There is a lot of buzz surrounding the draft of the Electric Vehicle policy introduced by the Delhi government. This announcement has led to corrections in the stock prices of various companies operating in different segments of the value chain. In this article, we will delve into a comprehensive analysis of the entire Gas value chain, exploring the key players at each stage, and examining the implications of the current regulatory changes as well as the future of this sector.

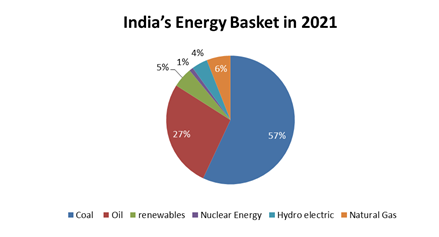

The Indian gas sector is undergoing a remarkable transformation, playing a pivotal role in the nation’s energy diversification and sustainability efforts, as India’s economy grows and its energy demand continues to rise. Natural gas is one of the cleanest fossil fuels available in India and currently accounts for around ~6.7% of India’s primary energy mix. The government plans to develop a gas-based economy in the country and is targeting to raise the share of natural gas in the energy mix to 15% by 2030.

(Source: Company data, Moneyworks4me research)

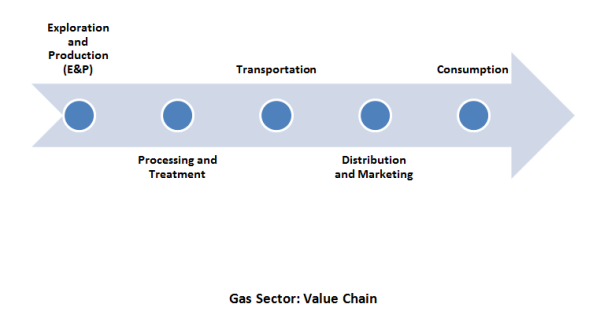

Understanding the Gas Sector Value Chain

The gas sector value chain encompasses various stages involved in the production, transportation, and distribution of natural gas. Here’s an overview of the different segments and the players involved in each:

Gas Sector: Value Chain

Exploration and Production (E&P): The E&P stage involves the discovery, drilling, and extraction of natural gas reserves. Major players in this phase include both public and private entities like ONGC (Oil and Natural Gas Corporation), Reliance Industries, and GAIL (Gas Authority of India Limited). These companies invest heavily in exploration, drilling, and production activities.

Processing and Treatment: Once extracted, natural gas often contains impurities such as sulfur compounds and moisture. Processing and treatment facilities, run by companies like Petronet LNG and Gujarat State Petronet Limited, clean the gas, making it suitable for transportation and consumption. Petronet LNG and GSPC LNG focus on LNG terminals and regasification facilities.

Transportation: After treatment, the gas needs to be transported from production sites to end-users. Two primary modes of gas transportation are pipelines and LNG (Liquefied Natural Gas) carriers. Major players in pipeline transportation include GAIL, Indian Oil Corporation (IOC), and Adani Gas.

Distribution and Marketing: This segment focuses on supplying natural gas to various end-users, including industries, households, and commercial establishments. Leading distribution companies like Indraprastha Gas Limited (IGL) and Mahanagar Gas Limited (MGL) distribute piped natural gas to homes, while Adani Gas and Gujarat Gas cater to industrial and commercial clients.

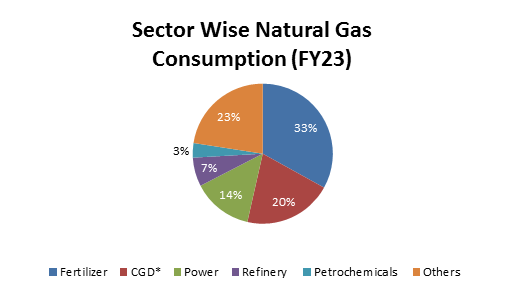

Consumption: The final stage involves consumers who use natural gas for various applications, including electricity generation, heating, cooking, and transportation. It also plays a crucial role in industries such as fertilizer production, city gas distribution (CGD), power generation, and refineries, facilitating essential processes and functions in each of these areas.

(Source: Company data, Moneyworks4me research, CGD-City Gas Distribution)

Key Trends in the Indian Gas Sector

The Indian gas sector is witnessing several trends, with the adoption of natural gas as a clean energy source taking the forefront. In alignment with global environmental objectives, India is progressively turning to natural gas as a cleaner substitute for traditional coal and oil. This transition is steered by the government’s dedication to curbing carbon emissions and enhancing air quality.

