In the earlier article, you read about the different types of Equity and Solution-Oriented MFs. In this one, we will discuss the different types of Debt and Balanced Mutual Funds.

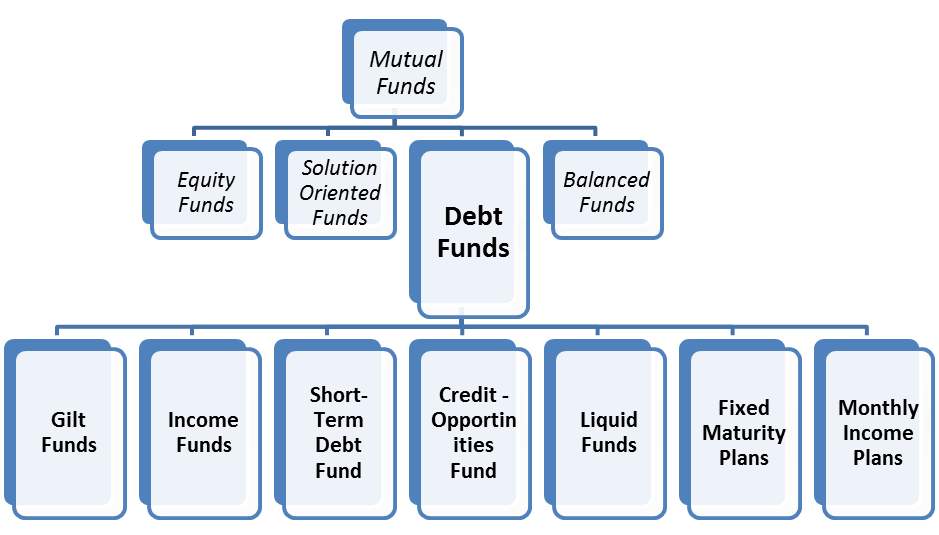

Debt Funds:

These Mutual Funds invest mainly in Debt instruments like Bonds i.e. where the returns are not dependent on any company performance. However, since they essentially provide loans to different entities, they do run the risk of defaults. Debt Funds differ based on whom they loan money to and for how long.

When investing in Debt Funds, you need to remember that;

- Data available to Advisors for research is usually inadequate. This may lead to improper analysis of Debt and Debt-related securities. Most Investment Advisors, therefore, are not able to give an opinion on Debt securities.

- Corporate Bonds in India tend to be illiquid, as they aren't traded in the secondary market very regularly, and hence, add liquidity risk to the portfolio. Moreover, they tend to have a lower credit rating, adding credit risk to a portfolio

Debt Funds include,

1. Gilt Funds:

These invest in Government Securities with different maturities. E.g. A long-term Gilt Fund holds Government Bonds from 15 to 30 years. Since the investment is in Government Bonds, these Funds carry almost zero default risk, but high-interest rate risk.

In fact, the longer the maturity, the higher the interest rate sensitivity. A Gilt Fund Manager actively manages a portfolio based on his/her outlook on the interest rate. The returns can also be volatile, and therefore, these are suitable for investors with Moderate Risk Profile.

The minimum investment in Government Securities is 80% of total assets (across maturity).

2. Income Funds:

These invest in Government Securities and Corporate Bonds & Debentures, across varying maturities. An Income Fund Manager employs a mixed strategy of buying and selling bonds based on interest rate outlook and holding the Bonds to maturity.

As a result, Income Funds can earn good returns in different interest rate scenarios. These Funds too are sensitive to interest rate movements, albeit less than Gilt Funds, and are suitable for investors with Moderate to High-Risk Profile.

3. Liquid Funds:

These Funds’ aim is to provide easy liquidity. Therefore, they invest in highly liquid money-market instruments (Treasury Bills, Certificate of Deposits, Commercial Paper, and Term Deposits) with maturities of 91 days or less.

These funds are less volatile and provide higher returns than a savings bank account. They provide a good option for investors to park their surplus idle cash in a low-risk instrument and also get higher returns than a bank account.

4. Short-term Debt Funds:

Invest in money-market instruments, with 2-3 years’ maturities. The Fund Manager usually holds Bonds to maturity for accrual income. Suitable for investors with Conservative Risk Profile, looking for a stable income.

5. Credit-opportunities Funds:

Invest in Corporate Bonds & Debentures of 2-3 years’ maturities. However, the credit rating of these instruments is lower than that in Short-term Debt Funds. These allow investors to earn slightly higher returns. As the Bonds are still held to maturity, interest rate risk is very low. Suitable for investors with a Moderate Risk Profile.

6. Monthly Income Plans (MIP):

MIPs invest majority (75-80%) of their portfolio in Fixed Income Securities and the remaining (20-25%) in Equities. The Debt investments provide a MIP Fund with stable returns, and the Equity portion allows it to get higher returns than regular Debt Funds. However, this also makes MIPs riskier than regular Debt Funds.

7. Fixed Maturity Plans (FMPs):

Close-ended schemes with a fixed tenure (similar to a bank FD, where investor’s money will be locked in for a period). The FMP Fund Manager invests in Fixed Income Securities with maturities matching his/her scheme tenure.

This also reduces re-investment risk. As a result, the returns of these schemes are stable (and higher than bank FDs), making them suitable for investors with the Conservative Risk profile and looking for a tax advantage.

Who should invest in Debt Funds?

People who have shorter investment horizons and/or lower risk appetite may choose to invest in Debt Mutual Funds. Ideally, every investor should have a certain allocation towards fixed-income instruments as a part of asset- allocation.

