There’s a buzz about the paint industry in the media, and we’re here to keep you in the loop. We’ll tell you what’s going on, how things are changing, and which colors should be in your investment palette.

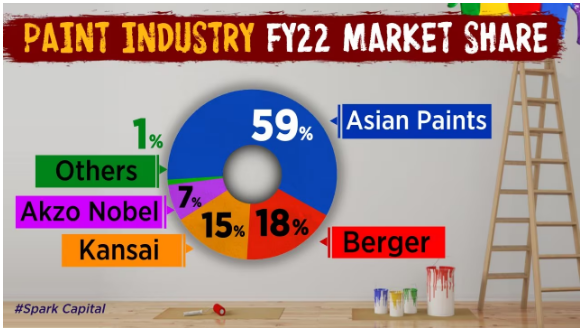

The Indian paint industry is already quite organized (>70% share), with a few big players like Asian Paints, Berger Paints, and Kansai dominating the scene. The Indian paint industry is split between decorative paints (Asian paints and Berger paints) and industrial paints (Kansai Nerolac). Decorative paint is a high-margin business as compared to that of industrial paints. Many new players are entering this market.

What Are the Players Up To?

- Grasim Industries is getting ready to launch “Birla Opus” early next year by investing Rs 10,000 crore. Grasim has its manufacturing plants located in Haryana, Punjab, Tamil Nadu, Karnataka, Maharashtra, and West Bengal, which will have a total capacity of 1,332 million liters per annum (MLPA) and an R&D facility in Maharashtra which is already set up.

- JSW Paints, part of the JSW Group, plans to invest Rs 750-1,000 crore to boost production. JSW Paints is looking to double its network to 10,000 retail touchpoints in the coming 2-3 years. The company is looking to target around 5% of the decorative paints industry.

- Asian Paints is going big with a capex of Rs. 6,750 crore, focusing on capacity expansion, backward integration, and acquisitions.

- Berger Paints is aiming to double its revenue to Rs 20,000 Cr by 2028-29. To achieve this, the company is going to expand its capacity to 1100 MLPA from the current 620 MLPA.

Why the Paint frenzy?

According to an Industry report, India’s per capita paint consumption is only 3.8 liters, compared to a global average of 15 liters. That’s a whopping 75% less! Plus, the price per liter in India is 61% lower than the global average. Akzo Nobel India predicts that the paint and coating industry will reach a staggering Rs 1 lakh crore by 2028 (CAGR 10%+). No wonder everyone’s excited!

What are the industry dynamics?

Paint prices depend on raw materials, with crude oil being a big factor. Advertising and marketing also eat up a chunk of costs.

Most paint demand comes from repainting (about 75%+). Paints typically last about five years before losing their luster. According to the Nomura report “Repainting cycle in India should shorten from 6.9 years in 2019 to 5.6 years in 2031, driven by heightened hygiene awareness, more rented homes and new solutions like virtual painting tools and mechanized painting services.”. To capture this market, branding becomes crucial. New players and old ones alike must spend on advertising, which might squeeze margins as the competition in the industry is increasing. In paints, scalability is just not about having manufacturing plans and a distributor network.

Think about the last time you decided to refresh the paint in your home. Did you carefully choose the paint colors and finishes, or did you simply defer to the recommendations of your contractor? It’s a common practice for consumers to rely on the guidance of architects or interior designers when it comes to selecting paints. However, this seemingly straightforward decision-making process conceals a broader landscape of challenges and opportunities within the painting industry.

The painting industry has seen attempts at innovative ‘painting solutions’ to change how we approach home renovations. These efforts aim to transform options for consumers and enhance painter experiences, yet the results are mixed. While technology and products have advanced, consumer behavior and painter practices remain largely unchanged.

This leads us to the question can newcomers disrupt traditions and redefine home painting? Companies like Urban Company are attempting to deliver modern solutions, bridging consumer preferences and the painter’s needs. Whether they’ll succeed remains uncertain, but they offer a glimpse into an evolving landscape.

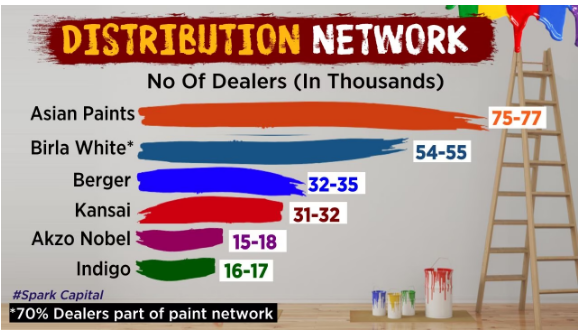

Asian Paints is in a league of its own, outselling the next three players combined. While many attribute Asian Paint’s success to a strong brand, its true moat is its logistics network. Serval decades ago, Asian Paints began removing intermediaries – distributors and wholesalers- from its supply chain directly tapping into the point of sale that are paint dealers. The network of more than 70,000 dealers that they have built is a significant competitive advantage over Berger Paints and Kansai Paints. The dealers may switch to other brands that offer better incentives, quality, or variety of paints. Moreover, the dealers have limited space and resources to stock multiple brands of paints, especially when each brand has a wide range of SKUs, color shades, paint types, and color mixing machines. Therefore, the existing players may have to invest more in retaining their dealer network, while the new entrants may have to build their own network from scratch. This may create entry barriers and increase the cost of distribution for the new players.

Outlook

Asian Paints and Berger Paints have been the dominant players in the paint industry, delivering a 19% CAGR return over the last 5 years and enjoying premium valuations. However, the entry of new players who have a strong pedigree, umbrella brands, and some even a network may force the somewhat oligopolistic structure of the paint industry to a near monopolistic competition structure. On the supply side industry is expected to add 20% of the current level over the next three to four years. However, on the demand side, the industry’s growth is about 9% to 10% in FY24 existing players face challenges in maintaining their market share and margins. If new players are able to gain market share, re-rating may occur for existing players. The industry might see some exciting changes in the coming years. It’s going to be interesting to see how the industry evolves.

In a nutshell, the Indian paint industry is like a canvas waiting to be painted with new opportunities and challenges. Whether you’re picking paint for your home or investing in paint stocks, keep an eye on the colorful journey ahead!

Check out our peer comparison for the industry and make an informed decision 10-year X-ray.

Best Stocks From:

Undervalued Nifty 50 Nifty 500 – Quality with Price Strength Screener Alpha Cases 5 Stars Rated Stocks from Nifty 500 Business Houses Group

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | Ebook | WhatsApp: 9860359463

*Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

*Disclaimer: The securities quoted are for illustration only and are not recommendatory