Compound Interest is the 8th wonder of the world. He, who understands it, earns it; he who doesn’t, pays it! – Albert Einstein

To allow compounding to make its magic work on your investments, do these 3 things,

1. Have patience!

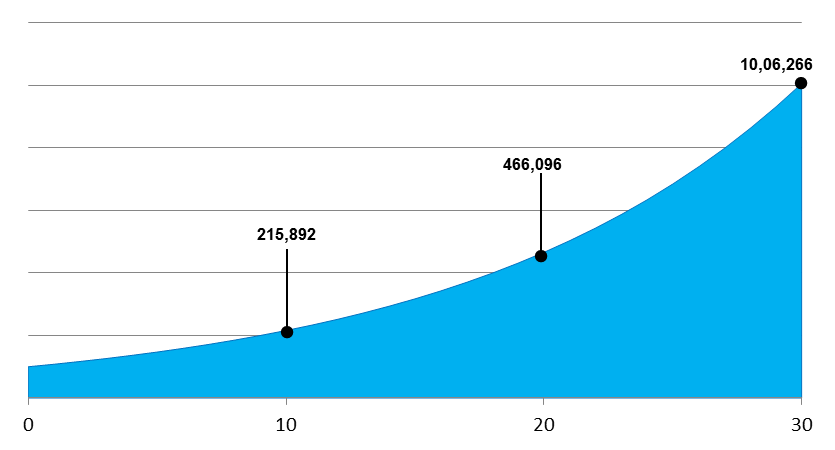

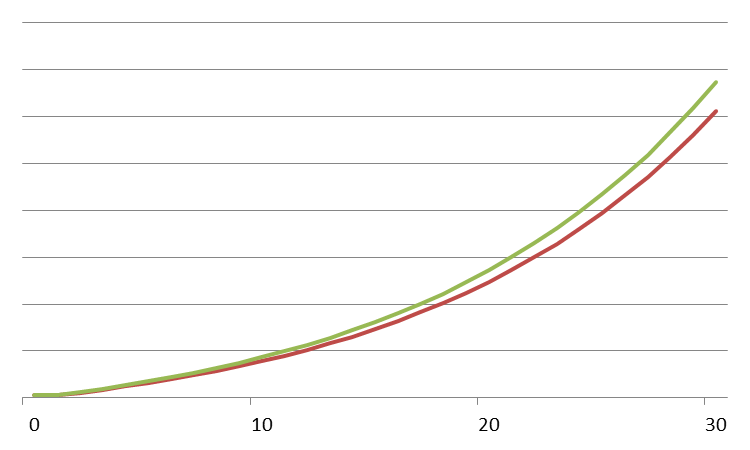

Look at this graph. If you invest 1 lac and allow it to compound at 8%, you will have Rs. 2.15 lacs after 10, Rs. 4.66 lacs after 20 years and Rs. 10 lacs after 30 years. In the 1st10 years, you earn Rs. 1.15 lacs, the 2nd 10 years period Rs. 1.5 lacs and in the 3rd next 10 years Rs. 4.4 lacs! And, the earnings will go on increasing exponentially! So, have patience, allow compounding to work.

2. Start early!

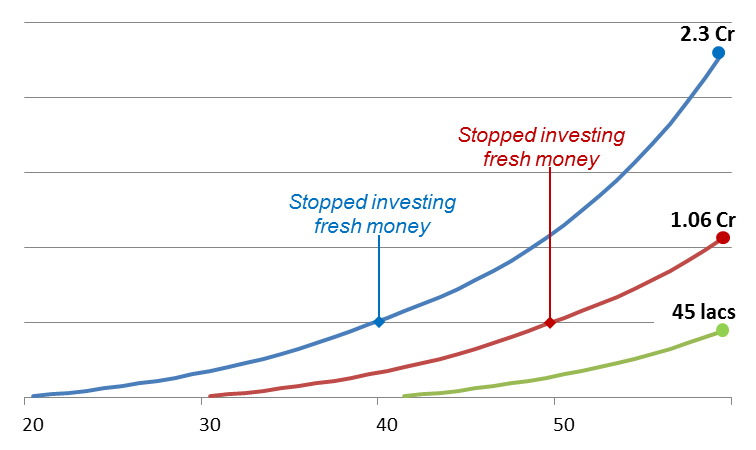

In compounding, when you start saving outweighs how much you save. Look at this graph

If you invested Rs. 1 lac every year from age 20 to 40 and compounded at 8%, then by 60 you would get Rs. 2.3 Cr. If you started 10 years late, invested from age 30 to 50, you would get Rs 1 Cr— from 40 to 60, just Rs. 45 lacs. In all cases, you invested for the same 20 years! So, what changed? You allowed the compounding to start early! So, with a pretty decent income and with a little self-control on spending you can start investing early

At 40 even 50 or more, people still have many years during which they can compound their money at a good healthy rate. They must immediately invest their Investable Surplus sensibly—not recklessly in the hope to make up lost time. They cannot risk losing their capital and don’t have time on their side to recoup some poor investment decisions. With proper asset allocation, it is very much possible for them to secure their future, and even fund their dreams.

3. Start with as much as you can!

If you invest Rs. 1 lac every year for 30 years at 8% interest, you will get Rs. 1.22 Cr at the end of the 30th year. And, for Rs. 1.1 lac every year, you will get Rs. 1.34 Cr. It means for extra 3 lacs invested over 30 years, you will get Rs. 12 lacs! And, remember the compounding is still working!

The most powerful force in the universe is compound interest. So,

- Start early

- Invest consistently

- Don’t remove the money, and

- Let the “force” lift you

See this interesting story to understand “Power of Compounding”

Advanced reading:

- https://www.investopedia.com/walkthrough/corporate-finance/3/discounted-cash-flow/compounding.aspx

- https://www.tonyrobbins.com/ask-tony/power-of-compounding/

Try Compounding Calculator:

https://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php

Read the next article to understand: ‘Why it’s important to commit to long-term investing?’

Watch the Video:

Best Stocks From:

Top 10 Stocks for 2024 Best EV Stocks in India Screener Alpha Cases Best Solar Energy Stocks in India Top AI Stocks in India Best Drone Stocks in India Best Sugar Stocks in India Top 10 Infrastructure Stocks in India Best Fintech Stocks in India Top Media Stocks in India Top Fertilizer Stocks in India

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory