Buyback details:

Buyback date – 1st Feb, 2012 to 19th Jan, 2013

Buyback quantity – upto 12 Cr. shares

Buyback price – max. Rs. 870

Buyback amount – max Rs. 10,440 Cr.

MoneyWorks4me verdict – Good opportunity to sell/participate in the buyback

So, tell me more about Reliance Industries Ltd?

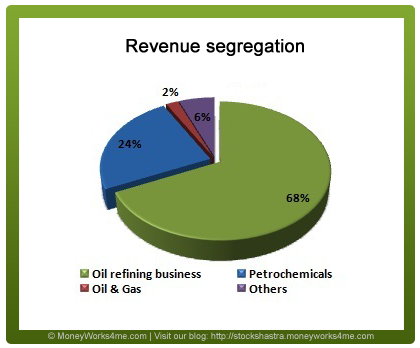

Reliance Industries Ltd (RIL), a Mukesh Ambani Group company, started with textiles and is today one of India’s largest diversified conglomerate. Currently, majority of its revenue comes from its Oil refining business. It has the largest refining capacity at any single location in India. Other significant divisions in terms of revenue generation include Petrochemicals and Oil & Gas. In term of market capitalization, it is India’s largest company.

Reliance Industries Ltd (RIL), a Mukesh Ambani Group company, started with textiles and is today one of India’s largest diversified conglomerate. Currently, majority of its revenue comes from its Oil refining business. It has the largest refining capacity at any single location in India. Other significant divisions in terms of revenue generation include Petrochemicals and Oil & Gas. In term of market capitalization, it is India’s largest company.

The company has built up a war chest for acquisitions, and the cash on books is estimated to be close to Rs. 84,000 Cr. The company has plans to enter into the growing telecom segment with the launch of 4G network service in the latter half of 2012. It has also announced its intention to help Network 18 to acquire some regional channels and ensure some stake for itself in its media business.

On 20th January 2012, RIL announced a buy back issue while also reporting its December quarter quarterly results.

First, let’s see what are share buybacks?

A company earns profits from running its business which it re-invests to grow its business. If the company does not have sufficient opportunities to invest the money profitably, it is expected to return the profits earned to its shareholders. There are two ways by which a company can do this, either through dividends or through buybacks. While dividend is taxable at the company’s end, the advantage of share buybacks is that it does not attract any such taxes. So, companies usually buyback shares as a way to distribute profits to its shareholders.

So, what is RIL’s buyback offer?

As per the announcement made by the company, the board has approved the buyback of upto 12 Cr. fully paid up equity shares of Rs.10/- each, at a price not exceeding Rs. 870 per equity share, payable in cash. This amounts to an aggregate amount not exceeding Rs.10,440 crore from the open market through Stock Exchange(s). The maximum buy back price represents a nearly 10% premium over the closing price of Rs 792 on 20th Jan 2012. The duration of the buyback will be from 1st Feb 2012 to 19th Jan 2013.

An important point to remember – This is a market buyback which means that the company will go and buy the shares from the stock exchange, and there is no way for a shareholder to offer their shares to the company individually.

This is not the first time the company has come up with such a buyback offer. Earlier too, the company had come up with such a buyback offer in 2004.

Let’s see what happened then…

Previous offer in 2004: The size of the issue then was expected to be Rs. 2999 Cr., however the company bought stocks worth only Rs. 150 Cr. (only 5% of buyback offer). This time however we expect the company to buy back more than it bought back in 2004 in percentage basis. The reason why we expect the buyback to be higher is due to the fact that the company has not been able to identify new investment opportunities for quite some time and holding such huge amount of cash on its balance sheet has negative impact on the stock performance of the company. Also, SEBI now insists that the company should buy atleast 25% worth of the stocks planned to be bought back. This works out to a minimum buyback amount of Rs. 2610 Cr.

So, what could be the possible/probable reasons for the buyback?

Piled up cash on books: RIL holds huge amount of cash on its balance sheet. The total amount of cash with the company as per the latest quarterly result is Rs. 35,501 cr. In addition to this the company holds investments worth Rs. 48,288 cr. Adding up both we get Rs. 83,789 cr.

Investors have not been happy with the company sitting on such a huge amount of cash on its books for so long and have hence penalised the stock leading to lower valuations for the stock. The stock (down about 13%) has underperformed the benchmark index (sensex down about 7.5%) since last year.

Attempt to shore up sentiment following disappointing quarterly results:

Reliance Industries declared its Q3FY12 results on 20th Jan. On a Y-o-Y standalone basis, the net sales realization has increased by 42.39% whereas the PAT has decreased by 13.55%. On Q-o-Q basis the net sales has increased by 8.36% however the PAT has decreased by a substantial 22.15%.

The main reason for the decline in the profits have been the declining margins for the company in both the major segments of its operations. GRM (Gross refining margin) which is an indicator of the performance of its refining business has been lower than Singapore index for the first time. Same has been true for the petrochemical margins. The company has maintained high inventory levels and in absence of demand it has been difficult for the company to liquidate the inventory piled up since last quarter.

Refinery operated at 111% capacity with throughput for the current quarter being 17.2 MMTPA. RIL has planned maintenance shutdown for 3 weeks in Feb’12. This will reduce the throughput of the company further in next quarter.

Average output from K6-D6 was 41 mmscmd in the current quarter. Also due to unfavourable gas prices in US the company plans to spend less on shale gas reserves in US in coming financial year. The company is also reworking on its domestic E&P plan along with BP subject to government approvals. The company has said that it will provide detailed plan by Dec’12.

Thus, the buyback could also be an attempt to shore up the negative sentiment surrounding the stock and prevent the price from falling further.

Our conclusion on the buy back:

We believe that the current buyback offer is proposed in order to ensure that the stock price does not fall further from current levels given the underperformance of the stock and the lack lustre results in the current quarter. And this has actually worked in favour for the company. From a low of Rs. 678 earlier in Jan, the stock price has now crossed 800 levels. Whether the company completes the entire buy back quota remains to be seen; in most likelihood it won’t.

The max price of Rs. 870 for the buyback will ensure that the stock price remains within the narrow range around Rs. 870. However, investors need to understand that the results have been extremely poor and also much lower than analysts’ estimates. The bad news of poor results and declining margins does overweigh the good news of buy back.

We advise our customers to take this as an opportunity and consider selling in the open market as long as the stock price is in close range to Rs. 870.

You are giving a wrong advice to investors. You are forgetting that after buyback, the book value of the share will proportionately increase & therefore the market price will also increase. RIL is a vibrant company & therefore very soon they will find some investment opportunities, may be in some other field.

Need your suggestion.

I want to sell my Reliance Industries stock. Is it better to sell it now? Or wait for some more time to minimize my loses? If I have to wait then how long? 3 months? 6 months? so that I can get good price and minimize my loses?

want to sell reliance shares in the buybackoffer at Rs. 870. How to go about it? pl adv.My mail id is drbrajesh01@gmail.com

The company has opted for an open market buy back which means that the company will buy the shares through open market operations. You must have observed that since the company has announced this buy back, the stock price has gone up. You can sell the shares directly in the open market at any price near Rs. 870/- . (Remember Rs. 870/- has been provided as the higher limit for the buy back. So you can sell your shares at any price less than, but in close vicinity of Rs. 870/-)