Grasim Industries Ltd.- Will it clock high growth rates in the long-term?

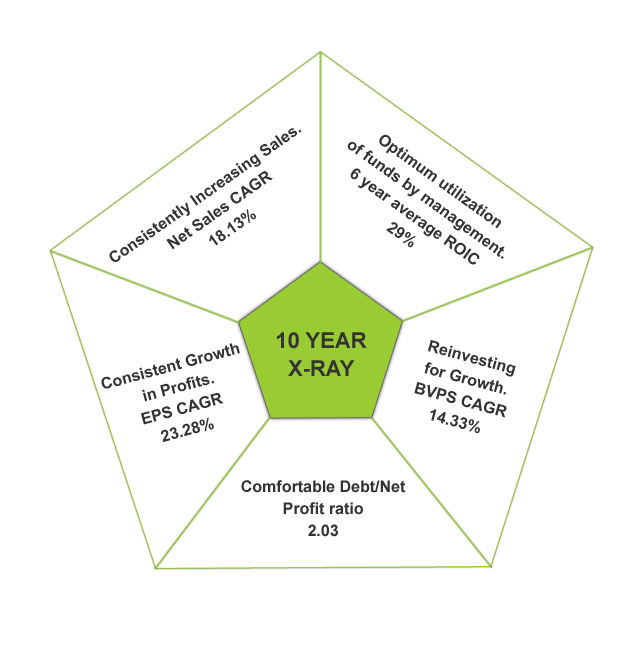

Grasim’s 10 Year X-RAY: Green (Very Good)*

*The 10 YEAR X-RAY of Grasim is on a consolidated basis, as it derives a major portion of its revenue from cement subsidiary

Grasim Industries Ltd., in brief

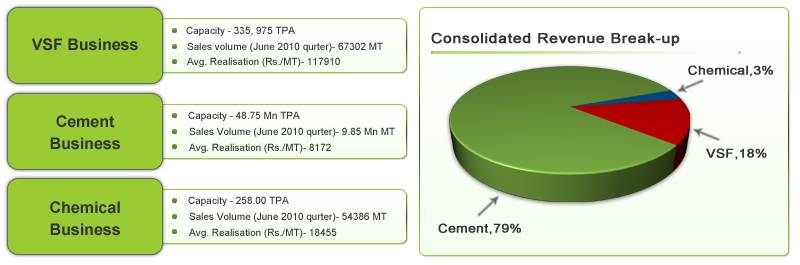

Grasim Industries Ltd, the flagship company of the Aditya Birla Group, is engaged in manufacturing of viscose staple fibre (VSF), cement, chemicals and textiles. It is the world’s largest producer of Viscose Staple Fibre (VSF), a easily blendable fibre used in apparels, home textiles, dress material, knitted wear and non-woven applications. After the merger of UltraTech Cement and Samrudhi Cements Ltd (SCL), UltraTech (major subsidiary of Grasim) becomes the largest domestic cement player with a total capacity of 49 MTPA (millions tone per annum). It is the market leader in White Cement with a total capacity of 0.5 MTPA. It is also the second largest producer of Caustic soda (which is used in the production of VSF) in India. Grasim derives its revenues from three revenue segments- VSF (18%), Cements (79%), Chemicals (3%). The company was incorporated in 1947. The operations of the company are as shown below:

What does Grasim’s past say? *

Grasim Industries Ltd has shown phased performance, where during the first 3 years of the decade its performance was unsatisfactory. But from FY 2004 the growth has been very good. Net Sales increased from Rs.5498 Cr. in FY 2004 to Rs. 19956 Cr. in FY 2010, registering a CAGR of 18.13%.

The company has improved its operating margins over the years from an average of 22% (FY02-06) to 31% right now. This is mainly due to the captive resources for its raw materials. This efficiency had helped it clocked an impressive EPS CAGR of 23.28%. The BVPS has also grown by over 20% between FY 2004 and FY 2009. In the last 6 years the average ROIC is 29% which indicates that the management has utilized the funds efficiently. The Debt to Net Profit ratio of 2.03 indicates a comfortable debt position.

Hence, considering all these factors, the 10 YEAR X-RAY of Grasim Industries Ltd. is Green (Very Good).

