Nykaa IPO Details:

IPO Date: Oct’28th to Nov’1st 2021

Total Shares for Subscription: ~4.75 Cr

IPO Size: ~Rs. 5300 Cr

Lot Size: 12 shares

Price Band: Rs. 1085-1125/ share

Market Capitalization: ~53,000 Cr

Recommendation: Subscribe for risk takers

Nykaa IPO Analysis Podcast

Subscribe Us On: Spotify | Google Podcast | YouTube

Purpose of FSN E-Commerce Ventures Ltd IPO:

90% of the proceeds of the IPO will go to existing shareholders. The company will receive the rest utilized in the following form:

- Invest in subsidiaries to fund the setup of new retail stores (Rs.35 Cr)

- Capital expenditure for setting up new warehouse (Rs.35 Cr)

- Repayment of borrowings (Rs.130 Cr)

- Branding Expenditure (Rs.200 Cr)

About the FSN E-Commerce Ventures Ltd

FSN E-COMMERCE VENTURES (Nykaa) was incorporated in 2012 to engage in the trading of beauty and wellness products through its online portal ‘nykaa.com’. Since inception, capital and resources have been invested in designing a differentiated journey of brand discovery and building a digitally native consumer technology platform, by delivering a content-led, lifestyle retail experience for the consumers.

The company has a diverse portfolio of beauty, personal care, and fashion products, including owned brand products manufactured. As of March 31, 2021, the company offered approximately 20 Lakh SKUs from 3,826 national and international brands across business verticals

Online and offline channel: Nykaa has an online presence via website and app with cumulative downloads of 4.4 Cr in mobile apps. Warehousing: It supplies online purchases with 18 warehouses spread across 6,00,000 sq. ft. Offline presence comprises 73 physical stores across 38 cities in India.

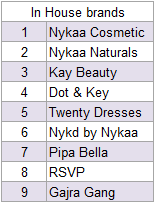

Nykaa owns a portfolio of 13 brands. including Nykaa Naturals, Nykaa Cosmetics, Kay Beauty, Nykd by Nykaa, 20 Dresses, RSVP, Mondano, Likha, Pipa Bella.

Financials

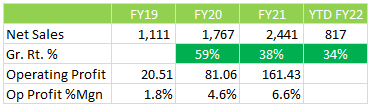

Nykaa has been reporting stellar growth above 30-40% CAGR. We expect a similar growth trajectory over the next 3-5 years.

The company is profitable at the operating level which is quite good as it can fund a lot of growth internally. The bulk of the investment is in form of advertisement and promotion. New investment can happen in inventory if the company goes for its own brands.

Management

Falguni Nayar (Founder, Executive Chairperson & Managing Director and Chief Executive Officer) is a post-graduate diploma in management from the Indian Institute of Management, Ahmedabad, and has over 26 years of experience in e-commerce, investment banking, and broking

Nihir Parekh (CEO, NykaaMan business arm of Nykaa E-Retail) is an MBA from INSEAD and has over 11 years of experience in the technology and E-commerce sector. Previously employed with Genentech Inc, USA, and GE Healthcare

Reena Chabra (CEO – Private labels) holds a Bachelor’s degree in Arts from Punjab University and has over 23 years of experience in the cosmetic and e-commerce industry. Previous employment experiences include Colorbar Cosmetics Private Limited, Hindustan Unilever Limited, Marico Industries Limited

Moneyworks4me Opinion:

How is the business model? Good, bad, or gruesome?

Good (Potential to become great if it can make its customer base sticky). Nykaa is an online distribution-based cosmetics brand and becoming an eCommerce platform for other branded products in beauty and fashion.

Scaling up

Digital parameters

- Nykaa is seeing good traction with new visitors. From 91 lacs in 2019 to 2.03 Cr for 5 months of FY22 ending Aug’21.

- The number of visits is also up from 37.8 Cr to 66 Cr in 2021.

- The average order value is Rs. 1886 which is high enough to make delivery costs of 70-120/delivery minuscule. The delivery cost is 4-5% of the order value that the company absorbs today. Over time, Nykaa can either pass it on to consumers or start a subscription plan.

- Operations are profitable which is a positive as it can fund growth internally. It won’t need fresh funds from time to time to fund growth.

Opportunity Size:

Beauty products is Rs. 1,00,000 Cr industry with a growth rate of 15%+. With just a 3% market share, the company has a lot of room to grow.

The fashion industry is even bigger at Rs. 7,00,000 Cr but more heterogeneous and can’t be assumed as Nykaa addressable market as on today. Nykaa’s share of the Fashion business is very small and scope to expand. However, the fashion industry has more Stock Keeping Units which can lead to higher inventory investments, lower turns, and hence lower return on equity. As of now the size of this business is small and the company is experimenting lot of things to conclude how it would evolve.

Challenges:

Online distribution is a gruesome business as big whales like Amazon and Flipkart can swallow many small ventures by beating them in delivery/price/reach. So online distribution alone will not make a cut for the longevity of the business.