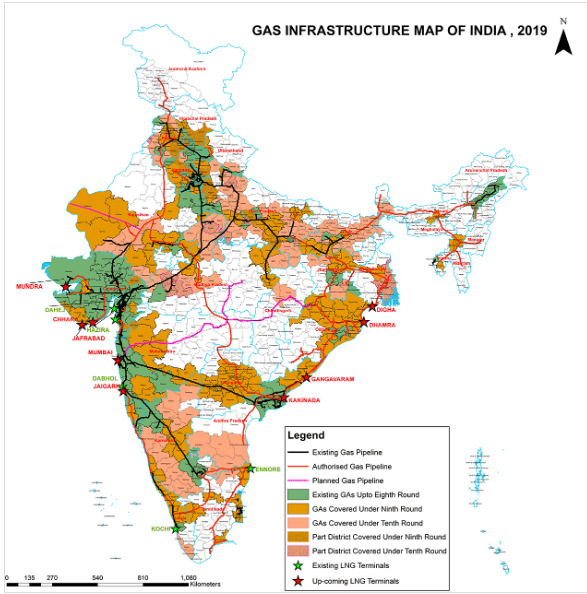

Expanding Gas Infrastructure: India is actively enhancing its gas infrastructure to cater to the rising demand for natural gas. Investments are being made in expanding the network of pipelines and LNG terminals, crucial for linking remote areas and ensuring a consistent gas supply. Currently, the country boasts an operational natural gas pipeline network spanning approximately 17,000 km. To ensure nationwide access to natural gas, plans are underway to add approximately 15,500 km of pipelines. These developments aim to complete the National Gas Grid and are currently in different stages of progress.

Source: Ministry of Petroleum and Natural Gas

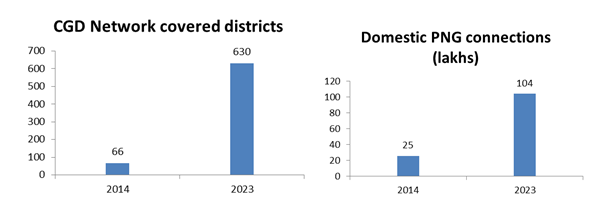

City Gas Distribution (CGD) Expansion: The government has been promoting the expansion of CGD networks to provide piped natural gas to households and CNG (Compressed Natural Gas) for vehicles in more cities. This move helps reduce vehicular emissions and offers a convenient and cleaner fuel source to consumers.

Source: Government websites

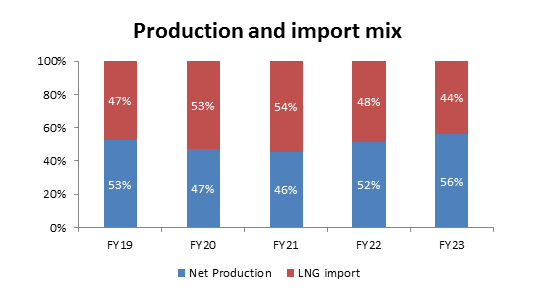

Global LNG Deals: India is actively engaging in international LNG agreements to secure a stable supply of natural gas. Long-term contracts with countries like Qatar and the United States play a crucial role in ensuring energy security.

(Source: Company data, Moneyworks4me research)

Current regulatory Changes:

Recently, the Delhi government has put forward an Electric Vehicle (EV) transition policy designed for ride-hailing services (Ola, Uber, and likes), delivery providers, and e-commerce firms. This policy necessitates a gradual transition toward electric vehicles, with the target of ensuring that 50% of new vehicle acquisitions are electric within three years from the policy’s activation and reaching 100 percent within five years. By April 1, 2030, all aggregators are mandated to have a fleet comprised entirely of electric vehicles.

Following this announcement, the stocks of City Gas Distribution (CGD) companies such as Indraprastha Gas (IGL) and Mahanagar Gas (MGL) experienced a significant decline. This drop in stock value can be attributed to the fact that a substantial portion of IGL’s revenue is generated from operations in the Delhi National Capital Region (NCR). The proposed Electric Vehicle (EV) policy by the Delhi government is perceived as unfavorable for these companies.

The reason for this negative market reaction is likely twofold:

Impact on Demand: The shift towards electric vehicles, as mandated by the EV policy, could potentially reduce the demand for traditional fossil fuels, including natural gas, which is distributed by CGD companies. As a result, companies like IGL and MGL might see a decrease in their customer base, particularly if ride-hailing services and other transport-related sectors transition to EVs. Other states may also come up with a similar policy.

Revenue Implications: A significant portion of the revenue generated by CGD companies is reliant on their existing customer base, especially in regions like Delhi NCR. If there is a shift away from natural gas usage, these companies may face revenue challenges and need to adapt their business models to cater to the changing market dynamics.

It’s important to note that the impact on these companies will depend on various factors, including the speed of EV adoption, the effectiveness of the policy, and the company’s ability to diversify their offerings or adapt to the changing landscape. IGL is already investing in electric charging stations to mitigate this risk.

Outlook

The Indian gas sector is undergoing a remarkable transformation, with a focus on cleaner and more sustainable energy sources. As the nation continues to diversify its energy mix, the value chain of the gas sector plays a crucial role in ensuring a reliable and efficient supply of natural gas. We remain vigilant of evolving EV adoption but think CGD could provide opportunities in the near term.

Check out the 10 year x-ray of MGL

Check out the 10 year x-ray of IGL

Best Stocks From:

Undervalued Nifty 50 Nifty 500 – Quality with Price Strength Screener Alpha Cases 5 Stars Rated Stocks from Nifty 500 Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory