It’s that time of the year when every salaried class individual starts looking for tax-saving alternatives. Mutual Fund ELSS scheme is one of these options and the best one available at that.

What is an Equity Linked Saving Scheme or ELSS?

ELSS or Equity Linked Savings Scheme is like any other equity mutual fund scheme, with a crucial difference in offering tax benefits. An ELSS gives you a tax deduction benefit of up to ?1.5 lakh under Section 80C.

Why is ELSS fund the best alternative?

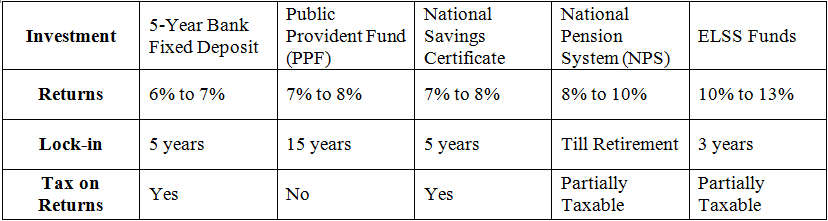

Simply put, it gives you the best chance to earn higher returns than any other tax-saving alternative, as it is the only pure equity investment vehicle that offers tax benefits. See the table below for a comparison with other tax-saving instruments.

What is the Lock-in Period?

It comes with a three-year lock-in period. While some call this a hindrance others tout it as an advantage, given that the other alternatives have a higher locked-in period.

We believe, neither is the case. Investing in an equity mutual fund is similar to investing in direct stocks. You need to invest in an ELSS scheme with a long-term horizon of 7-10 years, just like you would invest in stocks.

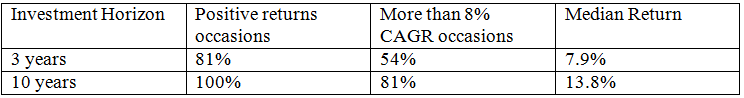

E.g. take one of the random funds SBI Long Term Equity fund with the longest history. Over a 24 year period, if you had invested in it for any 3 years, you would have seen positive returns for 78% of the time but over 8% CAGR returns only 55% of the time.

Median returns in those positive years would have been 9.6%. However, if you had remained invested over 10 year period, you would have earned positive returns always and besides more than 8% CAGR for almost 84% of the time. The median return over 10 year period would have been 12.3%.

SBI Tax Gain Regular Plan:

Sensex without Dividends:

Obviously, it is much safer and better to stay invested for 10 years or more to get the maximum benefit of ELSS. Short-term returns in equity investment are always more volatile but long-term returns are to a large extent consistent and predictable.

How to shortlist the best ELSS fund?

Quality of the portfolio, consistency of returns, upside potential and Expense ratio are a few parameters you should look at while choosing an ELSS fund. It will help you shortlist the best ELSS funds.

Quality of the Portfolio

We have a method of fundamental analysis to ascertain the quality of stocks based on their ‘10-Year performance on key parameters’ (Green-Orange-Red).

If the Fund is holding a lot of Red stocks, it means it’s taking high risks. Over the long term, good quality (Green) stocks give the highest returns but occasionally a fund may buy risky (Red) stocks to generate high returns in the short term which may go against it.

A fund with a Green Quality of Portfolio rating is preferable over others.

Consistency of returns

Though past returns are no guarantee to future returns, a fund that has generated consistent returns in the past is more likely to keep doing so in the future, other things being the same.

By other things, we mean the fund manager or his investment process, things that will decide the funds’ returns.

Upside potential

Again just like you wouldn’t buy a stock if there is no further upside left, you should check for the upside potential before you buy an MF.

You can calculate the upside by looking at how much returns the current portfolio generates over the next 3-5 years.

Expense ratio

Most investors think that apart from the fees that they pay to distributors, mutual funds themselves have no fees. This is not true.

A fund expense ratio is the fees you end up paying the fund manager for his services and other operational costs.

Just like you would look for the lowest fees for any service, choose a fund with the lowest expense ratio

Read the article to know: Top 10 Multicap Mutual Funds 2021

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: