Kalyan Jewellers IPO Details:

IPO Date: March 16th to March 18th, 2021

Total Shares for subscription: ~13.5 Cr

IPO Size: ~Rs. 1,175 Cr

Lot Size: 172 shares

Price Band: Rs. 86-87/ share

Market Capitalization: ~8,960 Cr

Recommendation: Avoid

Purpose of Kalyan Jewellers IPO

- To finance business working capital requirements and general corporate purposes. (~800 Cr)

- Offer for sale (375 Cr) by promoters

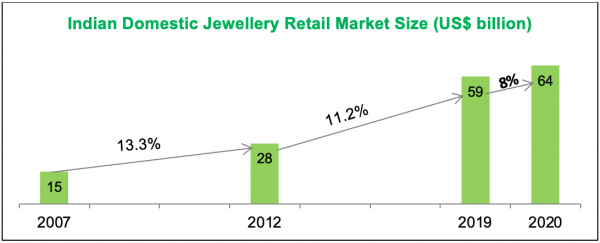

About the Industry

The Indian jewellery retail sector’s size in FY20 was ~US$64 billion with an organized retail share stood of ~32%. The organized players are national and regional, while the rest of 68% jewellery retail continues to be dominated by the unorganized segment. There are over 500,000 local goldsmiths and jewellers. Wedding and related jewellery constitute 60% of India’s total demand, which is a resilient portion of demand.

It is expected that the larger players in the organized space will gain market share from the unorganized segment because of weaker balance sheets and lower profitability post GST adoption.

On the demand side, consumers’ flight to a safer brand for large size purchase, large inventory with design, mandatory hallmarking, and strong systems/processes means more benefit for the large organized jewellers.

About the Kalyan Jewellers India Limited

Kalyan Jewellers India Limited (“Kalyan Jewellers”) is Rs. 10,000 Cr company incorporated in 1993 in Kerala. The company is one of the largest jewellery companies in India after Titan. The company was established by its founder and one of its Promoters, T.S. Kalyanaraman.

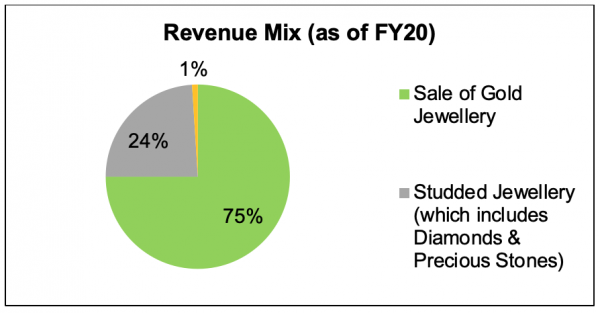

The key business activities of the company are to manufacture and sell a wide range of gold, studded, and other jewellery products across various price points ranging from jewellery for special occasions, such as weddings, which is the highest-selling product category, to daily-wear jewellery.

Initially, the company was started with a single showroom in Kerala, and over the years, it has expanded its presence with 107 showrooms located across 21 states and union territories in India.

It also expanded overseas with 30 showrooms located in the Middle East for the Indian population in the Middle East. The total showrooms of the company have increased from 77 as of March 2015 to 137 showrooms as of June 2020.

The company has a major dominance in Southern markets. As of June 2020, 72 of our 137 showrooms were located outside of South India (South India includes Kerala, Tamil Nadu, Andhra Pradesh, Telangana, Pondicherry, and Karnataka).

Operations outside South India contributed ~48% of FY20 revenues. In addition, the company has a relatively diversified presence across larger and smaller cities, semi-urban and rural regions. For FY20, ~51% of the revenue in India was generated from sales outside tier-I cities.

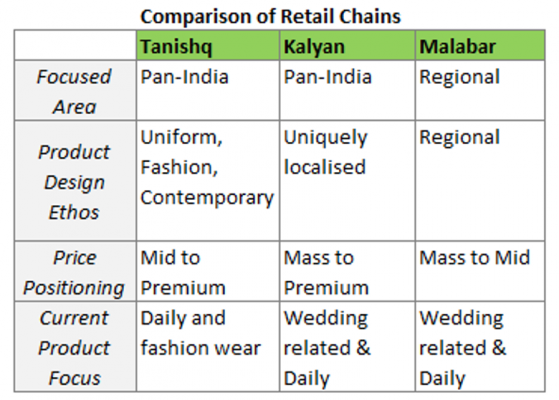

Competition

Tanishq (Titan Company Limited) is the leader in the Indian Jewellery market with ~4% share of the overall jewellery market and 12.5% share of the organized jewellery market, based on FY19. For the same period, Kalyan Jewellers, based on revenues, had ~2% share of the overall jewellery market and ~6% share of the organized jewellery market.

Other competition includes regional players which have a relationship with customers for decades. Many local jewellers are upgrading their services and offerings.

The ad spends as a % of the revenue by the company for FY20 was 2.8% (vs 2.4% by Titan).

Management of Kalyan Jewellers

Mr. T.S. Kalyanaraman is the Chairman, the Managing Director, and Promoter of the company. He has over 45 years of retail experience, out of which over 25 years are in the jewellery industry.

Mr. T.K. Seetharam and Mr.T.K. Ramesh is a whole-time Director and Promoter. They have been involved in the business since the company’s inception and oversee the development of the business strategy. T.K. Seetharam has an experience of ~22 years and T.K. Ramesh has an experience of 20 years in jewellery industry.

