Multicap funds invest in stocks across Large, Mid & Small market cap. This flexibility to switch between sectors and stocks belonging to any market capitalization allows the fund manager to take advantage of a larger pool from which to build and manage the portfolio and deliver returns.

This article covers the following:

What Are Multicap Funds?

Multicap funds invest in stocks across Large, Mid & Small market cap. This flexibility to switch between sectors and stocks belonging to any market capitalization allows the fund manager to take advantage of a larger pool from which to build and manage the portfolio and deliver returns.

[bctt tweet=”The minimum investment in Equity & Equity-related instruments for Multicap funds is 65% of total assets.” username=”MoneyWorks4ME”]Who should invest in Multicap Funds?

Multicap funds are a good way to take exposure to a broader market and are suitable for investors with moderate risk appetite.

Investors who want to take benefit of the growth potential of mid and small cap stocks without exposing themselves to high risk should invest in Multi-cap funds rather than mid & small cap funds.

The Multicap Fund Manager has the mandate to change the mix of large/mid/small cap in the fund’s portfolio depending on his assessment of the risk-reward opportunities.

The mid/small cap fund manager has less room to reduce risk and hence these funds are usually more volatile. Keep in mind, like any other equity product you need to be invested in a Multicap fund for the long term (5-7 years).

How to choose the Best Multicap Mutual Funds?

1. Quality of portfolio

An important parameter in shortlisting a fund for investment in assessing the underlying stocks in the portfolio of the fund.

This helps us understand how much risk we are taking for that extra return in our portfolio. Avoid funds with large exposure to small and risky quality companies.

2. Performance Consistency

Though the fund may be a top performer today, it is not necessary that it will be able to repeat this performance in the future.

However, if it has a track record of consistently beating the benchmark year after year, it would give us more confidence in the fund managers’ ability to do so in the future too.

Avoid funds with poor return consistency.

3. Past 5-year rolling return

Across the industry, advisors analyze funds return for the last 3 years, 5 years and 10 years. However, the starting and endpoint of all these periods make a big difference to what these returns are.

This is inadequate as past poor performance may get hidden in recent good performance and vice versa. The past performances of schemes which have been reshuffled significantly to adhere to SEBI’s reclassification are even more irrelevant.

You should instead look at individual fund’s returns performance versus its benchmark on a rolling basis of a reasonable time-frame say 3 or 5 years, rather than every year performance or point to point past performance.

4. Turnover ratio

Choose a fund with the low turnover ratio which helps us avoid brokerage and impact costs. An investor should be even more wary of these costs as they’re hidden (not disclosed by the AMC), but definitely eat up into your returns.

How do you find the best Multicap funds based on the above analysis?

At MoneyWorks4me, we provide data on all the above 4 parameters and is available free; (link is given below). This will assist your investment decision and help you avoid costly mistakes. Before you go there, here are some important tips on how to use it.

Sort the list on the basis of the 5-year rolling returns in the descending order so that the fund with the highest return is on the top.

Whilst you can see the full list on our site, given below are the Top 10 Multicap funds based on these criteria. Now you can see how each of these funds measures the other parameters to shortlist the few that you need to go into details before making a decision.

- Portfolio Quality: Funds with a higher percentage of risky quality companies will be indicated as RED, while those holding good quality companies will show Green colour code.

- Similarly, funds with a poor return consistency are colour coded RED, while those with good return consistency are coded Green. As mentioned above you should prefer a lower turnover fund between two funds that have been close to the other parameters.

- A good thumb rule is to avoid Red i.e. a riskier portfolio and/or a less consistent performer in favour of others with similar or even slightly lower rolling returns.

Top 10 Multicap funds based on 5-year rolling returns

Updated On: Nov 05, 2019

| Scheme Name | Q | P | 3 Year Rolling Return (%) | 5 Year Rolling Return (%) |

| Invesco India Multicap Fund |

|

|

20.12 | 21.28 |

| IDFC Multi Cap Fund |

|

|

18.06 | 18.88 |

| Kotak Standard Multicap Fund |

|

|

16.29 | 17.76 |

| Nippon India Multi Cap Fund |

|

|

16.09 | 16.67 |

| Motilal Oswal Multicap 35 Fund |

|

|

16.92 | 16.09 |

| Franklin India Equity Fund |

|

|

14.38 | 15.75 |

| HDFC Equity Fund |

|

|

14.78 | 15.70 |

| Parag Parikh Long Term Equity Fund |

|

|

15.07 | 15.66 |

| BNP Paribas Multi Cap Fund |

|

|

15.27 | 14.67 |

| Aditya Birla Sun Life Equity Fund |

|

|

13.94 | 14.67 |

Q – Quality; P – Performance (*for the complete & updated list click here)

Some other important points to take into account when choosing Mutual funds for investment include: Now the last thing you want to do is jump and invest based on the above.

What you can do is have a meaningful discussion with your advisor using the above.

- Your risk appetite – Always check if the investment product is meant for you, both financially and emotionally.

- Your asset allocation – Do no ignore asset allocation and invest in a popular fund. There is enough research to show that proper asset allocation is an important factor for portfolio returns.

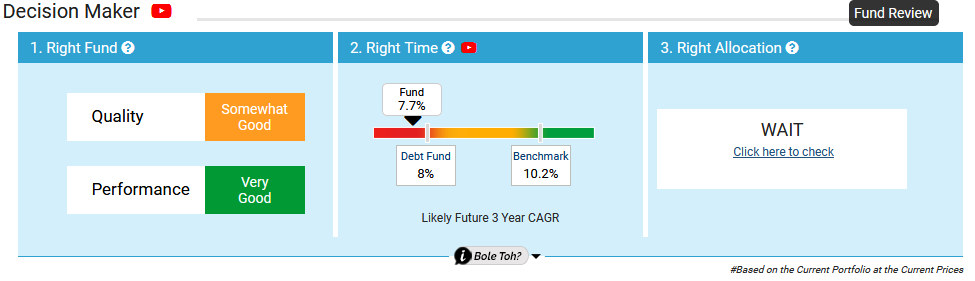

- Sufficient diversification – Invest across 4-5 mutual fund schemes such that their strategies and portfolio not only complement each other but also your direct stock portfolio. This is important to cap the downside risk on our portfolio, as one strategy does not work all the time in the market. MoneyWorks4me Members can see this by uploading their portfolio on our site and using the link in the Right allocation Box of the Moneyworks4me Decision Maker.

- When investing lumpsum you need an answer to one very important question – Can you expect a good enough return by investing in the fund right now? Ultimately, an equity fund is a collection of stocks and if most of them are currently over-priced (and probably show high past returns today); you are likely to get a low return going forward. MoneyWorks4me Members can check if this return is likely to be better than the FD/Debt Fund in the Right Time box of the Moneyworks4me Decision Maker.

Read the next article to know: Top 10 Large Cap Mutual Funds 2019

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463