Choosing a right Mutual Fund can be a tricky affair. With an array of products being offered in the market by different fund houses, it may be confusing for you while choosing or avoiding a fund. MoneyWorks4me’s unique method of comparing Mutual Funds on the most appropriate parameters will help you invest in Mutual Funds that match your needs and Risk Profile. Moreover, in-depth fundamental research will give you the conviction to hold the selected Mutual Funds over a longer period.

Step 1: Ensure you are doing an Apple-to-Apple comparison

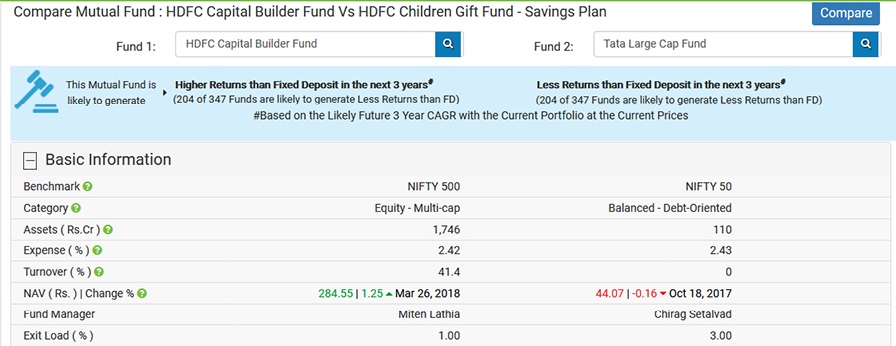

While comparing two Funds, it’s important that you do an apple-to-apple comparison i.e. the same type of Funds or having the same Benchmark Index. Therefore, check this first. Here’s a comparison of two well-known Funds – HDFC Large Cap Fund & Tata Large Cap Fund. Both are Large-cap, but follow different Benchmark Indices, which is acceptable. So, both Funds are comparable.

Then, compare on Assets under management (AUM) which tells us, if they are of similar size or vastly different, next Expense ratio, and Entry/exit loads as these charges eat into your returns and the Turnover ratio which tells us % of holdings replaced over one year.

Asset under Management (AUM) is slightly higher for HDFC Large Cap. The Expense Ratio and Exit Load are almost the same. So, size and expense-wise these two funds are similar. But, the Turnover ratio of Tata Large Cap Fund is considerably higher compared to HDFC Large Cap Fund. It shows that the Fund Manager changed 25% of his holding by new ones over one year.

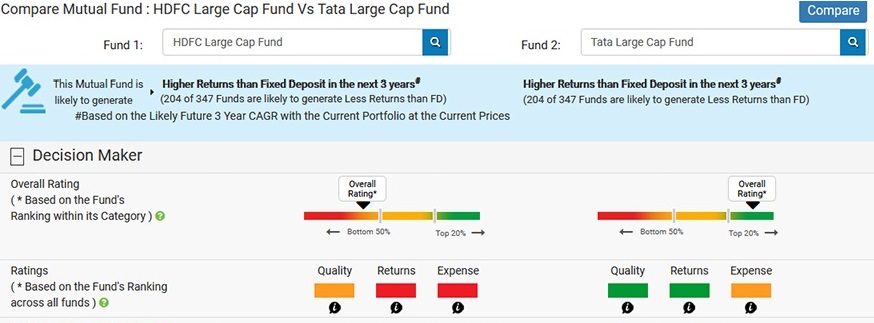

Step 2: Look at the Decision maker

After selecting two comparable Funds, first look at 2 things

1. Is it a Right Fund?

- What is the quality of assets that a Fund is holding? Does it give an assurance that Fund is ‘Andar se Strong’?

- How consistent has the Fund been in generating excess Returns?

- Is the Fund’s Expense Ratio justified by the excess Returns it has generated?

- We rank Funds in their category on these parameters as in Green (Top – 20%), Orange (Between 20%-50%) and Red (Below 50%). A Fund may have different rating on these parameters, so how do you decide? To address this challenge, we have developed an ‘Overall Rating’. So, look at the Overall Rating to know if the Fund is right. Also, click ‘Bole Toh’ to get more insights on those Funds.

Tata Large Cap Fund’s Quality & Expense Ratio is Orange (20%-50%), which is compensated by its Returns Performance i.e. Green (Top – 20%). Therefore, its Overall rating is Green. Whereas, HDFC Large Cap Fund’s Quality & Expense Ratio is Red (Below 50%). Therefore, despite having Orange (20%-50%) Quality, its Overall Rating is Red.