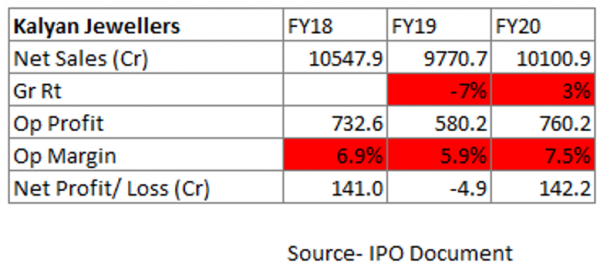

Financials of Kalyan Jewellers

Kalyan’s sales have been in the range of Rs. 8,500-10,000 Cr in last 4-5 years. Several disruptions from Demonetization, GST, and strikes have led to limited growth in the last 4-5 years. However, one can expect future sales growth in line with the growth of the organized sector.

Strengths of Kalyan Jewellers

- A strong brand in the Indian Jewellery Market

- Pan-India presence

- Highly localized with customer preferences

Risks in Kalyan Jewellers

- Geographical concentration with ~50% coming from South India

- Sales growth has an influence gold prices

- High debt to fund inventory

MoneyWorks4me Opinion

Jewellery is a growth industry in India, especially wedding jewellery. Gold holds a special place in Indians as i) Jewellery for Wedding ceremony ii) store of value. This is the reason why Jewellery has long-term structural growth.

Kalyan Jewellers is expanding Pan-India to take advantage of organized sector growth. It has focused on advertising, top-notch retail stores outlet for building trust, and localizing the design for winning customers.

The jewellery industry works on relationships with customers as once trust is established, families seldom change their jewellery.

However, post-GST and demonetization, the cost savings on jewellery making have reduced between organized and unorganized players. Add to it that organized players are focusing on localization strategy for design, more trustworthy in terms of quality, and offer more choice with large inventory. This is pulling the crowd to organized players off late.

We believe this phenomenon is quite favorable for organized players like Kalyan Jewellers and Titan Company.

Valuation of Kalyan Jewellers

Kalyan Jewellers has single-digit growth in the last four years but we expect low double-digit growth over the next 5-10 years in line with growth in jewellery and organized market in jewellery industry.

Kalyan Jewellers has a higher share of South India which means a higher share of gold-rich jewellery which has lower margins versus diamond studded ones. This is the reason it has a lower operating margin versus Titan.

With Enterprise value to Sales of ~1x and EBITDA margin of 7%, the P/E ratio of Kalyan Jewellers is ~27x on normalized earnings.

Large inventory backed with debt and thin margins makes profits outlook and ROE% very unpredictable. We do not believe the market will price the company at a higher valuation till the return metrics improve.

We would recommend to AVOID for now and watch for improvement in returns before taking a long-term position.

Those who wish to invest for Listing gains can go for 1 lot but we can’t be certain whether the market will cheer a company with no numbers to prove its mettle.

Note: We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on a business model and valuation.

| IPO Activity | Date |

| IPO Open Date | 16th March 2021 |

| IPO Close Date | 18th March 2021 |

| Basis of Allotment Finalisation Date | 23rd March 2021 |

| Refunds Initiation | 24th March 2021 |

| A credit of Shares to Demat Account | 25th March 2021 |

| IPO Listing Date | 26th March 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 172 | ₹ 14,964 |

| Maximum | 13 | 2236 | ₹ 194,532 |

| Date | QIB | NII | Retail | Employee | Total |

| Mar 16, 2021, 05:00 | 0.00x | 0.20x | 1.10x | 1.15x | 0.60x |

| Mar 17, 2021, 05:00 | 0.24x | 0.89x | 1.90x | 1.91x | 1.21x |

| Mar 18, 2021, 05:00 | 2.76x | 1.91x | 2.82x | 3.74x | 2.61x |

When will the Kalyan Jewellers India Ltd IPO open?

Kalyan Jewellers IPO will open for subscription on Tuesday, March 16, and will close on Thursday, March 18.

What is the price band of Kalyan Jewellers India Ltd IPO?

The price band for Kalyan Jewellers IPO is Rs. 86-87.

What is the lot size for Kalyan Jewellers India Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 172 shares, up to a maximum of 13 lots i.e. Rs. 1, 94,532.

What is the issue size of Kalyan Jewellers India Ltd IPO?

The total issue size is ~13.50 Cr shares raising Rs. 1175 Cr.

What is the quota reserved for retail investors in Kalyan Jewellers India Ltd IPO?

The quota for retail investors in Kalyan Jewellers IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on March 23 and refunds will be credited by March 24. Shares allotment will be credited in Demat accounts by March 25.

What is the listing date of Kalyan Jewellers India Ltd IPO?

The tentative listing of Kalyan Jewellers IPO is March 26.

Where could we check the Kalyan Jewellers India Ltd IPO allotment?

One can check the subscription status on Link Intime.

Who are the leading book managers to the issue?

Book running lead managers to the IPO are Ambit Private Limited, Axis Capital Limited, IIFL Holdings Limited, and JM Financial Consultants Private Limited.

What does Kalyan Jewellers India Ltd do?

Kalyan Jewellers is one of the leading companies in jewellery retail. It has Rs. 10,000 Cr in sales and 130+ stores Pan-India.

Who are the peers of Kalyan Jewellers India Ltd?

The peers of Kalyan Jewellers India Ltd are Tanishq and Malabar Gold

What if I do not get the allotment?

If not allotted then subscribe to MoneyWorks4me PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp 8055769463