*We have calculated the figures on a consolidated basis for 2 reasons

a) During the FY 2010 a major restructuring of the cement segment has taken place. The cement business was demerged into Samrudhi Cements Ltd as a subsidiary of the company from 1st Oct. 2009. Hence, FY10 cannot be compared with the past

b) The company has now merged 2 of its subsidiaries i.e. Samruddhi Cement and UltraTech cement; the revenue of which will only show in the consolidated performance

To view its past 10 year performance on a standalone basis, in a simple color-coded 10 YEAR X-RAY, visit MoneyWorks4me.com

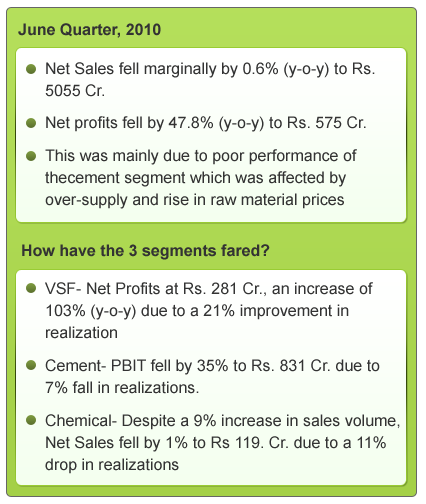

What is Grasim’s Short-term Outlook?

Cement segment dampens consolidated performance in June’10 quarter:

The cement segments sales and profit fell in the June quarter mainly due to 2 reasons:

- Oversupply in the cement segment greatly affected UltraTech Cement’s sales & profitability.

- Increase in cost of domestic & imported coal and the expiry of sales tax exemption in West Bengal.

Due to the capacity expansions by almost all cement companies, this situation of oversupply is likely to continue in the coming 2-3 quarters. This may affect the realizations and hence profits of the cement segment in the short-term.

What is in-store for FY 2011?

1) Acquisition of ETA Star Cements by UltraTech Ltd.:

This acquisition planned in FY 11 has a total capacity of 3 mn tone adding to the existing total capacity of 49 MTPA of its cement segment. Earlier UltraTech exported 1-2 MTPA cement to countries like Dubai, Bangladesh etc, now it will cater to these markets through the production facilities of Star Cements. Hence, the position of the company would be strengthened in these areas.

2) VSF likely to be affected in coming quarters for 2 reasons:

a) Suspension of production at Nagda likely to hamper the volumes of VSF segment:The production of the Nagda unit, which is Grasim’s largest VSF unit was temporarily suspended due to water shortage from 31st May, 2010 to 26th July, 2010. During that period it operated at 20% capacity and has now resumed their operations to full capacity. In the coming quarter, the loss of production in the Nagda facility is likely to have a negative impact on the volume growth of the VSF segment.

b) Realization in the VSF segment likely to be effected by the oversupply condition:The rising inventory level on an industry basis can be expected to lead to a situation of oversupply in the coming quarters. The overall industry demand has also been hampered by the ongoing Euro zone crisis. Considering these factors the realization in the VSF segment is likely to be hampered which may bring down the profit margins of the segment.

With the company’s cement segment expected to be affected by oversupply and its VSF segment facing the above concerns, we can expect the short-term outlook of the company to be Red (Not Good)

What is Grasim’s Long-term Outlook?

Grasim Industries has an impressive past, registering a good growth in its financials. Its short-term is facing certain concerns and is expected to be shaky for the next few quarters. At the back of this, is Grasim headed for a high growth in future?

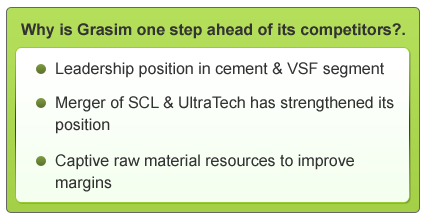

1) Grasim Industries Ltd is one of the leading global players in Cement & VSF:

Grasim’s cement segment’s operations are carried out by UltraTech which is one of the most well established brands in the cement sector and with the merger of Samruddhi cements, it has a pan India presence. Also, its brand Birla White is the largest White Cement producer in India. It is also the world’s largest producer in (VSF) with a total global share of 24%.

The leadership position of Grasim in the Cement & VSF segment will help to grow its revenue in the future.