Does a Red Fund mean it’s risky or not good? No. What it means that there are better Funds in its category, and you must look at them.

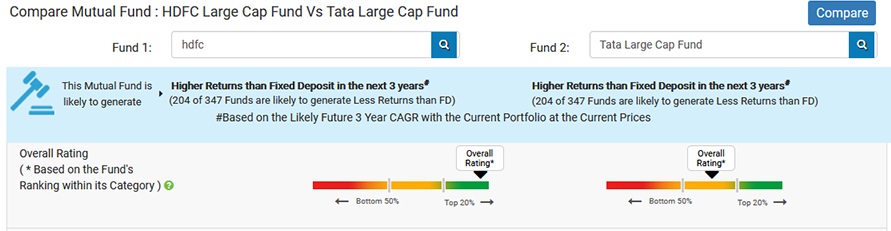

2.Is it Right Time to buy the Fund?

Most people select Funds looking at the returns in the past, while they are investing for returns in Future! Isn’t that an irony?

Before investing, look at the likely Future Returns the two Funds are going to generate. We calculate likely Future 3 year CAGR, based on the current valuation of assets, their fair price (i.e. MRP).

Tata Large Cap Fund is a Green Fund, but its returns are less than its Benchmark. Whereas, HDFC Large Cap Fund, a Red Fund, has a higher potential upside. It means that HDFC Large Cap Fund has picked some risky assets that have potential for better returns.

For some Funds, you will not get the Potential Upside (as it will be a paid feature). So, you need to check at least if these Funds are going to give more returns than FD, and how much of their portfolio is over-valued. More the over-valued portfolio, less will be the likely Future returns

Step 3: Look at the details of these Funds to build your conviction

1. Returns Performance

“Don’t spend a lot of time pouring over the past performance charts. That’s not to say you shouldn’t pick a Fund with a good long-term record. But, it’s better to stick with a steady and consistent performer than to move in and out of Funds, trying to catch the waves.”― Peter Lynch, Beating the Street, a legendary investor

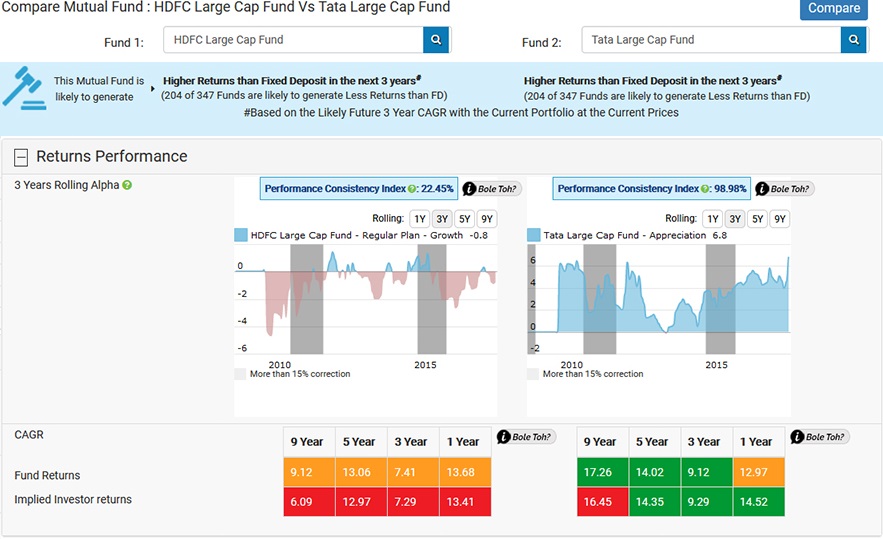

Look at how consistently Funds have generated Alpha on rolling basis (Rolling Alpha means the excess return generated over the Benchmark by a Fund, with different start dates). Higher Performance Consistency Index indicates that a Fund has generated the Rolling Alpha consistently. Also, look at the CAGR for Fund Returns and Implied Investor Returns. Green is better. Click ‘Bole Toh’ to get insight on Performance Consistency Index & CAGRs.

The Performance Consistency Index for Tata Large Cap is 98.9%, it has consistently generated an ‘Alpha’. Whereas HDFC Large Cap Fund has the Performance Consistency Index of 1.03%, it has consistently underperformed than its Benchmark. Even the CAGR is Red i.e. over a period of one, three and five years; the Fund has underperformed than its Benchmark.

