Tax planning is a crucial component of financial planning, aiding in the reduction of tax liabilities and facilitating savings for future objectives. Among the numerous tax-saving options, two widely utilized ones are the Equity Linked Savings Scheme (ELSS) and the Public Provident Fund (PPF), both offering tax benefits under Section 80C of the Income Tax Act, of 1961. Despite this commonality, these two instruments differ in various aspects. In this blog, we will compare ELSS and PPF and help you decide which one is better for you.

What is ELSS?

ELSS refers to Equity Linked Savings Scheme, a mutual fund category primarily investing in equity and equity-related securities. ELSS funds come with a mandatory lock-in period of three years, prohibiting early withdrawals. These funds present the potential for higher returns due to their linkage to stock market performance. However, the associated risk is higher given the market’s volatility and unpredictability.

What is PPF?

PPF, or Public Provident Fund, is a government-backed savings scheme providing assured returns and tax advantages. The maturity period for PPF is 15 years, extendable for an additional five years. Deposits ranging from a minimum of Rs. 500 to a maximum of Rs. 1.5 lakh per financial year can be made in a PPF account. The government sets the interest rate quarterly, with the current rate standing at 7.1% for the October-December 2023 quarter. PPF investments fall under the Exempt-Exempt-Exempt (EEE) category, meaning investments up to 1.5 lakhs (during a financial year) is exempted along with the accumulated amount and interest at the time of withdrawal.

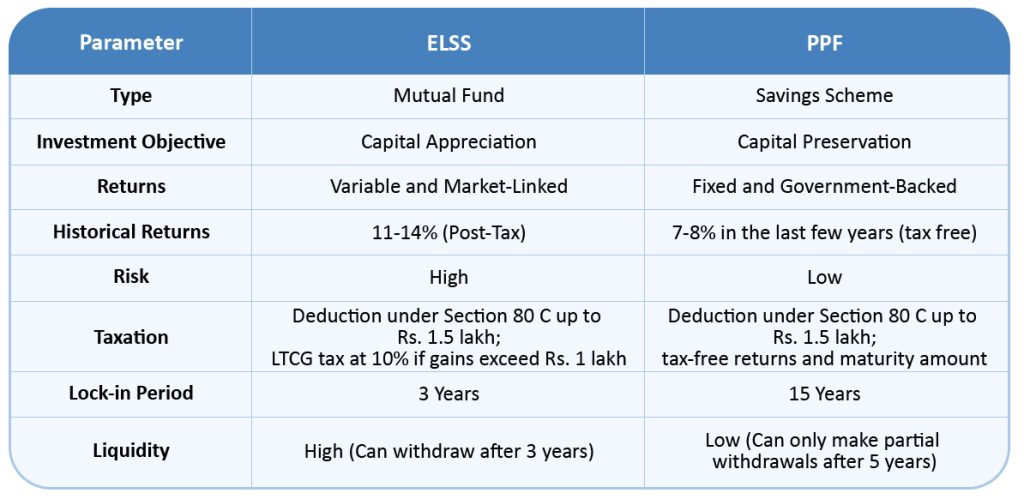

Let us now compare ELSS and PPF on various parameters and see how they differ from each other.

Returns

ELSS funds have the potential to yield higher returns compared to PPF, primarily due to their investment in equity markets. Historically, ELSS funds have demonstrated post-tax returns ranging between 11-14% (moderate) over 3-year and 5-year periods. However, it’s important to note that ELSS returns are not guaranteed and are contingent on market conditions and the fund manager’s performance. On the other hand, PPF provides fixed and assured returns backed by the government. The interest rate on PPF, although subject to quarterly revisions, has generally been in the 7-8% range in recent years.

Risk

ELSS funds carry inherent market risk because of their investment in equity and equity-related securities. The value of investments can vary based on market fluctuations and the performance of the underlying companies. ELSS funds are better suited for investors with a high-risk tolerance and a long-term investment horizon. In contrast, PPF is a low-risk investment choice, offering guaranteed returns and capital protection. The interest rate on PPF, determined by the government, remains stable despite market fluctuations. PPF is an appropriate option for investors with a lower risk appetite aiming to save for long-term goals like retirement.

Taxation

ELSS and PPF both offer tax benefits under Section 80C of the Income Tax Act, 1961. You can claim a deduction of up to Rs. 1.5 lakh in a financial year for the amount invested in either of them. However, the taxation of the returns and the maturity amount differs for ELSS and PPF. ELSS returns are taxable as long-term capital gains (LTCG) at 10% if the gains exceed Rs. 1 lakh in a financial year. PPF returns and the maturity amount are tax-free in the hands of the investor.

Lock-in Period

ELSS funds have the shortest lock-in period of three years among all tax-saving instruments falling under Section 80C. This implies that you have the flexibility to withdraw your investment after three years from the date of investment. Nevertheless, even after the completion of the lock-in period, you have the option to continue your investment in ELSS funds if desired. In contrast, PPF imposes a long lock-in period of 15 years, extendable for an additional five years. Complete withdrawal before the maturity period is not allowed. However, partial withdrawals are permissible after the fifth year from the end of the year in which the account was opened.

Liquidity

ELSS funds provide greater liquidity compared to PPF due to their shorter lock-in duration. Redemption of ELSS units is possible after three years, and funds can be received within a few days. Additionally, investors have the flexibility to switch from one ELSS fund to another if dissatisfied with their fund’s performance. PPF, on the other hand, offers lower liquidity due to its extended lock-in period. Complete withdrawal before maturity is restricted, and partial withdrawals are only permitted after five years, subject to specific conditions and limits.

ELSS vs PPF: A Comparison

Which is better: ELSS or PPF?

The optimal choice between ELSS and PPF depends on individual factors such as risk tolerance, investment objective, time horizon, and tax considerations. ELSS may be suitable for high-risk investors seeking potentially higher returns with a shorter lock-in period and greater liquidity. On the other hand, PPF could be more suitable for low-risk investors looking for stable returns, capital security, and tax-free income.

It’s advisable to evaluate ELSS and PPF based on various criteria and align your choice with your specific financial circumstances. Some investors may even opt for a diversified approach by investing in both instruments to achieve a balanced portfolio. Ultimately, the decision should be tailored to your unique financial needs and preferences.

If you want to know the top ELSS funds to invest in 2024, you can check out our curated list. (Here)

Best Funds From:

Best ETF Funds Best Flexi Cap Funds Best Nifty Index Funds Best Large Cap Funds Best Tax Saver ELSS Funds Fund Screener Best Mutual Funds SIP Calculator

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory