LIC Limited IPO Details:

IPO Date: 4th May 2022 – 9th May 2022

Total Shares for subscription: ~22 Crore

IPO Size: ~Rs. 21,000 Cr

Lot Size: 15 shares

Price Band: Rs. 902-949/ share (addition Rs 60 discount for policyholders)

Market Capitalization:~Rs. 6 Lakh Cr

Recommendation: Subscribe

Proceeds of the offer:

The company will not receive any proceeds from the listing as it is purely an offer for sale.

About Life Insurance Industry

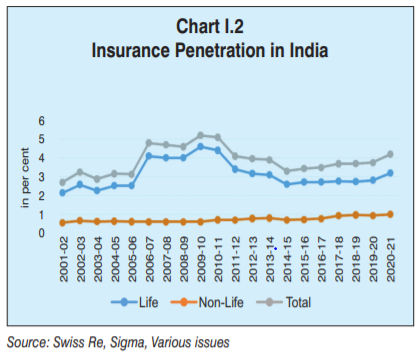

India’s life insurance industry stands at around Rs. 6.2 trillion in terms of total premium as of FY21. According to data published by Swiss Re Group, India has the world’s 10th largest life insurance industry in terms of the total premium. India’s share in the global life insurance market was 2.73% in 2019.

LIC is a dominant player in the Indian Life Insurance sector with a market share of ~66% of overall premiums. According to the IRDAI report, Life insurance penetration in India, which is measured as a ratio of premium to GDP, and density which is measured as a ratio of premium to the total population both rose marginally in 2019. Total life insurance premium has grown at a CAGR of 16.04% since the privatization of the industry in 2000. The industry’s Assets under Management (AUM) grew to Rs. 35.33 trillion in FY19.

Backed by regulatory reforms and the adoption of digital technologies, the industry is witnessing improved transparency and increased innovation. Further, the growing awareness of the need for protection products, rising disposable income with the growing middle class, financialization of savings, and under-penetration of life insurance in the country are long-term tailwinds for the sector.

About LIC of India

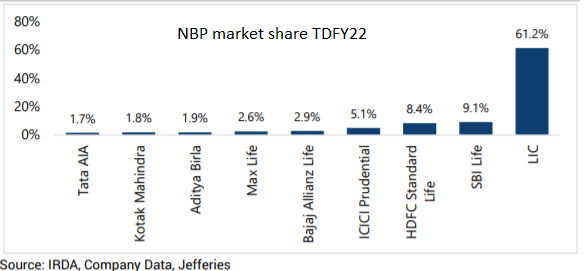

LIC is the largest life insurer in India, with a market share of 64.1% in terms of premiums and 66.2% market share in terms of New Business Premium. The company offers participating insurance products and non-participating products i.e unit-linked insurance products (ULIPs), saving insurance products, term insurance products, health insurance, and annuity & pension products.

LIC accounts for 60%+ of life insurance new premiums and 40%+of retail APE (Annual Premium Equivalent), 95% of which is driven primarily by its 13.5 Lakh agents and it also has 72 Banca partnerships. It is the biggest asset manager amongst life insurers with~ INR40trn (~US$527bn) in AUM. Govt of India, the current 100% owner of LIC, proposes to divest 3.5% of LIC’s equity through an offer for sale.

Financials of LIC of India

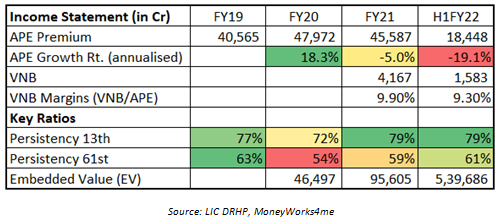

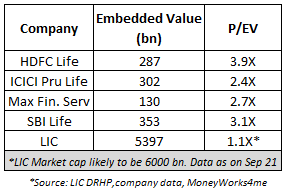

LIC’s Embedded Value stood at INR5.4trn (US $72bn) for Sep-21 which is up from Rs. 956 bn in Mar-21- as it is now allocating 100% profits of non-par products to shareholders. Sep-21 EV of top 3 listed players was in the range of INR290bn-. 350bn. Peers like HDFC Life, SBI Life, IPRU Life trade at 2.4x-3.9x Sep’21EV and have steady-state RoEVs between ~16%-19% with higher VNB margins.

LIC’s VNB margin for FY21 and 1HFY22 stood at 9.9% and 9.3% respectively- broadly reflecting the Par-heavy product mix. As per DRHP, in a scenario of 10% surplus sharing in Par products, LIC’s FY21 VNB margin could expand to 12.3%, ceteris paribus. This compares to a 25%-26% comparable margin for listed industry peers.

Insurance companies have a different business model and do not report Financial Statements as others. Do not consider ROEV, or P/E ratio type ratios as a basis of analysis.