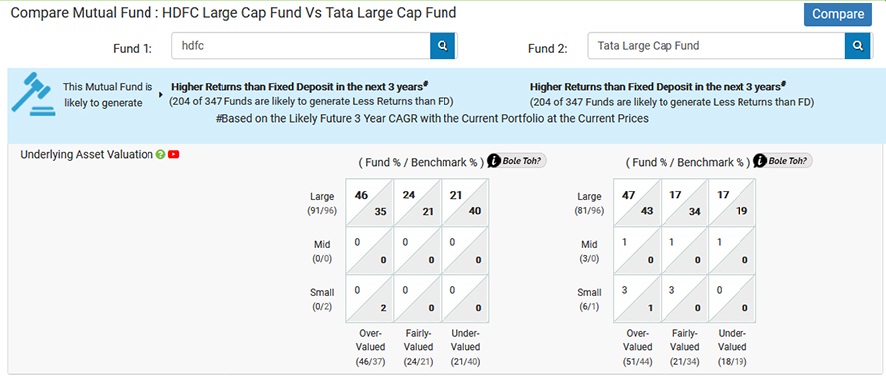

2. Portfolio Quality:

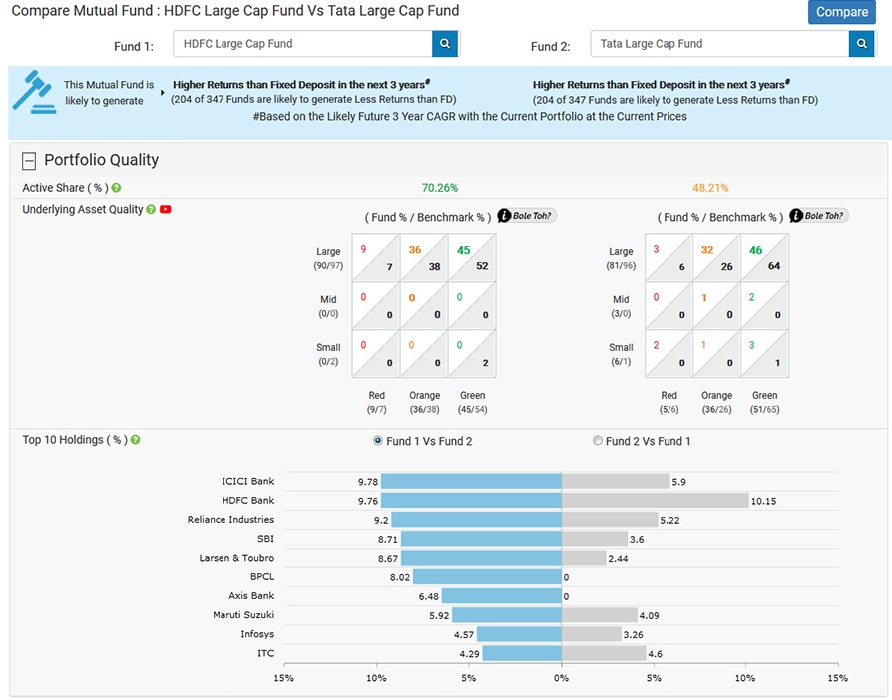

Look at the quality and composition of the assets that these Funds hold. Active Share tells us how much a Fund’s portfolio is different than its Benchmark. If it’s low, it means portfolios of a Fund and its Benchmark are similar and, so will be their returns. Then, it makes more sense to buy that Index Fund, rather than paying Expense Ratio for the Mutual Fund.

Check how’s the Fund’s spread across Large, Mid & Small cap assets and different risk levels. More Large cap & Green-Orange assets indicates the Fund is more prudent, and picking quality assets. Mid Cap & Green-Orange assets indicate the Fund is cautiously choosing assets that can generate higher returns

Here Active share (%) of HDFC Large Cap Fund is high (however, it has not helped much, because it hasn’t generated an Alpha for long periods.)and its holding is skewed to top 6 stocks. Underlying Asset Quality matrix shows that Tata Large Cap Fund could be more quality-conscious and evenly spread while choosing assets.

To summarise, Mutual Funds Sahi Hai, lekin kuch hi! Past Returns can mislead, therefore, compare Funds before investing.

- Do an Apple-to-Apple comparison i.e. compare Funds of the same category or Benchmark

- Look at the Decision Maker to check if it’s a Right Fund and it’s the Right Time

- Check Funds’ Returns Performance i.e. have they consistently generated Alpha on rolling basis

- Check the Quality of Funds’ portfolio i.e. are they picking Large-cap-Green-Orange assets and, Active Share and are they skewed or evenly spread across their assets

Do smart MF Investment – Choose the best, eliminate the rest!

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Start Chat | Request a Callback | Call 020 6725 8333 | WhatsApp 8055769463