2) UltraTech Cement (subsidiary of Grasim) becomes the largest cement player after the merger:

The merger of Samrudhi Cements and UltraTech cement makes it the largest cement player with a total capacity of 49 MTPA and approx. 20% market share in India. The 22 cement plants spread across India with its 504 MW of captive thermal capacity will function under one entity-i.e. UltraTech Cements. ACC with its total capacity of 28 MTPA comes at a distant second place. This unified and single cement entity makes it the 10th largest cement producer in the world. This would provide UltraTech (subsidiary of Grasim Ind. Ltd.) with a pan India presence under one entity enabling it to take better advantage of the growing Indian economy. For modernization, up gradation etc it will be spending Rs. 4475 Cr. It is also spending Rs 5600 Cr. for expanding its cement business in Chhatisgrah & Karnatka which will lead to an addition of 10 MTPA to the existing capacity. This increased cost is a cause for concern as the company is spending big amounts on up gradation etc where the return on investment is likely to be low.

With this merger, Grasim is expected to strengthen its position in the cement industry.

3) Efficient Working Capital Management:

The company has an efficient working capital management, a clear indication of good management of funds as the company does not have cash locked up in its current assets. Its working capital days is only 11 days, with the working capital of UltraTech being 6 days only.

4) Captive Raw Material Resources will improve margins:

a) 80% of power requirement met by its own captive thermal plants

b) Captive production of pulp (raw material for VSF) protects it against the rising pulp price.

c) It is also one of the largest producers of rayon grade caustic soda (raw material for VSF)

These captive raw material resources have helped Grasim maintain impressive margins in past and will continue to do so in future, too.

5) New VSF plant to be commissioned by 2013 in Vilayat, Gujarat:

The company is in the process of setting up a new VSF plant at a Vilayat, Gujarat with a capacity of 80000 MT with a total capital expenditure of Rs 1000 cr. The plant is likely to start its production process by 2013. This would further consolidate the position of the company in the VSF segment in which it is the global leader.

6) Growing Indian economy will be the key growth driver:

The growth process of cement segment of Grasim is closely linked with the development in the Indian economy. With the development of the economy the purchasing power of the people in general also rises. According to reports by UN, urbanization in India is expected to increase from 28.7% in 2005 to 37.2% in 2025. In the 11th Planning commission, housing requirement of 74 million units and infrastructure investment of over Rs. 20,00,000 Cr. in sectors like power, railways, roads, irrigation, textile etc has been planned. Thus the growing infrastructure expenditure and rising demand for housing units will be the key growth drivers for the cement segment of the company.

7) Cause for Concern:

Grasim is one of the biggest players worldwide in VSF and Cement segment but is also exposed to various forms of risk and concern which might hamper the Sales and profitability of the company.

- The rise in raw material prices of cotton, pulp, diesel and coal etc can lead to rise in raw material cost thus adversely hampering the profit margins

- The VSF segment can be adversely affected by the volatile demand condition in the export market

- The company is planning to spend a huge amount of Rs.4475 Cr. on up gradation on modernization of cement plants; the return on which may be on the lower side

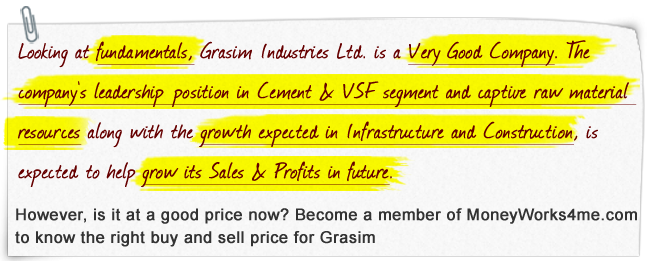

The concerns like oversupply of cement faced by the company in the short-term are not expected to hamper its long-term growth. Looking at the company’s leadership position in cement & VSF, its competitive advantage of captive raw material resource and the growth expected in the infrastructure & construction, we can expect the long term outlook of the company to be Green ( Very Good)

Conclusion:

Grasim has a leadership position in the VSF & Cement segment which was further strengthened by the merger of SCL & UltraTech Cements. With its captive plants providing steady & economical supply of raw materials for the company and the good growth expected in Infrastructure & Construction, the company is poised for good growth in future.

Yes, Grasim Industries Ltd. is an investment-worthy company, but is it at a good price to buy? Or is the market overvaluing it? To find out what investment decision you must take on Grasim right now, become a member of www.MoneyWorks4me.com to find its right value.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

1 comment