Within Debt MF, investors looking to park money for short-term, less than 1-3 years, may invest in Liquid Funds or Ultra-Short-Term Funds. These are also useful for temporarily parking money when you don’t have the opportunity to invest in equity markets.

Investors with longer investment horizon, more than 3 years, may choose to invest in Corporate Debt opportunities, Dynamic Bond Funds or Government Securities Funds which earn higher returns than Liquid Funds.

Debt Funds help in a meeting near term goals like Down-payment for purchasing a house, school fees, retirement in the next 3-5 years, etc.

Longer-term Debt Funds tend to be volatile too, so one shouldn’t be under impression that they don’t carry any risk. Moreover, Corporate Bond Funds also carry credit risk that leads to volatility in the Fund’s NAV.

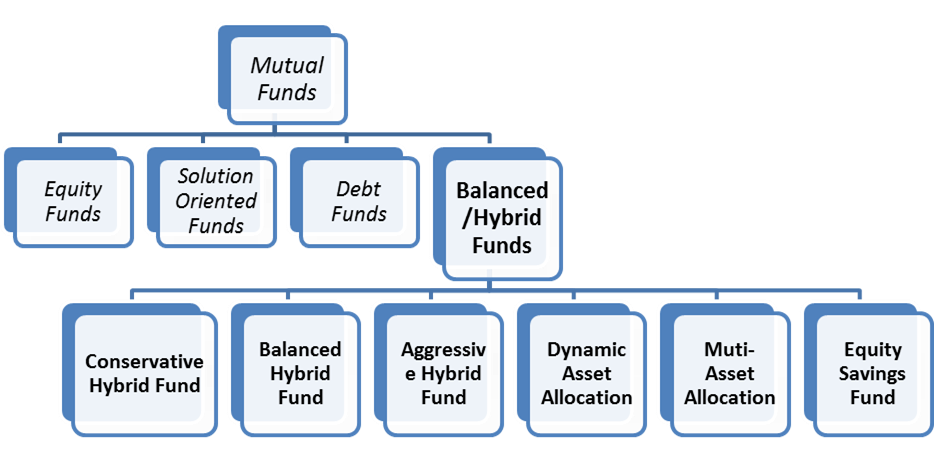

Balanced Funds:

Balanced Mutual Fund/Hybrid Funds invest in a mix of Equity and Debt, roughly ~60% in Stocks and 40% in Bonds. They are likely to be less volatile than pure Equity Schemes as the Debt portion offers a cushion in times of volatility.

Amongst Balanced Funds, Hybrid Funds can also be called Asset Allocation Funds which rebalance the Fund to a pre-fixed Equity-Debt mix. Dynamic Funds increase or reduce equity exposure based on market valuations.

The dilemma of investing in Balanced Funds is that there are no specific regulations as to what the Fund is required to invest in e.g. in Equity how much, in what market cap.

So, while the volatility is reduced due to the Debt portion, it is not obvious what risks have been taken on the Equity side. In contrast, when you invest in a pure Equity Fund you chose the category of stocks the Fund invests in.

Balancing of the portfolio can be done by the investor at his end by consulting a Fiduciary Investment Advisor. One can simply buy a Short-term Debt Fund and an Equity Fund with lesser cost, and still, achieve a ‘balanced’ portfolio.

1. Conservative Hybrid Fund:

It is an open-ended hybrid scheme investing predominantly in Debt instruments. Investment in Equity & Equity-related instruments is between 10% and 25% of total assets; Investment in Debt instruments is between 75% and 90% of total assets.

2. Balanced Hybrid Fund:

It is an open-ended balanced scheme investing in Equity and Debt instruments. Equity & Equity-related instruments are between 40% and 60% of total assets; Debt instruments are between 40% and 60% of total assets. No Arbitrage is permitted in this scheme.

3. Aggressive Hybrid Fund:

It is an open-ended hybrid scheme investing predominantly in Equity & Equity-related instruments, between 65% and 80% of total assets. Debt instruments are between 20% 35% of total assets.

4. Dynamic Asset Allocation/Balanced Advantage:

It is an open-ended Dynamic Asset Allocation Fund. Investment in Equity/Debt that is managed dynamically, and changes depending on market conditions.

5. Multi-Asset Allocation:

It is an open-ended scheme investing in any three asset classes. Invests in at least three asset classes with a minimum allocation of at least 10% each in all three asset classes.

6. Equity Savings Fund:

It is an open-ended scheme investing in Equity, Arbitrage, and Debt. The minimum investment in Equity & Equity-related instruments is 65% of total assets and minimum investment in Debt is 10% of total assets.

Who should invest in Balanced Funds?

Investors with long investment horizon and Moderate Risk Appetite can consider these Funds. Investors new to Equity may start with Balanced/Hybrid Funds until they learn to handle volatility.

Balanced/Hybrid Funds can be used for long-term goals just like Equity MFs. But, they may have lower volatility and likewise, will earn lower returns than pure Equity MFs.

We believe investors having an investment horizon of more than 5 years can consider investing in Balanced/Hybrid MF. Aggressive investors also may consider Dynamic Asset Allocation Funds, especially when market valuations are high.

To conclude, investing in a particular type of Mutual Fund doesn’t change based on the recent performance of that Fund. It all depends on your personal financial planning.

Read the article to know:‘Familiarise yourself with different terminologies used in MF industry’

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: