Dear Readers,

We hope you have read our blog on Peaceful Investing Experience in Volatile Markets. If not, you should read it first before moving ahead.

Now that you have understood what leads to a peaceful investing experience, let’s understand what are the next steps you should take and invest in for the long term with MoneyWorks4me?

What are the right actions to be taken now?

1. Maintain sufficient Liquidity

Ensure that you have secured your short-term goal requirements (3-5 years) and emergency funds (1-2 years of expenses) in instruments that can be easily liquidated (Cash/FD/Liquid funds). This is what we call Cash Comfort. This provision will not let you sway during interim corrections in the equity markets.

2. Rebalance your portfolio

We have highlighted the importance of Asset Allocation in our “peaceful Investing” blog. Since equity is declining and other asset classes like Gold are rising, your portfolio is more likely to deviate from your intended asset allocation. You should take this opportunity to reset asset allocations if you haven’t done so recently.

Use our Portfolio Manager to upload your portfolio and get insights on asset allocation and key risks

If you have a sizeable portfolio of 25 Lakhs and more and find it challenging to manage it on your own, you should partner with us in your wealth creation journey. Our Omega Portfolio Advisory will collaborate with you right from educating you on the investing process to decision making to the easy and effective execution of recommended actions. Omega is a zero conflict of interest fiduciary multi-asset portfolio advisory solution.

3. Superstars Dashboard

Our Superstars plan enables DIY Investing. In addition to our recommendations of stocks placed in the Buy Zone and stocks in CORE SIP, our subscribers have ready access to the tools to make informed decisions based on their knowledge, experience, and risk-taking ability.

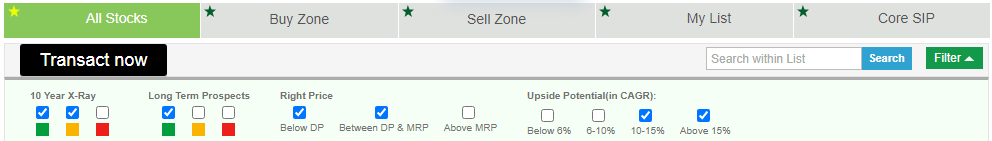

You can also use the “Filter” in our Plan Dashboard to find more ideas to consider in your portfolio.

You will be able to screen the companies based on Upside Potential, Price level, Quality, and Future Prospects.

Sample Screen:

1. 10Y X-Ray: Green/Orange

2. Future Prospects: Green

3. Price: Below DP/Between DP and MRP

4. Upside Potential : > 10%

Also, our subscribers can check the flags we have raised on companies based on triggers,

Positive Triggers: Green Flag

Negative Triggers: Red Flag

DIY Investors can consider initiating positions in stocks that fit the above sample screening criteria and preferably have a green flag.

Our Analyst team tracks and updates the flag notes to reflect the recent fundamental or structural developments. So, when you have surplus money that you have not invested you can invest in the Core SIP portfolio and some of the ideas that you find by using the filters on the Plan Dashboard.

Check our Superstars Plans NOW.

Key Takeaways:

- Use the MoneyWorks4me Financial Planning tool to prepare a simple yet comprehensive financial plan for your goals.

- Deploy the right surplus; expect the right returns and stay invested for as long it requires to achieve your goals. This is the Wealth Building Formula.

- Build a diversified multi-cap portfolio of high-quality companies acquired at reasonable prices. Check our Superstars Multi-cap solution for making informed investment decisions.

- Asset Allocation is your key to a peaceful investing experience. Collaborate with Omega Portfolio Advisory for a one-stop solution to address all your investing needs.

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463