What will help Nykaa: (i) Customers getting used to it, so it can start a subscription model for future stickiness (ii) offer quality & innovative products to beat out the competition.

Strengths:

- Strong brand and product quality

- Low-cost distribution through the online channel

Risks:

- Similar quality products can be introduced by other brands or at a lower price.

- Online distribution is very competitive with large-scale players like Amazon, Flipkart.

Valuation – High Risk, High return?

Nykaa today earns ~Rs. 3300 Cr annualized based on Q1FY22 sales. This is almost 34% higher than last year. We expect a run rate of 25-30% over the next 5 years thanks to the growing industry and online channel of distribution growing at a faster pace.

At the asking price, the market cap is around Rs. 53,000 Cr which is almost 16x Price to sales. At the operating profit level, current margins look subdued to an early stage of growth where it spends heavily on marketing and promotion.

Headline valuation looks quite steep, the upside risk with high-growth business is that growth can be exponential in the initial years or a company can expand the scope of its business by venturing into different products/markets or acquiring them. For example, Nykaa’s expansion into the bigger addressable markets like the Fashion industry increased its scope. Because of such possibilities linear forecasting, fundamental investing models do not work.

So if it really scales up faster than industry growth, it can become at least 4 times today’s size, in 5 years’ time. Since industry size is Rs. 8L Cr (including Beauty and Fashion), it has ample scope to grow. Since it is an online distribution business, it can grow without requiring much capital investment.

Because the company is a high growth, as well as it is present in an attractive sector, it is valued at a very steep price. It will remain a high-risk and high-return investment for a small portion of a portfolio. Such high-risk ventures are usually funded by private equity players that manage smaller, “riskier” portions of HNI or institutional investors’ portfolios; in that case, why should it be any different for a retail investor?

If you like the business model or willing to accept high risk, for ‘potential’ high return (high risk doesn’t guarantee high return), you can SUBSCRIBE in IPO, restricting it to 1% of 2% of your portfolio.

For others, Subscribe for a listing gain investment and later deploy the funds to more predictable, undervalued stocks. We understand that not everyone looks for the ‘best investment’ in the market but steady compounding.

Note: We do not recommend buy just because the IPO market is hot. We do not earn any commission or fee for promoting IPOs so expect an honest review from us on the business models and valuation.

| IPO Activity | Date |

| IPO Open Date | Oct 28, 2021 |

| IPO Close Date | Nov 1, 2021 |

| Basis of Allotment Date | Nov 8, 2021 |

| Refunds Initiation | Nov 9, 2021 |

| A credit of Shares to Demat Account | Nov 10, 2021 |

| IPO Listing Date | Nov 11, 2021 |

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 12 | ₹ 13,500 |

| Maximum | 14 | 168 | ₹ 189,000 |

| Date | QIB | NII | Retail | Employee | Total |

| Oct 28, 2021 | 1.39x | 0.60x | 3.50x | 0.68x | 1.55x |

| Oct 29, 2021 | 4.72x | 4.17x | 6.32x | 1.18x | 4.82x |

| Nov 01, 2021 | 91.18x | 112.02x | 12.24x | 1.88x | 81.78x |

When will the Nykaa IPO open?

Nykaa IPO will open for subscription on Thursday, October 28th, and closes on Monday, November 1st.

What is the price band of Nykaa IPO?

The price band for Nykaa IPO is Rs. 1085-1125/share.

What is the lot size for Nykaa IPO?

Retail investors can subscribe to the IPO minimum lot size is 12 shares, up to a maximum of 14 lots i.e. Rs. 1,89,000/-.

What is the issue size of Nykaa IPO?

The total issue size is ~ Rs. 5352 Cr.

What is the quota reserved for retail investors in Nykaa IPO?

The quota for retail investors in Nykaa IPO is fixed at 10% of the net offer.

When will the basis of allotment be out?

Allotment will be finalized on November 8th and refunds will be initiated by November 9th. Shares allotment will be credited in Demat accounts by November 10th.

What is the listing date of Nykaa IPO?

The tentative listing date of Nykaa IPO is Thursday, November 11th.

Where could we check the Nykaa IPO allotment?

One can check the subscription status on Link Intime India Private Ltd.

What does Nykaa do?

Nykaa is into online sales and distribution of cosmetics products. It has its own website, marketing, and distribution.

Who are the peers of Nykaa?

There are no direct peers of Nykaa. In unlisted space, Flipkart or Amazon India come close to Nykaa’s business model.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks and Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. You get all this for a price that can be as low as Rs. 5,999 under a limited period offer. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Airtel, ICICI Bank.

Click here, for the Recent IPO complete list and IPO Historic data 2021.

If you liked what you read and would like to put it into practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Need help on Investing? And more….Puchho Befikar

Why MoneyWorks4me | Call: 020 6725 8333 | WhatsApp: 8055769463