Hindustan Zinc Ltd. – What makes it a class apart?

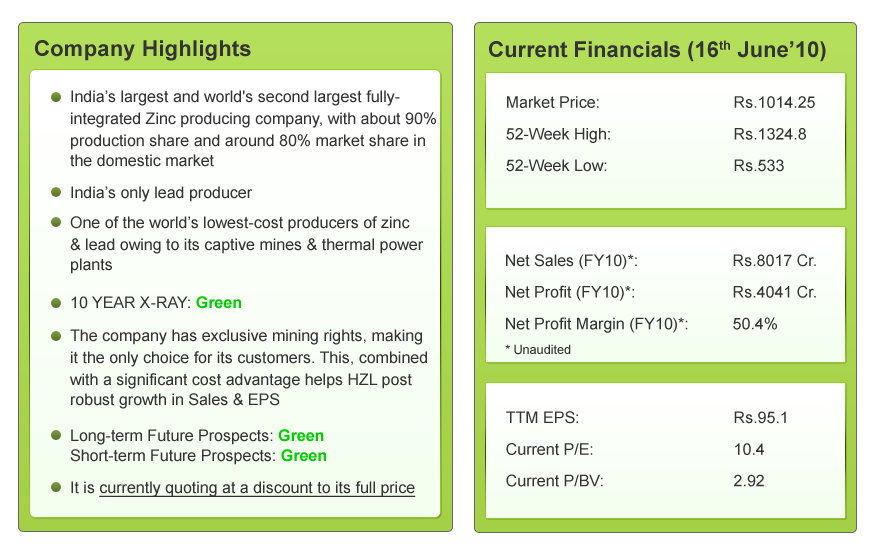

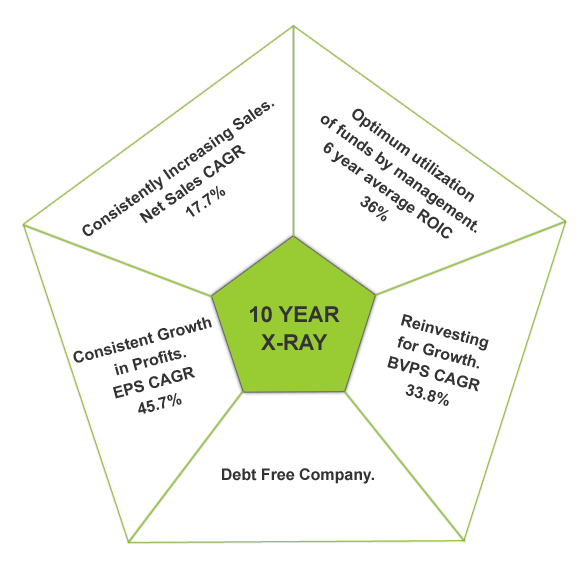

Hindustan Zinc’s 10 YEAR X-RAY*: Green (Very Good)

(* 10 YEAR X-RAY shows the financial performance of a company in the last 10 years.)

Hindustan Zinc Ltd, in brief

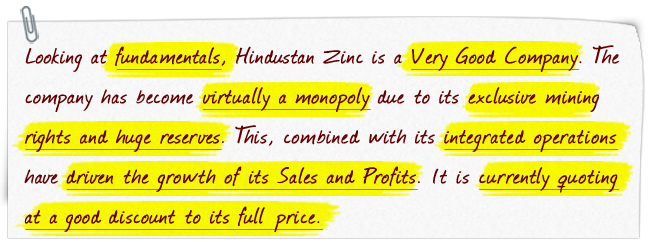

Hindustan Zinc Ltd. (HZL) is India’s largest zinc-producing company, with about 90% production share and around 80% market share in the domestic market. It has one of the largest mining assets in the world. The company is engaged in mining and refining ore to produce non-ferrous metals – zinc, lead and silver with a total installed capacity of 14,62,000 TPA. Its operations are fully-integrated from mining to production of metals. HZL’s captive mines of zinc and lead ore are located in Rajasthan, with total reserves of 298.6 MT – equivalent to 33 MT of refined zinc MIC (metal in concentrate). Its captive mines and thermal power plants give the company a significant cost advantage, making it one of the lowest-cost producers of zinc in the world. Sterlite Industries has a 65% stake in HZL, whereas the Government of India owns a 29% stake.

