For an investor, looking for a constant source of income, there is no greater satisfaction than the arrival of dividend cheques which paint a pretty profit. Getting to that level though begins with knowing exactly where to put your hard-earned money. One needs to understand the workings and weaknesses of a company, as well as its financials. For most, this word inspires a certain mind-numbing confusion, but breaking it down to basics, makes it easier to skip the brain drain.

One of the ABC’s in the financial analysis of a company is the understanding of dividends.It helps clear the air about companies’ policies and payouts and guides investors into making better investment decisions.

So what’s a Dividend?

When a company earns profits, it can either reinvest this money into further enhancing the business or it can distribute it among its shareholders. This portion of the profits distributed to shareholders is called dividend. Many stable and established companies pay dividends to their shareholders. Whereas, high growth companies usually invest the profits back into their company to sustain the high growth rate! Some of the regular dividend paying companies in India are , TCS, ITC, Hero MotoCorp, HUL etc.

Before dividends can be paid out though, there’s an entire process to go through, starting with the Board of Directors of a company.

- Declaration date is when the Board publicly states its intention to pay a dividend, along with an announcement of the dates for record and payment. As of this day, the company now owes money to the stockholders.

- Date of record is the date when the company reviews who its shareholders exactly are so as to decide which holders are entitled to receive dividends.

- Ex-Dividend Date is when the shareholders are entitled to be paid. It is usually set up two days prior to the record date. If you were to buy shares after this date, you’d miss out on the cash which would instead wind up in the hands of the previous owner.

- Payment date spells the end of the wait. The day the money finally ends up in your pockets.

Dividend Types:

Either fluctuating or at a fixed amount, dividends come in a variety of forms, each with their own ups and downs.

Based on the payment mode:

- Cash Dividends: One of the most common forms of payment, a cash dividend is paid either by cheque or money transfer. The dividend amount is pre-declared and is usually non-taxable in the hands of the recipients, but those with preferred stock have to be paid before it’s doled out to the common stockholders. A great hard-cash-generator, this option is also a great tool for reinvestment. Such dividends are paid out on the face value of shares. Thus a 10% dividend on a Rs. 10 FV stock, will earn you a dividend of Rs. 1 per stock.

- Stock / BonusDividends: This is when a company pays not in the form of money, but rather in the distribution of additional shares. Similar to a stock split, it’s useful in upping the number of your shares at a lower price without diluting the initial value. The amount of shares to be paid is decided by the number of shares already owned. If you were to own a 100 shares, a 1:2 bonus issue would give you 50 more shares. Not a bad alternative for those who want to add to their portfolio.

Based on the time of payment:

- Regular Dividends: Dividend paid out annually to investors at the end of the year.It is also known as final dividend as it is paidout after the finalization of accounts, every year.

- Interim Dividends: Dividends paid out before the end of the financial year, usually semi-annually. These dividends usually accompany the company’s interim statements.

- Special Dividends: Once in a while, a company may pay a special one-time dividend. This can happen when there’s some cause for celebration – , huge one-time gains, or achievement of certain milestones, etc.

Now that you know about dividends and their types, let’s have a look at a few other important dividend related questions:

A Question of Taxes

In India, you aren’t required to pay any tax on dividends. That responsibility lies in the hands of the companies issuing them. They need to pay a Corporate Dividend Tax along with the usual levied income tax.

What is Dividend Yield?

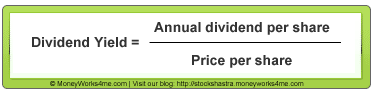

The dividend yield tells you how much a company pays out in proportion to its share price. On a more personal note, it tells you how much you’re making from each rupee you’ve invested, but most importantly it tells you how to differentiate between companies issuing the same dividend.

It’s calculated by dividing the dividend by the latest price per share.

What is the Dividend Payout Ratio?

This is the percentage of profits that a company pays out to its shareholders. It is calculated as below:

Mature companies usually have a higher payout ratio, where there is little room for growth and paying dividends is the best way to utilize profits. However, in itself, this ratio tells you very little and should be analysed in context with the company’s past trend, its peers and the industry.

Dividend Debate:

When a company pays out high dividends, it gives the impression that it’s probably geared for lower than average growth. Though it gives the illusion of strength and confidence, it’s best to not to get over excited. You need to be able to tickoff the other criteria as well. Make sure the company boasts of a history of growth and profits. If not you may find yourself in a losing situation, with the business.

Then there are those companies which either pay low or have a no dividend policy. This doesn’t necessarily mean that they’re a bad investment. Those that have chosen this route may have done it with the strategy to reinvest into the growth of their business. A company that has a higher sum to pay towards dividends has far less to fund its growth potential.

At the end of the day high dividend stocks may seem tempting, but you have to take stock of the bigger picture. Has the company made profits steadily over a ten year period? Has it managed to survive the downswings? Is it debt free and keen on expansion? If your answer is a ’Yes’ to all these questions, then the chances of it being a solid company to invest in are higher.

To read more on high dividend paying stocks Click Here.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463