After reading the headline, you are probably wondering ‘Why is stock investing, so much like owning a Fruit Orchard? Let’s find out.

Investor can be of 3 types:

- Fisherman:A fisherman goes everyday to catch fish and depends on luck and chance to get it. A Day-trader works this way.

- Vegetable Farmer: A vegetable famer puts in a lot of efforts to get vegetables grow, for a month or two. An Investor with short-term perspective of 30/60/90 day horizon works like this.

- Fruit Orchard Owner: A Fruit Orchard Owner takes pains to decide which fruit to plant. Then s/he prepares the soil accordingly and takes all the trouble required to plant the tree the right way and at the right time. After planting the tree, s/he waits patiently for the tree to bear fruit. S/he relies on the health of the tree to grow and bear fruit. He knows that once the tree bears fruit, it will continue to do so for a long time, and hence, he can reap the benefits for many years to come. In one season the tree may not bear fruit, but as long as the health of the tree is good, he is confident that it will bear fruit in the next season.

Why 'Fruit Orchard Owner' types better than the other two?

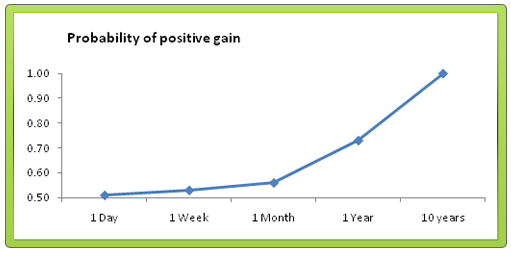

Fishermen depend on luck, and the Vegetable Farmer depends on tending to the investment continuously to bear some result. Both have short-term perspectives and require continuous engagement. But here’s the catch – It has been proved that the probability of earning returns in the short-term is more like tossing a coin with 50-50 chance of getting the positive result. This is more like a computer picking up a stock for you. Whereas, like a Fruit Orchard Owner, before investing, an Investor needs to take all the efforts to find and check if the company has the ability to grow in future and be a winner. Your return on the investment will depend on the growth & strength of the company in the long-term. Just as the case a non-productive season, you need not worry about the short-term ups and downs of the company, as long as you are confident that it is fundamentally strong.

Take a look at this graph, the probability of a positive gain and return increases with the time-horizon. Around 50 %, from 1 day to 1 month, and 70% for a year. It reaches a point of certainty almost 100% for a period of 10 years—the risk over a long-term period is almost minimal. This is because, in the long-term usually, the market price correct themselves to a rational level based on the company’s capacity to grow and earn; unlike the short-term where your returns is based more on market behavior. Also, when you have a short-term perspective, pushing in and pulling out money increases your transaction costs and your tax on capital gains. These extra costs are immediately removed, once you invest with a long-term perspective. All this, ensures better returns with minimal risk over a long-term (10 year) horizon.

In spite of knowing this, why don’t people invest with a long-term perspective?

Do you know what’s the most nail-biting part of the a Football game—penalty shots, right? How many times a goalkeeper misses a shot hit in the center, because he dived to the right/left. A research shows that goalkeepers tend to dive to the left or the right as much as 94 out of 100 times. In reality, if they had stayed in the center, they would have saved more goals, as 60% of the goals are hit in the center! But would a goalkeeper look good standing still? Here is where most of us get trapped. The zest to earn fast money is almost ingrained in all of us; the desire of which leads to being in action all the time. Investors are always itching to take some action on their stock. If analysed it should be bought regardless of the price, and when bought you still might be glued its price movement. And, if the price drops and your stock is in loss, you tend to take further action on it. Why? Because people regret losses 2-2.5 times more than similar-sized gains. This desire to be in action all the time leads to buying and selling at the wrong times; leading to usually negative or meager returns. It’s a sign of a short-term perspective. Therefore, avoid checking your portfolio often and suppress the desire to be in action all the time. Keep a long-term perspective, as this will give you the best returns with minimal risk.

To conclude,

- In investing, be like a Fruit Orchid Owner - invest in right stocks & have a long-term perspective

- Avoid the desire to be in action

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: