When we talk about a company’s performance, the first thing that comes to mind is profit. After all, no one wants to own or invest in a business that consistently loses money.

But while profits matter, cash flow matters more. Because a company can report accounting profits and still be struggling to pay its employees, suppliers, or lenders. Ultimately, it’s cash—not paper profits—that keeps a business alive.

A company with strong, consistent cash flow can fund new investments, grab growth opportunities, and survive tough cycles better than one that doesn’t. That’s why analysts often call the cash flow statement the most “honest” financial statement—harder to manipulate than the income statement.

But is it really that immune to manipulation?

Let’s find out.

Understanding the Cash Flow Statement

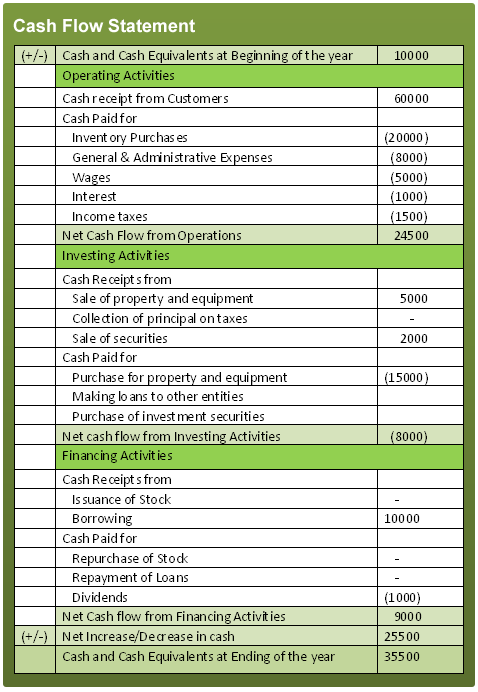

Unlike the income statement or balance sheet, the cash flow statement tells you where the money actually went—the inflows and outflows during a specific period.

- The income statement shows profits earned on paper.

- The balance sheet gives a snapshot of what the company owns and owes.

- The cash flow statement connects the two—it’s the company’s financial reality check.

It tells you whether the revenue reported has actually been received in cash.

A company’s cash flow statement is divided into three key parts:

1. Cash Flow from Operating Activities (CFFO)

This section shows cash generated or used from the company’s core business—selling products, paying salaries, buying raw materials, and paying taxes.

A healthy company should ideally generate most of its cash from operations.

2. Cash Flow from Investing Activities

This covers the buying or selling of assets like plants, equipment, property, or financial investments. Cash spent here usually means the company is investing in future growth.

3. Cash Flow from Financing Activities

This shows how the company raises or repays money—through debt, equity, or dividends.

Why Cash Flow from Operations (CFFO) Matters Most

Cash flow from operations is often the go-to metric for analysts because it reveals how much cash the business is truly generating from its core activities.

Ideally, a company’s operating cash flow should be positive and growing over time. But when management is under pressure to meet market expectations, even this “honest” number can be massaged.

Let’s look at how companies manipulate cash flows—and what red flags you should watch for.

How Companies Inflate Cash Inflows

1. Recording Financing Cash as Operating Cash

This is one of the oldest tricks in the book.

Imagine Jack Corporation, which manufactures precious metals. Jack, the CEO, needs to show strong operating cash flow. He “sells” inventory to Bank XYZ—but with an agreement to buy it back later.

In reality, that’s a loan, not a sale. But Jack records it as cash inflow from operations, making the company look like it’s generating more cash than it actually is.

Red Flag: A sudden spike in operating cash without a matching increase in sales or margins could indicate misclassification.

2. Selling Accounts Receivable (Securitization)

Jack Corporation also has huge pending payments from customers. To show quick cash, it sells those receivables to a finance company for a discounted price.

The cash inflow appears now—but it’s borrowed from the future. This artificially boosts the current period’s CFFO, but leaves less cash for the next one.

Red Flags:

Sudden jumps in cash flow with no clear reason

Shrinking receivables alongside flat or falling revenue

Limited disclosure about receivables sold or securitized

How Companies Deflate Operating Cash Outflows

Manipulating inflows is one side of the game; reducing outflows is the other.

Here’s how that happens:

1. Capitalizing Operating Costs

Companies sometimes treat regular expenses as investments to shift them out of the operating section.

For instance, WorldCom infamously classified billions in everyday line costs as capital expenditures. This inflated operating cash flow, because what should’ve been an expense under operations appeared as an “asset purchase” under investing.

Red Flags:

Sharp rise in fixed assets or “capital work in progress”

Falling operating costs despite rising sales

New or vague asset categories appearing on the balance sheet

2. Misclassifying Inventory Purchases

Some companies report inventory purchases as “investing” outflows instead of operating ones.

That move reduces reported operating expenses and boosts CFFO.

But it’s misleading—buying inventory is part of running the business, not investing for the future.

Red Flags:

Large or unexplained increases in capital expenditure

Inventory growing faster than sales

Inconsistencies between COGS trends and operating cash flow

The Bottom Line

Yes, the cash flow statement is harder to manipulate than profit numbers—but it’s not impossible.

Companies can temporarily inflate cash inflows, delay outflows, or shuffle entries between sections to make things look better than they are.

As investors, you don’t need to be forensic accountants. But you do need to be alert.

Here’s a quick checklist:

- Focus on operating cash flow — it should be the biggest contributor.

- Compare cash flow trends with earnings growth.

- Be wary of sudden improvements in CFFO without revenue growth.

- Read notes to financial statements carefully — manipulation often hides in the footnotes.

At MoneyWorks4Me, we believe that strong businesses don’t just earn profits; they generate sustainable cash flows. Because, in the end, cash—not accounting entries—keeps a company alive.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: