The Indian pipe industry is one of the silent enablers of India’s infrastructure story.

From homes and farms to factories and smart cities, pipes form the backbone of water supply, drainage, irrigation, and sanitation systems.

Over the past decade, the industry has evolved from a fragmented, unorganized setup into a consolidated sector led by strong branded players. With India’s rapid urbanization and government-led infrastructure spending, the growth outlook for the pipe sector remains robust.

Industry Overview

The Indian pipe industry is integral to multiple end-use applications — water supply, irrigation, drainage, plumbing, oil & gas, and construction.

Plastic pipes dominate the market because of their cost efficiency, corrosion resistance, and durability.

The key polymer types used are:

Polymer Type | Share of Demand | Key Applications |

UPVC (Unplasticized PVC) | ~65% | Agriculture, Plumbing, Drainage |

CPVC (Chlorinated PVC) | ~15% | Hot & Cold-Water Plumbing, Fire Safety |

HDPE (High-Density Polyethylene) | ~15% | Irrigation, Sewage, Industrial Use |

PP / PPR (Polypropylene) | ~4% | Industrial Fluids, Specialty Uses |

Composite pipes — combining plastic and metal — are gaining traction in niche plumbing and industrial applications for their strength and flexibility.

Key Segments and Applications

The Indian pipe market can broadly be classified into four end-use segments:

1. Agriculture and Irrigation (~50–65% of demand)

Used for water supply and drip irrigation systems, these pipes are mainly made of PVC and HDPE.

Government focus on irrigation efficiency and micro-irrigation adoption supports steady demand.

2. Plumbing (~35–40%)

Covers residential and commercial water distribution systems.

Growth is driven by real-estate expansion, urban housing, and the replacement of metal pipes with CPVC and composite variants.

3. Sewerage and Drainage (~10–15%)

Used in wastewater, stormwater, and sanitation networks.

Smart Cities, AMRUT, and Swachh Bharat missions have accelerated this segment.

4. Industrial (~5%)

Includes chemical, oil & gas, power, and fire-protection applications.

Industrial CPVC, PP, and metal pipes are preferred due to their ability to handle high temperature and pressure.

Shift from Unorganized to Organized Players

The Indian pipe sector has undergone rapid formalization:

- Organized sector share rose from ~50% in FY10 to ~67% in FY21.

- Top-5 organized players’ share jumped from 22% in FY12 to ~43% in FY21.

This shift has been driven by:

- Brand awareness and product quality focus.

- Distribution expansion by national players.

- Rising compliance standards and GST implementation.

- Technological sophistication in fittings and CPVC segments where unorganized players struggle to compete.

Demand Drivers

1. Infrastructure and Government Initiatives

Schemes like Jal Jeevan Mission, Pradhan Mantri Awas Yojana, Smart Cities Mission, and Swachh Bharat Mission continue to generate demand for water, sanitation, and housing infrastructure — all heavy users of piping systems.

2. Urbanization and Rising Incomes

With per-capita pipe consumption at ~11 kg per annum in India (vs. global average of 17 kg), there is immense headroom for growth as rural housing improves and urban infrastructure expands.

3. Water Management and Conservation

The increasing adoption of drip irrigation, rainwater harvesting, and wastewater reuse systems is driving steady structural demand.

4. Technological Upgradation and Quality Preference

Consumers now prioritize leak-proof, lead-free, and long-life pipes.

Brands offering composite, fire-resistant, or low-noise products are gaining share.

Industry Dynamics and Margin Structure

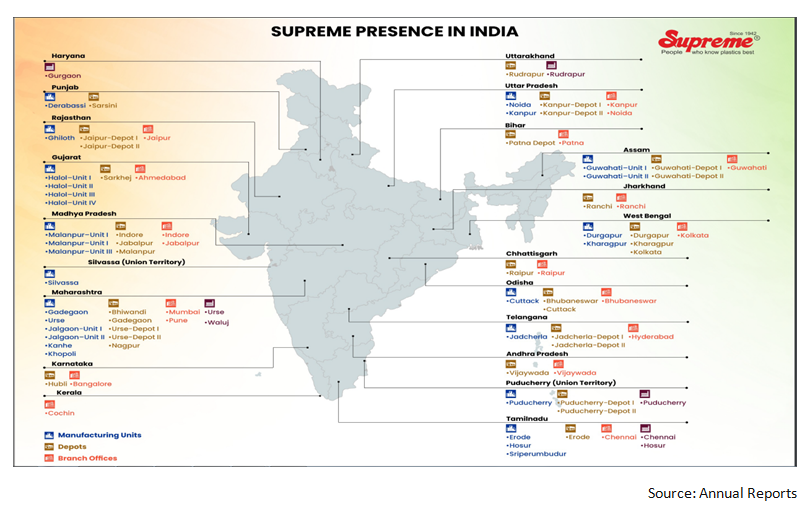

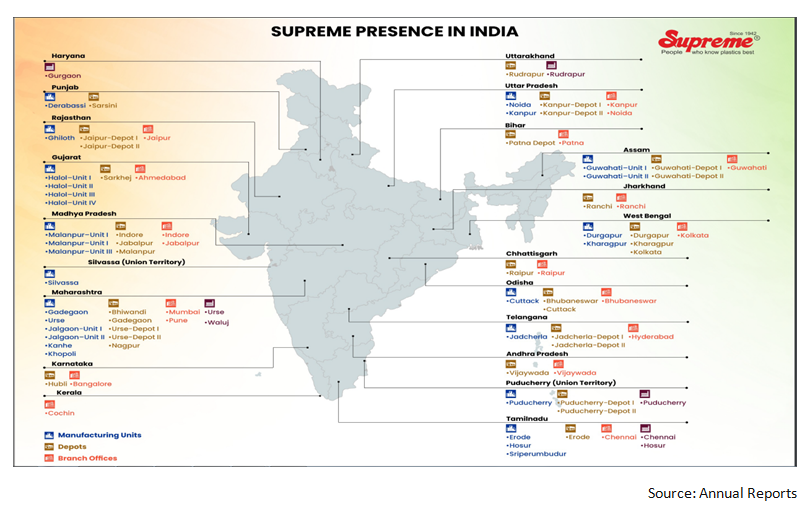

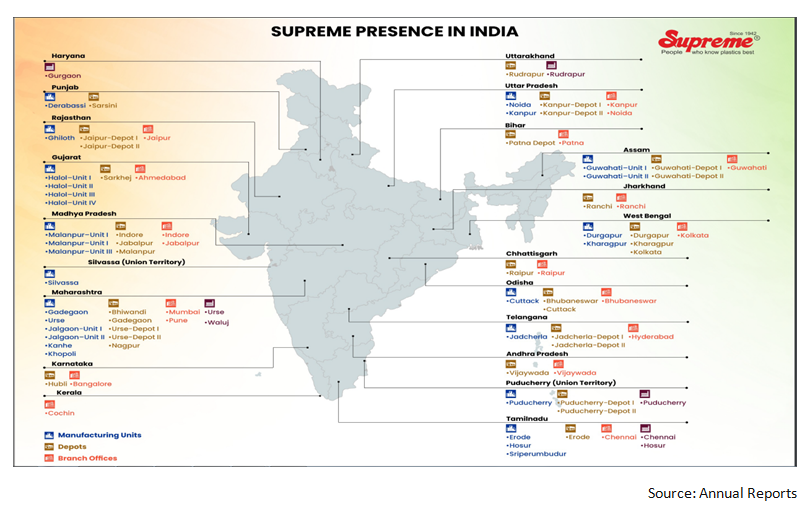

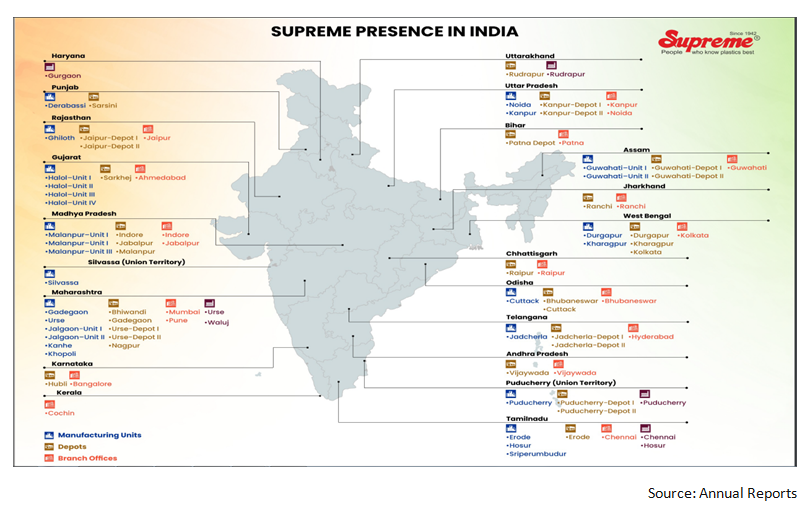

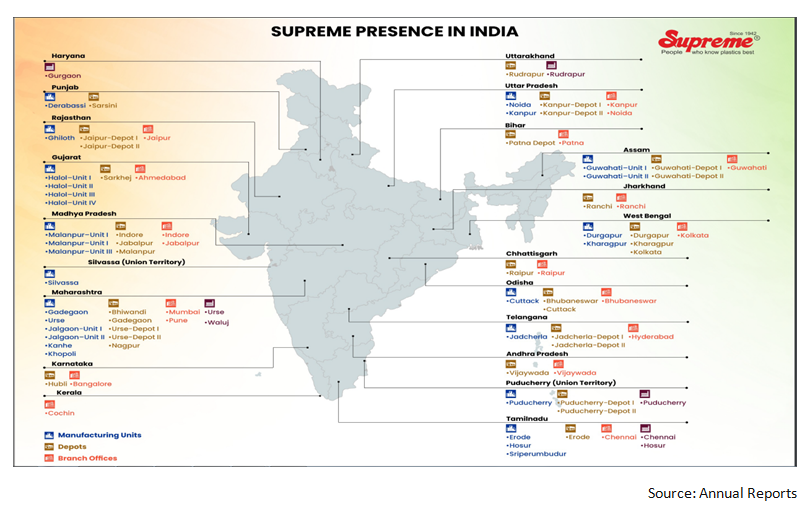

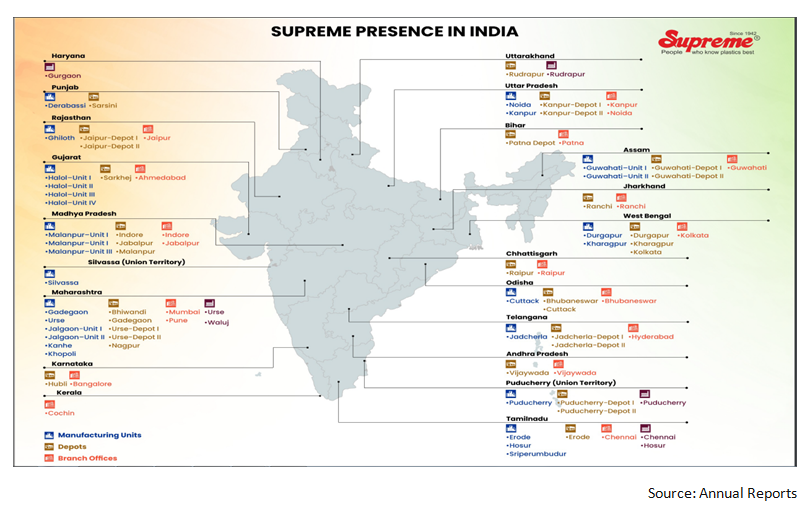

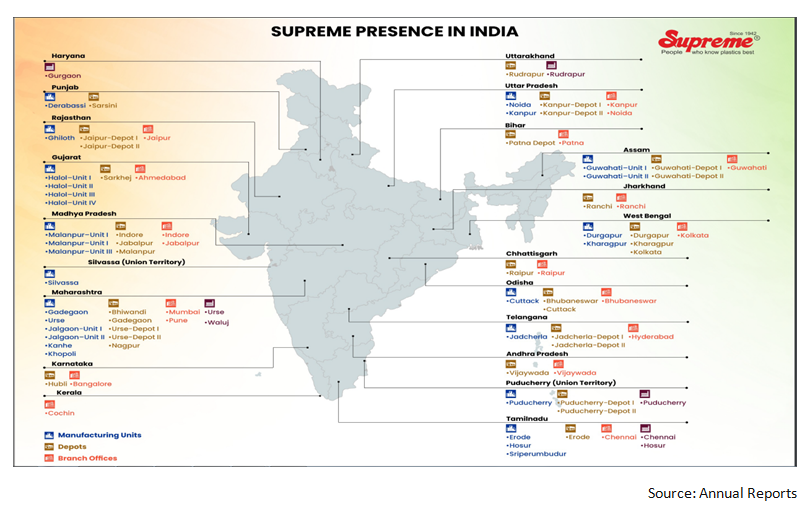

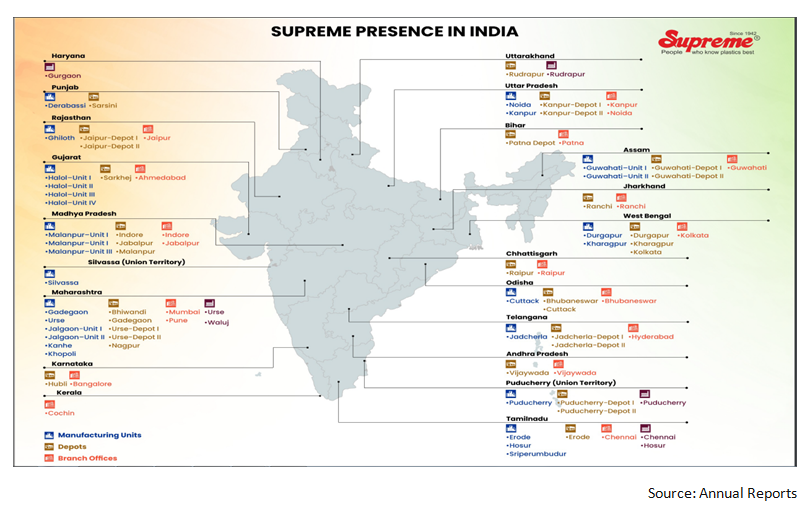

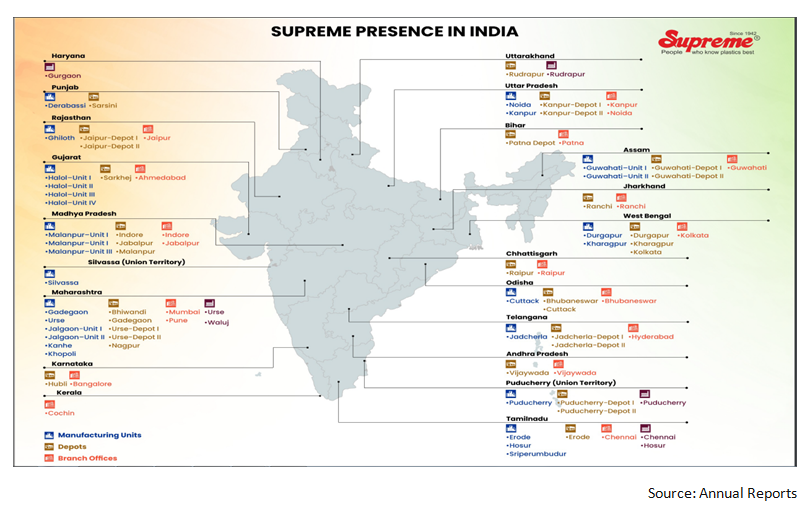

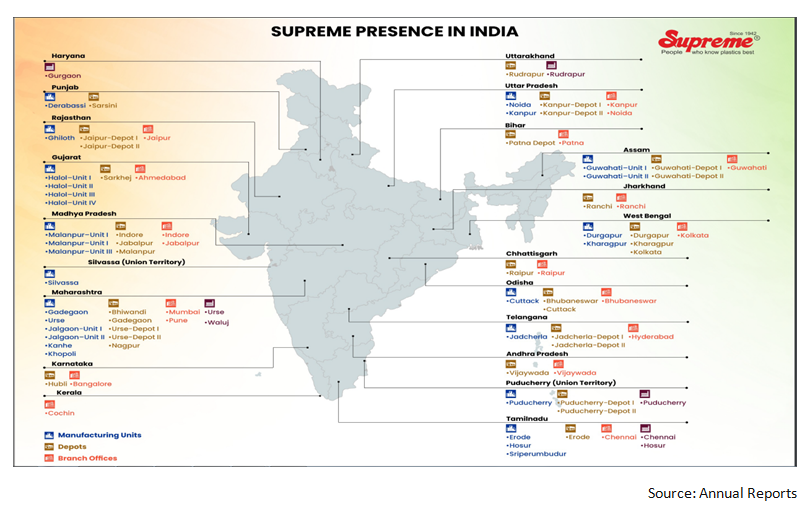

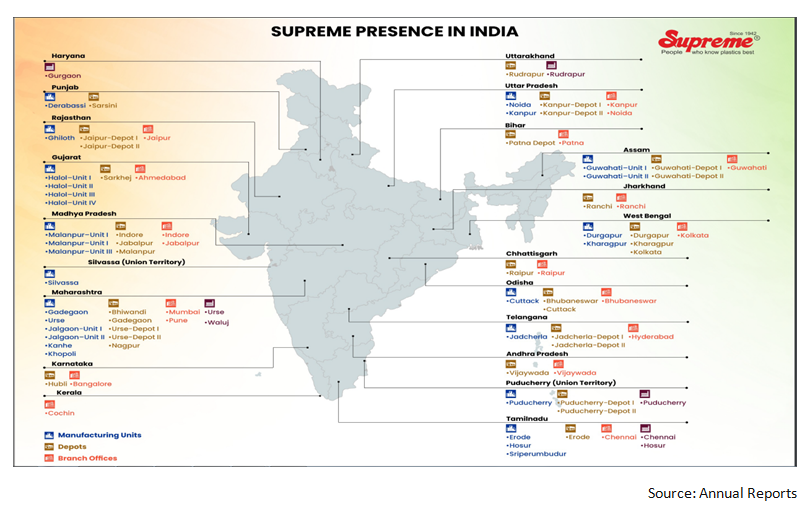

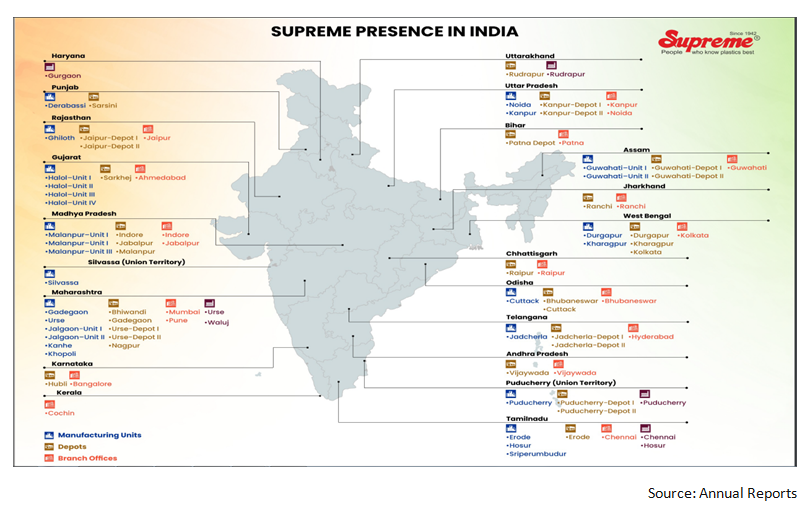

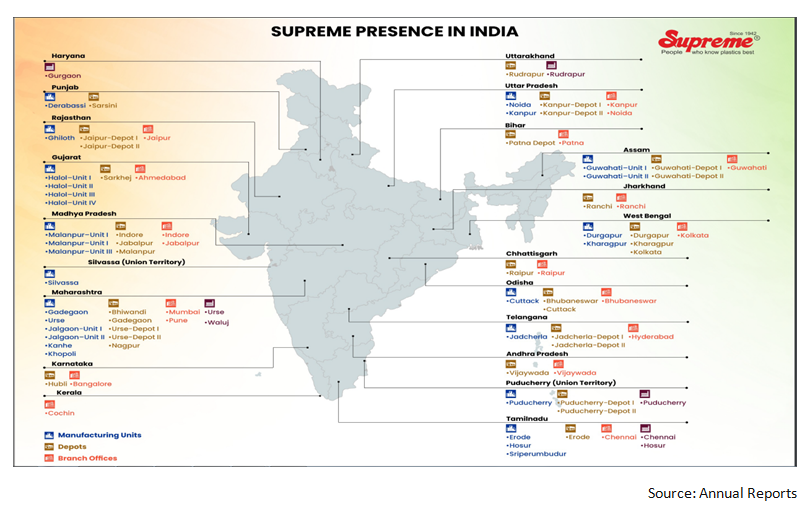

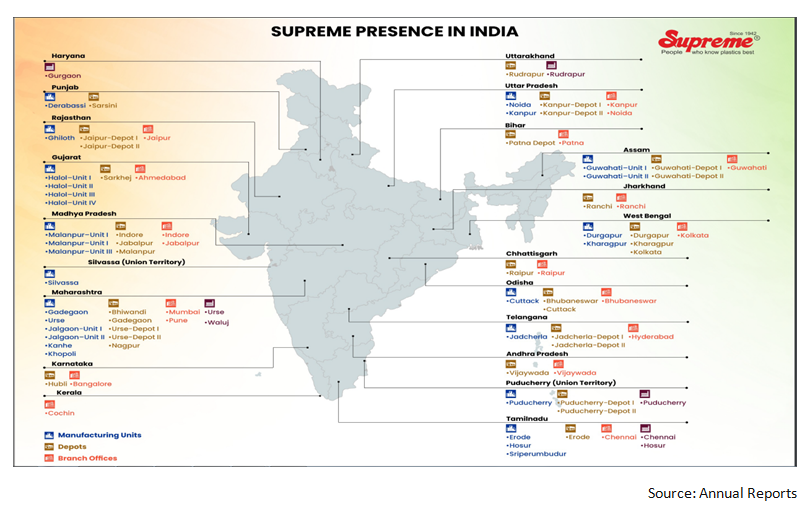

