This article covers the following:

Review

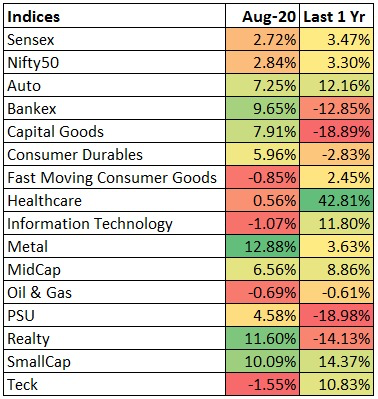

On Jul 31, Nifty closed at 11,387, around 3% higher over last year. In the last 3 years, Nifty is up 14% translating into ~4.7% CAGR.

Nifty has bounced back 52% from its intraday lows with healthy participation across the board. The announcement of Fiscal stimulus by the US government and quantitative easing from the central bank across the world may have caused a break on selling pressure inequities. Offlate, the increased activity of retail investors in mid and small cap space also led to a recovery in small and mid-cap indices as well.

FII purchased Rs. 47,000 Cr worth of shares in Aug’20 versus purchases of Rs. 7,000 Cr in Jul’20.

As per our previous note, GDP may have contracted in 20-25% range, the actual print came out a decline of 23.9% year on year. US GDP contracted by 9% and 33% annualized in the Apr-Jun’20 quarter.

Outlook

As on date, the average upside of our coverage universe is likely to be more than 10.5% CAGR over the next 3 years based on current estimates.

We find that the Nifty 50 index trades above its fair value while there are pockets of extreme overvaluation and undervaluation. A lot of liquidity helped beaten down stocks to rally however, the economic indicators do not point to a V-shaped recovery as yet.

Small cap and companies showing disruption in earning are very likely to come off during market reversal. Companies in sectors like chemicals, pharmaceuticals, IT, Telecom, utilities and rural focused companies will report good earning this year. Most of the stocks in these sectors are trading close to fair price or slightly overvalued.

We are looking at companies that have good earning triggers over the next 2 years as we are not certain whether broad-based recovery will happen immediately. We are investing in companies i) coming out of sector consolidation/debt reduction, or ii) introducing new products, or iii) commissioning new capacities or iv) executing orders in hand. This gives certainty of growth rather than plain anticipation.

We would avoid bargain hunting in sectors or stocks that may have become cheap but they have high debt or they operate in cyclical sectors. There is a good reason to believe that until demand recovers, the discretionary (usually cyclical) won’t come back. Hence we are avoiding directly hit sectors like Hotels, Transport, Multiplexes and discretionary consumption sectors like Autos, large ticket consumer durables, etc.

We are studying sectors that would benefit on the path to recovery. We would be interested in i) Hotels – Hotels already had a good cycle and large demand versus supply, current fall out can lead to drop in rooms by stressed players ii) Auto Ancillaries – They can grow faster than Autos on recovery in domestic and exports.

We have not aggressively added new ideas due to uncertainty about how the businesses shape up in the next few quarters. Very few companies have a clear trajectory and visibility over the next 2 years.

We are looking for more opportunities in exports like Chemicals, Pharma, Textile exports, or Light Engineering with more opportunities opening up for Indian companies as the client wants to diversify away from China. Even if the recent returns look high, they have a long runway from increasing market share globally. We will cautiously pick stocks that show actual data proving our hypothesis rather than buying any stock as a theme.

Risks

Indian Economy

GDP data saw the biggest decline versus other countries due to more stringent lockdown as India’s large population made it necessary to contain the virus quickly. Unfortunately, the cases are still on the rise as more people returned to work and started traveling.

Many sectors are coming out of hibernation of Lockdown from low 10-20% utilization to around 60-70% utilization in August’20. Popular high frequency data like car registration, toll roads, diesel usage, and electricity generation show month on month improvement but still lower than pre-COVID levels.

We are tracking i) GST collections per month (starting August) ii) Auto Sales (Retail recovered to Feb level but pent up demand not exciting) iii) Cement offtake (Still low). Other indicators may or may not indicate actual recovery as they might be too concentrated on one segment or they might be lagging indicators.

