MoneyWorks4me ‘Implied Investor Returns’ show that investor returns are lower than mutual fund returns over long time periods. One would ask how can investor returns be any different than a fund’s returns?

There are primarily two reasons; both investors’ behaviors. One, investors add more money when markets are high and pull it out when markets are low also known as ‘Buy High – Sell Low’ behavior. Second, investors are constantly hopping out of the underperforming fund and hopping into an outperforming fund, also known as ‘Chasing Performance’ behavior.

‘Buy High – Sell Low’ behavior is widely known and accepted. This happens primarily because investors get into equities when the going is good and the sentiments very positive and many because they don’t want to miss the bus. They have a shorter time horizon, usually triggered by a correction in the market thereby. That this behavior gives subpar returns is self-evident. Goal-Based Investing and Asset allocation provide a good remedy to correct this unproductive investor behavior and lead to better outcomes.

In this blog, we focus on the second counter-productive investor behavior.

The pitfall of Chasing Performance

In personal finance circles, it is a well-known fact that no fund can outperform market return ‘all the time’. Even if many funds do outperform in long term say 10 years, they will have several underperforming periods in between. For generating better than market returns, the fund has to construct a portfolio that is different than the market. Hence their performance will lag and lead the market from time to time.

Funds that are underperforming the market are often despised. Since the laggard fund’s return might be lagging the top performer by a large margin, many investors conclude that there is no comeback possible for this fund and hence exit and buy the recent top performer.

However, what investors miss out on is that many funds follow a process method or rationale of selecting the stocks in the portfolio. They choose to underperform in some market situations hopefully for a short duration and make big gains otherwise. By not understanding underlying stocks and processes, investors misunderstand a fund’s underperformance as a fund manager’s losing his edge. This mistake becomes obvious once the market situation starts favoring the very style of investing that one exited. And in contrast, the chosen top-performing fund corrects because it is holding many stocks whose prices have runway above fair prices.

A star fund manager, Warren Buffett has also lagged behind market returns in 33% of years and yet he has one of the most stellar track-record on returns. Had investors hopped in and out of his stock, they would have missed a fantastic compounding story.

Joel Greenblatt in his book mentions one of the top-performing funds in the US that earned a stellar 18% CAGR from 2000 to 2010 when index return was 0% CAGR. But an average investor in that fund earned -11%, yes minus 11% CAGR. This is because they hopped out when the fund underperformed and hopped in after its outperformance.

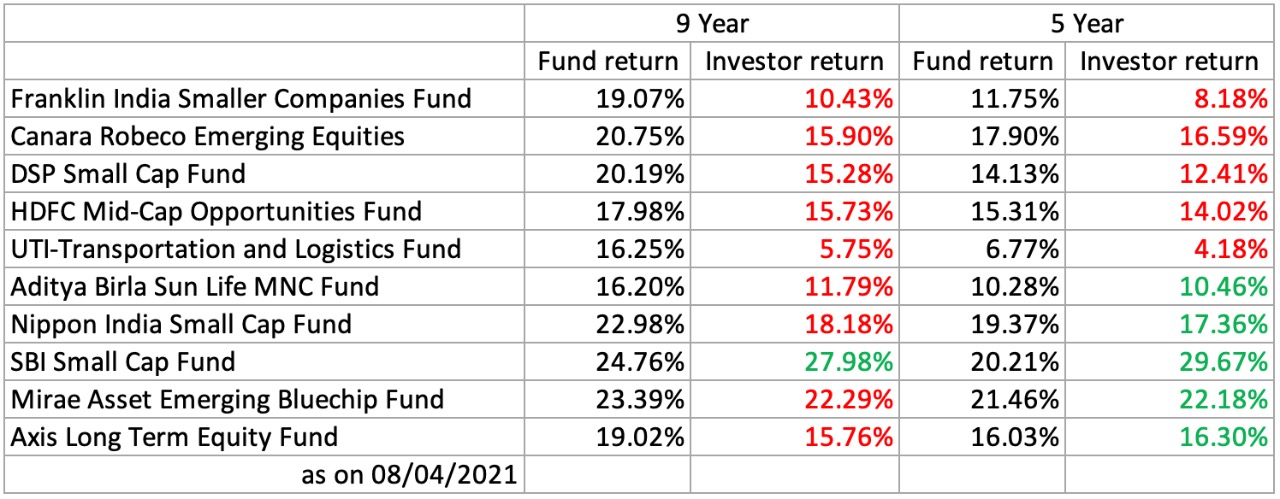

We have shortlisted some of the best performing funds in India to see how investors in those funds fared. (Updated on 8th April 2021)

As you can see in the above table investor’s returns are significantly lesser than the fund’s return. This was because investors poured more money after the fund’s performance and pulled out money after its poor performance.

How should you invest in Mutual funds?

We recommend investing in a fund by understanding the fund’s process and under which market and economic conditions is it likely to outperform and underperform. This understanding helps in staying invested during the underperformance and able to earn returns equivalent to the fund’s returns. Most advisors and investors do not try to understand the underlying process but act based on past performance and evaluate the fund’s performance over the shorter time frame for future performance.

At MoneyWorks4me, we suggest investing in 4-6 funds with complementing processes such that at least one or two funds in the portfolio will be performing at any given point. This will reduce the urge to switch funds frequently and capture the fund’s returns & outperformance over 10 years.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Register FREE | SmartSIP | Themes | Subscribe

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp: 8055769463