APE: Annual premium equivalent (APE) is a measure used for comparison of life insurance revenue by normalizing the policy premiums into the equivalent of regular annual payments.

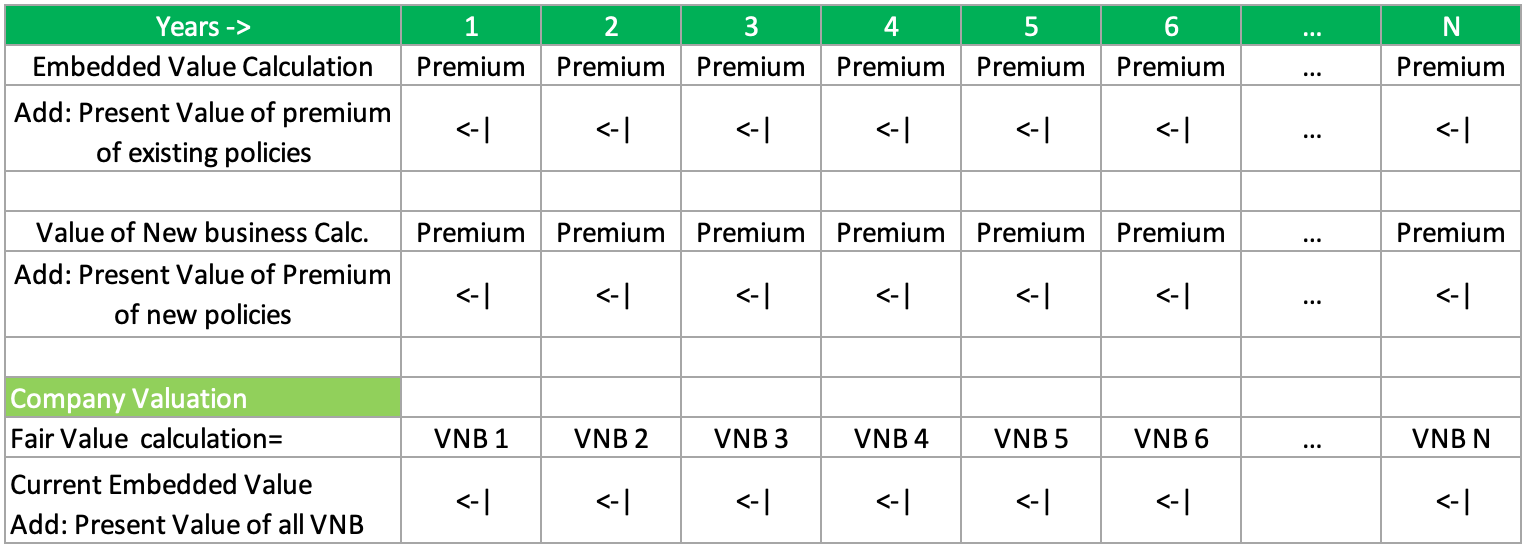

Embedded Value (EV): Embedded value is the sum of all future premiums to be received from existing policies. This can be taken as a fixed component in valuation.

Value of New Business (VNB): This is the sum of future premiums of this year’s policies (using the same persistency and profit assumption). This has to be estimated for the future and added to EV. It is nothing but the EV in the future for each year.

Persistency: The persistency ratio is the ratio of life insurance policies receiving timely premiums in the year and the number of net active policies. A longer-term persistency ratio like 5 years is more important to understand whether a policyholder is continuing its policy. A persistency ratio of 50% for the 5th year (or 61 months) means only 50% of policyholders have continued paying the premium, while the rest have stopped.

Market share dynamics

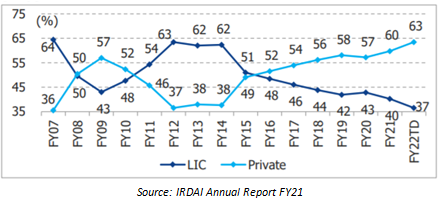

Over FY15-till date, its new business premium (NBP) market share has declined from 69% to 61%

while retail APE market share has dipped from 51% to 38%.

Retail APE Market share FY22TD

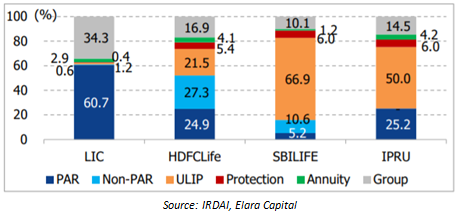

LIC Product Mix vs Peers

Participating products (PAR) contribute ~92% to individual APE, which is ~71% of total APE; group savings is the major component, contributing ~96% to the group APE. Other players have a more balanced mix as seen above.

A higher mix of PAR policies leads to lower VNB margins (value of new business/APE) of 9.5% as against the industry average of 25-27%. An increasing mix of Non-participating (NPAR) businesses can drive growth in the future.

Positives:

- Leading insurance provider company in India and fifth largest global insurer by GWP.

- A range of life insurance products to meet the varied insurance needs of individuals.

- Strong omnichannel distribution network; 1.34 million agents, 3463 active Micro insurance agents, 174 alternate channels, etc.

- Largest asset manager in India with an established financial performance track record.

- Highly experienced and qualified management team.

Risks:

- lower attractiveness of recalibrated par products,

- lower persistency and higher surrenders

- Possibility of unanticipated intensity in mortality claims due to ongoing pandemic,

- Sharp fluctuations in interest rate leading to change in Embedded Value,

- Inability to retain, recruit individual agents,

- Any union unrest, slowdown, increased wage cost, etc.

Valuation:

Insurance companies are valued as [EV + P/VNB or DCF of Value of New business]. Use of P/EV is not the right way to value an insurance company but can be used only for reference versus other peers.

EV is the embedded value of the future premium, this stream of cash flows is valuable to shareholders. We add the present value of New Business which is nothing but EV from the future. This gives us market capitalization for the company. This in turn is used by analysts calling it P/EV.

Currently listed players like SBI Life, HDFC Life, and ICICI Pru Life trade at an average P/EV multiple of 2.5X.

As per the reported EV (Sept 21) of LIC and IPO valuation, LIC is expected to list at a valuation of 1.1X Embedded value which is at a significant discount to its listed peers

MoneyWorks4me Opinion:

We see LIC’s Distribution edge, increasing sales mix of direct and corporate channels, and a gradual shift to high margin Non-Par products to be possible drivers for LIC’s future growth which might negate lower than industry growth rates.

We recommend subscribing to policyholders, employees, and retail investors for a long-term horizon.

| IPO Activity | Date |

| IPO Open Date | May 04, 2022 |

| IPO Close Date | May 09, 2022 |

| Basis of Allotment Date | May 12, 2022 |

| Refunds Initiation | May 13, 2022 |

| A credit of Shares to Demat Account | May 16, 2022 |

| IPO Listing Date | May 17, 2022 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 15 | ₹ 14,235 |

| Maximum | 14 | 210 | ₹ 199,290 |

| Date | QIB | NII | Retail | Employees | Policyholder | Total |

| Day 1 May 4, 2022 |

0.33x | 0.27x | 0.60x | 1.17x | 1.99x | 0.67x |

| Day 2 May 5, 2022 |

0.40x | 0.47x | 0.93x | 2.22x | 3.11x | 1.03x |

| Day 3 May 6, 2022 |

0.56x | 0.76x | 1.23x | 3.06x | 4.01x | 1.38x |

| Day 4 May 7, 2022 |

0.67x | 1.08x | 1.46x | 3.54x | 4.67x | 1.66x |

| Day 5 May 8, 2022 |

0.67x | 1.24x | 1.59x | 3.79x | 5.04x | 1.79x |

| Day 6 May 9, 2022 |

2..83x | 2.91x | 1.99x | 4.40x | 6.12x | 2.95x |

When will the LIC Ltd IPO open?

LIC Ltd IPO will open for subscription on Wednesday, 04th May 2022, and closes on Monday, 09th Feb 2022.

What is the price band of LIC Ltd IPO?

The price band for LIC Ltd IPO is Rs. 902-949/share.

What is the lot size for LIC Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 15 shares, up to a maximum of 14 lots i.e. Rs. 1,99,290/-.

What is the issue size of LIC Ltd IPO?

The total issue size is ~ Rs. 21,000 Cr.

What is the quota reserved for retail investors in LIC Ltd IPO?

The quota for retail investors in LIC Ltd IPO is fixed at 35% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on May 12th and refunds will be initiated by May 13th. Shares allotment will be credited in Demat accounts by May 16th.

What is the listing date of LIC Ltd IPO?

The tentative listing date of LIC Ltd IPO is Tuesday, May 17th.

Where could we check the LIC Ltd IPO allotment?

One can check the subscription status on KFintech Pvt Ltd.

What does LIC Ltd do?

LIC Ltd is the largest life insurer in India, with a market share of 64.1% in terms of premiums and 66.2% market share in terms of New Business Premium. The company offers participating insurance products and non-participating products i.e unit-linked insurance products (ULIPs), saving insurance products, term insurance products, health insurance, and annuity & pension products.

Who are the peers of LIC Ltd?

Listed company peers for LIC Ltd. are SBI Life Insurance Ltd., HDFC Life Ltd, ICICI Prudential Ltd., and Max Financial Services.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, ICICI Bank.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

Find the Best Undervalued Stocks from Nifty 100:

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463