CAMS IPO Details:

IPO Date: Sept. 21st – 23rd 2020

Total Shares for subscription: ~1.8 Cr

Lot Size: 12 shares

Price Band: ₹ 1229-1230/ share

Market Cap: ₹ 5,997 Cr

Purpose of IPO:

Offer for sale by existing shareholders. The company will not receive any proceeds of the offer.

About Computer Age Management Services (CAMS) Ltd:

Business of the Company

CAMS is a technology-driven financial infrastructure and service provider. It is India’s largest registrar and transfer agent of mutual funds. Karvy is the second player with a 30% market share.

The services provided include technology-based services such as dividend processing, transaction origination interface, payment, transaction execution, dividend processing, intermediary empanelment, report generation, investor interface, settlement and reconciliation, compliance-related services, and brokerage computation.

The company also provides services in the area of electronic payment collections services business, insurance services business, alternative investment funds services business, banking, and non- banking services business, KYC registration agency business, and software solutions business.

Size & Market Share

As of July 2020, the company had an aggregate market share of ~70% based on mutual fund AAUM managed by its clients and serviced by the company.

Source of Revenue

The management fees from domestic mutual funds account for ~73% of the total income of the company.

Reach Points

CAMS has a wide network comprising 25 states, 278 service centers, and five union territories. It also offers services online through a mobile application. This is supported by call centers in four major cities – Mumbai, New Delhi, Chennai, and Kolkata.

Major Shareholders

The company’s marquee shareholders include Great Terrain (an affiliate of Warburg Pincus), HDFC, HDFC Bank, and NSEIL, among others.

Positives:

- The company caters to most of the key mutual fund houses in India.

- The growth is dependent on Mutual fund AUM which has been growing in India for the past decade.

Risks:

- The business is largely dependent on the growth, value, and composition of AAUM of the mutual fund’s industry, which is cyclical in nature.

- Disruptions due to regulations or data breach or technological could adversely affect the business and its reputation.

- Significant client concentration exists as the top 5 clients comprise ~70% of the revenue.

Moneyworks4me Opinion:

Registrar and transfer agent forms a crucial role in the mutual fund industry. Just like banking operations, CAMS is like the operations department of the mutual fund industry with a 70% market share.

CAMS is an asset-light business with key tie-ups with large MFs and with little to no competition as long as CAMS keeps providing efficient and low-cost services to its clients. This ensures the sustainability of the business model and ROE.

The growth of the company depends on an increase in AUM of the industry and the trajectory of expense ratios charged by MFs. There is little doubt that AUM of MF will grow over the next 5-10 years however, the growth in fees might not clock the same growth rate as AUM growth as i) rising AUM leads to falling expense ratio ii) incremental money can come into low-cost products like index funds, etc.

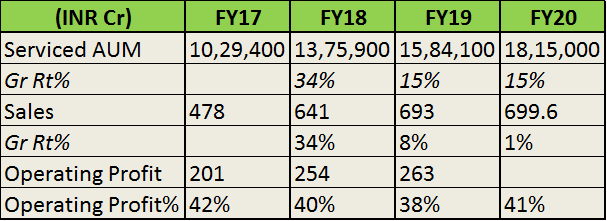

Financials

If we assume 10-12% Equity CAGR return and 6% debt CAGR return, AUM can grow 7-8% without new inflows. Additional growth will come from new inflows ~7% CAGR based on our estimate. This leads to around 14% CAGR in AUM. Falling expense ratios can eat into this growth upto 2-5% implying long term sales growth rate CAMS at 9-12% CAGR. With little variable costs, earning growth of CAMS can clock around 12-14% CAGR in the best case.

What should an investor do?

As on today, financial intermediaries including exchanges, depositories, etc. are attracting a lot of money because i) their sales haven’t impacted from lockdown, slowdown, etc, ii) a lot of money has moved out of banks and found solace to this space and insurance as a proxy to the financial sector, iii) NSE IPO in the near term has kept the sector buoyant.

The above factors will ensure, CAMS IPO will be a hit on the market. We did not find any red flag in the company or the business model. Valuation, which certainly appears to be at the higher end of a fair price, is the only concern for this company. (30-40% higher than the reasonable price at 23x P/E ratio)

In a popular IPO, bagging 1 lot is also difficult. So if 1 lot =15,000 is not a big sum for your equity portfolio (less than 2% of the portfolio), you can participate in this IPO. We do not find merit in buying the stock after listing (even if it happens at the bid price). You can switch to better financial intermediaries over time.

In the financial intermediaries space, we will prefer CRISIL, MCX, and NSE (whenever it gets listed). These companies have better growth opportunities with moat characteristics. Others are mostly operations/backend companies who would enjoy good valuation only till growth remains high.

We await NSE IPO as we find NSE is a very good business model with good prospects.

If you liked what you read and would like to put it in to practice “Create Free Account at MoneyWorks4me.com”. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.