Ask anybody why they bought something, anything and the most common answer is quality, “Achhi Quality Ka Hai”. I don’t think you are any wiser after such an answer. So, if you are smart you will ask “what did you see in it that convinced you that this is good quality?”. You need to ask the same question when talking about the quality of a stock.

How to assess stock and conclude about its quality? Let us understand this with the help of cricket because then we understand things better. There is no doubt about the talents that Sehwag and Dravid have. If you had to select only one, who would you select? There can be much debate around the answer – depends on the other team members, current form, who are we playing against, and is it a T-20 match or a Test match. But what if you had to select between them for a Test match? The answer overwhelmingly would be Dravid. Why? Many reasons, but essentially because Dravid is a more consistent performer, better at shot selection, and temperamentally better suited for a test match.

Now investing in stocks is like playing a test match. And you back a team (portfolio) that has many players (stocks) with Dravid-like qualities. Investing, like a test match, is less entertaining, and thrilling than watching T20, but remember you are not investing for entertainment, thrill, or adventure but for growing your money and reaching financial goals.

In terms of businesses, consistency is essential in the generation of returns (ROCE/ROE) and shot selection can be related to the capital allocation policies of the management. A company that is able to generate consistent returns above its capital cost is no doubt good quality. Now, as shareholders, we want profits generated to be utilized for further profitable growth (similar high returns as the current business) and any extra profits returns to us as dividends. But what if a company (promoter) tends to make ‘large’ capital investments for future business opportunities, consuming all the cash flow generated and more that may not generate similar returns as the current business. In cricket, it a like a ‘good’ batsman who starts chasing every ball to score a boundary. And we know that sooner than later the batsman is going to be out. We want to avoid such stocks. What we want as investors is a management that has a good capital allocation policy and appreciates the interests of us minority shareholders.

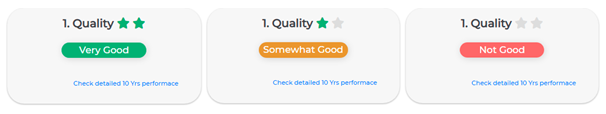

MoneyWorks4Me DeciZen uses the same approach to assess the quality of a company. Any company which has had a long track record in delivering ROCE/ROE in excess of its cost of capital is considered very good quality and one with no consistent track record can be considered to be not good.

While making investment decisions, assessing the quality should always be the first step. It only makes sense to look at the valuation after ascertaining the quality and avoid not good quality companies. Instead, look for investment opportunities in the universe of very good quality companies. Somewhat good quality companies can be studied a little deeper before you decide on investing in them.

After you have identified good quality companies look at their valuations and see if investing in them makes any sense. How to do that? Read our next blog and find out “How to Identify Undervalued Stocks?”

How to Invest in Stocks Systematically & Succeed?:

Best Stocks From:

Nifty 50 Nifty Next 50 Nifty 100 Nifty 200 Nifty 500 Healthcare Auto FMCG Nifty Financial Services Chemicals & Fertilizers Dividend Opportunities SmallCap 250 MidCap 100

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463