UTI AMC IPO Details:

IPO Date: Sept. 29th – Oct 1st 2020

Total Shares for subscription: ~4 Cr

Lot Size: 27 shares

Price Band: ₹ 552-554/ share

Issue Size: ₹ 2,160 Cr

Purpose of IPO:

- To achieve the benefits of listing the on the Stock Exchanges

- Exit route to the existing shareholders like LIC, SBI, BOB, PNB, and T. Rowe Price Global Investment Services.

About the UTI AMC:

Business

UTI AMC has established the first mutual fund in India and has been in the asset management industry for more than 55 years with strong brand recognition in the mutual industry.

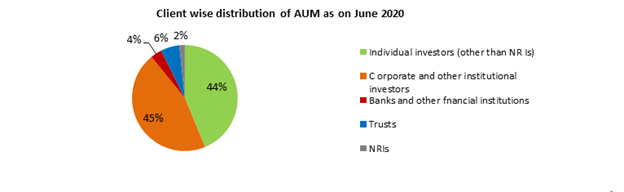

Incorporated in 2002, UTI Asset Management Company is in the business of managing the domestic mutual funds of the UTI Mutual Fund. It provides portfolio management services to institutional clients and high nets worth individuals like Employee Provident Fund Organisation (EPFO), National Skill Development Fund (NSDF), and Postal Life Insurance. The company manages retirement funds like the National Pension Scheme, offshore funds like the Shinsei UTI India Fund, and many other funds catering to a diverse group of individuals, institutional investors, banks, trusts, and NRIs.

Size & Market Share

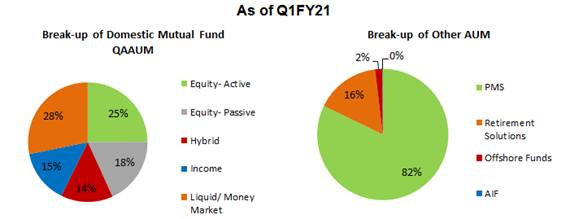

In terms of mutual fund business, the company manages 153 mutual fund schemes comprising equity, hybrid, income, liquid, and money market funds with a Quarterly Average AUM (QAAUM) of ~Rs. 1.3 lakh Cr as of June 2020.

UTI AMC is the seventh-largest AMC in India in terms of mutual fund AUM. The company had a domestic mutual fund QAAUM of Rs. 1,33,630 Cr and other AUM of Rs. 8,49,390 Cr as of June 2020. The AUM for PMS business was at Rs. 6,97,050 Cr during the same period.

As of September 2019, the company managed 6% of the industry AUM, the top being HDFC mutual fund managing ~15%.

AUM & Performance

Schemes invested in UTI’s six core equity strategies (forming ~92% of AUM) have outperformed their respective benchmark indices (by an average of 1.3% per annum) for an average return of 9.6% per annum in the 10-year period ended June 30, 2020.

Source of Revenue

The bulk of revenue is generated from the management fees for the funds managed. The management fees from domestic mutual funds account for ~73% of the total income of the company.

Reach Points

UTI is recognised nationwide for its deep-rooted reach and more than 55 years of heritage as a leading and pioneering, participant in the mutual fund industry. UTI has a multi-channel distribution network with both in-house capabilities and external distribution channels. The company’s distribution channel comprises ~53000 Independent Financial Advisors, internal sales teams, and distributor’s arrangements with domestic, foreign banks, and other distributors.

UTI AMC has four sponsors SBI, LIC, PNB, and BOB each of which has the Government of India as a majority shareholder. UTI AMC also has a global AMC T. Rowe Price International Ltd as one of its major stakeholders with a 26% stake in the Company.

Promoter

UTI AMC is a professionally managed company and does not have an identifiable promoter.

Positives:

- Reasonably large AUM size to enjoy the benefit of operating leverage

- Present in the industry with growth tailwind in long term.

Negatives:

- AMC being a cyclical business performs poorly during bear markets

- The increase in popularity of low margin products like ETFs and index funds has reduced the profitability

- Regulatory caps can impact growth/profitability.

Moneyworks4me Opinion:

Asset management is in a secular growth phase. With 95% of Indian assets tied up in physical assets like Gold and Real Estate, we believe there is a lot of potential from these assets to convert into financial assets with banks and asset management companies.

Though this sector has long term growth, it is a cyclical industry. When the markets are in a boom, inflows are high, and as well as AUM value is high as market prices move up. But in the down cycle, outflows and lower market prices take AUM down significantly.

In the US, a developed market for financialization, asset management companies do not make a lot of money. Shift towards i) low-cost passive funds ii) Fund managers and analysts have more bargaining power who take away a higher share of fees in salaries iii) Competition is high and fragmented as the market size is huge.

While this might be true in the Indian context too eventually, for now online and financial awareness is increasing to opt for financial assets over physical assets, AMCs with better distribution will have an edge for several years before their profitability drops. AMCs have high operating leverage since fixed costs are high and almost no variable costs. A small drop in Revenues can lead to a large drop in profits.

In the asset management business, the key competitive advantages come from i) Scale ii) Distribution iii) Low Cost.

UTI AMC has a scale as it is the top 7 asset management with a 6% market share, but the distribution network is average versus peers who have sister banks to promote/cross-sell funds.

The current valuation of UTI AMC is 25X of 2020 EPS. Alternatively, as a % of AUM, UTI is priced at 5% of AUM which appears fully priced to overvalued for a company that hasn’t been executing good growth in good years as well. Growth in AUM was primarily from EPFO money into passive index funds.

We would prefer HDFC AMC or ICICI AMC over UTI.

Currently, we recommend Avoid in this sector due to i) expected drop in profitability ii) Slowdown in inflows leading to lower growth in the medium-term iii) High valuation without an equivalent growth in AUM/profitability.

If you liked what you read and would like to put it in to practice Create Free Account at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463