What does Hindustan Zinc’s past say?

HZL has performed robustly in all its parameters over the last 10 years. Its impressive fundamental past forms a strong base for its future. Due to the exclusive mining rights and continuously increasing capacity, its Net Sales have recorded an impressive growth of 17.7% (9 year CAGR). Being the only integrated player in the country, has given it a significant cost advantage reflected in high profit margins. As a result, its EPS has recorded more than 45% growth over 10 years (CAGR) whereas the 6 year average ROIC is 36%. HZL has the ability to charge high prices due to its exclusive mining rights and this has resulted in an excellent financial track record

Hence, the 10 YEAR X-RAY of HZL is Green (Very Good)

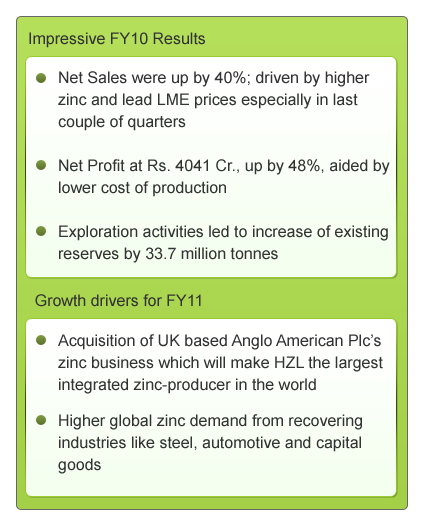

What is Hindustan Zinc’s Short-term Outlook?

- HZL has started production from a 2,10,000 TPA capacity smelter in Rajasthan, a quarter ahead of schedule. The construction activities at another 100,000 TPA lead smelter at Rajpura Dariba with its associated 160 MW captive power plant are also on schedule. These additional plants will contribute significantly to the revenue in coming quarters.

- In 2010, the global supply for zinc is expected to lag behind the global demand which is estimated to grow by more than 11% in 2010. Similarly, lead demand (8% growth) is expected to outstrip its supply. Zinc and lead prices are hence expected to remain firm going forward. However, factors like dollar movements, ongoing European crisis and demand from China will be crucial in determining prices.

HZL is well-poised to grow in the short-term, led by an uptick in global zinc demand due to the strong recovery in steel, construction, engineering & automotive industry.

Hence, we can expect the short-term outlook of HZL to be Green (‘Very Good’)–

What is Hindustan Zinc’s Long-term Outlook?

Exclusive mining rights give the company a monopolistic advantage:

Stock Shastra #7 highlighted the importance of being able to charge a toll. HZL is a very good example of how this unique advantage has helped the company become a class apart. Let’s see how

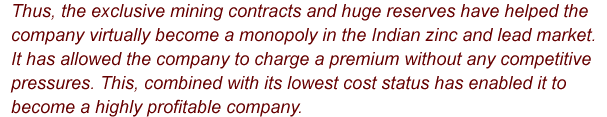

HZL has huge Zinc and Lead ore reserves with almost exclusive mining rights. Its total reserves (proved and probable) and resources (measured, indicated and inferred) as of March 31, 2010 stood at 298.6 MT. HZL has only one domestic competitor- Binani Industries (a non-integrated player) in the domestic market which has a capacity of just 38000 TPA as compared to HZL’s capacity of 14,62,000 TPA (includes Anglo American Plc’s capacity). Thus, Hindustan Zinc Ltd. has become the only domestic choice for its customers

Zinc and lead prices follow the London Metal Exchange (LME) price movements. Another option that its customers could consider is that of importing their concentrated ore requirements. However, importing becomes financially unviable due to the high import duties and freight charges over and above the LME prices. This enables HZL to infact enjoy a premium over LME prices which has been reflected in its consistently high profit margins