While every sector operates in the same economy, the effects of Covid-19 would affect them differently. The experts are using the term ‘K’ shaped recovery for the same. On the right side upward curve shows few sectors benefitting immensely while lower curve showing other sectors falling further.

Examples include (beneficiary vs loser) OTT versus cinemas, private transport versus public, organised versus unorganised, telecom versus electricity, consumer foods versus consumer discretionary, fast food chain versus hawkers, edtech versus schools.

Beyond a point forecasting, macroeconomics is tough. We remain optimistic that the pandemic will affect only near term economic parameters but it won’t dampen demographics of the country nor can it stop the long term momentum in GDP growth and rising consumerism.

Is the right time to buy small caps/Funds?

Short answer, no. As an aggregate, small caps are more vulnerable than large caps till the time economy recovers. We believe that small caps as a group will be risky and can surprise negatively if liquidity gets sucked out. However, one can selectively buy stocks that have growth coming through. There are many small caps in IT, Pharma, Chemicals, and others that have healthy growth and also trade cheaper than many large cap stocks. We have included them in Booster plans.

What shall be the plan of action for future cash deployment, add or wait for a correction?

There two possible outcomes for the market. We believe that the market at the index level doesn’t have legs to keep rising from current levels. Either there will be a similar correction like early 2020 or there could be a rangebound market correcting 15% every 6 months such that overall next 2 years level of Nifty levels are the same. It has happened in the past the market recovered after correction but stayed flat over 2-3 years on index levels (Check periods between 94-99 and 2010-14) while there was activity in individual companies.

The best action is to focus on individual companies with good prospects and keep buying them on every small correction.