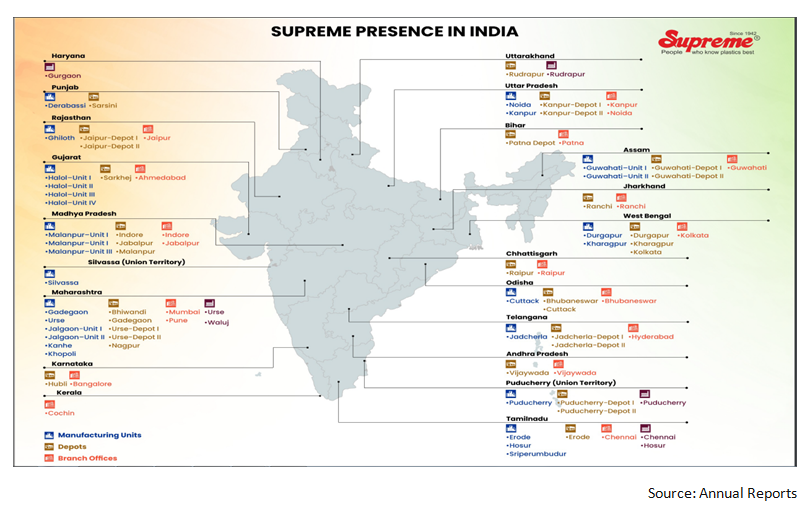

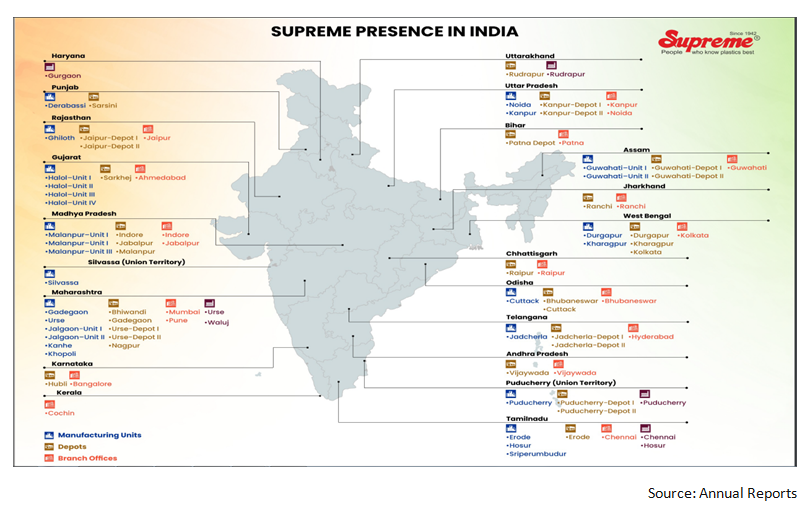

A. Pan-India Manufacturing Footprint

Given the bulky nature of pipes and high freight costs (4–6% of sales), organized players have built multi-location plants to optimize logistics and improve dealer margins.

This cost advantage continues to erode the competitiveness of regional unorganized players.

B. Strong Distribution Networks

Branded manufacturers are expanding into Tier-2 and Tier-3 towns, bringing consistent supply, quality assurance, and faster delivery — strengthening their channel dominance.

C. Margin Differentiation by Product Type

Segment | Approx. EBITDA Margin | Remarks |

Fittings | 18–20% | High technical complexity, multiple SKUs |

CPVC Pipes | 16–18% | Specialized product, limited competition |

Plumbing PVC | 12–13% | Mid-range margin, organized dominance |

Sewerage/DWC | 9–12% | Bulk demand, moderate pricing power |

Agri PVC | 6–9% | Commodity nature, farmer price sensitivity |

Fittings and CPVC remain the most profitable niches, while agri pipes continue to face pricing pressure from smaller players.

Leading Players in the Indian Pipe Industry

The Indian plastic piping market is dominated by a few organized players that have built nationwide manufacturing footprints, strong brand equity, and deep distribution networks. Among these, Supreme Industries, Astral Limited, Finolex Industries, and Prince Pipes & Fittings stand out as the key listed entities shaping the sector’s long-term trajectory.

1. Supreme Industries Ltd.

Company Overview

Supreme Industries is India’s largest plastic processor and a diversified industrial conglomerate with presence across Plastic Pipes, Consumer Products, Packaging Products, and Industrial Products.

Its Plastic Piping Division alone contributes the majority of revenue and is among the largest in Asia with an installed capacity of approximately 7,50,000 MTPA (FY24).

The company manufactures a wide range of products across 10,000+ SKUs, catering to agriculture, plumbing, sewerage, and industrial segments.

Financial Performance

- 10-year Sales CAGR: ~12%

- 10-year Profit CAGR: ~14%

- Consistent EBITDA margins in the range of 15–17%, supported by product diversification.

- Debt-free balance sheet with strong cash generation and ROCE consistently above 25%.

Strategic Outlook

Supreme commands ~12% market share in the organized domestic plastic piping segment. Its wide product basket, extensive dealer network, and strong brand recall ensure leadership in both the B2C and institutional markets.

The company is expanding capacity and introducing lead-free, low-noise, and composite CPVC pipes, while deepening its penetration in Tier-2 and Tier-3 markets.

2. Astral Limited

Company Overview

Astral is the market leader in CPVC pipes and fittings, credited with pioneering the introduction of CPVC plumbing systems in India.

The company has expanded its product offerings beyond pipes into adhesives, sanitaryware, faucets, and storage tanks, transforming itself into a complete home solutions brand.

