The union budget 2022-2023 reflects the government’s commitment to boost economic growth. The focus remains on infrastructure development fuelled by higher public sector CAPEX and thereby hoping to unleash private sector CAPEX.

Key Numbers:

- The Budget projects a fiscal deficit for FY23 at 6.4% vs 6.9% of GDP in FY22

- Real GDP to grow by 8-8.5%, nominal by 11.1%

- Revenue Receipts to grow by 6% YoY, aided by a 10% increase in Tax revenue

- Adjusted CAPEX to increase by 15% YoY to Rs 6 trillion

- No changes in the direct tax rate, personal or corporate.

- Divestment target lowered to 65,000 Cr, including LIC IPO

- National Highways network will be expanded by 25,000 km in FY23 and Rs. 20,000 crore will be mobilized through innovative ways of financing

- PM Awas Yojana – Rs. 48,000 crore has been allocated for housing in FY23 and aims to complete 80 lakh houses in both rural and urban region

- Har Ghar, Nal Se Jal – FY23 allocation of Rs. 60,000 crore to cover 3.8 crore household

- 19,500 crore for PLI for the manufacture of high-efficiency modules, with priority to fully integrated manufacturing units from polysilicon to solar PV modules

Key Measures:

Higher Capex: The focus on infrastructure is evident from the high CAPEX allotment of Rs. 7.5 trillion, an increase of 24.5% YoY. Adjusting for one-offs (such as settling sir India Liabilities) actual CAPEX growth is around 15% YoY. Despite this, CAPEX to GDP ratio at 2.9% is the highest ever seen yet.

Increase in Bond Yields: This huge growth in Capex will be met by higher borrowings from the government and a slower fiscal consolidation. Bond Yields immediately increased as a result. Given the expected increase in Fed interest rates and subsequent tightening monetary policy by RBI, increasing oil rates, we expect bond yields to rise further in the coming year.

Focus on Quality expenditure: The share of revenue expenditure has been reduced to 81% of total expenditure for FY23E (owing to the removal of pandemic-related social measures). Also, the total subsidy bill has been reduced to 1.2% of GDP, leaving more fiscal space for capital expenditure in FY23E.

Disinvestment target for FY22RE revised downward to Rs 78,000 core (including LIC IPO) vs. earlier budgeted target of Rs 1,75,000 crore. For FY23E, it is pegged at Rs 65,000 crore, which looks realistic, in our view.

Digital Rupee: The RBI will issue a digital rupee in FY23 using blockchain and other technologies. India has been conducting research across wholesale and retail segments for Central Bank Digital Currency (CBDC).

Cryptos come under the tax radar: From April 1, 2022, the transfer of digital assets will be taxed at 30%. No deduction except the cost of acquisition will be allowed and no loss in the transaction will be allowed to be carried forward as well.

Sector Highlights:

Infrastructure: Railways benefit from a 14% hike in CAPEX. Power sector Capex increased to Rs 24,000 Cr from 19,500 Cr last year. Domestic solar manufacturing to benefit from an increase in customs duty to 40% on imported solar photovoltaic modules and 25% on imported solar photovoltaic cells.

25,000 km of national highways to be completed in 2022-23. Funds to the tune of Rs. 20,000 crore would be mobilised. Outlay towards MoRTH increased by 52% versus FY22 at Rs. 1,99,108 crore. Outlay towards NHAI up by 3% vs FY22 at Rs. 1,34,015 crore. Pradhan Mantri Gram Sadak Yojana’s outlay for FY2023 stands at Rs. 19,000 crore, up by 35.7% as against FY22.

Automobiles: Battery swapping policy to be laid out with interoperability in constrained urban areas to improve efficiency in the EV ecosystem and encourage EV sales. Private sector to be encouraged for ‘battery or energy as a service’ business models.

Construction Materials: Pradhan Mantri Awas Yojana (urban plus rural) outlay increased by 1.3%/74.5% YoY to Rs. 48,000 crore vis-à-vis FY22. Allocation towards Smart Cities increased by 3%/5.4% to Rs. 6,800 crore vis-àvis FY22. Allocation of Rs. 60,000 crore made for Jal Jeevan Mission for FY2023 to cover 3.8 crore households.

Cement: Higher allocation to MoRTH (up by 52%), Pradhan Mantri Awaas Yojana (up 1.3%), Pradhan Mantri Gram Sadak Yojana (up 35.7%), Smart Cities (up 3%) visà-vis FY22.

Logistics: 100 PM Gati Shakti cargo terminals development and 4 Multimodal logistics parks awards over 3 years. Four Multi-Modal logistics parks to be awarded through PPP mode in 2022-23.

Defence: The government is committed to reducing defence imports under AtmaNirbhar Bharat Abhiyaan and thus has increased capital procurement from domestic companies to 68% in FY23 as compared to 58% in FY22.

Telecom: 5G spectrum auctions will be conducted in 2022 to facilitate the rollout of 5G mobile services within 2022-23 by private telecom providers.

What to expect:

The Union Budget 2022-2023 focuses on Physical as well as digital development. This is a surprisingly fresh investment-oriented approach as compared to a consumer-oriented approach, which we believe will help in the revival of private CAPEX, leading to multi-year economic growth.

Infrastructure, capital goods, and manufacturing sectors continue to be a bright spot, given a 30% hike in budgeted expenses. The banking sector will be another key beneficiary given the increase in borrowing an expected uptick in the credit growth cycle.

What is meant by the Union budget?

Union Budget is a comprehensive report of the Government’s finances in which revenues from all sources and expenditures for all activities are presented. Union Budget lays down the statement of the estimated receipts and expenditures of the government for the coming financial year. It sets out how the government proposes to allocate the financial resources among the various agencies that make claims on it and how it proposes to raise the finances for this.

Who prepares the Union Budget?

The budget is made through a consultative process involving the Ministry of Finance, NITI Aayog, and spending ministries. The finance ministry issues guidelines to spend based on which ministries present their demands. The Budget Division of the Department of Economic Affairs in the finance ministry is the nodal body responsible for producing the Budget.

Why is the Union Budget Important?

In a democracy like India, the government cannot arbitrarily spend, borrow, or tax money. So, for the government to function effectively and help improve the economic and social framework of the country, budgeting and planning are a necessity. Union budget ensures Resource Allocation, Price Control, and Reducing Economic Inequality.

What is the income tax slab for 2022-23?

There is no change to the income tax rate or income tax slab for FY2022-23.

How much we can save under 80C in 2022-23?

There are no changes in tax deductions for Budget 2022-23. You can save Rs. 46,800/- under section 80C by investing 1,50,000. One can additionally save 15,000 by investing in National Pension System.

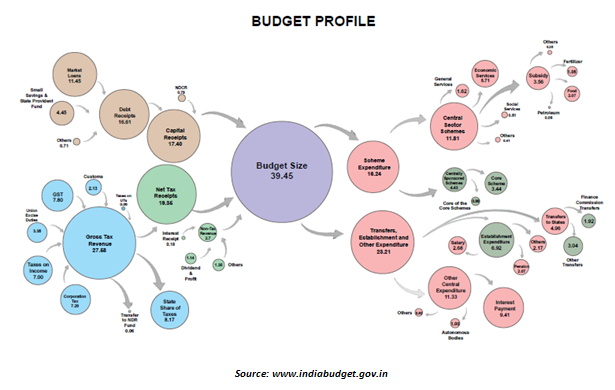

What is the total budget of India in 2022-23?

The total Budget for the year 2022-23 is around Rs. 39.5 Lakh Crores. The budget is equal to the total expenditures committed by the government.

Is Union Budget 2022-23 good or bad?

Budget 2022-23 was cheered by the market as it reflected high investments that will be made by the government to revive the economy. While it was good for a few sectors, for others it was neutral. Overall, Budget 2022 was more positive than negative.

What are the 3 types of budgets?

Budgets are of 3 types – Balanced budget, Surplus budget, and Deficit budget. A government budget is said to be a deficit budget if the estimated government expenditure exceeds the expected government revenue in a particular financial year. A deficit budget is best suited for developing economies like India.

Make Informed Stock Investing DeciZen:

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463