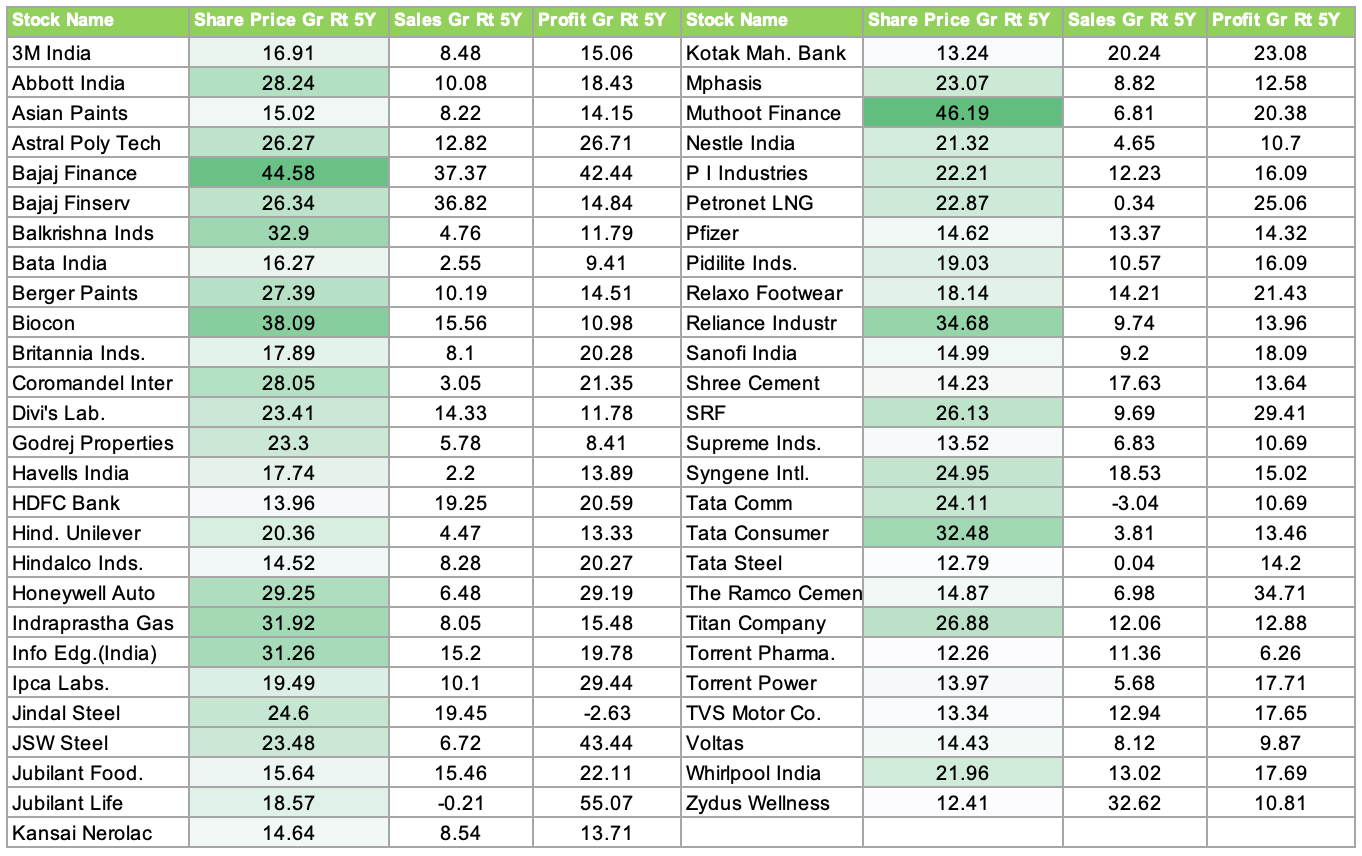

If we buy good quality companies with good growth, we will make a good return irrespective of the market. The above table shows that companies that reported good sales and profit growth CAGR over the last 5 years have earned more than 12-20% CAGR versus Nifty’s 7% CAGR. This gives us confidence that the market does reward individual companies even if the average market is lackluster over the next 12-18 months

In every market cycle, the type of stocks that perform well keep changing. Consumer stocks and financials had a good run in the last decade, this may change in the future where pharma and engineering sectors can perform well as they have got a tailwind from global manufacturing looking for new avenues for sourcing.

For the mutual funds portion, one can go with SIP with a diversified process of investing. Quality and growth funds can lose in performance to value and growth at a reasonable price because of valuation differential and because growth is happening in the non-traditional sector (Chemicals & IT was never looked at as growth sector). We have seen this happening already if you observe last year’s gainers. Most fund managers chose to miss a few sectors as those sectors do not feature in the index.

Stocks have rallied, what if they correct after we buy them?

Going forward, it may appear that stocks have become expensive in comparison to March lows, so do not get anchored to March Lows. Many stocks are still cheap and trade at 12-15x FY22 P/E ratio.

We are managing only long term money and predicting near term events is futile. We do not find any merit in second-guessing what’s going to happen in the next 6 months-1 year. If the shortlisted stocks are good companies, with good growth prospects, they will bounce back as soon as the selling stops. This clearly shows picking the right stocks must be easier than predicting the market.

How to manage asset allocation: If you are afraid about the economy, people losing jobs, your own finances, commit lower than usual in equity. Say instead of Rs. 100 in equity in normal times, commit only 60 or 70 or even 50 is fine. But after doing this, do not wait for bottom prices or get scared of volatility because there is always a risk of missing out 13-15% CAGR returns right on our platter. Keep buying with this amount and wait for your comfort to add more. This is better than regretting missing out on the entire amount.

We continue to recommend Gold Fund/Gold (up to 5-10% of the portfolio) as a hedge from contagion risks and allocation to safe liquid funds/Fixed Deposits (10-20%) within in equity portfolio for capturing new opportunities.

How to allocation funds: Restrict your allocation to 3-5-7% in each stock and diversify across 20-25 names. And not more than 25% in each mutual fund. This will keep you at peace, and not significantly dent your portfolio performance.

Avoid any type of regret while investing. Regret can come either way, either missing stock or not adding enough to a winning stock. Rather focus on overall strategy as explained above.

Beyond this, tinkering asset allocation will only reduce long term returns thereby missing one’s target corpus. We have diversified our stocks portfolio, we have diversified assets and we have a long term horizon. Together this takes care of all potential risks in investing.

MoneyWorks4me Outlook:

If you liked what you read and would like to put it into practice Create Free Account at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463