HZL also has the advantage of having its own mining and beneficiation facilities, making it amongst the world’s lowest cost zinc producer. Over the years, it has been consistently reducing its production costs and increasing profit margins. HZL’s cost of production is currently pegged at about $750, against a global average of $1,200 per tonne

HZL to become a world leader:

HZL is acquiring UK-based Anglo American Plc’s zinc business for $1.34 billion (Rs 6,011 crore) in an all-cash deal. Anglo American Zinc is one of the top five global zinc producers. The acquisition will boost HZL’s production of lead and zinc by 37% (by 3,98,000 TPA). HZL will thus become the largest integrated zinc-producer in the world with an 11% market share of the global zinc market

Focus on Silver production for the future:

HZL is focussiong aggresively on increasing its silver production. It expects to become Asia’s largest and world’s sixth largest silver-producing company by 2013 with a total production of 5,00,000 kg per annum. Currently the company produces 1,00,000 kg of silver. It has undertaken expansion of its Sindesar Khurd mines in Rajasthan to augment its capacity. Currently, around 77% of India’s annual silver demand is met through imports. At present, Hindustan Zinc’s market share in the domestic market is 2.5%. Post-augmentation of the capacity, it is likely to be Asia’s largest primary silver producer

Growing demand for zinc:

Demand for zinc in India is estimated to grow by 15%, compared with the global average of 5%, on account of rapid growth of infrastructure development and India emerging as a major sourcing hub for galvanised sheets. The steel industry consumes 70% of the zinc produced here. With the expected growth in automobiles and other major capital goods industries, the demand for the zinc will also rise. Also, the burgeoning demand from China and increased demand from other emerging economies like India, Brazil, the Middle East and South East Asia have resulted in a deficit. Thanks to the capacity expansion by HZL, it is expected to gain immensely from this supply demand mismatch

HZL has a strong leadership position in the domestic as well as global market. Its competitive advantage of toll (exclusive mining rights), huge reserves and integrated plants have remained its key growth driver till date. This combined with its strong thrust into silver production are expected to drive growth in the future

Hence, we can expect long-term outlook of HZL to be Green (Very Good)

Conclusion:

HZL’s exclusive mining contracts, huge reserves and fully integrated plants have been its major growth drivers till date. No secondary metal player can do without zinc produced by HZL. With its latest acquisition, HZL is on its way to become the world’s largest integrated zinc-lead producer, with the lowest cost of production. This combined with the growing demand for zinc and its increasing thrust towards silver production will help it to maintain its market leadership position in future

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463

You should have given the past returns to investors like dividend, bonus, rights etc

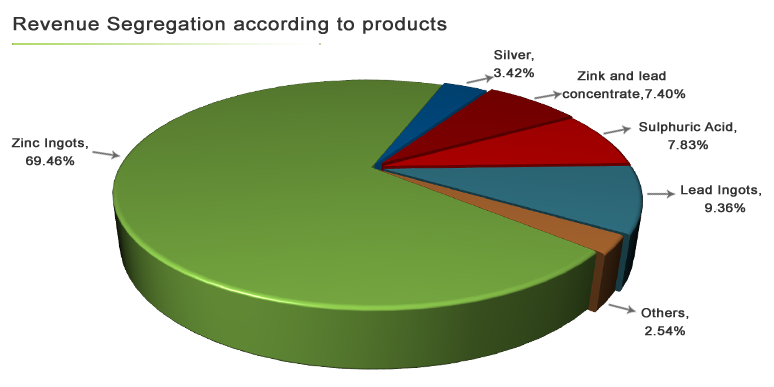

In revenue segregation pie, how come both zinc and lead ingots contribute 69%? still a good analysis of the company…….wanted u guys to come up with companies like this one rather than companies like Hero honda, infosys, titan, asian paints etc. which everyone already aware……. thanks jagadees