Total manufacturing capacity stands at ~4,27,000 MT, with plants strategically located across India.

Financial Performance

- 10-year Sales CAGR: ~20%

- 10-year Profit CAGR: ~22%

- EBITDA Margins: 16–18% range, among the highest in the industry.

- Maintains robust cash flow generation, with minimal leverage and steady ROCE in the 20–25% range.

- High working capital efficiency driven by strong brand-led pricing power.

Strategic Outlook

Astral’s success is built on strong branding (“Astral Pipes,” “Astral Adhesives,” and “Resinova”), continuous product innovation, and a pan-India distribution footprint.

The company is leveraging its brand equity to enter adjacent categories and improve operating leverage.

Going forward, Astral’s focus remains on premium product segments such as CPVC, drainage, and adhesives to sustain profitability and growth momentum.

3. Finolex Industries Ltd.

Company Overview

Finolex Industries is India’s only backward-integrated PVC pipe and fittings manufacturer, producing both PVC resin and finished pipes.

Its annual capacity includes 4,00,000 TPA of pipes and fittings and 2,72,000 TPA of PVC resin, ensuring full control over quality and cost competitiveness.

The company primarily serves the agriculture and rural housing markets, giving it deep penetration but a lower-margin mix.

Financial Performance

- Revenue CAGR (10 years): ~8–9%

- Profit CAGR: Moderate, impacted by volatility in PVC-EDC spreads.

- EBITDA margins: Historically 10–18%, depending on resin spreads.

- Debt levels: Minimal; maintains a strong balance sheet with net cash position in most years.

- Profitability correlates strongly with PVC–EDC spread trends, as resin contributes significantly to overall margins.

Strategic Outlook

Finolex benefits from cost advantages due to captive resin production, assured quality, and reduced logistics expenses.

However, exposure to the cyclical agri segment and raw material volatility constrains margin consistency.

Going forward, Finolex aims to expand its presence in plumbing and non-agri segments to improve margin stability and reduce dependence on commodity demand cycles.

4. Prince Pipes and Fittings Ltd.

Company Overview

Prince Pipes is among the fastest-growing organized players in the plastic pipe industry, with a strong focus on plumbing and sewerage applications, which together account for ~77% of its total revenue.

The company operates 10 manufacturing facilities across India, ensuring pan-India reach and lower logistics costs.

Its extensive product range includes CPVC, UPVC, HDPE, and PPR pipes and fittings.

Financial Performance

- 5-year Sales CAGR: ~13–14%

- 5-year Profit CAGR: ~18%

- EBITDA margins: 12–14%, driven by plumbing and CPVC products.

- ROCE: 15–18%, with improving working capital efficiency post-IPO.

- Reduced debt in recent years, improving cash flow generation.

Strategic Outlook

Prince Pipes continues to strengthen its brand through endorsements, retail expansion, and product diversification.

While it remains highly correlated with real-estate and infrastructure cycles, the company’s emphasis on CPVC and fittings segments supports margin improvement.

With continuous investments in marketing, capacity addition, and dealer expansion, Prince aims to consolidate its presence among the top five national players.

Industry Outlook

The Indian plastic pipe industry has historically grown faster than GDP — driven by housing, irrigation, and infrastructure investments.

Future Growth Drivers

- Sustained government spending on water, housing, and sanitation.

- Rising replacement demand from metal to plastic pipes.

- Rural market expansion via organized players’ distribution networks.

- Consolidation improving pricing discipline and profitability.

Between FY21 and FY25, the industry is expected to grow at 12–14% CAGR, up from 10–12% in the previous decade.

Cautionary Note on Valuations

While fundamentals remain strong, market valuations of leading players already reflect optimism.

Investors should focus on quality companies with prudent capital allocation, pricing power, and long-term execution visibility.

Key Takeaway

The Indian pipe sector represents a long-run structural opportunity — a play on urbanization, housing, irrigation, and infrastructure.

With consolidation, better quality control, and the increasing preference for organized brands, the future of this industry looks resilient, scalable, and profitable.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: