Shikhar is a 24 year old young guy who has just completed his studies and has recently entered the corporate world. He lives with his parents, thus has no rent expense, his education was funded by his parents, so no loans to worry about. He takes care of his own expenses and also helps out a little with the household expenses. A typical urban Indian youngster but with a crucial difference. Shikhar knows the importance of saving early for a better future, thanks to him being a finance graduate.

He has a few plans for the future. He wants to start saving for his wedding though he does not plan to get married for another 4-5 years. His wedding budget is about 10 lacs. Before that he wants to buy a decent car. He wishes to buy a house in the next 10-11 years. He believes that a decent house today can be bought in around 50 lacs. Obviously saving for his retirement is an important goal, something he has learnt from his parents.

He knows there are many free tools available online that will help him plan for the future. A quick search leads him to the MoneyWorks4me’s Financial Planning Tool, which he finds allows him to plan for all his goals and also make changes with ease. After watching a short demo video, he fills up his details, eager to find out what his plan would look like.

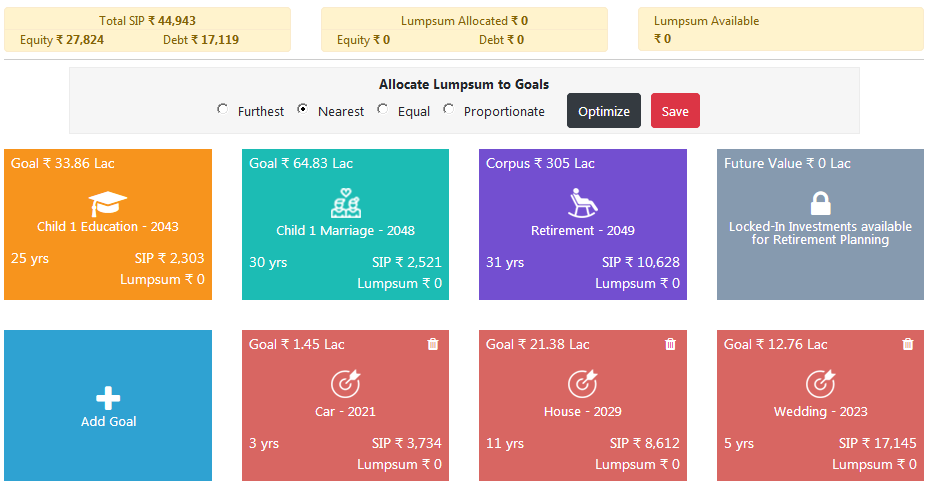

Here’s a snapshot of his financial plan:

Though he had not initially planned to save for a child, after seeing that MW4me allows to enter a child’s age in future (the number of years after which you plan to have a child to be entered in negative), he decided to also start saving for his family.

Shikhar required total savings of ~79200 to achieve all his goals, which would reduce significantly (by ~32000) once his near term goals like Car and Wedding are achieved. However, for Shikhar this was a huge amount. Shikhar’s monthly savings were close to just 50000 p.m.

While contemplating on how to achieve his saving goals, Shikhar realised that he had provided for 100% financing of the car and the house. He could do away with this. After all interest rates on these were reasonable, so he could plan to take a loan. He decided that he would make a 25% down payment on the car and the house, and for the rest he would take a loan.

Here’s what his updated financial plan looked like:

Now, his required monthly savings decreased to ~Rs 42000. Well, this was definitely doable. In fact, he would be left with surplus in hand! But, he wanted to dig further. So he diverted his attention to the retirement tab.

He was happy with the 80:20 portfolio allocations to equity and debt, respectively. His longer time horizon would give him an advantage, allowing him to wait out the equity drawdown periods. He, however, decided he wanted to retire early at the age of 55, as opposed to age of 60 assumed by MW4me. Starting his savings early made this option possible for him.

As he made the change he saw the total SIP move to ~Rs 45000. Happy to know that he could retire early, Shikhar moves to investigate the tool further. But he also wondered if he had under-estimated the living expenses relevant for retirement. He would alter it later.

At that moment the return expectation grabs his eye – 12% on equity and 5% on debt. He thinks MW4me’s return expectations to be conservative. Surely a 15% return on equity was possible, equity investments are supposed to give high returns! Before making any changes, he decides to do a little research. After reading MW4me’s return expectations blog, he understands it was better to err on the conservative side now then to have a shortfall of money in retirement or worse even lose his hard earned money.

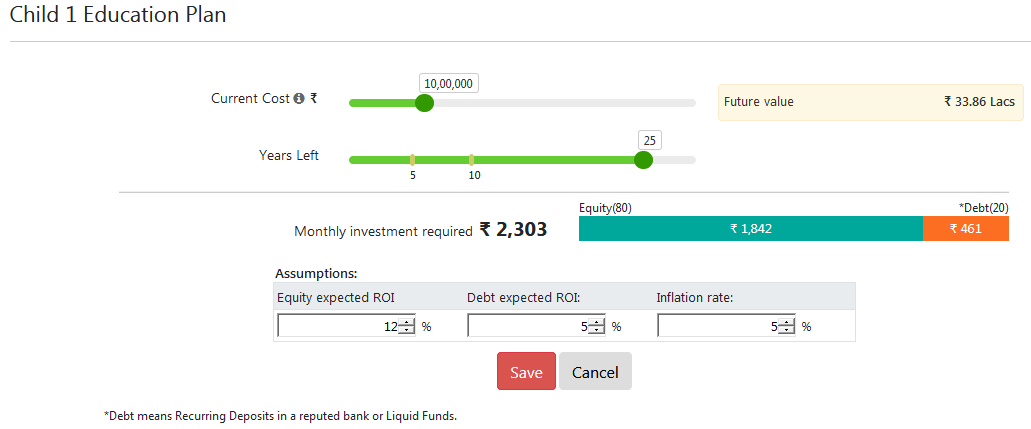

He then moved his attention to child education tab and saw a cost estimate of 10 lacs. He, however, felt that he would want his child to pursue higher education abroad and thus decided to increase the education fees to 40 lacs.

Once he was done with all the changes, his required savings had gone up by another 7000. His total required saving were now 51,851.

He realised this would be a stretch, but with a little cut down on unnecessary expenses, he could still achieve this. Of course, his required monthly savings would be much lesser if he had a lump sum saving in hand. He thus, decided to invest any future lump sum received (like yearly bonus) towards these goals. And he would work hard anyway to get ahead in his career with good increments, allowing him to save and invest more in the early years. He could rest easy and plan for more ambitious things after a few years. He felt lucky to be living his parents because that allowed him the opportunity to build a solid corpus early and he was not going to waste it. And he had the access to the MoneyWorks4me Financial Planning Tool to update his plans with ease.

Also Read:

Smart Things You Can Do To Meet Your Financial Goals: Part 1

Smart Things You Can Do To Meet Your Financial Goals: Part 2

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463