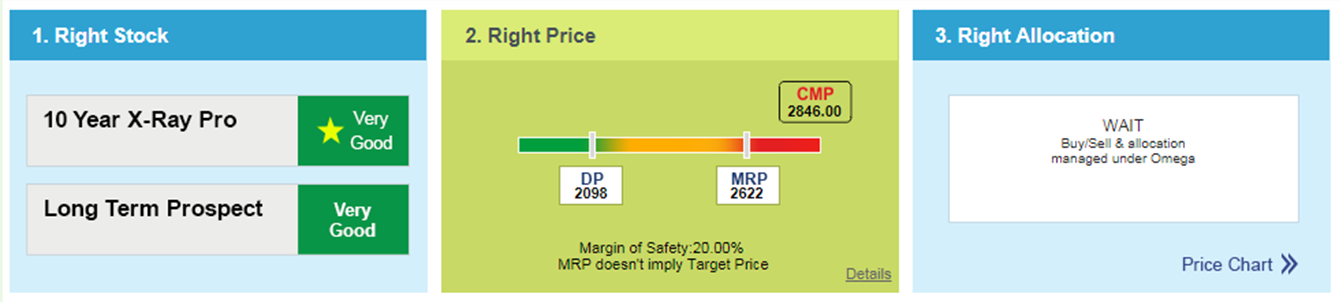

In Stock investing, the price is always known, and always changing, and there are plenty of buyers and sellers at a price. Shopping in such a market can be very daunting. The human mind solves the discomfort caused by pricing by resorting to a comparison. The common anchors used are the 52-week high and low, Price/Earning, Price/Book Value. But these are poor anchors and can lead to wrong decisions! (Read our blog posts on Myths.) The MRP (Maximum Retail Price) of a stock is the anchor we recommend that you use because it is a good estimate of its fair price.

But how can you use MRP as an anchor to make good decisions?

We use the idea of Margin of Safety (MOS). Whenever engineers build something, first they design it using all their knowledge, and then they apply a factor of safety; that is, they over-specify the design. So, if a bridge has to withstand a maximum load of 100 tons, they design it for 125 tons to take care of any eventuality they haven’t thought of. However, they always say the bridge is designed for a maximum of 100 tons! The Value Investing Guru Benjamin Graham introduced the same concept of Margin of Safety in investing (The Intelligent Investor, Chapter 20: “Margin of Safety”). In the above example, the MOS is 20% on 125 tons. This is similar to a sale on some items in a market; i.e. the seller is offering a discount on the MRP. So, if there is a discount of 20% on the MRP, you get the item at 80% of the MRP. MOS works the same way.

So, the price you would be willing to pay, the Discounted price = MRP – Margin of Safety%

Why do you need a Margin of Safety when investing in stocks?

Valuation of company stock is done by Equity Analysts trained in using different techniques based on pretty sound theory. However, Analysts are required to make some projections about the company’s performance in the future and/or some assumptions. However, no one can predict the future with certainty.

When you buy a stock at its MRP, what the valuation says is that you can get returns at the expected rate of return, e.g. 15% in the long term. But if things don’t pan out as expected, one may earn returns lower than the expected rate of return. But if you buy at its Discount Price with a MOS of, say 20%, then there is a good chance you will get 15% or maybe even slightly more.

In short, MOS is like a helmet while riding a bike. When your son or daughter starts riding a two-wheeler, don’t you always insist that they wear a helmet? You do, right? Else you worry about them all the time they are out.

But what should be the Margin of Safety for stocks?

Benjamin Graham’s answer was 50%!

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price – Warren Buffett

So, you should be willing to buy company stocks that you consider wonderful at a Fair price or MRP without insisting on a MOS. Hence, the MOS can range from 0% to 50%.

That’s understandable. Some companies have a more predictable business and perform within a narrow band, and thus the margin of error when valuing them is low. These are companies that operate in categories that are large, have strong market shares that they can retain or grow, have pricing power, and have a low/no-debt, non-cyclical business. The performance of other companies can fluctuate a lot more.

We, at MoneyWorks4me, prefer to buy companies at fair prices, if they have a superior past track record, the longevity of growth, and competitive edge to grow profitability. The Margin of Safety in such companies comes from strong execution and visibility of growth. At times, when markets have run up and nothing is available at a Discounted Price, we prefer such companies and invest a portion of our portfolio in them. These companies are likely to keep compounding over the long term and generate good shareholder value, even if not bought at Discounted Prices.

So, does the market give opportunities to buy a stock at a very low price?

Yes, it does! In reality, there are many occasions when the market tends to over-react and undervalues a fundamentally strong company, perhaps because it is facing tough times right now, or due to some negative rumors, or it may be just out of favor, etc. But in the long term, its stock price will appreciate rationally based on its earning capacity. So, when investing, always keep a long-term perspective in mind, and make sure you take advantage of such opportunities.

You can get MRP & DP for Top 200 stocks with our Superstars Plan; click to know more. Also, see the Demo of how Superstars helps you to get three things right for your Stock Investment: Right Stock, Right Price and Right Allocation!

Best Stocks From:

Top 10 Stocks for 2024 Best EV Stocks in India Screener Alpha Cases Best Solar Energy Stocks in India Top AI Stocks in India Best Drone Stocks in India Best Sugar Stocks in India Top 10 Infrastructure Stocks in India Best Fintech Stocks in India Top Media Stocks in India Top Fertilizer Stocks in India

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory

astrazeneca pharma wich type of stock

this time if we buy @720rs. astrazeneca share, can suggest astrozeneca pharma stock beneficial yes or not. in next upcoming week………