Mutual Funds today come in all shapes and sizes — equity, debt, hybrid, thematic, index-based, and even “solution-oriented.” But with so many options, investors often find themselves asking:

Which type of Mutual Fund is right for me?

To bring clarity and consistency, SEBI (Securities and Exchange Board of India) introduced a categorization and rationalization framework for Mutual Funds in October 2017. Let’s understand why it was done and how you can use this classification to make smarter investment choices.

Why Did SEBI Categorize Mutual Funds?

Before 2017, every Asset Management Company (AMC) could launch multiple funds with similar objectives — often confusing investors. For example, one AMC could have two “large-cap” funds with different strategies or benchmarks, making it hard to compare performance.

So, SEBI stepped in to bring discipline and transparency.

The goals of the new classification were:

- To help investors compare funds more easily.

- To ensure each fund follows a clearly defined investment mandate.

- To allow only one scheme per category for every AMC.

Simply put, this reform ensures fund managers stick to their lane — and investors know exactly what they’re buying.

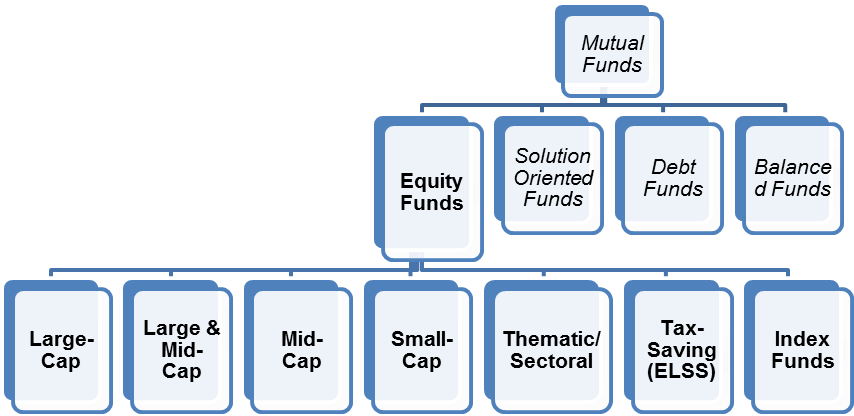

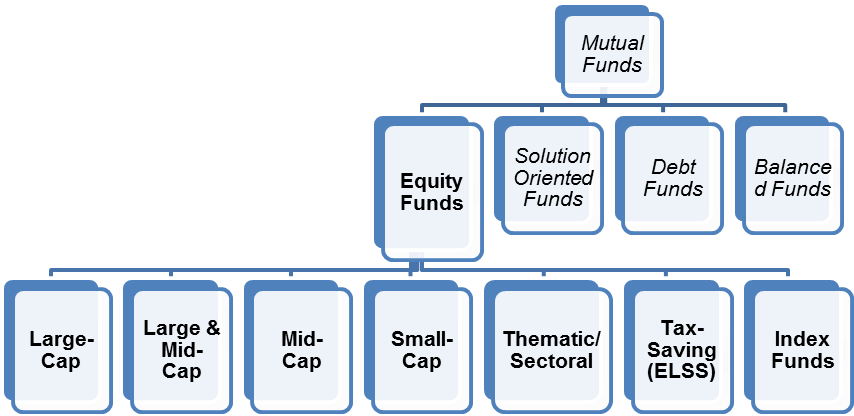

How Are Mutual Funds Categorized?

SEBI classifies Mutual Funds into four broad types:

- Equity Funds

- Debt Funds

- Hybrid or Balanced Funds

- Solution-Oriented Funds

Your ideal type depends on three things:

- Investment Horizon – How long you plan to stay invested.

- Risk Appetite – How much volatility you can handle.

- Investment Goal – What you’re investing for (wealth creation, steady income, retirement, etc.).

Here’s a quick comparison:

Type of Fund | Asset Composition | Investment Objective | Long-Term Return Expectation | Typical Time Horizon | Lock-in Period |

Equity Fund | Minimum 65% in equities | Long-term capital growth | 13–15% | 5 years+ | No (except ELSS) |

Debt Fund | Minimum 65% in debt instruments | Stable periodic returns | 6–9% | Few days to 5 years | No |

Hybrid/Balanced Fund | 20–80% equity; rest in debt | Steady returns + capital growth | 8–11% | 3–5 years | No |

Solution-Oriented Fund | Debt–equity mix like Balanced Funds | Goal-based wealth creation | 8–11% | 5 years+ | Yes (5 years) |

1. Equity Mutual Funds

These funds invest more than 70% of their money in stocks, aiming for capital appreciation over time.

They’re ideal for long-term investors — those with a 5+ year horizon who can handle short-term market volatility.

Here are the key types of Equity Funds in India:

a) Large-Cap Funds

Invest in the Top 100 companies by market capitalization.

- Minimum 80% of assets in large-cap stocks.

- Relatively stable compared to mid and small-cap funds.

b) Mid-Cap Funds

Invest in the next 150 companies (101–250) by market cap.

- Minimum 65% in mid-cap stocks.

- Potential for higher returns — but with higher volatility.

c) Large & Mid-Cap Funds

A blend of both.

- Minimum 35% in large-caps and 35% in mid-caps.

- Offers balance between stability and growth potential.

d) Small-Cap Funds

Invest in companies beyond the Top 250.

- Minimum 65% in small-cap stocks.

- High growth potential but very volatile in the short term.

e) Multi-Cap Funds

Diversified across large, mid, and small-cap stocks.

- Minimum 65% in equities overall.

- Balanced exposure across market segments.

f) Thematic or Sector Funds

Invest in a specific sector or theme, like Healthcare, IT, or ESG.

- Minimum 80% in that theme or sector.

- Best for experienced investors who understand sector cycles.

g) Index Funds / ETFs

Replicate an existing market index like Nifty 50 or Sensex.

- 95%+ invested in index constituents.

- Passive strategy, low cost, and suitable for beginners.

h) Tax-Saving or ELSS Funds

Equity Linked Savings Schemes (ELSS) offer tax deduction under Section 80C.

- Minimum 80% in equities.

- 3-year lock-in period (shortest among all tax-saving options).

- Ideal for long-term wealth creation and tax saving.

Who Should Invest in Equity Funds?

- Investors with a 5-year or longer horizon.

- Those comfortable with short-term volatility for higher long-term returns.

- Ideal for goals like retirement, child’s education, or wealth creation.

Pro tip: Avoid lump-sum investments when valuations are high; use SIPs and diversify across categories.

2. Solution-Oriented Funds

These funds are marketed as ready-made solutions for specific life goals — like retirement or your child’s education.

But here’s the truth: They don’t offer any special benefit over a regular equity or hybrid fund. In fact, they come with a 5-year lock-in period, reducing flexibility.

Still, they can be useful for investors who prefer goal-labeled investments.

a) Retirement Funds

- Designed for long-term wealth creation for retirement.

- 5-year lock-in or till retirement (whichever is earlier).

- Asset mix similar to balanced or hybrid funds.

b) Children’s Funds

- Aimed at building wealth for a child’s education or future goals.

- 5-year lock-in or until the child turns 18.

- Again, no special advantage over a well-chosen equity fund, except goal-labeling.

MoneyWorks4Me Insight:

You can achieve the same goals with a disciplined SIP in a diversified equity or hybrid fund — without being locked in unnecessarily.

The Bottom Line

Mutual Funds have become more structured and transparent after SEBI’s 2017 categorization.

But that doesn’t mean choosing the right one is easy. The right fund depends on your time horizon, goals, and comfort with risk.

- Choose Equity Funds for long-term wealth creation.

- Opt for Debt Funds for safety and steady returns.

- Use Hybrid Funds for balanced exposure.

- Approach Solution-Oriented Funds only if you’re comfortable with lock-ins.

At MoneyWorks4Me, we simplify this process — helping you identify which funds fit your financial goals, risk appetite, and time horizon through clear analysis and actionable insights.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: