the power that we consumers have!

Another reason why Consumer spending is important is because it is the leading indicator of the health of the economy. This means looking at the consumer spending, we could get a pretty good idea in advance whether the economy is doing good or bad. Wonder how ? It’s pretty simple.

One of the most important factors which drive the stock prices is the corporate earnings. But what drives the corporate earnings? Well a lot of things actually. But, among these things, one of the most crucial is consumer spending. Take a look at the graph below to get a better idea( click on the image to enlarge it).

(Don’t get bamboozled by the numbers surrounding the graph, rather look at the two lines). From the chart it is clear that the impact of a change in consumer spending happens on Net PAT of Sensex 30 companies with a lag of 1-2 quarter. For instance in the 3rd quarter 2009-10 you can see consumer spending rising, the effect of which shows in the corporate earnings in the next quarter. Thus, consumer spending can help you know beforehand where the corporate earnings are headed!!

So, how does consumer spending get affected?

Consumer spending does not get eroded by itself but it happens due to a certain chain of events.

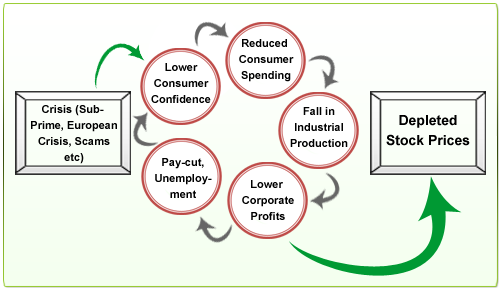

Above is a pictorial depiction of the vicious circle of crisis. If increased consumer spending is the hero for corporate profits, then the villain is a Crisis (e.g. The Sub-Prime Crisis in 2008) which leads to reduction in the spending. A crisis creates an environment where we don’t feel like going overboard with our spending. We tend to postpone our big purchases like house, car etc. In fact if things start getting worse, we even start cutting back on things like movies, restaurants etc.

The reduced consumer spending leads to lower demand situation. The producers respond by cutting down on the production, thus we ultimately see poor financial results from corporates. More often than not poor financial results lead to depleted stock prices. Now if the production, sales & profits are down then the companies increasingly resort to cost cutting measures like no bonuses, pay-cuts, and even laying off people. This further lowers the consumers’ confidence and the whole circle repeats again.

Whenever there is a downturn or a crisis, we hear people saying – “This time it’s different”. But more often than not the reality is – “Every time it’s more or less the same.” The cycle seen above repeats with nearly every downturn or crisis.

So, as an investor look out for such events which make you and people around you reluctant about spending money. It might actually be the start of a downturn!

Sectoral Impact of fall in Consumer Spending:

Consumer spending is the cornerstone of corporate profits. A fall in it has an overall negative impact on all the sectors of the economy & this is when you see the stock market tumbling. Predictably though, some sectors get affected more than others.

- Real Estate & Automobile – Buying a house, car, bike etc. usually requires us to borrow a large part of the money from the bank. During tough times, it is unlikely that we will borrow and spend and these purchases are the ones we most likely postpone. These sectors are usually most impacted by lower consumer spending.

- Consumer Goods – Other things on which we tend to cut down expenditures on are luxury items like home theater, LCD TVs, refrigerator, washing machine etc. The companies producing such luxury items are impacted heavily during these times.

- Banking Sector- The banking sector is highly affected by any loss in consumer confidence. Lower consumer spending leads to lower borrowing. To overcome this, the banks lower their lending rates trying to attract borrowers. Also, if you don’t feel like spending and borrowing, you would most certainly be saving more. Thus banks face a double impact a) Lowering of lending rates, b) Higher Interest Outlay on deposits due to increase in savings. This lowers their Net Interest Margins and the profitability for the banks.

- Pharma Sector- The Pharma sector would be relatively less impacted by lower consumer spending. If you have a headache you don’t postpone the purchase of medicine to the next quarter, do you? Medicine and health care services is more of a necessity than luxury, thus they are less impacted. However companies manufacturing life style drugs (eg. weight loss drugs, hair loss drugs) would be adversely affected, as these drugs are not dire necessities.

- Infrastructure- Infrastructure investment is mostly a government activity. In order to get out of a crisis situation, govt. spends more. Thus there is an increase in spending towards building roads, railways, metros etc. Companies involved in execution of infrastructure projects are relatively less impacted and with a lag they would stand to gain due to higher govt. expenditure.

Other industries like IT & textile sector would be more impacted by a global downturn than a domestic crisis as the majority of these companies depend on US & European clients. The recent European crisis had a major impact on IT and Textile sector due to lower export demand.Also, if this circle continues to persist, then shipping industry faces the brunt of it as the lower export demand would seriously impact the shipping business. Thus poor performance by the shipping sector could be a good indicator of downturn already having settled in the economy.

The entire capital intensive sector would be impacted due to lower consumer spending but with a greater lag than compared to Real Estate or automobile sector.

So, How to use this knowledge to make money in the Stock Market?

Consumer spending thus seems to be a very good solution to find out where the stock market is headed. Unfortunately, the data for consumer spending comes approximately a quarter late, thus making it difficult for us to exactly know the amount of consumer spending in advance. However, there are various ways in which we can find out about the pattern of consumer spending.

- Learn from your own consumption pattern and that of the people around you. If you and the people around you are delaying the decision to buy a house, a car, TV, fridge etc. this might be your first cue to overall lower consumer spending. A dip in footfall in shopping malls, restaurants, markets etc. may also be a good way to identify lower consumer spending.

- Look for the monthly automobile sales figures in newspapers, TV channels etc. If the growth in sales is lower or is showing reducing trends continuously then surely one of the major causes is reduced consumer spending.

- Lower consumer spending affects stock from real estate, automobiles, banks etc the most. However you can look for investment in fundamentally strong companies of these sectors when they are available at discount during the downturn.

- Sectors like Pharma, FMCG and Infrastructure are relatively less impacted by lower consumer spending. Look towards investment in such sectors.

Consumer spending is the leading indicator of knowing how the stock market and the economy would be performing. Invest your money at the right time in the stocks and sectors which happen to gain the most with higher consumer spending and avoid sectors like real estate, automobiles, and banking etc during lower spending times.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

Very well explained and a wonderful article on how to pick up stocks for investments.

Thank you for your appreciation. Do keep reading and posting your feedback.

Great educational Articles.I am liking it lot eventhough I have been in the market for last 6 years…I will be interested to know more about team…I am unable to figure out who’e venture is moneyworks4me ?

beutifully corelated

Thank you. Do keep reading & posting your comments.

Thanks for your appreciation. It is great to know that our articles are useful for the beginners as well as experienced investors like you. We have a very dedicated research team headed by Raymond Moses and Thiagarajan Sreeram. You can know more about the team here.

http://www.moneyworks4me.com/About-Us.html

REALLY GOOD ARTICLE. THIS SITE REALLY GOOD KNOWLEDGE AS HOW THE STOCK MARKET WORK.

ONE SHOULD VISIT THIS SITE DAILY TO MEMORISE THE BASICS OF STOCK MARKET

Thanks for your appreciation. Yes we believe understanding the basics about stock market is crucial for investing in it. Do keep reading and posting your feedback

good article

Thanks for your appreciation.

good article

very good article.thanks for that .expecting more such articles like impact of gold price on market,exchange rate,petrol price,govt.policy,festivals,vacations,new trends,etc i am a regular reader of money works 4me.thanks thanks alot

Thanks for your appreciation & advice. Yes, we are also working towards presenting the interaction of Stock market with factors like FIIs, GDP, exchange rates etc. Do keep reading and posting your comments.

A Wonderful source for the basics. Provides great knowledge on how various factors in the economy act, interact and influence the stock market is amazing and thanks for your efforts to educate and lead towards more infromed decisions to invest in the stock market.

Thanks for your views & appreciation. Definitely, this is what we intend to achieve through Stock Shastra: Educate the retail investors about the basics about stock investing & enable them to make informed decisions.

where to get PFCE data?

I am really happy to see such a website which educates people in such a simple way that even a novice can easily understand .. great effort guys .

very valuable article

it was nice information giving about the consumer spending.