Craftsman Automation IPO Details:

IPO Date: March 15th to March 17th, 2021

Total Shares for subscription: ~55 Lakh

IPO Size: ~Rs. 824 Cr

Lot Size: 10 shares

Price Band: Rs. 1488-1490/ share

Market Capitalization: ~3,140 Cr

Recommendation: Subscribe for listing gains

Purpose of Craftsman Automation IPO

- To make repayment /pre-payment of company’s debts

- To meet general corporate purposes.

About the Craftsman Automation India Limited

Incorporated in 1986, Craftsman Automation is Rs. 1,800 Cr Auto ancillary company engaged in manufacturing precision components. The company designs, develop and manufacture a range of engineering products for Automobile companies.

The company is involved in the machining of cylinder blocks and cylinder heads in the intermediate, medium, and heavy commercial vehicles segment as well as in the construction equipment industry in India. Craftsman Automation is among the top 3-4 component players with respect to the machining of cylinder block for the tractor segment in India.

Products & Manufacturing Facilities:

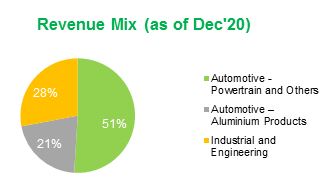

The company is engaged in 3 business segments, namely

- Powertrain and other products for the automotive segment (“Automotive – Powertrain and Others”),

- Aluminum products for the automotive segment (“Automotive – Aluminium Products”)

- Industrial and engineering products segment (“Industrial and engineering”).

The company is present across the entire value chain in the automotive-aluminum products segment, providing diverse products and solutions. The company owns 12 state-of-the-art manufacturing facilities across 7 cities of India. Its customer base includes Tata Motors, Daimler India, Tata Cummins, Mahindra & Mahindra, Royal Enfield, Siemens, Escorts, Ashok Leyland, VE Commercial Vehicles, TAFE Motors & Tractors, etc.

Management of Craftsman Automation:

Srinivasan Ravi is the Chairman & Managing Director of the company. He holds a bachelor’s degree in mechanical engineering from PSG College of Technology, Coimbatore. He is the Promoter of this company and has experience of more than 34 years in the automotive industry.

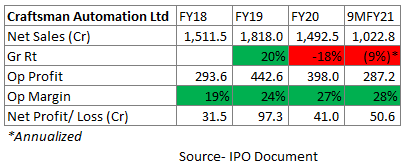

Financials of Craftsman Automation:

The company has seen a decline in its revenue since FY18 majorly due to a significant decline in automobile sales even prior to COVID-19. This is because the business of the company is directly related to auto sales as the customers primarily comprise large automotive OEMs.

Craftsman Automation has an overall debt of ~Rs. 700 crore and a Debt/ Equity ratio of ~1.

Strengths:

- Presence across the value chain

- Long term and well-established relationships with marquee domestic and global OEMs

- Long term growth potential in lines with auto industry growth

Risks:

- Cyclical due to heavy dependence on Auto industry

- High debt

MoneyWorks4me Opinion on Craftsman Automation IPO

How is the company quality?

Average:

Craftsman Automation caters to the automobile sector, especially commercial vehicles, and construction equipment. The auto sector has been in a down cycle for the past few years. With the recovery in economic activity, the auto sector is growing fast on a low base. Hence we expect an upcycle in the auto industry due to government budget expenditures towards infrastructure and rural industry.

We usually buy cyclical companies at the start of the cycle but OEMs have already factored in most of the future growth in their valuations. Hence, companies like Craftsman Automation can be a good proxy for the cyclical recovery of autos.

The small scale of operations, cyclical industry, and high debt make us cautious investing in Craftsman Automation for the long term. We believe large OEMs or auto financiers are better and safer ways to participate in the growth of the auto sector.

Valuation

How is the valuation for Craftsman Automation?

Reasonable:

- Valuation of Craftsman Automation is reasonable, with enterprise value Rs. 3,800 Cr for potential sales of Rs. 1,800 Cr translating into ~8.5x EV/EBITDA or 16x P/E ratio on normalized earnings.

- However, a favorable business environment for commercial vehicles and reasonable valuation make us positive at least for listing gains. We wouldn’t recommend buying post listing as we find company quality is average.

Note: We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on the business model and valuation.

| IPO Activity | Date |

| IPO Open Date | 15th March 2021 |

| IPO Close Date | 17th March 2021 |

| Basis of Allotment Finalisation Date | 22nd March 2021 |

| Refunds Initiation | 23rd March 2021 |

| A credit of Shares to Demat Account | 24th March 2021 |

| IPO Listing Date | 25th March 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 10 | ₹ 14,900 |

| Maximum | 13 | 130 | ₹ 193,700 |

| Date | QIB | NII | Retail | Total |

| Mar 15, 2021, 05:00 | 0.00x | 0.09x | 1.06x | 0.55x |

| Mar 16, 2021, 05:00 | 0.56x | 0.19x | 2.11x | 1.26x |

| Mar 17, 2021, 05:00 | 5.21x | 2.84x | 3.43x | 3.81x |

When will the Craftsman Automation Ltd IPO open?

Craftsman Automation IPO will open for subscription on Monday, March 15, and will close on Wednesday, March 17.

What is the price band of Craftsman Automation Ltd IPO?

The price band for Craftsman Automation IPO is Rs. 1488-1490.

What is the lot size for Craftsman Automation Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 10 shares, up to a maximum of 13 lots i.e. Rs. 1, 93,700.

What is the issue size of Craftsman Automation Ltd IPO?

The total issue size is ~55 lakh shares raising ~ Rs. 824 Cr.

What is the quota reserved for retail investors in Craftsman Automation Ltd IPO?

The quota for retail investors in Craftsman Automation IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on March 22 and refunds will be credited by March 23. Shares allotment will be credited in Demat accounts by March 24.

What is the listing date of Craftsman Automation Ltd IPO?

The tentative listing of Craftsman Automation IPO is March 25.

Where could we check the Craftsman Automation Ltd IPO allotment?

One can check the subscription status on Link Intime.

Who are the leading book managers to the issue?

Book running lead managers to the IPO are Axis Capital Limited and IIFL Holdings Limited.

What does Craftsman Automation Ltd do?

Craftsman Automation is an Auto ancillary company engaged in manufacturing precision components. The company designs, develop and manufacture a range of engineering products for Automobile companies.

The company is engaged in 3 business segments, namely

- Powertrain and other products for the automotive segment (“Automotive – Powertrain and Others”),

- Aluminum products for the automotive segment (“Automotive – Aluminium Products”)

- Industrial and engineering products segment (“Industrial and engineering”).

Who are the peers of Craftsman Automation Ltd?

The peers of Craftsman Automation Ltd are Bharat Forge Limited, Endurance Technologies Limited, Jamna Auto Industries Limited, Mahindra CIE Automotive Limited, Minda Industries Limited, and Sundram Fasteners Limited.

What if I do not get the allotment?

If not allotted then subscribe to MoneyWorks4me PRO.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Kyunki yeh paise ka mamala hai

Why MoneyWorks4me | Why Register | Call: 020 6725 8333 | WhatsApp 8055769463